|

市场调查报告书

商品编码

1871222

粗粒生物燃料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Coarse Grain Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球粗粒生质燃料市场价值为 507 亿美元,预计到 2034 年将以 10.9% 的复合年增长率成长至 1,424 亿美元。

该产业的强劲成长得益于政府不断扩大的燃料掺混政策以及对永续航空燃料原料需求的增加。随着各国加强减少对化石燃料的依赖,生物燃料目标在减排策略中扮演关键角色。以玉米和高粱等粗粮为原料生产的乙醇正成为交通运输燃料政策的重要组成部分,尤其是在航空业寻求脱碳路径之际。促进乙醇基可持续航空燃料发展的监管架构正在帮助粗粮生物燃料拓展到公路运输以外的新应用领域。对永续性、国家能源安全以及资源在地化利用的日益重视,都为创造有利的商业环境做出了贡献。随着国际社会对净零排放目标的承诺不断推进,各产业正加速采用低碳燃料。粗粮基乙醇因其显着更低的生命週期排放量,正成为交通运输和工业生态系统长期脱碳计画的关键组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 507亿美元 |

| 预测值 | 1424亿美元 |

| 复合年增长率 | 10.9% |

2024年,乙醇燃料市占率达到78.6%,预计到2034年将以11%的复合年增长率成长。这一主导地位主要得益于政策驱动的需求以及干磨乙醇生产技术的日益普及。在美国,大部分乙醇产自干磨厂,这些工厂采用现代技术来提高原料转换效率、降低能耗并优化产品价值。这些工厂将玉米和高粱转化为乙醇、玉米油和酒糟,为生产链带来经济和环境双重价值。

到2034年,生质柴油市场规模将达到250亿美元。虽然传统植物油仍是主要原料,但作为乙醇精炼副产品的玉米油在生质柴油混合的应用日益广泛。这种融合不仅提高了原料利用效率,而且透过最大限度地减少浪费和实现最终用途多样化,也符合循环生物经济的原则。

2024年,美国粗粮生物燃料市场占93%的份额,产值达187亿美元。这一领先地位得益于农业政策与气候目标的紧密结合,粮食生产成为一项战略优势。美国和加拿大的生物燃料计划与涵盖交通、农业和工业领域的更广泛的脱碳计划紧密相连,强化了该地区对能源独立和排放控制的承诺。

粗粒生物燃料市场的主要企业包括Verbio、雪佛龙、Praj Industries、科莱恩、POET、道达尔能源、FutureFuel、丰益国际、安德森公司、ADM、耐斯特、My Eco Energy、博雷加德、Zilor、BTG Bioliquids、Munzer Bioindustrie、UPM、CropEnergies、中集团和加粮。为了巩固其在全球粗粒生物燃料市场的地位,主要企业正在实施多项重点策略。各公司正大力投资技术升级,尤其是在干磨和发酵系统方面,以提高製程效率和产品产量。扩大原料来源并将玉米油等副产品纳入生质柴油产业链,有助于提升营运价值。许多公司也与政府机构合作,使产品开发与监管目标保持一致,尤其是在永续农业燃料(SAF)领域。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争性标竿分析

- 战略仪錶板

- 创新与技术格局

第五章:市场规模及预测:依燃料类型划分,2021-2034年

- 主要趋势

- 乙醇

- 生质柴油

- 其他的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 运输

- 航空

- 其他的

第七章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 印尼

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ADM

- Borregaard

- BTG Bioliquids

- Cargill

- Chevron

- Clariant

- COFCO

- CropEnergies

- FutureFuel

- Munzer Bioindustrie

- My Eco Energy

- Neste

- POET

- Praj Industries

- The Andersons

- TotalEnergies

- UPM

- Verbio

- Wilmar International

- Zilor

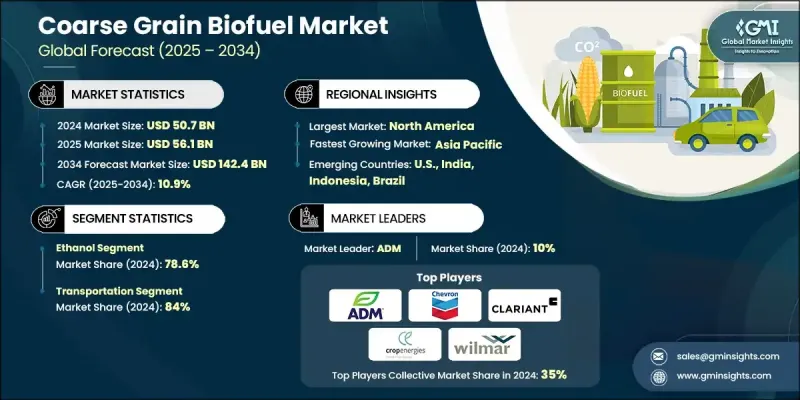

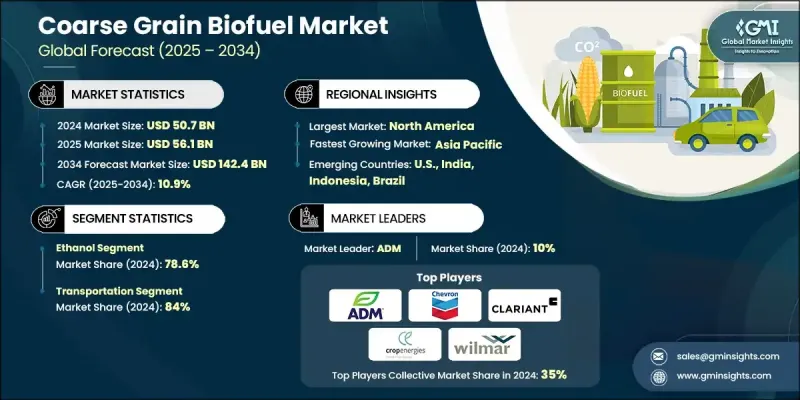

The Global Coarse Grain Biofuel Market was valued at USD 50.7 Billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 142.4 Billion by 2034.

Strong growth in the sector is supported by expanding government mandates on fuel blending and increasing feedstock demand for sustainable aviation fuel. As countries ramp up efforts to reduce dependence on fossil fuels, biofuel targets are playing a key role in emissions reduction strategies. Ethanol produced from coarse grains such as corn and sorghum is becoming integral to transport fuel policies, particularly as the aviation sector looks for decarbonization pathways. Regulatory frameworks that promote ethanol-based SAF are helping to expand the role of coarse grain biofuels into new applications beyond road transportation. Growing emphasis on sustainability, national energy security, and the shift toward localized resource utilization are all contributing to a favorable business environment. With international commitments to net-zero targets gaining momentum, industries are accelerating the adoption of low-carbon fuels. Coarse grain-based ethanol, with its significantly lower lifecycle emissions, is emerging as a key component in long-term decarbonization plans across both transportation and industrial ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $50.7 Billion |

| Forecast Value | $142.4 Billion |

| CAGR | 10.9% |

The ethanol-based fuels segment accounted for a 78.6% share in 2024 and is forecast to grow at a CAGR of 11% through 2034. This dominant position is being driven by policy-driven demand and the increasing application of dry mill ethanol production technologies. In the U.S., most ethanol output comes from dry mill plants, which have adopted modern technologies to enhance feedstock conversion efficiency, reduce energy use, and optimize product value. These facilities convert corn and sorghum into ethanol, corn oil, and distillers' grains, delivering both economic and environmental value to the production chain.

The biodiesel segment will reach USD 25 Billion by 2034. While traditional vegetable oils remain a primary input, corn oil, a byproduct of ethanol refining, is seeing expanded use in biodiesel blending. This integration not only boosts the efficiency of feedstock utilization but also aligns with the principles of a circular bioeconomy by minimizing waste and diversifying end uses.

U.S. Coarse Grain Biofuel Market held 93% share in 2024, generating USD 18.7 Billion. This leadership is underpinned by a strong alignment of agricultural policy and climate goals, with grain production serving as a strategic advantage. Biofuel initiatives across the U.S. and Canada are closely tied to broader decarbonization plans involving transport, agriculture, and industrial sectors, reinforcing the region's commitment to energy independence and emissions control.

Key companies in the Coarse Grain Biofuel Market include Verbio, Chevron, Praj Industries, Clariant, POET, TotalEnergies, FutureFuel, Wilmar International, The Andersons, ADM, Neste, My Eco Energy, Borregaard, Zilor, BTG Bioliquids, Munzer Bioindustrie, UPM, CropEnergies, COFCO, and Cargill. To solidify their position in the Global Coarse Grain Biofuel Market, major players are deploying several focused strategies. Companies are heavily investing in technology upgrades, particularly in dry mill and fermentation systems, to improve process efficiencies and product yields. Expanding their feedstock base and incorporating co-products like corn oil into biodiesel chains is helping increase operational value. Many firms are also collaborating with government bodies to align product development with regulatory goals, especially in the SAF segment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, Mtoe)

- 5.1 Key trends

- 5.2 Ethanol

- 5.3 Biodiesel

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Mtoe)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Aviation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Mtoe)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Indonesia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ADM

- 8.2 Borregaard

- 8.3 BTG Bioliquids

- 8.4 Cargill

- 8.5 Chevron

- 8.6 Clariant

- 8.7 COFCO

- 8.8 CropEnergies

- 8.9 FutureFuel

- 8.10 Munzer Bioindustrie

- 8.11 My Eco Energy

- 8.12 Neste

- 8.13 POET

- 8.14 Praj Industries

- 8.15 The Andersons

- 8.16 TotalEnergies

- 8.17 UPM

- 8.18 Verbio

- 8.19 Wilmar International

- 8.20 Zilor