|

市场调查报告书

商品编码

1871317

戈谢氏症药物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Gaucher Disease Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

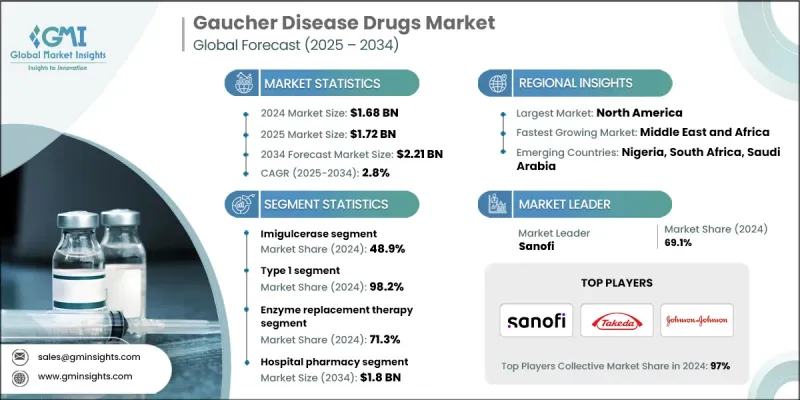

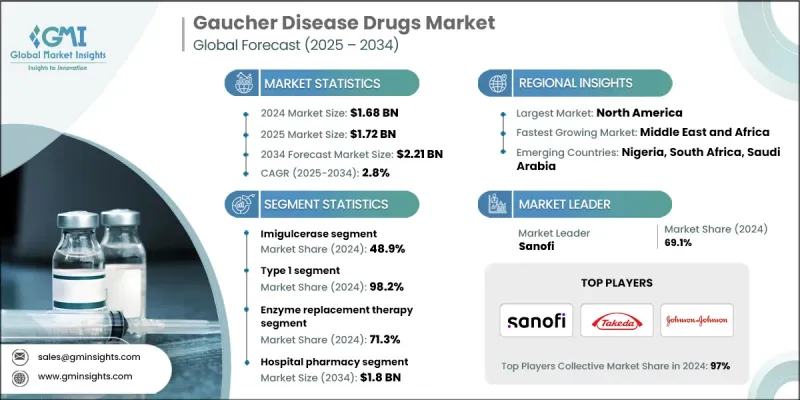

2024 年戈谢氏症药物市场价值为 16.8 亿美元,预计到 2034 年将以 2.8% 的复合年增长率增长至 22.1 亿美元。

随着人们对罕见遗传疾病的认识不断提高、诊断技术不断进步以及酵素替代疗法和底物减少疗法的普及,市场正在稳步扩张。戈谢氏症是一种由葡萄糖脑苷脂酶缺乏引起的溶小体贮积症,在过去十年中取得了显着的治疗突破。标靶治疗透过解决潜在的酵素缺乏问题、改善患者的生活品质和控制疾病症状,正在重塑患者的治疗模式。武田药品工业株式会社、强生公司和赛诺菲等领先的製药公司正透过持续的研发、策略合作和专注于罕见疾病的平台,推动创新。区域差异影响着治疗重点,某些亚型在亚太地区更为常见,而北美和欧洲则以1型病例为主,这凸显了针对特定区域的治疗方案以及酶替代疗法(ERT)和底物减少疗法(SRT)的可及性的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16.8亿美元 |

| 预测值 | 22.1亿美元 |

| 复合年增长率 | 2.8% |

2024年,伊米苷酶(Imiglucerase)市占率为48.9%。这种重组酵素替代疗法可弥补葡糖脑苷脂酶缺乏,帮助分解体内累积的葡糖脑苷脂,进而缓解疾病症状。其广泛的应用得益于显着的临床疗效、已证实的长期安全性以及广泛的监管批准,使其成为医疗服务提供者和患者信赖的治疗方案。

2024 年,1 型戈谢氏症 (GD1) 市占率为 98.2%。 GD1 是最常见的亚型,其特征是全身性症状,但没有神经系统受累,因此对现有疗法的反应更敏感,也是全球药物开发和商业化工作的重点。

2024年,美国戈谢氏症药物市场规模预估为6.457亿美元。美国先进的医疗基础设施、广泛的临床应用以及对个人化医疗的重视,为戈谢氏症的早期诊断和长期管理提供了支持。酵素替代疗法,如伊米苷酶和维拉苷酶α,以及口服底物减少疗法(如依利格鲁司他)的日益普及,是该地区戈谢病治疗的主要手段。

全球戈谢氏症药物市场的主要参与者包括ANI Pharmaceuticals, Inc.、辉瑞公司、武田药品工业株式会社、强生公司、Protalix BioTherapeutics, Inc.、Navinta, LLC、Dipharma SA、Prevail Therapeutics、ISU ABXIS、Generium和赛诺菲。这些公司正透过大力投资研发下一代疗法和罕见疾病平台来巩固其市场地位。他们积极寻求策略合作伙伴关係和合作,以扩大全球市场准入并获得监管部门的批准。市场领导者专注于以患者为中心的治疗方案,包括针对不同亚型和地区的客製化疗法。他们也透过医疗服务提供者和患者群体的教育计画来提升品牌知名度。持续创新、精准的行销策略以及对新兴市场的拓展,帮助这些公司保持竞争优势;而合规性和智慧财产权保护则进一步巩固了其市场地位。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 戈谢病患病率不断上升

- 加大对戈谢氏症治疗药物研发的投资

- 提高对及时诊断和治疗的认识

- 政府对罕见疾病疗法的支持力道不断加大

- 产业陷阱与挑战

- 治疗费用高昂

- 存在严格的监管审批程序

- 市场机会

- 新兴市场扩张与本地製造

- 底物减少疗法的采用

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术格局

- 当前技术趋势

- 改进的临床生物标记

- 基因治疗方法

- 人工智慧引导的药物发现平台

- 新兴技术

- 多组学整合用于个人化治疗

- 量子计算在药物设计优化的应用

- 当前技术趋势

- 专利分析

- 未来市场趋势

- 管道分析

- 2024年定价分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依药物类型划分,2021-2034年

- 主要趋势

- 伊米苷酶

- Velaglucerase alfa

- Taliglucerase alfa

- Eliglustat

- 米格鲁司他

第六章:市场估计与预测:依疾病类型划分,2021-2034年

- 主要趋势

- 1型

- 3型

第七章:市场估计与预测:依治疗类型划分,2021-2034年

- 主要趋势

- 酵素替代疗法

- 底物替代疗法

第八章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 医院药房

- 零售药房

- 网路药房

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

- 哥伦比亚

- 秘鲁

- 厄瓜多

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- 奈及利亚

- 以色列

- 伊朗

第十章:公司简介

- ANI Pharmaceuticals, Inc.

- Dipharma SA

- Generium

- ISU ABXIS

- Johnson & Johnson

- Navinta, LLC

- Pfizer Inc.

- Prevail Therapeutics

- Protalix BioTherapeutics, Inc.

- Sanofi

- Takeda Pharmaceutical Company Limited

The Gaucher Disease Drugs Market was valued at USD 1.68 billion in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 2.21 billion by 2034.

The market is steadily expanding as awareness of rare genetic disorders rises, diagnostic techniques improve, and access to enzyme replacement and substrate reduction therapies broadens. Gaucher disease, a lysosomal storage disorder caused by glucocerebrosidase deficiency, has seen significant therapeutic breakthroughs over the past decade. Targeted treatments are reshaping patient care by addressing the underlying enzyme deficiency, improving quality of life, and managing disease symptoms. Leading pharmaceutical companies such as Takeda Pharmaceutical Company Limited, Johnson & Johnson, and Sanofi are driving innovation through continuous research and development, strategic collaborations, and rare disease-focused platforms. Regional variations influence treatment focus, with certain subtypes more prevalent in Asia Pacific, while North America and Europe are dominated by Type 1 cases, highlighting the importance of region-specific therapy availability and access to both enzyme replacement therapies (ERTs) and substrate reduction therapies (SRTs).

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.68 Billion |

| Forecast Value | $2.21 Billion |

| CAGR | 2.8% |

The Imiglucerase segment held a share of 48.9% in 2024. This recombinant enzyme replacement therapy compensates for glucocerebrosidase deficiency, aiding the breakdown of accumulated glucocerebroside and alleviating disease manifestations. Its widespread adoption is supported by strong clinical efficacy, proven long-term safety, and broad regulatory approval, establishing it as a trusted treatment among healthcare providers and patients.

Type 1 Gaucher disease (GD1) segment held a 98.2% share in 2024. GD1, the most common subtype, is characterized by systemic symptoms without neurological involvement, making it more responsive to existing therapies and a central focus for drug development and commercialization efforts globally.

U.S. Gaucher Disease Drugs Market was valued at USD 645.7 million in 2024. The country's advanced healthcare infrastructure, widespread clinical adoption, and emphasis on personalized medicine support early diagnosis and long-term management of Gaucher disease. Enzyme replacement therapies like imiglucerase and velaglucerase alfa, along with increasing use of oral substrate reduction therapies such as eliglustat, dominate treatment practices in the region.

Key players in the Global Gaucher Disease Drugs Market include ANI Pharmaceuticals, Inc., Pfizer Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson, Protalix BioTherapeutics, Inc., Navinta, LLC, Dipharma SA, Prevail Therapeutics, ISU ABXIS, Generium, and Sanofi. Companies in the Gaucher Disease Drugs Market are strengthening their presence by investing heavily in R&D for next-generation therapies and rare disease platforms. They pursue strategic partnerships and collaborations to expand global access and regulatory approvals. Market leaders focus on patient-centric approaches, including tailored therapies for different subtypes and regions. They also enhance visibility through education programs for healthcare providers and patient communities. Continuous innovation, targeted marketing strategies, and expansion into emerging markets help companies maintain a competitive edge, while regulatory compliance and intellectual property protections further consolidate their market foothold.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Disease type trends

- 2.2.4 Therapy type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of Gaucher disease

- 3.2.1.2 Growing investments for developing Gaucher disease therapies

- 3.2.1.3 Increasing awareness towards timely diagnosis and treatment

- 3.2.1.4 Rising government support for rare disease therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of therapies

- 3.2.2.2 Presence of stringent regulatory approval procedures

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market expansion and local manufacturing

- 3.2.3.2 Substrate reduction therapy adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Improved clinical biomarkers

- 3.5.1.2 Gene therapy approaches

- 3.5.1.3 AI- guided drug discovery platforms

- 3.5.2 Emerging technologies

- 3.5.2.1 Multi-omics integration for personalized therapy

- 3.5.2.2 Quantum computing for drug design optimization

- 3.5.1 Current technological trends

- 3.6 Patent analysis

- 3.7 Future market trends

- 3.8 Pipeline analysis

- 3.9 Pricing analysis, 2024

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Imiglucerase

- 5.3 Velaglucerase alfa

- 5.4 Taliglucerase alfa

- 5.5 Eliglustat

- 5.6 Miglustat

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1

- 6.3 Type 3

Chapter 7 Market Estimates and Forecast, By Therapy Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Enzyme replacement therapy

- 7.3 Substrate replacement therapy

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Chile

- 9.5.5 Colombia

- 9.5.6 Peru

- 9.5.7 Ecuador

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

- 9.6.5 Nigeria

- 9.6.6 Israel

- 9.6.7 Iran

Chapter 10 Company Profiles

- 10.1 ANI Pharmaceuticals, Inc.

- 10.2 Dipharma SA

- 10.3 Generium

- 10.4 ISU ABXIS

- 10.5 Johnson & Johnson

- 10.6 Navinta, LLC

- 10.7 Pfizer Inc.

- 10.8 Prevail Therapeutics

- 10.9 Protalix BioTherapeutics, Inc.

- 10.10 Sanofi

- 10.11 Takeda Pharmaceutical Company Limited