|

市场调查报告书

商品编码

1871295

实验室自建检测市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Laboratory Developed Tests Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

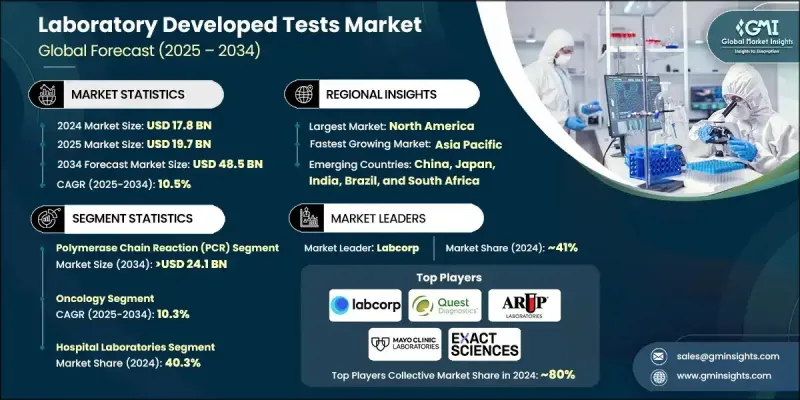

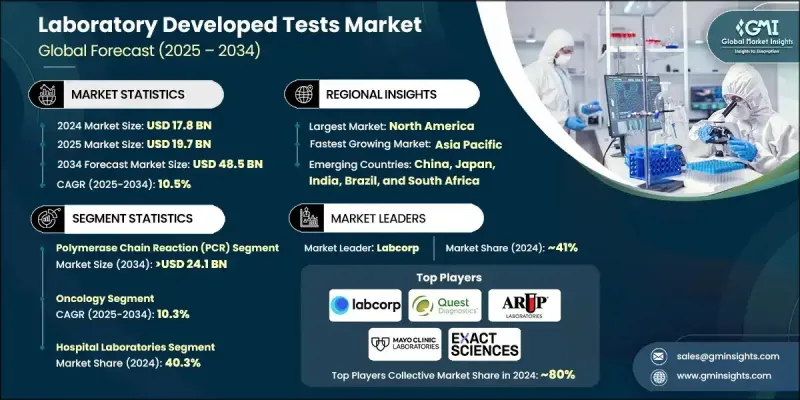

2024 年全球实验室自建测试市场价值为 178 亿美元,预计到 2034 年将以 10.5% 的复合年增长率增长至 485 亿美元。

实验室自建检测(LDT)的快速增长主要得益于人们对疾病早期检测意识的提高、传染病和慢性病患病率的上升,以及癌症和遗传性疾病病例的不断增加。 LDT是指在同一实验室内完成创建、生产和使用的诊断测试,它彻底改变了个人化医疗,改善了疾病管理并辅助临床决策。 LDT能够快速创新并根据特定患者的需求量身定制测试,这正在改变医疗保健行业,尤其是在需要精准个体化诊断的复杂疾病领域。各公司提供种类繁多的测试,从先进的下一代定序(NGS)检测到复杂的分子诊断和生物标记检测。这些测试利用了最先进的技术,包括高通量基因组学、人工智慧驱动的演算法、生物资讯学平台和云端资料整合。随着癌症发生率的持续攀升,对早期、准确和个人化诊断的需求也日益增长。 LDT发挥着至关重要的作用,能够快速检测基因突变、生物标记和疾病亚型,这对于制定标靶治疗方案和改善患者预后至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 178亿美元 |

| 预测值 | 485亿美元 |

| 复合年增长率 | 10.5% |

由于全球癌症负担日益加重,预计到2034年,免疫组织化学(IHC)领域将以9.9%的复合年增长率成长。 IHC对于识别肿瘤标记、辅助治疗方案选择以及支持个人化医疗策略至关重要,巩固了其在肿瘤诊断领域的地位。

受全球病毒和细菌感染发生率上升的推动,预计到2034年,传染病领域将以11%的复合年增长率成长。实验室自建检测(LDT)的灵活性和快速週转能力使其成为疫情防治和日常传染病诊断不可或缺的工具。

2024年,美国实验室自建检测(LDT)市场规模预计将达到68亿美元,这得益于其强大的医院和参考实验室网络,这些机构能够开发和验证复杂的检测方法,尤其是在肿瘤学、传染病和遗传疾病领域。北美,特别是美国的监管环境历来鼓励LDT领域的创新,使实验室能够应对不断出现的健康挑战。人工智慧、自动化和新一代定序技术的整合持续推动着市场成长,使该地区成为先进诊断技术开发的领导者。

全球实验室自建检测(LDT)市场的主要企业包括IgX、Freenome、GUARDANT、HealthBio、veracyte、BioReference、MicroGenDX、prognomiQ、梅奥诊所实验室(MAYO CLINIC LABORATORIES)、SONIC HEALTHCARE USA和GeneDx。这些企业致力于持续创新,整合人工智慧、机器学习和新一代定序等尖端技术,以提高侦测准确性和缩短週转时间。与医院、研究机构和生技公司建立策略合作关係,有助于拓展检测产品组合,加速市场进入。对生物资讯学和云端运算的投资,促进了高级资料分析和患者资讯的无缝整合,从而提高诊断精度。此外,各企业也优先考虑合规性,并灵活适应不断变化的医疗环境,以保持竞争优势。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 癌症和遗传性疾病发生率不断上升

- 传染病和慢性病盛行率不断上升

- 人们越来越重视疾病早期检测

- 技术进步

- 产业陷阱与挑战

- 替代检测方法的可用性

- 市场机会

- 自动化与数位病理的融合

- 成长驱动因素

- 成长潜力分析

- 报销方案

- LDT定价模型及策略

- 临床实验室收费标准(CLFS)影响分析

- 联邦医疗保险B部分承保范围及报销率

- 监管环境

- 技术格局

- 目前技术

- 新兴技术

- 未来市场趋势

- 价值链分析

- 消费者行为分析

- 投资环境

- 2024年定价分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 聚合酶炼式反应(PCR)

- 下一代定序(NGS)

- 免疫组织化学(IHC)

- 其他技术

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 肿瘤学

- 传染病

- 遗传及罕见疾病

- 心臟病学

- 自体免疫疾病与发炎性疾病

- 其他应用

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院实验室

- 私人参考实验室

- 专业诊断实验室

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ARUP Laboratories

- BioReference

- EXACT SCIENCES

- Freenome

- GeneDx

- GUARDANT

- HealthBio

- IgX

- Labcorp

- MAYO CLINIC LABORATORIES

- MicroGenDX

- prognomiQ

- Quest Diagnostics

- SONIC HEALTHCARE USA

- Veracyte

The Global Laboratory Developed Tests Market was valued at USD 17.8 billion in 2024 and is estimated to grow at a CAGR of 10.5% to reach USD 48.5 billion by 2034.

The rapid growth is largely driven by increasing awareness around early disease detection, the rising prevalence of infectious and chronic illnesses, and a growing number of cancer and genetic disorder cases. LDTs, which are diagnostic tests created, manufactured, and used within a single laboratory, revolutionize personalized medicine, improving disease management and aiding clinical decision-making. Their ability to rapidly innovate and tailor tests to specific patient needs is transforming healthcare, especially in the context of complex conditions that require precise and individualized diagnostics. Companies offer an extensive range of tests, from advanced next-generation sequencing (NGS) panels to sophisticated molecular diagnostics and biomarker assays. These tests utilize state-of-the-art technologies, including high-throughput genomics, AI-driven algorithms, bioinformatics platforms, and cloud-enabled data integration. As cancer rates continue to climb, the demand for early, accurate, and personalized diagnostics intensifies. LDTs play a crucial role by enabling the swift detection of genetic mutations, biomarkers, and disease subtypes, which are vital for tailoring targeted treatments and enhancing patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.8 Billion |

| Forecast Value | $48.5 Billion |

| CAGR | 10.5% |

The immunohistochemistry (IHC) segment is anticipated to grow at a CAGR of 9.9% through 2034, due to the increasing global burden of cancer. IHC is essential for identifying tumor markers, assisting treatment choices, and supporting personalized medicine strategies, solidifying its place in oncology diagnostics.

The infectious diseases segment is expected to grow at a 11% CAGR through 2034, driven by the rising global incidence of viral and bacterial infections. The flexibility and rapid turnaround offered by LDTs make them indispensable for managing outbreaks and everyday infectious disease diagnosis.

U.S. Laboratory Developed Tests Market generated USD 6.8 billion in 2024, benefiting from a robust network of hospitals and reference labs capable of developing and validating complex tests, particularly in oncology, infectious diseases, and genetic conditions. The regulatory environment in North America, especially the U.S., has traditionally encouraged innovation in LDTs, allowing labs to respond to emerging health challenges. The integration of AI, automation, and next-generation sequencing technologies continues to fuel growth, establishing the region as a leader in advanced diagnostic development.

Leading companies in the Global Laboratory Developed Tests Market include IgX, Freenome, GUARDANT, HealthBio, veracyte, BioReference, MicroGenDX, prognomiQ, MAYO CLINIC LABORATORIES, SONIC HEALTHCARE USA, and GeneDx. Companies in the Laboratory Developed Tests Market focus on continuous innovation by integrating cutting-edge technologies such as AI, machine learning, and next-generation sequencing to enhance test accuracy and turnaround time. Strategic collaborations and partnerships with hospitals, research institutes, and biotech firms enable expanded test portfolios and faster market entry. Investments in bioinformatics and cloud computing facilitate advanced data analytics and seamless integration of patient information, improving diagnostic precision. Additionally, companies prioritize regulatory compliance and agile adaptation to changing health landscapes to maintain a competitive advantage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of cancer and genetic disorders

- 3.2.1.2 Rising prevalence of infectious and chronic diseases

- 3.2.1.3 Growing awareness and focus on early disease detection

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Availability of alternative testing methods

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of automation & digital pathology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.4.1 LDT pricing models & strategies

- 3.4.2 Clinical laboratory fee schedule (CLFS) impact analysis

- 3.4.3 Medicare Part B coverage & reimbursement rates

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Future market trends

- 3.8 Value chain analysis

- 3.9 Consumer behavior analysis

- 3.10 Investment landscape

- 3.11 Pricing analysis, 2024

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polymerase chain reaction (PCR)

- 5.3 Next-generation sequencing (NGS)

- 5.4 Immunohistochemistry (IHC)

- 5.5 Other technologies

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Infectious diseases

- 6.4 Genetic & rare disorders

- 6.5 Cardiology

- 6.6 Autoimmune & inflammatory conditions

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital laboratories

- 7.3 Private reference labs

- 7.4 Specialty diagnostic labs

- 7.5 Other End use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ARUP Laboratories

- 9.2 BioReference

- 9.3 EXACT SCIENCES

- 9.4 Freenome

- 9.5 GeneDx

- 9.6 GUARDANT

- 9.7 HealthBio

- 9.8 IgX

- 9.9 Labcorp

- 9.10 MAYO CLINIC LABORATORIES

- 9.11 MicroGenDX

- 9.12 prognomiQ

- 9.13 Quest Diagnostics

- 9.14 SONIC HEALTHCARE USA

- 9.15 Veracyte