|

市场调查报告书

商品编码

1876554

健康监测汽车座椅市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Health-Monitoring Car Seat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

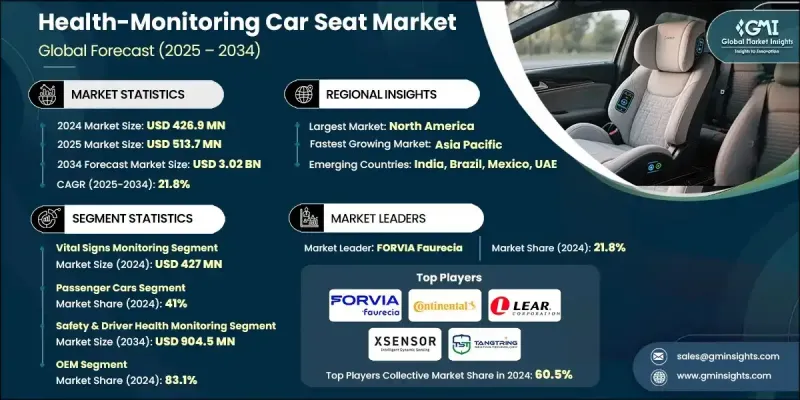

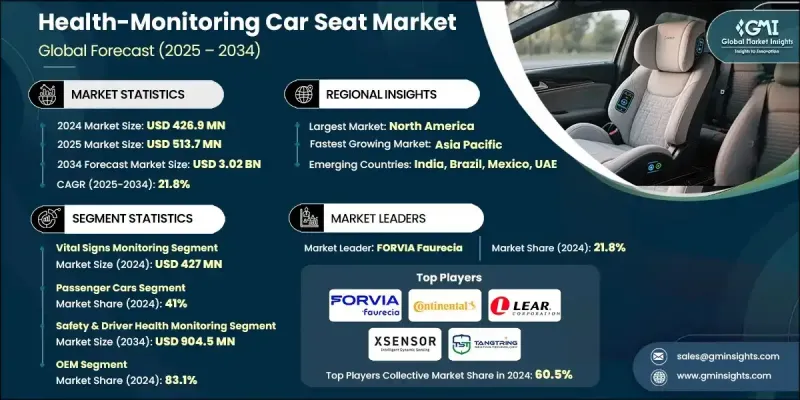

2024 年全球健康监测汽车座椅市场价值为 4.269 亿美元,预计到 2034 年将以 21.8% 的复合年增长率增长至 30.2 亿美元。

人们日益关注个人健康和福祉,推动了对配备健康监测技术的智慧汽车座椅的需求。消费者越来越重视能够追踪生命征象、疲劳和压力水平的安全功能,这促使汽车製造商将生物辨识感测器和人工智慧健康系统整合到汽车座椅中。穿戴式电极、感测器和人工智慧技术的进步,使得即时监测乘员的心率、呼吸和姿势成为可能,从而实现预测性健康警报、个人化舒适体验和提升驾驶安全性。预计到2030年,该市场规模将从2024年的32.2万套成长至85.6万套。随着汽车互联性和自动驾驶程度的提高,车内健康监测正成为一项关键的差异化优势,能够持续追踪乘员的健康状况,并支持主动安全措施。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.269亿美元 |

| 预测值 | 30.2亿美元 |

| 复合年增长率 | 21.8% |

2024年,生命征象监测市场规模达到4.27亿美元,预计到2034年将以21.3%的复合年增长率成长。该市场透过嵌入座椅的电容式心电图感测器采集心率、血压和呼吸数据,提供可靠且稳定的讯号。受监管要求和消费者日益增强的驾驶员健康意识的推动,该市场在商用车队和高端汽车製造商中尤其受欢迎。

到 2024 年,乘用车细分市场将占据 41% 的份额,因为 SUV 和轿车越来越多地采用人工智慧座椅系统,该系统可以监测生命体征、姿势和疲劳程度,提供即时警报和可自订的舒适度。

预计到2024年,美国健康监测汽车座椅市场将占据85.4%的份额,市场规模达7,280万美元。美国汽车製造商正引领健康监测技术的整合,尤其是在高阶车型领域。关注商用驾驶员健康的监管架构进一步推动了此类系统在车队营运中的应用,从而提升乘员的安全和福祉。

全球健康监测汽车座椅市场的主要参与者包括 Tangtring Seating Technology、ZF Friedrichshafen AG、伟世通公司、大陆集团、NOVELDA、罗伯特博世有限公司、佛吉亚佛吉亚、李尔、延锋和 XSENSOR Technology。这些公司正采取多种策略来巩固市场地位并扩大市场占有率。他们加大研发投入,以提高感测器精度、人工智慧驱动的分析能力以及座椅舒适度。与汽车製造商和健康技术供应商的合作加速了先进监测系统的创新和整合。各公司致力于透过可自订和预测性的健康功能实现产品差异化,从而提升安全性和使用者体验。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 健康意识日益增强

- 感测器和人工智慧领域的技术进步

- 监管和安全标准

- 互联自动驾驶汽车的成长

- 消费者对个人化机舱体验的需求日益增长

- 产业陷阱与挑战

- 实施成本高昂

- 资料隐私和安全问题

- 市场机会

- 与可穿戴设备和健康应用程式集成

- 拓展电动车和高端汽车业务

- 人工智慧驱动的预测性健康分析

- 新兴市场与都市化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 新兴技术

- 专利分析

- 价格趋势分析

- 按组件

- 按地区

- 成本分解分析

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来趋势

- 主要市场趋势和颠覆性因素

- 成本效益分析与投资报酬率模型

- 总拥有成本分析

- 投资报酬率计算

- 成本削减路线图

- 按市场区隔分類的价值主张

- 使用者体验与人因工程

- 人体工学设计考量

- 使用者接受度和采用障碍

- 文化和地域偏好

- 无障碍设计与通用设计

- 未来展望与技术路线图

- 技术演进路线图(2025-2035)

- 新兴应用及用例

- 与自动驾驶车辆的集成

- 5G 和边缘运算的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重要新闻和倡议

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依功能划分,2021-2034年

- 主要趋势

- 生命征象监测

- 姿势/座椅压力监测

- 疲劳/嗜睡侦测

- 生物特征感测

- 热舒适度/居住舒适度感测

- 多参数/集成感测

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 低容量性状

- MCV

- C型肝炎

- 电动车

- 纯电动车

- 插电式混合动力汽车

- 燃料电池电动车

第七章:市场估算与预测:依销售管道划分 2021-2034 年

- 主要趋势

- OEM

- 售后市场

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 安全与驾驶员健康监测

- 舒适性和人体工学提升

- 健康/预防保健

- 车队驾驶员监控

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 新加坡

- 泰国

- 越南

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Continental AG

- Denso Corporation

- FORVIA (Faurecia)

- Lear

- Magna International Inc.

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

- 区域玩家

- Aptiv PLC

- Autoliv AB

- Gentex Corporation

- HARMAN International (Samsung)

- Hyundai Mobis

- Infineon Technologies AG

- Joyson Safety Systems

- NOVELDA

- Tangtring Seating Technology Inc.

- Visteon Corporation

- XSENSOR Technology

- Yanfeng

- Technology Specialists (Components / Sensors)

- NXP Semiconductors

- Sensirion AG

- STMicroelectronics

- TDK Corporation

- TE Connectivity

- Texas Instruments

- 新兴企业/新创公司

- Comfort Motion Global

- ContinUse Biometrics

- Neteera Technologies

The Global Health-Monitoring Car Seat Market was valued at USD 426.9 million in 2024 and is estimated to grow at a CAGR of 21.8% to reach USD 3.02 billion by 2034.

The rising focus on personal health and wellness is driving the demand for smart automotive seats equipped with health-monitoring technologies. Consumers are increasingly prioritizing safety features that track vital signs, fatigue, and stress, encouraging automakers to integrate biometric sensors and AI-enabled wellness systems. Advances in wearable electrodes, sensors, and artificial intelligence now enable real-time monitoring of occupants' heart rate, respiration, and posture, allowing predictive health alerts, personalized comfort, and enhanced driving safety. In terms of units, the market is expected to expand from over 322K in 2024 to 856K by 2030. As vehicles become more connected and autonomous, in-cabin health monitoring is emerging as a key differentiator, enabling continuous tracking of occupant wellbeing and supporting proactive safety measures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $426.9 Million |

| Forecast Value | $3.02 Billion |

| CAGR | 21.8% |

The vital signs monitoring segment generated USD 427 million in 2024 and will grow at a CAGR of 21.3% through 2034. This segment captures heart rate, blood pressure, and respiration via capacitive ECG sensors embedded in the seat, delivering reliable and consistent signals. It is particularly popular among commercial fleets and high-end vehicle manufacturers, driven by regulatory requirements and growing consumer awareness of driver health.

The passenger cars segment held a share of 41% in 2024, as SUVs and sedans increasingly incorporate AI-enabled seat systems that monitor vital signs, posture, and fatigue, providing real-time alerts and customizable comfort.

U.S. Health-Monitoring Car Seat Market held 85.4% share in 2024, valued at USD 72.8 million. US automakers are spearheading the integration of health-monitoring technologies, particularly in premium vehicle segments. Regulatory frameworks focusing on commercial driver health further encourage the adoption of such systems in fleet operations, promoting occupant safety and well-being.

Key players in the Global Health-Monitoring Car Seat Market include Tangtring Seating Technology, ZF Friedrichshafen AG, Visteon Corporation, Continental AG, NOVELDA, Robert Bosch GmbH, FORVIA Faurecia, Lear, Yanfeng, and XSENSOR Technology. Companies in the health-monitoring car seat market are adopting several strategies to strengthen their market presence and expand their foothold. They are investing in research and development to enhance sensor accuracy, AI-driven analytics, and seat comfort features. Collaborations with automakers and health technology providers accelerate innovation and integration of advanced monitoring systems. Firms are focusing on product differentiation through customizable and predictive wellness features that enhance safety and user experience.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Feature

- 2.2.2 Vehicle

- 2.2.3 Sales channel

- 2.2.4 Application

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health awareness

- 3.2.1.2 Technological advancements in sensors and ai

- 3.2.1.3 Regulatory and safety standards

- 3.2.1.4 Connected and autonomous vehicle growth

- 3.2.1.5 Increasing consumer demand for personalized in-cabin experience

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation cost

- 3.2.2.2 Data privacy and security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with wearables and health apps

- 3.2.3.2 Expansion in electric and premium vehicles

- 3.2.3.3 Ai-driven predictive health analytics

- 3.2.3.4 Emerging markets and urbanization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon Footprint Considerations

- 3.13 Future trends

- 3.14 Major market trends and disruptions

- 3.15 Cost-benefit analysis & roi models

- 3.15.1 Total cost of ownership analysis

- 3.15.2 Return on investment calculations

- 3.15.3 Cost reduction roadmap(15-20% decline by 2030)

- 3.15.4 Value proposition by market segment

- 3.16 User experience & human factors

- 3.16.1 Ergonomic design considerations

- 3.16.2 User acceptance & adoption barriers

- 3.16.3 Cultural & regional preferences

- 3.16.4 Accessibility & universal design

- 3.17 Future outlook & technology roadmap

- 3.17.1 Technology evolution roadmap (2025-2035)

- 3.17.2 Emerging applications & use cases

- 3.17.3 Integration with autonomous vehicles

- 3.17.4. 5 G & edge computing impact

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Feature, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Vital signs monitoring

- 5.3 Posture/seat-pressure monitoring

- 5.4 Fatigue/drowsiness detection

- 5.5 Biometric sensing

- 5.6 Thermal / occupant comfort sensing

- 5.7 Multi-parameter / integrated sensing

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Electric vehicle

- 6.4.1 BEV

- 6.4.2 PHEV

- 6.4.3 FCEV

Chapter 7 Market Estimates & Forecast, By Sales channel 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.1.1 Safety & driver health monitoring

- 8.1.2 Comfort & ergonomics enhancement

- 8.1.3 Wellness / preventive health

- 8.1.4 Fleet driver monitoring

- 8.1.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Continental AG

- 10.1.2 Denso Corporation

- 10.1.3 FORVIA (Faurecia)

- 10.1.4 Lear

- 10.1.5 Magna International Inc.

- 10.1.6 Robert Bosch GmbH

- 10.1.7 Valeo SA

- 10.1.8 ZF Friedrichshafen AG

- 10.2 Regional players

- 10.2.1 Aptiv PLC

- 10.2.2 Autoliv AB

- 10.2.3 Gentex Corporation

- 10.2.4 HARMAN International (Samsung)

- 10.2.5 Hyundai Mobis

- 10.2.6 Infineon Technologies AG

- 10.2.7 Joyson Safety Systems

- 10.2.8 NOVELDA

- 10.2.9 Tangtring Seating Technology Inc.

- 10.2.10 Visteon Corporation

- 10.2.11 XSENSOR Technology

- 10.2.12 Yanfeng

- 10.3 Technology Specialists (Components / Sensors)

- 10.3.1 NXP Semiconductors

- 10.3.2 Sensirion AG

- 10.3.3 STMicroelectronics

- 10.3.4 TDK Corporation

- 10.3.5 TE Connectivity

- 10.3.6 Texas Instruments

- 10.4 Emerging Players / Startups

- 10.4.1 Comfort Motion Global

- 10.4.2 ContinUse Biometrics

- 10.4.3 Neteera Technologies