|

市场调查报告书

商品编码

1871281

柴油动力建筑发电机组市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Diesel Fired Construction Generator Sets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

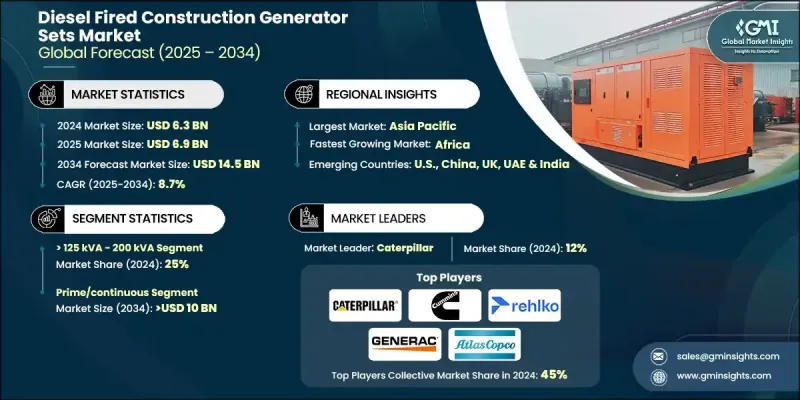

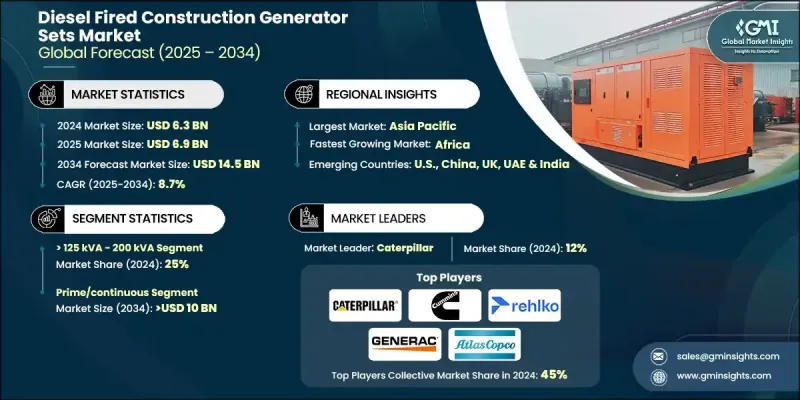

2024 年全球柴油建筑发电机组市场价值为 63 亿美元,预计到 2034 年将以 8.7% 的复合年增长率增长至 145 亿美元。

对清洁能源技术的监管压力日益增大,以及对燃油效率和成本优化的高度重视,正在推动市场成长。建筑公司正转向新一代柴油发电机组,这些发电机组兼具可靠性和更高的环保性能。无论专案规模大小,这些发电机组都不可或缺,为电网接入有限或不稳定的作业提供可靠的离网电力。柴油发电机组的设计旨在为设备、照明和临时现场设施提供持续的能源供应,即使在偏远或环境恶劣的地区也能确保工作流程不间断。这些系统专为应对严苛的现场条件而设计,可提供稳定的性能和长久的使用寿命,满足高要求建筑活动的营运需求。随着各行业寻求在不牺牲性能的前提下实现可持续的解决方案,向先进、高效的柴油系统的过渡正日益普及。由于不间断的能源供应对于现场安全和生产力至关重要,柴油发电机组在基础设施、交通运输和大型建设项目中的应用不断增长,并持续推动市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 63亿美元 |

| 预测值 | 145亿美元 |

| 复合年增长率 | 8.7% |

预计到2034年,功率范围在50 kVA至125 kVA之间的发电机组市场规模将达到15亿美元。市场需求的成长源于其灵活性和支持中型建设项目(例如商业综合体、道路和维护工程)的能力。这些发电机组能够为包括泵浦、搅拌机和物料搬运系统在内的关键设备提供稳定可靠的电力,因此非常适合需要多班次作业的施工环境,在这些环境中,性能和正常运行时间至关重要。

预计2025年至2034年间,备用建筑发电机市场将以8%的复合年增长率成长。需求激增的主要原因是需要可靠的紧急备用系统,以便在电网中断或恶劣天气导致的停电期间自动启动。这些系统永久安装在建筑工地,透过在停电期间维持必要的电力供应,确保施工连续性和工地安全。随着极端天气事件的日益频繁以及对电力驱动机械的依赖性不断增强,采用备用发电机组已成为维持各种规模专案生产力的策略性必要措施。

2024年,美国柴油建筑发电机组市场占据85%的份额,市场规模达9.043亿美元。美国建筑业高度依赖持续稳定的电力供应来运作重型机械、起重机、照明系统和其他关键的现场基础设施。电网不稳定、电力中断和极端天气频繁,凸显了强大且高效的现场电力系统的重要性。因此,柴油发电机组凭藉其耐用性、可靠性和即时供电能力,仍然是各类建筑项目中最受欢迎的选择。

全球柴油建筑发电机组市场的主要参与者包括瓦锡兰、卡特彼勒、康明斯、马恆达动力、斯特林发电机、格里夫斯棉业、苏迪尔动力、阿特拉斯科普柯、罗尔斯·罗伊斯、FG威尔逊、阿格雷科、HIMOINSA、雷尔科、三菱重工、JC Bamford、50kandpford、Colek、GeneC。这些企业正采取多种策略来扩大其竞争范围并巩固市场领导地位。主要参与者正在投资先进的引擎技术,以提高燃油效率、减少排放并确保符合日益严格的全球法规。产品多元化仍然是一项核心策略,各公司正在开发紧凑型和混合动力发电机组,以满足建筑工地的灵活应用需求。与建筑承包商和租赁服务提供者的合作有助于扩大分销网络,并改善客户获得客製化电力解决方案的途径。企业也正在利用数位监控系统和预测性维护工具来提高营运可靠性并最大限度地减少停机时间。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 製造能力评估

- 供应链韧性与风险因素

- 配电网路分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 柴油建筑发电机组成本结构分析

- 价格趋势分析(美元/单位)

- 按地区

- 按功率等级

- 新兴机会与趋势

- 数位化与物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

- 拉丁美洲

- 战略仪錶板

- 策略倡议

- 重要伙伴关係与合作

- 主要併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争性标竿分析

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级划分,2021-2034年

- 主要趋势

- ≤ 50 kVA

- 50千伏安 - 125千伏安

- 125千伏安 - 200千伏安

- 200千伏安 - 330千伏安

- 330千伏安 - 750千伏安

- 750千伏安以上

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 支援

- 削峰

- 主/连续

第七章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 肯亚

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- Aggreko

- Ashok Leyland

- Atlas Copco

- Caterpillar

- Cummins

- FG Wilson

- Generac Power Systems

- Greaves Cotton

- HIMOINSA

- Jakson

- JC Bamford Excavators

- Kirloskar

- Mahindra Powerol

- Mitsubishi Heavy Industries

- Rehlko

- Rolls-Royce

- Sterling Generators

- Sudhir Power

- Supernova Genset

- Wartsila

The Global Diesel Fired Construction Generator Sets Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 14.5 billion by 2034.

Increasing regulatory pressure for cleaner energy technologies and the strong focus on fuel efficiency and cost optimization are shaping market growth. Construction companies are moving toward next-generation diesel gensets that combine reliability with improved environmental compliance. These generators remain indispensable across large and small construction projects, offering dependable off-grid power for operations where electrical grid access is limited or inconsistent. Diesel fired generator sets are engineered to supply continuous energy to run equipment, lighting, and temporary on-site installations, ensuring uninterrupted workflow even in remote or challenging environments. Designed to withstand rugged field conditions, these systems deliver consistent performance and longevity, meeting the operational needs of demanding construction activities. The transition toward advanced, high-efficiency diesel systems is gaining traction as industries seek sustainable solutions without compromising performance. Their growing application in infrastructure, transportation, and large-scale construction projects continues to strengthen market expansion, as uninterrupted energy remains critical to safety and productivity on-site.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $14.5 Billion |

| CAGR | 8.7% |

The >50 kVA - 125 kVA power range segment will reach USD 1.5 billion by 2034. Rising demand stems from their flexibility and capability to support mid-scale construction projects such as commercial complexes, roads, and maintenance works. These generator sets offer steady and dependable power to operate critical equipment including pumps, mixers, and material handling systems, making them highly suitable for multi-shift construction operations where performance and uptime are key considerations.

The standby construction generator segment is projected to grow at a CAGR of 8% from 2025 to 2034. The demand surge is primarily driven by the need for reliable emergency backup systems that automatically activate during power failures caused by grid disruptions or adverse weather events. Permanently installed on construction sites, these systems ensure operational continuity and site safety by maintaining essential power supply during outages. With the increasing frequency of extreme weather conditions and rising dependency on electrically powered machinery, the adoption of standby gensets has become a strategic necessity for maintaining productivity across projects of varying sizes.

U.S. Diesel Fired Construction Generator Sets Market held 85% share in 2024, generating USD 904.3 million. The country's construction industry relies heavily on continuous power availability to run heavy machinery, cranes, lighting systems, and other critical on-site infrastructure. Recurring grid instabilities, power interruptions, and severe weather patterns have heightened the importance of robust and efficient on-site power systems. As a result, diesel gensets remain the most preferred option across diverse construction projects due to their durability, reliability, and readiness to deliver instant power.

Key players in the Global Diesel Fired Construction Generator Sets Market include Wartsila, Caterpillar, Cummins, Mahindra Powerol, Sterling Generators, Greaves Cotton, Sudhir Power, Atlas Copco, Rolls-Royce, FG Wilson, Aggreko, HIMOINSA, Rehlko, Mitsubishi Heavy Industries, J C Bamford Excavators, Kirloskar, Ashok Leyland, Generac Power Systems, Jakson, and Supernova Genset. Companies in the Diesel Fired Construction Generator Sets Market are pursuing multiple strategies to expand their competitive reach and reinforce market leadership. Major players are investing in advanced engine technologies to enhance fuel efficiency, reduce emissions, and ensure compliance with tightening global regulations. Product diversification remains a core strategy, with companies developing compact and hybrid-ready gensets for flexible applications across construction sites. Collaborations with construction contractors and rental service providers help expand distribution networks and improve customer access to customized power solutions. Firms are also leveraging digital monitoring systems and predictive maintenance tools to enhance operational reliability and minimize downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Power rating trends

- 2.1.3 Application trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of diesel fired construction generator sets

- 3.8 Price trend analysis (USD/Unit)

- 3.8.1 By region

- 3.8.2 By power rating

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East

- 4.2.5 Africa

- 4.2.6 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Peak shaving

- 6.4 Prime/continuous

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkiye

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Ashok Leyland

- 8.3 Atlas Copco

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 FG Wilson

- 8.7 Generac Power Systems

- 8.8 Greaves Cotton

- 8.9 HIMOINSA

- 8.10 Jakson

- 8.11 J C Bamford Excavators

- 8.12 Kirloskar

- 8.13 Mahindra Powerol

- 8.14 Mitsubishi Heavy Industries

- 8.15 Rehlko

- 8.16 Rolls-Royce

- 8.17 Sterling Generators

- 8.18 Sudhir Power

- 8.19 Supernova Genset

- 8.20 Wartsila