|

市场调查报告书

商品编码

1876540

工具机主轴单元市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Machine Tool Spindle Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

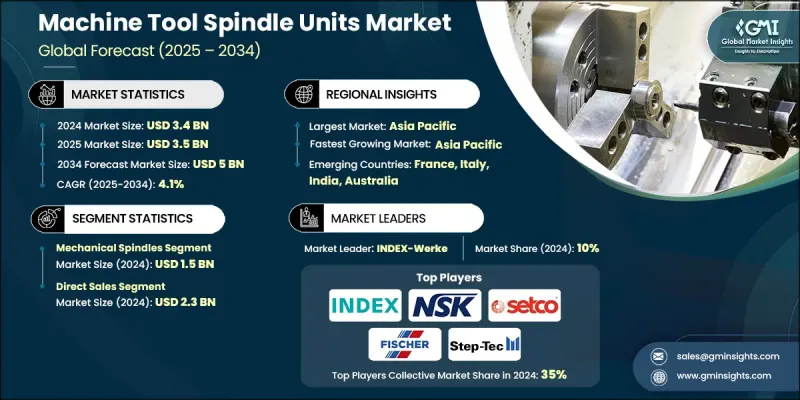

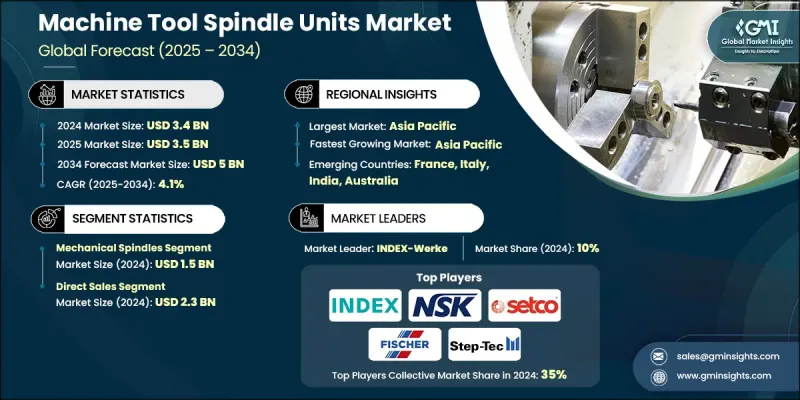

2024 年全球工具机主轴单元市场价值为 34 亿美元,预计到 2034 年将以 4.1% 的复合年增长率增长至 50 亿美元。

各行业对高精度加工的需求不断增长,包括航太、汽车、电子和医疗器材等,这推动了精密主轴市场的发展。製造商正增加对先进主轴技术的投资,以实现更高的转速、更低的振动和更稳定的扭矩,从而生产出公差严格、几何形状复杂、表面光洁度极佳的零件。在对精度要求极高的应用领域,例如先进的传动系统零件、涡轮叶片和微电子产品,精密主轴的需求尤其旺盛。更小更轻的材料进一步凸显了对精密加工的需求。高性能主轴也有助于多轴数控加工和增材-减材混合製造,其中主轴可对3D列印零件进行后处理。日益严格的全球品质标准和监管要求也持续推动精密主轴在全球的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 50亿美元 |

| 复合年增长率 | 4.1% |

2024年,机械主轴市场规模预计将达15亿美元。其受欢迎的原因在于结构简单、经久耐用且运行时间长。由于机械主轴没有整合电机,而是依靠外部驱动,因此成本更低、维护更便捷,尤其适合中小型製造商。其坚固耐用的设计使其成为需要稳定扭矩和刚性的重载应用的理想之选。

2024年,直销分销管道创造了23亿美元的收入。直销模式使主轴製造商能够与终端用户建立牢固的关係,了解他们的特定加工需求,并提供量身定制的解决方案。直接互动还能确保使用者获得技术支援、客製化服务和更完善的回馈机制,进而提升整体客户体验。

美国工具机主轴单元市场占78.2%的市场份额,预计2024年市场规模将达2.1亿美元。市场成长主要得益于国内製造业的復苏以及联邦政府为促进半导体、电动车和国防製造业发展而推出的各项措施。这些投资推高了对先进主轴的需求,尤其是与CNC工具机相容的多轴和人工智慧整合型主轴。此外,美国製造商也积极采用混合增材-减材加工系统,这些系统高度依赖高性能主轴来提高生产效率,并在复杂的加工作业中保持精度。

全球工具机主轴单元市场的主要参与者包括EMCO集团、泷泽机床、Buffoli工业集团、Step-Tec、GMN Paul Muller工业、Setco主轴、FISCHER主轴技术、NSK中西、IBAG主轴技术、WestwindColomb、INDEX-Werke、Professional Instrumentsal.这些企业正实施多种策略以巩固其市场地位。他们大力投资研发,以提高主轴转速、精度、振动控制和耐用性。策略合作与伙伴关係拓展了他们的分销管道,并使他们能够进入新的工业应用领域。各公司致力于开发可客製化的解决方案,以满足航太、汽车和电子製造商的独特需求。併购则用来巩固市场占有率并取得先进技术。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 高精度加工的需求不断成长

- 主轴设计方面的技术进步

- 对节能紧凑型解决方案的需求

- 产业陷阱与挑战

- 高昂的研发和生产成本

- 原料成本波动

- 机会

- 智慧製造与工业4.0

- 客製化和模组化主轴系统

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品/技术类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品/技术类型划分,2021-2034年

- 主要趋势

- 机械主轴

- 电动/机动主轴

- 气动主轴

- 专用/混合型主轴

第六章:市场估计与预测:依技术表现划分,2021-2034年

- 主要趋势

- 标准转速主轴(0-8,000 转/分)

- 高速主轴(8,000-25,000 转/分)

- 超高速主轴(25,000-60,000+ RPM)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 加工中心(立式/卧式)

- 车床/车床

- 研磨机

- 铣床

- 齿轮切削/精加工机床

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 汽车产业

- 航太

- 医疗技术

- 能源领域

- 国防工业

- 一般製造业

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Buffoli Industries Group

- Changzhou Hanqi Spindle

- Colombo Filippetti

- EMCO Group

- FISCHER Spindle Technology

- GMN Paul Muller Industrie

- IBAG Spindle Technology

- INDEX-Werke

- Kessler Spindle Systems

- NSK Nakanishi

- Professional Instruments Company

- Setco Spindle

- Step-Tec

- Takisawa Machine Tools

- Westwind Air Bearings

The Global Machine Tool Spindle Units Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 5 billion by 2034.

The growth is fueled by rising demand for high-precision machining across industries, including aerospace, automotive, electronics, and medical devices. Manufacturers are increasingly investing in advanced spindle technologies to achieve higher speeds, lower vibration, and consistent torque, enabling the production of parts with tight tolerances, intricate geometries, and superior surface finishes. High demand is particularly observed in applications requiring extreme precision, such as advanced drivetrain components, turbine blades, and microelectronics. Smaller and lighter materials further emphasize the need for precise machining. High-performance spindles also facilitate multi-axis CNC machining and additive-subtractive hybrid manufacturing, where spindles post-process 3D-printed components. Growing global quality standards and regulatory requirements continue to drive the adoption of precision spindles worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5 Billion |

| CAGR | 4.1% |

The mechanical spindles segment generated USD 1.5 billion in 2024. Their popularity is attributed to their simplicity, durability, and high uptime. Without an integrated motor, mechanical spindles rely on external drives, which makes them cost-effective and easier to maintain, particularly for small and mid-sized manufacturers. Their robust design is ideal for heavy-duty applications requiring consistent torque and rigidity.

The direct sales distribution segment generated USD 2.3 billion in 2024. Selling directly allows spindle manufacturers to build strong relationships with end-users, understand their specific machining requirements, and provide tailored solutions. Direct engagement also ensures access to technical support, customization, and enhanced feedback loops, improving overall customer experience.

U.S. Machine Tool Spindle Units Market held 78.2% share, generating USD 210 million in 2024. Market growth is driven by revitalized domestic manufacturing and federal initiatives promoting semiconductors, electric vehicles, and defense manufacturing. These investments are increasing the demand for advanced spindles, particularly multi-axis and AI-integrated models compatible with CNC machinery. U.S. manufacturers are also adopting hybrid additive-subtractive machining systems that rely heavily on high-performance spindles to enhance productivity and maintain precision in complex operations.

Key players in the Global Machine Tool Spindle Units Market include EMCO Group, Takisawa Machine Tools, Buffoli Industries Group, Step-Tec, GMN Paul Muller Industrie, Setco Spindle, FISCHER Spindle Technology, NSK Nakanishi, IBAG Spindle Technology, Westwind Air Bearings, INDEX-Werke, Professional Instruments, Kessler Spindle Systems, Colombo Filippetti, and Changzhou Hanqi Spindle. Companies in the Global Machine Tool Spindle Units Market are implementing multiple strategies to strengthen their position. They are investing heavily in research and development to improve spindle speed, precision, vibration control, and durability. Strategic collaborations and partnerships expand their distribution reach and enable entry into new industrial applications. Firms are focusing on developing customizable solutions to meet the unique requirements of aerospace, automotive, and electronics manufacturers. Mergers and acquisitions are leveraged to consolidate market share and acquire advanced technologies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product/technology type

- 2.2.3 Technology performance

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-precision machining

- 3.2.1.2 Technological advancements in spindle design

- 3.2.1.3 Demand for energy-efficient and compact solutions

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High R&D and production costs

- 3.2.2.2 Fluctuating raw material costs

- 3.2.3 Opportunities

- 3.2.3.1 Smart manufacturing & industry 4.0

- 3.2.3.2 Customization & modular spindle systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product/technology type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product/Technology Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Mechanical spindles

- 5.3 Electric/motorized spindles

- 5.4 Air-driven spindles

- 5.5 Specialized/hybrid spindles

Chapter 6 Market Estimates and Forecast, By Technology Performance, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Standard Speed Spindles (0-8,000 RPM)

- 6.3 High-Speed Spindles (8,000-25,000 RPM)

- 6.4 Ultra-High Speed Spindles (25,000-60,000+ RPM)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Machining centers (vertical/horizontal)

- 7.3 Turning machines/lathes

- 7.4 Grinding machines

- 7.5 Milling machines

- 7.6 Gear cutting/finishing machines

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive industry

- 8.3 Aerospace

- 8.4 Medical technology

- 8.5 Energy sector

- 8.6 Defense industry

- 8.7 General manufacturing

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Buffoli Industries Group

- 11.2 Changzhou Hanqi Spindle

- 11.3 Colombo Filippetti

- 11.4 EMCO Group

- 11.5 FISCHER Spindle Technology

- 11.6 GMN Paul Muller Industrie

- 11.7 IBAG Spindle Technology

- 11.8 INDEX-Werke

- 11.9 Kessler Spindle Systems

- 11.10 NSK Nakanishi

- 11.11 Professional Instruments Company

- 11.12 Setco Spindle

- 11.13 Step-Tec

- 11.14 Takisawa Machine Tools

- 11.15 Westwind Air Bearings