|

市场调查报告书

商品编码

1871244

数位临床解决方案市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Digital Clinical Solution Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

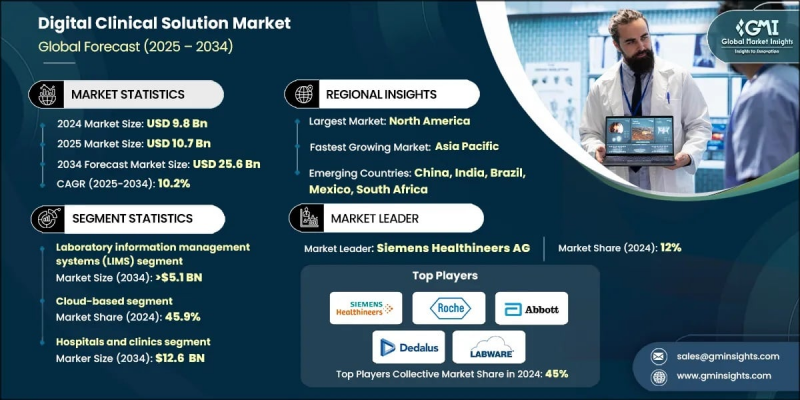

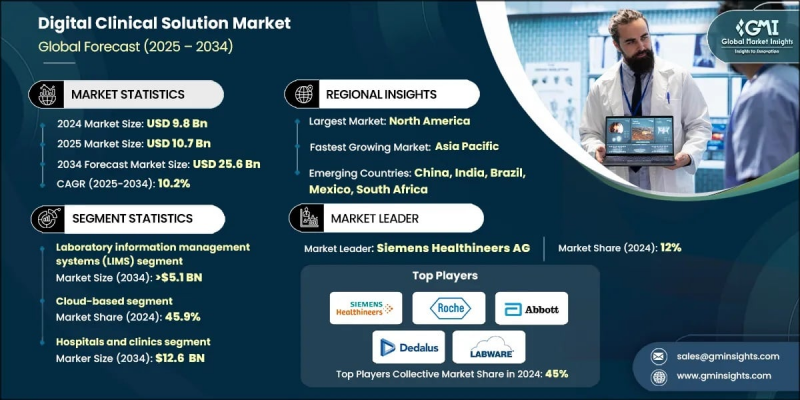

2024 年全球数位临床解决方案市值为 98 亿美元,预计到 2034 年将以 10.2% 的复合年增长率增长至 256 亿美元。

市场强劲成长势头源自于对可扩展、以数据为中心、以患者为中心的医疗保健模式日益增长的需求。随着慢性病增多、人口老化和医疗专业人员短缺等挑战的不断加剧,数位化平台正在重塑全球医疗服务的提供方式。创新的医疗技术正在改善协调性、诊断精准度和整体治疗效果。随着医疗系统向效率和价值导向模式转型,数位化临床解决方案的采用持续加速,帮助医疗机构更好地管理病患资料、简化工作流程并提升营运绩效。数位化临床解决方案涵盖先进的软体和技术平台,旨在简化医疗营运、改善临床流程并提升患者疗效。这些系统能够帮助医疗机构、实验室和研究机构管理临床资料、确保合规性并利用资料分析进行策略决策。它们在实现即时监测和促进医疗环境中的循证临床干预方面发挥着至关重要的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 98亿美元 |

| 预测值 | 256亿美元 |

| 复合年增长率 | 10.2% |

预计到2034年,资料分析和报告软体市场将以11.2%的复合年增长率成长。这一成长主要归功于临床对分析洞察、预测建模和绩效追踪的日益依赖,以提升临床效率。随着医疗服务提供者越来越重视数据驱动和结果导向的医疗服务,先进的分析工具对于将复杂的患者资料转化为可操作的洞察,从而优化诊断和治疗决策,变得至关重要。

到2024年,基于云端的部署模式市占率将达到45.9%。其广泛应用得益于市场对灵活、经济且易于部署的医疗保健技术的需求。云端基础设施使医疗机构能够安全地管理和交换患者信息,而无需依赖成本高昂的实体系统。这种灵活性既支持发达的医疗保健市场,也支持新兴地区,使医疗服务提供者能够在确保资料安全和合规性的同时,扩展其数位化能力。

预计到2024年,美国数位临床解决方案市场规模将达39亿美元。美国凭藉先进的医疗基础设施、对数位医疗技术的大量投资以及政府大力推动数位转型的倡议,继续引领全球市场。美国对互联互通、数据驱动型医疗的重视,正在加速医院、诊断中心和门诊网路等各领域整合临床解决方案的部署。

全球数字临床解决方案市场的主要参与者包括雅培实验室、贝克曼库尔特公司、Bio-Rad Laboratories Inc.、CLTech、COYALab、DataArt、Dedalus、罗氏公司、GrupoBIOS SA、GTPLAN、IL Werfen、KERN IT、LabCoreSoft、LabWare、Matrix Sistemas、Optilink SRL、Pixeon、西门子医疗、Tesi Group 和 Tips Salud。为了巩固自身地位,数位临床解决方案领域的关键企业正专注于创新、合作和产品组合拓展。许多企业正大力投资研发,以增强软体功能、提高互通性并提供人工智慧驱动的分析,从而改善临床结果。与医疗服务提供者和技术公司的策略合作有助于加速跨不同医疗生态系统的整合和客製化。此外,各企业也强调併购和产品多元化,以扩大其全球影响力。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 远距医疗和远距保健的需求日益增长

- 数位临床软体解决方案的技术进步

- 临床工作流程管理需求日益增长

- 产业陷阱与挑战

- 高昂的实施和维护成本

- 医疗保健和熟练专业人员短缺

- 市场机会

- 政府主导的数位健康计划

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依软体划分,2021-2034年

- 主要趋势

- 实验室资讯管理系统(LIMS)

- 实验室资讯系统(LIS)

- 中介软体解决方案

- 即时资料监控系统

- 库存管理软体

- 企业资源规划(ERP)

- 临床决策支援系统(CDSS)

- 电子实验纪录本(ELN)

- 数据分析和报告软体

第六章:市场估算与预测:以交付方式划分,2021-2034年

- 主要趋势

- 基于云端的

- 本地部署

- 杂交种

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 实验室

- 临床和诊断实验室

- 研究实验室

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc

- CLTech

- COYALab

- DataArt

- Dedalus

- F. Hoffmann-La Roche Ltd.

- GrupoBIOS SA

- GTPLAN

- IL Werfen

- KERN IT

- LabCoreSoft

- LabWare

- Matrix Sistemas

- Optilink SRL

- Pixeon

- Siemens Healthineers AG

- Tesi Group

- Tips Salud

The Global Digital Clinical Solution Market was valued at USD 9.8 Billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 25.6 Billion by 2034.

The market's strong momentum is driven by the growing need for scalable, data-centric, and patient-focused healthcare models. With increasing challenges such as the rise in chronic illnesses, aging populations, and shortages in healthcare professionals, digital platforms are reshaping the delivery of care worldwide. Innovative healthcare technologies are improving coordination, diagnostic precision, and overall treatment outcomes. As healthcare systems shift toward efficiency and value-based models, the adoption of digital clinical solutions continues to accelerate, helping institutions better manage patient data, streamline workflows, and enhance operational performance. Digital clinical solutions encompass advanced software and technology platforms designed to simplify healthcare operations, improve clinical processes, and elevate patient outcomes. These systems assist healthcare facilities, laboratories, and research organizations in managing clinical data, ensuring compliance, and utilizing data analytics for strategic decision-making. They play a critical role in enabling real-time monitoring and facilitating evidence-based clinical interventions across healthcare environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 billion |

| Forecast Value | $25.6 billion |

| CAGR | 10.2% |

The data analytics and reporting software segment is anticipated to grow at a CAGR of 11.2% through 2034. This expansion is attributed to the growing reliance on analytical insights, predictive modeling, and performance tracking to support clinical efficiency. As healthcare providers increasingly focus on data-driven and outcome-based care, advanced analytics tools are becoming essential for transforming complex patient data into actionable insights that enhance diagnostic and therapeutic decisions.

The cloud-based deployment model segment held a 45.9% share in 2024. Its widespread adoption is fueled by the demand for flexible, affordable, and easily deployable healthcare technologies. Cloud infrastructure allows healthcare organizations to securely manage and exchange patient information without relying on costly physical systems. This flexibility supports both developed healthcare markets and emerging regions, enabling providers to expand their digital capabilities while maintaining data security and compliance.

United States Digital Clinical Solution Market reached USD 3.9 Billion in 2024. The U.S. continues to lead the global market, supported by advanced healthcare infrastructure, high investments in digital health technologies, and strong government initiatives promoting digital transformation. The nation's focus on connected, data-enabled healthcare is accelerating the implementation of integrated clinical solutions across hospitals, diagnostic centers, and outpatient networks.

Leading participants in the Global Digital Clinical Solution Market include Abbott Laboratories, Beckman Coulter Inc., Bio-Rad Laboratories Inc., CLTech, COYALab, DataArt, Dedalus, F. Hoffmann-La Roche Ltd., GrupoBIOS S.A., GTPLAN, IL Werfen, KERN IT, LabCoreSoft, LabWare, Matrix Sistemas, Optilink S.R.L., Pixeon, Siemens Healthineers AG, Tesi Group, and Tips Salud. To strengthen their position, key companies in the digital clinical solutions sector are focusing on innovation, partnerships, and portfolio expansion. Many are investing heavily in research and development to enhance software functionality, improve interoperability, and deliver AI-powered analytics for better clinical outcomes. Strategic collaborations with healthcare providers and technology firms help accelerate integration and customization across diverse healthcare ecosystems. Companies are also emphasizing mergers, acquisitions, and product diversification to expand their global footprint.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Software trends

- 2.2.3 Mode of delivery trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for remote healthcare and telemedicine

- 3.2.1.2 Technological advancements in digital clinical software solutions

- 3.2.1.3 Increasing need for clinical workflow management

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and maintenance costs

- 3.2.2.2 Shortage of healthcare and skilled professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Government led digital health initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Software, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Laboratory information management systems (LIMS)

- 5.3 Laboratory information systems (LIS)

- 5.4 Middleware solutions

- 5.5 Real-time data monitoring systems

- 5.6 Inventory management software

- 5.7 Enterprise resource planning (ERP)

- 5.8 Clinical decision support systems (CDSS)

- 5.9 Electronic lab notebooks (ELN)

- 5.10 Data analytics and reporting software

Chapter 6 Market Estimates and Forecast, By Mode of Delivery, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premise

- 6.4 Hybrid

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Laboratories

- 7.3.1 Clinical and diagnostic laboratories

- 7.3.2 Research laboratories

- 7.4 Other End use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Beckman Coulter, Inc.

- 9.3 Bio-Rad Laboratories, Inc

- 9.4 CLTech

- 9.5 COYALab

- 9.6 DataArt

- 9.7 Dedalus

- 9.8 F. Hoffmann-La Roche Ltd.

- 9.9 GrupoBIOS S.A.

- 9.10 GTPLAN

- 9.11 IL Werfen

- 9.12 KERN IT

- 9.13 LabCoreSoft

- 9.14 LabWare

- 9.15 Matrix Sistemas

- 9.16 Optilink S.R.L.

- 9.17 Pixeon

- 9.18 Siemens Healthineers AG

- 9.19 Tesi Group

- 9.20 Tips Salud