|

市场调查报告书

商品编码

1871284

滚子轴承市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Roller Bearings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

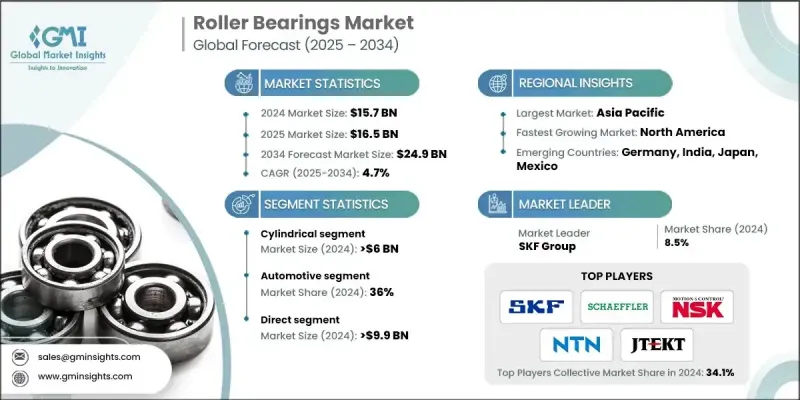

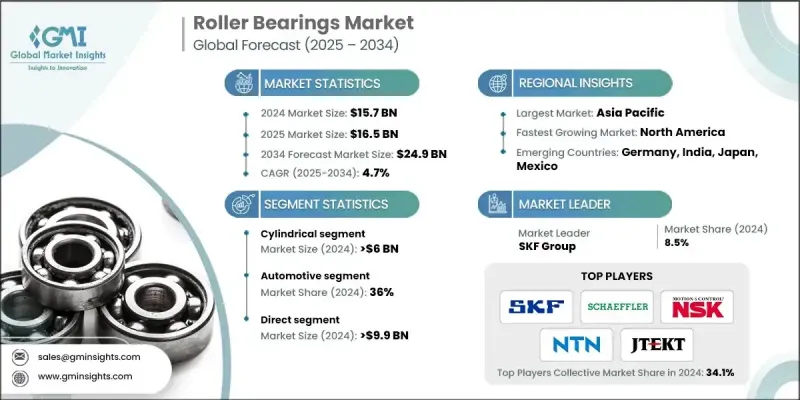

2024 年全球滚子轴承市场价值为 157 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 249 亿美元。

滚子轴承是建筑、采矿和製造等行业不可或缺的关键零件,可靠性和耐用性是高效运作的关键。工业领域自动化和先进机械的日益普及,推动了对能够承受重载、高压和极端温度变化的高性能轴承的需求。各国政府大力推广工业自动化和节能係统,进一步促进了市场成长。随着研发投入的不断增加,滚子轴承也在不断发展,以在严苛的工业环境中提供更高的性能、精度和使用寿命。支持再生能源和智慧製造的全球性倡议也持续影响着市场的发展,鼓励着能够提高效率和运作稳定性的创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 157亿美元 |

| 预测值 | 249亿美元 |

| 复合年增长率 | 4.7% |

2024年,圆柱滚子轴承市场规模预计将达到60亿美元,这主要得益于市场对能够承受重径向负荷并在高速下高效运行的轴承的需求。这些轴承广泛应用于工业电机、製造业和汽车系统。仅工业电机一项就占製造业总能耗的一半以上,而圆柱滚子轴承在提高其运行效率方面发挥着至关重要的作用,因此,各行各业对这类轴承的需求强劲,因为它们都致力于节能减排,降低维护成本。

2024年,直销通路市场规模达到99亿美元,凭藉其与原始设备製造商(OEM)建立直接合作关係的有效性,在滚轮轴承市场占据主导地位。直销模式使製造商能够提供客製化解决方案,同时确保顺畅的沟通和技术协作。这种模式在汽车、航太和重型设备製造等高价值产业尤其有利,因为在这些产业中,精准度、品质保证和性能可靠性是OEM的关键决策因素。

2024年,美国滚子轴承市占率达77.1%。美国先进的製造业生态系统、强大的汽车产业基础以及不断发展的航太和重型机械产业是推动这一成长的主要因素。持续的技术发展和主要行业参与者的存在巩固了美国在该地区的主导地位,从而支撑了国内外对工业级滚子轴承的需求。

全球滚子轴承市场的主要参与者包括NBI Bearings Europe、HKT Bearings、C&U Group、美蓓亚、NTN、NSK、SKF、舍弗勒集团、铁姆肯公司、RBC Bearings、Brammer、大同金属、哈尔滨轴承製造、捷太格特和Rexnord。滚子轴承市场的企业致力于技术创新、产品多元化和策略合作,以巩固其全球地位。对研发的大量投入使他们能够开发出先进、高耐久性的轴承,即使在极端条件下也能高效运作。许多企业正在采用自动化和智慧製造流程来提高精度并降低生产成本。与工业、汽车和航太领域的原始设备製造商 (OEM) 的合作确保了长期合约和产品客製化机会。扩大区域製造基地和供应链有助于加快交货速度并提高成本效益。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 工业扩张和自动化

- 汽车产业成长

- 技术进步与产品创新

- 产业陷阱与挑战

- 高昂的生产成本

- 替代技术的出现

- 机会

- 节能智慧型滚子轴承系统

- 工业自动化和智慧製造的成长

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码-8482)

- 主要进口国

- 主要出口国

- 差距分析

- 风险评估与缓解

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 圆柱形

- 锥

- 球形

- 其他的

- 针

- 推力

- 分裂

第六章:市场估算与预测:依材料分类,2021-2034年

- 主要趋势

- 钢

- 陶瓷製品

- 聚合物

- 杂交种

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 变速箱

- 电动机

- 泵浦和压缩机

- 风力涡轮机

- 传送带

- 工具机

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 汽车

- 农业

- 电力

- 采矿与建筑

- 铁路与航太

- 汽车售后市场

- 其他的

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Brammer

- C&U Group

- Daido Metal

- Harbin Bearing Manufacturing

- HKT Bearings

- JTEKT

- Minebea

- NBI轴承欧洲

- NSK

- NTN

- RBC Bearings

- Rexnord

- Schaeffler Group

- SKF

- The Timken Company

The Global Roller Bearings Market was valued at USD 15.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 24.9 billion by 2034.

Roller bearings serve as essential components across industries such as construction, mining, and manufacturing, where reliability and durability are key to efficient operations. The growing adoption of automation and advanced machinery across industrial sectors has driven the need for high-performance bearings capable of handling heavy loads, high pressure, and extreme temperature variations. Governments promoting industrial automation and energy-efficient systems are further fueling market growth. With increased focus on research and development, roller bearings are evolving to deliver improved performance, precision, and longevity in demanding industrial environments. Global initiatives supporting renewable energy and smart manufacturing also continue to influence the market's evolution, encouraging innovations that enhance efficiency and operational stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.7 Billion |

| Forecast Value | $24.9 Billion |

| CAGR | 4.7% |

The cylindrical roller bearing segment reached USD 6 billion in 2024, driven by demand for bearings that support heavy radial loads and perform efficiently at high speeds. These bearings are widely adopted in industrial motors, manufacturing, and automotive systems. Industrial motors alone account for more than half of total energy consumption in manufacturing, and cylindrical bearings play a crucial role in improving their operational efficiency, thereby driving strong demand across industries seeking energy savings and reduced maintenance costs.

The direct sales segment reached USD 9.9 billion in 2024, dominating the roller bearings market due to its effectiveness in maintaining direct partnerships with OEMs. Direct distribution enables manufacturers to deliver customized solutions while ensuring seamless communication and technical collaboration. This approach is particularly beneficial in high-value sectors such as automotive, aerospace, and heavy equipment manufacturing, where precision, quality assurance, and performance reliability are key decision factors for OEMs.

U.S. Roller Bearings Market held 77.1% share in 2024. The country's advanced manufacturing ecosystem, strong automotive base, and expanding aerospace and heavy machinery sectors are major contributors to this growth. Continuous technological development and the presence of key industry players have reinforced the U.S. as a dominant force in the region, supporting both domestic and global demand for industrial-grade roller bearings.

Major players in the Global Roller Bearings Market include NBI Bearings Europe, HKT Bearings, C&U Group, Minebea, NTN, NSK, SKF, Schaeffler Group, The Timken Company, RBC Bearings, Brammer, Daido Metal, Harbin Bearing Manufacturing, JTEKT, and Rexnord. Companies in the Roller Bearings Market are focused on technological innovation, product diversification, and strategic partnerships to strengthen their global presence. Heavy investment in R&D enables them to develop advanced, high-durability bearings that perform efficiently under extreme conditions. Many players are adopting automation and smart manufacturing processes to improve precision and reduce production costs. Collaborations with OEMs across industrial, automotive, and aerospace sectors ensure long-term contracts and product customization opportunities. Expanding regional manufacturing bases and supply chains allows for faster delivery and cost efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Application

- 2.2.5 End use Industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial expansion and automation

- 3.2.1.2 Automotive industry growth

- 3.2.1.3 Technological advancements and product innovation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Emergence of alternative technologies

- 3.2.3 Opportunities

- 3.2.3.1 Energy-efficient and smart roller bearing systems

- 3.2.3.2 Growth in industrial automation and smart manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-8482)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Cylindrical

- 5.3 Tapered

- 5.4 Spherical

- 5.5 Others

- 5.5.1 Needle

- 5.5.2 Thrust

- 5.5.3 Split

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Ceramic

- 6.4 Polymer

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Gearboxes

- 7.3 Electric Motors

- 7.4 Pumps & Compressors

- 7.5 Wind Turbines

- 7.6 Conveyors

- 7.7 Machine Tools

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Agriculture

- 8.4 Electrical

- 8.5 Mining & Construction

- 8.6 Railway & Aerospace

- 8.7 Automotive aftermarket

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Brammer

- 11.2 C&U Group

- 11.3 Daido Metal

- 11.4 Harbin Bearing Manufacturing

- 11.5 HKT Bearings

- 11.6 JTEKT

- 11.7 Minebea

- 11.8 NBI Bearings Europe

- 11.9 NSK

- 11.10 NTN

- 11.11 RBC Bearings

- 11.12 Rexnord

- 11.13 Schaeffler Group

- 11.14 SKF

- 11.15 The Timken Company