|

市场调查报告书

商品编码

1876552

汽车空气清净系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Air Purification System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

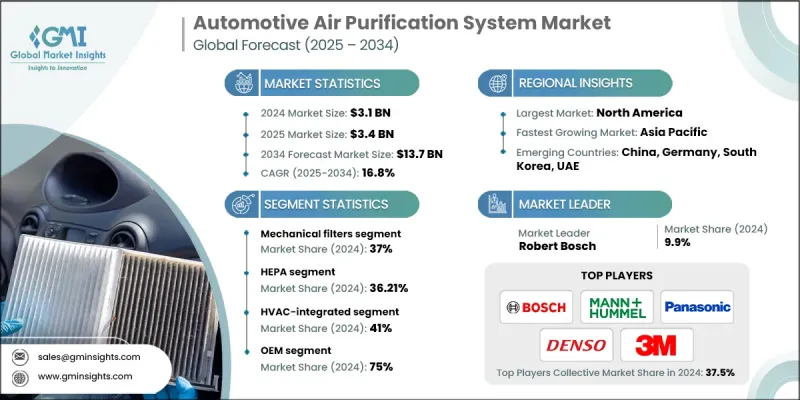

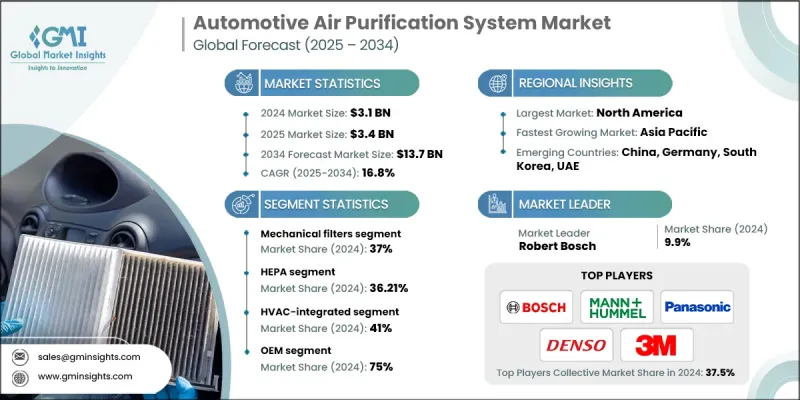

2024 年全球汽车空气清净系统市场价值为 31 亿美元,预计到 2034 年将以 16.8% 的复合年增长率增长至 137 亿美元。

市场成长得益于感测器技术的进步、人工智慧赋能的空气品质管理以及环保过滤材料的研发。领先的製造商正大力投资于节能、节省空间且智慧化的净化模组,这些模组能够与现代暖通空调系统和车载电子设备无缝整合。电装(Denso)、3M、松下(Panasonic)、博世(Robert Bosch)和曼胡默尔(MANN+HUMMEL)等行业领导者正在推动多级净化系统的创新,这些系统融合了高效能空气微粒过滤器(HEPA)、活性碳、电离和紫外线杀菌技术。这些系统不仅提升了乘客的舒适度,还透过可回收的过滤材料和低功耗电子控制,帮助永续发展。城市化进程加快、空气污染加剧以及消费者对车内空气品质日益增长的关注,正在推动全球市场需求,而汽车製造商则在新车中整合感测器驱动的空气管理单元,以满足消费者对更安全、更健康出行体验的日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 31亿美元 |

| 预测值 | 137亿美元 |

| 复合年增长率 | 16.8% |

2024 年机械过滤器市占率为 37%,预计 2025 年至 2034 年将以 13% 的复合年增长率成长。这些过滤器能有效捕捉细悬浮微粒(PM2.5 和 PM10),由于其价格实惠且可靠,因此在OEM和售后市场系统中广泛应用。

2024 年,HEPA 过滤细分市场占据 36.21% 的市场份额,预计到 2034 年将以 14.3% 的复合年增长率成长。 HEPA 过滤器因其能够有效捕捉过敏原和细小颗粒,在成本和性能之间实现了最佳平衡,仍然是首选,即使融合多种技术的混合系统越来越受欢迎。

亚太地区汽车空气清净系统市场在2024年占据了48.1%的市场。预计该地区将以17.9%的复合年增长率实现最快增长,到2034年市场规模将达到72.2亿美元。强劲的汽车产量、快速的城市化进程以及主要城市的高污染水平是推动市场普及的关键因素。日益增强的环保意识、可支配收入的增加以及国内外製造商对空气净化技术的积极投资,进一步促进了市场扩张。

汽车空气清净系统市场的主要参与者包括3M、夏普、曼胡默尔、博世、松下、电装、马瑞利、瑞典CabinAir、SKF和霍尼韦尔。这些公司正采取多种策略来提升市场地位并扩大商业版图。他们大力投资研发,以开发适用于现代汽车架构的多层净化系统、节能模组和紧凑型设计。与汽车OEM厂商建立策略合作伙伴关係,确保先进的空气清净装置能够无缝整合到新车型中。製造商也致力于拓展全球分销网络,并加强售后市场服务,以满足持续成长的需求。采用人工智慧赋能的空气品质管理和混合过滤解决方案是另一项关键策略,旨在实现产品差异化并为消费者提供附加价值。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 空气污染程度上升与健康意识增强

- 严格的车辆排放法规和车内空气品质标准

- 消费者对高端汽车功能的需求不断增长

- 电动车普及及其独特的暖通空调需求

- 产业陷阱与挑战

- 先进净化技术高昂的初始投资成本

- 与现有暖通空调系统的整合复杂性

- 维护要求及滤芯更换成本

- 新兴市场消费者意识有限

- 市场机会

- 重型设备和采矿业符合 ISO 23875 标准

- 针对现有车队的售后改装解决方案

- 与连网车辆技术和物联网系统的集成

- 新兴市场机动化与城市空气品质问题

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 区域一体化法规

- 国际标准协调

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 技术生命週期与成熟度评估

- 依纯化方法分類的技术成熟度

- 创新通路与新兴技术

- 专利到期时间表与技术商品化

- 颠覆性技术威胁及市场颠覆潜力

- 专利分析

- 成本細項分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 顾客行为与购买决策分析

- OEM决策标准和供应商选择流程

- 售后市场消费者偏好及价格敏感性

- 车队营运商的要求与投资报酬率考量

- 客户优先事项的区域差异

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 机械过滤器

- 吸附

- 主动灭菌

- 电离和静电系统

- 整合系统

- 感测器和电子元件

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 高效能空气过滤器

- 吸附

- 静电

- 紫外线/光催化

- 杂交种

第七章:市场估计与预测:按年计算,2021-2034年

- 主要趋势

- 暖通空调集成

- 仪表板

- 间接费用

- 座椅下方

- 便携的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 个人消费者/零售

- 车队所有者和租赁营运商

- 大众运输业者

- 商业企业

- 政府/紧急服务

第九章:市场估算与预测:依销售管道划分,2021-2034年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 葡萄牙

- 克罗埃西亚

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

第十一章:公司简介

- 全球参与者

- Panasonic

- Denso

- 3 M

- Honeywell

- Robert Bosch

- MANN+HUMMEL

- Sharp

- Marelli

- CabinAir Sweden

- SKF

- Valeo

- Freudenberg Filtration

- BorgWarner

- Donaldson

- 区域玩家

- Hengst

- Camfil

- Hanon Systems

- Visteon

- Parker Hannifin

- K&N Engineering

- 新兴参与者

- Philips Automotive

- Johnson Electric

- Filtron

- Sanden

The Global Automotive Air Purification System Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 16.8% to reach USD 13.7 billion by 2034.

Market growth is fueled by advancements in sensor technology, AI-enabled air quality management, and the development of eco-friendly filtration materials. Leading manufacturers are heavily investing in energy-efficient, space-saving, and intelligent purification modules that can seamlessly integrate with modern HVAC systems and vehicle electronics. Industry leaders such as Denso, 3M, Panasonic, Robert Bosch, and MANN+HUMMEL are driving innovation in multi-stage purification systems that incorporate HEPA filters, activated carbon, ionization, and UV sterilization technologies. These systems not only improve passenger comfort but also support sustainability initiatives through recyclable filter materials and low-power electronic controls. Growing urbanization, increasing air pollution, and rising consumer awareness of in-cabin air quality are driving demand globally, while automakers are incorporating sensor-driven air management units in new vehicles to meet the rising need for safer and healthier mobility experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 16.8% |

The mechanical filters segment held a 37% share in 2024 and is expected to grow at a CAGR of 13% from 2025 to 2034. These filters efficiently capture fine particulate matter (PM2.5 and PM10) and are widely used in both OEM and aftermarket systems due to their affordability and reliability.

The HEPA filtration segment held a 36.21% share in 2024 and is projected to grow at a CAGR of 14.3% through 2034. HEPA filters remain the preferred choice for their proven ability to trap allergens and fine particles, offering an optimal balance between cost and performance, even as hybrid systems incorporating multiple technologies gain popularity.

Asia-Pacific Automotive Air Purification System Market held a 48.1% share in 2024. The region is expected to achieve the fastest growth at a CAGR of 17.9%, reaching USD 7.22 billion by 2034. Strong automotive production, rapid urbanization, and high pollution levels in major cities are key factors driving adoption. Rising environmental awareness, higher disposable incomes, and active investments from both local and international manufacturers in air purification technologies are further boosting market expansion.

Key players in the Automotive Air Purification System Market include 3M, Sharp, MANN+HUMMEL, Robert Bosch, Panasonic, Denso, Marelli, CabinAir Sweden, SKF, and Honeywell. Companies in the Automotive Air Purification System Market are employing multiple strategies to enhance their market position and expand their footprint. They are investing heavily in R&D to develop multi-stage purification systems, energy-efficient modules, and compact designs suitable for modern vehicle architectures. Strategic partnerships with automotive OEMs ensure seamless integration of advanced air purification units in new vehicle models. Manufacturers are also focusing on expanding their global distribution networks and strengthening aftermarket offerings to capture recurring demand. Adoption of AI-enabled air quality management and hybrid filtration solutions is another key strategy to differentiate products and offer added value to consumers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Mounting

- 2.2.5 End use

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Air pollution levels & health awareness

- 3.2.1.2 Stringent vehicle emissions regulations & interior air quality standards

- 3.2.1.3 Rising consumer demand for premium vehicle features

- 3.2.1.4 Electric vehicle adoption & unique HVAC requirements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Investment Costs for Advanced Purification Technologies

- 3.2.2.2 Integration Complexity with Existing HVAC Systems

- 3.2.2.3 Maintenance Requirements & Filter Replacement Costs

- 3.2.2.4 Limited Consumer Awareness in Emerging Markets

- 3.2.3 Market opportunities

- 3.2.3.1 Heavy equipment & mining industry compliance with iso 23875

- 3.2.3.2 Aftermarket retrofit solutions for existing vehicle fleets

- 3.2.3.3 Integration with connected vehicle technologies & iot systems

- 3.2.3.4 Emerging markets motorization & urban air quality concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Regional integration regulations

- 3.4.2 International standards harmonization

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology Lifecycle & Maturity Assessment

- 3.7.3.1 Technology readiness levels by purification method

- 3.7.3.2 Innovation pipeline & emerging technologies

- 3.7.3.3 Patent expiration timeline & technology commoditization

- 3.7.3.4 Disruptive technology threats & market disruption potential

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Carbon footprint considerations

- 3.12 Customer Behavior & Purchasing Decision Analysis

- 3.12.1 OEM decision-making criteria & vendor selection process

- 3.12.2 Aftermarket consumer preferences & price sensitivity

- 3.12.3 Fleet operator requirements & roi considerations

- 3.12.4 Regional variations in customer priorities

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Mechanical filters

- 5.3 Adsorption

- 5.4 Active sterilization

- 5.5 Ionization & electrostatic systems

- 5.6 Integrated systems

- 5.7 Sensors & electronics

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 HEPA

- 6.3 Adsorption

- 6.4 Electrostatic

- 6.5 UV / photocatalysis

- 6.6 Hybrid

Chapter 7 Market Estimates & Forecast, By Mounting, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 HVAC-integrated

- 7.3 Dashboard

- 7.4 Overhead

- 7.5 Under-seat

- 7.6 Portable

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Individual consumers / retail

- 8.3 Fleet owners & rental operators

- 8.4 Public transport operators

- 8.5 Commercial enterprise

- 8.6 Government / emergency services

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Panasonic

- 11.1.2 Denso

- 11.1.3. 3 M

- 11.1.4 Honeywell

- 11.1.5 Robert Bosch

- 11.1.6 MANN+HUMMEL

- 11.1.7 Sharp

- 11.1.8 Marelli

- 11.1.9 CabinAir Sweden

- 11.1.10 SKF

- 11.1.11 Valeo

- 11.1.12 Freudenberg Filtration

- 11.1.13 BorgWarner

- 11.1.14 Donaldson

- 11.2 Regional Players

- 11.2.1 Hengst

- 11.2.2 Camfil

- 11.2.3 Hanon Systems

- 11.2.4 Visteon

- 11.2.5 Parker Hannifin

- 11.2.6 K&N Engineering

- 11.3 Emerging Players

- 11.3.1 Philips Automotive

- 11.3.2 Johnson Electric

- 11.3.3 Filtron

- 11.3.4 Sanden