|

市场调查报告书

商品编码

1876556

电子产业聚酰亚胺薄膜市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Polyimide Films for Electronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

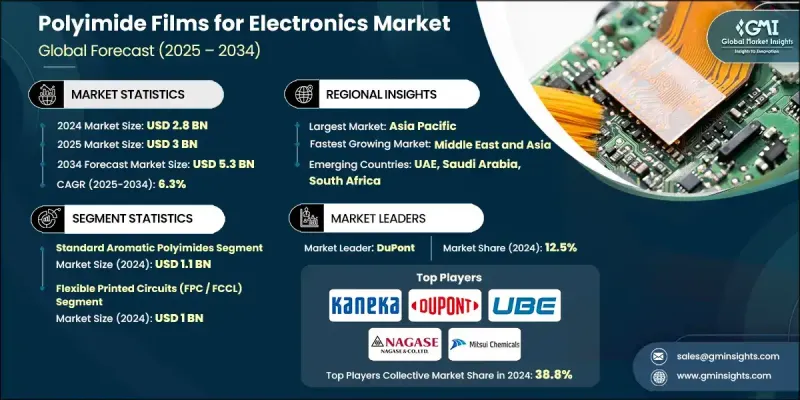

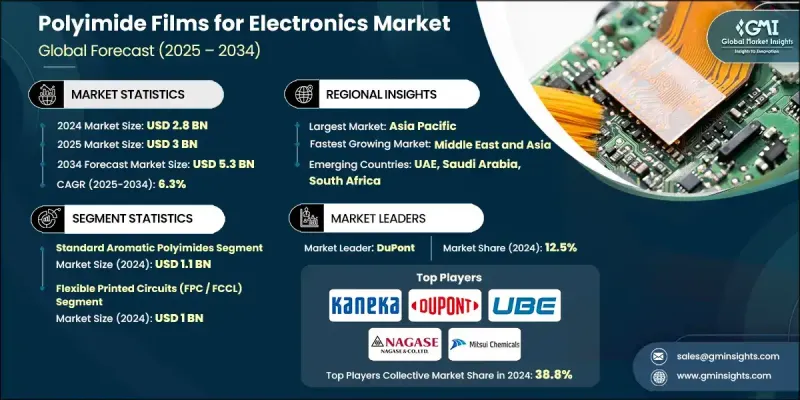

2024 年全球电子聚酰亚胺薄膜市场价值为 28 亿美元,预计到 2034 年将以 6.3% 的复合年增长率成长至 53 亿美元。

聚酰亚胺薄膜是一种先进的聚合物材料,因其卓越的热稳定性、耐化学性和机械强度而广受认可。由于其在极端温度下仍能保持绝缘性能,这些薄膜在电子行业中已广泛应用。聚酰亚胺薄膜由二胺和二酐聚合而成,具有优异的柔韧性和尺寸稳定性,使其成为柔性印刷电路、绝缘胶带和各种显示组件的理想选择。受小型化趋势、柔性穿戴装置以及5G整合等因素的推动,电子製造技术的不断进步正在加速对聚酰亚胺薄膜的需求。製造商也在开发新一代聚酰亚胺薄膜,以满足柔性混合电子产品对高可靠性和高性能的需求。随着各产业向轻量化、高性能和节能材料转型,聚酰亚胺薄膜在消费性电子产品、通讯设备和先进电路应用领域的需求持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 6.3% |

2024年,标准芳香族聚酰亚胺市场规模达11亿美元。其市场主导地位源自于其在柔性电路、导线绝缘和显示器基板等各种电子应用领域的广泛应用。这些材料的可靠性和成本效益使其成为大规模生产的首选。同时,导热聚酰亚胺的需求也在不断成长,因为它们能够有效散热,应用于高功率电子产品、电动车零件和小型半导体装置。导电和耐电晕聚酰亚胺在需要更高耐压性和更优异电性能的特殊应用中越来越受欢迎,尤其是在汽车、工业和航太电子领域。

2024年,柔性印刷电路(FPC/FCCL)市场规模预计将达到10亿美元。随着紧凑型和高密度电子元件的日益普及,该市场将持续成长。聚酰亚胺薄膜具有柔韧性、耐热性和电绝缘性等独特优势,使其成为先进电路设计和现代电子组件中不可或缺的材料。此外,在电动车、自动化技术和工业系统等领域对高温材料的日益需求推动下,聚酰亚胺薄膜在电线电缆绝缘、马达和磁线绝缘等其他关键应用领域也展现出巨大的发展潜力。

2024年,美国电子聚酰亚胺薄膜市场规模预估为4.018亿美元。在北美,由于柔性电子、航太系统、半导体和汽车技术的进步,市场需求持续成长。美国市场受益于高性能、低介电常数和无色聚酰亚胺薄膜的创新。强大的研发投入、主要电子产品製造商的入驻以及对永续材料生产的日益重视,进一步巩固了该地区作为聚酰亚胺薄膜开发和应用中心的地位。

全球电子聚酰亚胺薄膜市场的主要参与者包括Apical Film Solutions、荒川化学工业株式会社、CAPLINQ Corporation、CS Hyde Company、杜邦公司、Dunmore Corporation、弘毅工程塑胶有限公司、Kaneka Corporation、三井化学株式会社、长濑班株式会社、高性能工程塑胶有限公司、Qnity Eiblelectics、Rogernity Corporation,x, Roger Inc.、Taimide Tech Inc.、宇部兴产株式会社、武汉华星光电、优山科技有限公司和3M公司。电子用聚酰亚胺薄膜市场的领导企业正着力于创新、产品差异化和永续发展,以巩固其市场地位。许多公司正大力投资研发,以生产具有更优异的电学、热学和机械性能的高性能聚酰亚胺薄膜。此外,各公司也正在扩大产能,并与电子元件製造商建立合作关係,以开发客製化的薄膜解决方案。该公司的一项关键策略重点是环保和可回收材料,以符合全球永续发展目标。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对柔性穿戴电子产品的需求不断增长

- 5G和高频电子产品的扩展

- 材料科学的技术进步

- 产业陷阱与挑战

- 製造和加工工艺复杂度高

- 可回收性和可持续性方面的挑战

- 市场机会

- 电动车和先进汽车电子产品的扩张

- 先进显示技术的出现

- 整合到新兴半导体封装技术中

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 标准芳香族聚酰亚胺

- 基于PMDA/ODA的系统

- 导热聚酰亚胺

- 增强型导热係数变体

- 导电和电阻薄膜

- 可控製表面电阻率

- 防静电和电磁干扰屏蔽

- 耐电晕聚酰亚胺

- 高压交流电

- 电力电子

- 氟化聚酰亚胺

- 低介电常数

- 5G和高频通讯系统

- 复合增强聚酰亚胺

- 奈米颗粒增强型变异体

- 机械性质增强

- 涂层和金属化变体

- FEP涂层薄膜

- 铝和ITO金属化薄膜

- 特种涂层和表面处理

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 柔性印刷电路(FPC/FCCL)

- 电线电缆绝缘

- 温度电气绝缘

- 航太与国防

- 工业电机

- 电动汽车电池系统

- 电池组绝缘和热管理

- 显示和触控面板基板

- OLED和柔性显示器

- 触控感应器面板

- 马达和磁线绝缘

- 高温电机

- 工业和汽车电机

- 航太航太

- 多层保温系统

- 卫星和太空船电子设备

- 热控制与保护系统

- 半导体封装

- 晶片贴装与封装

- 先进包装技术

- 湿度敏感性和可靠性

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第八章:公司简介

- Apical Film Solutions

- Arakawa Chemical Industries Ltd.

- CAPLINQ Corporation

- CS Hyde Company

- DuPont

- Dunmore Corporation

- Hony Engineering Plastics Limited

- Kaneka Corporation

- Mitsui Chemicals Inc.

- NAGASE & Co. Ltd.

- Polyonics Inc.

- Qnity Electronics

- Rogers Corporation

- Saint-Gobain Performance Plastics

- Sheldahl Flexible Technologies Inc.

- SKC Kolon PI Inc.

- Taimide Tech Inc.

- Toyobo Co. Ltd.

- UBE Industries Ltd.

- Wuhan China Star Optoelectronics

- Yousan Technology Co. Ltd.

- 3M Company

The Global Polyimide Films for Electronics Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 5.3 billion by 2034.

Polyimide films are advanced polymer materials widely recognized for their exceptional thermal stability, chemical resistance, and mechanical strength. These films are used extensively in the electronics industry due to their ability to maintain insulation properties under extreme temperatures. Produced through the polymerization of diamines and dianhydrides, polyimide films offer superior flexibility and dimensional stability, making them ideal for use in flexible printed circuits, insulation tapes, and various display components. Continuous progress in electronics manufacturing, driven by miniaturization trends, flexible and wearable devices, and 5G integration, is accelerating demand for these films. Manufacturers are also developing next-generation polyimide films to meet the needs of flexible hybrid electronics, which require high reliability and performance. As industries shift toward lightweight, high-performance, and energy-efficient materials, the demand for polyimide films continues to expand across consumer electronics, communication equipment, and advanced circuitry applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6.3% |

The standard aromatic polyimides segment generated USD 1.1 billion in 2024. Their dominance stems from extensive usage across various electronic applications such as flexible circuits, wire insulation, and display substrates. The reliability and cost-effectiveness of these materials make them the preferred choice in mass production. Meanwhile, thermally conductive polyimides are witnessing growing demand due to their ability to efficiently dissipate heat in high-power electronics, electric vehicle components, and compact semiconductor devices. Electrically conductive and corona-resistant polyimides are gaining traction in specialized applications that require enhanced voltage resistance and electrical properties, particularly in automotive, industrial, and aerospace electronics.

The flexible printed circuits (FPC/FCCL) segment was valued at USD 1 billion in 2024. This segment continues to expand with the increasing adoption of compact and high-density electronic components. The unique attributes of polyimide films, such as flexibility, heat endurance, and electrical insulation, make them essential in advanced circuit designs and modern electronic assemblies. Other key applications, including wire and cable insulation and motor and magnet wire insulation, also show strong potential, driven by the transition toward high-temperature materials in electric vehicles, automation technologies, and industrial systems.

U.S. Polyimide Films for Electronics Market was valued at USD 401.8 million in 2024. In North America, demand continues to grow due to advances in flexible electronics, aerospace systems, semiconductors, and automotive technologies. The U.S. market benefits from innovation in high-performance, low-dielectric, and colorless polyimide films. Strong R&D investment, the presence of major electronics manufacturers, and the increasing shift toward sustainable material production further enhance the region's position as a hub for polyimide film development and application.

Key players in the Global Polyimide Films for Electronics Market include Apical Film Solutions, Arakawa Chemical Industries Ltd., CAPLINQ Corporation, CS Hyde Company, DuPont, Dunmore Corporation, Hony Engineering Plastics Limited, Kaneka Corporation, Mitsui Chemicals Inc., NAGASE & Co. Ltd., Polyonics Inc., Qnity Electronics, Rogers Corporation, Saint-Gobain Performance Plastics, Sheldahl Flexible Technologies Inc., SKC Kolon PI Inc., Taimide Tech Inc., UBE Industries Ltd., Wuhan China Star Optoelectronics, Yousan Technology Co. Ltd., and 3M Company. Leading companies in the Polyimide Films for Electronics Market are emphasizing innovation, product differentiation, and sustainability to strengthen their market foothold. Many firms are heavily investing in research and development to produce high-performance polyimide films with enhanced electrical, thermal, and mechanical properties. Companies are also expanding production capacity and forming partnerships with electronic component manufacturers to develop customized film solutions. A key strategic focus is on eco-friendly and recyclable materials, aligning with global sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for flexible and wearable electronics

- 3.2.1.2 Expansion of 5G and high-frequency electronics

- 3.2.1.3 Technological advancements in material science

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and processing complexity

- 3.2.2.2 Challenges in recyclability and sustainability

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric vehicles (EVs) and advanced automotive electronics

- 3.2.3.2 Emergence of advanced display technologies

- 3.2.3.3 Integration into emerging semiconductor packaging technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Million Meters)

- 5.1 Key trends

- 5.2 Standard aromatic polyimides

- 5.2.1 PMDA/ODA-based systems

- 5.3 Thermally conductive polyimides

- 5.3.1 Enhanced thermal conductivity variants

- 5.4 Electrically conductive & resistive films

- 5.4.1 Controlled surface resistivity

- 5.4.2 Anti-static & EMI shielding

- 5.5 Corona-resistant polyimides

- 5.5.1 High-voltage ac

- 5.5.2 Power electronics

- 5.6 Fluorinated polyimides

- 5.6.1 Low dielectric constant

- 5.6.2 5G & high-frequency communication systems

- 5.7 Composite & reinforced polyimides

- 5.7.1 Nanoparticle-enhanced variants

- 5.7.2 Mechanical property enhancement

- 5.8 Coated & metallized variants

- 5.8.1 FEP-coated films

- 5.8.2 Aluminum & ITO metallized films

- 5.8.3 Specialty coatings & surface treatments

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Million Meters)

- 6.1 Flexible printed circuits (FPC / FCCL)

- 6.2 Wire & cable insulation

- 6.2.1 Temperature electrical insulation

- 6.2.2 Aerospace & defense

- 6.2.3 Industrial motor

- 6.3 Electric vehicle battery systems

- 6.3.1 Battery pack insulation & thermal management

- 6.4 Display & touch panel substrates

- 6.4.1 OLED & flexible display

- 6.4.2 Touch sensor panel

- 6.5 Motor & magnet wire insulation

- 6.5.1 High-temperature motor

- 6.5.2 Industrial & automotive motor

- 6.6 Aerospace & space

- 6.6.1 Multilayer insulation systems

- 6.6.2 Satellite & spacecraft electronics

- 6.6.3 Thermal control & protection systems

- 6.7 Semiconductor packaging

- 6.7.1 Die attach & encapsulation

- 6.7.2 Advanced packaging technologies

- 6.7.3 Moisture sensitivity & reliability

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Million Meters)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Apical Film Solutions

- 8.2 Arakawa Chemical Industries Ltd.

- 8.3 CAPLINQ Corporation

- 8.4 CS Hyde Company

- 8.5 DuPont

- 8.6 Dunmore Corporation

- 8.7 Hony Engineering Plastics Limited

- 8.8 Kaneka Corporation

- 8.9 Mitsui Chemicals Inc.

- 8.10 NAGASE & Co. Ltd.

- 8.11 Polyonics Inc.

- 8.12 Qnity Electronics

- 8.13 Rogers Corporation

- 8.14 Saint-Gobain Performance Plastics

- 8.15 Sheldahl Flexible Technologies Inc.

- 8.16 SKC Kolon PI Inc.

- 8.17 Taimide Tech Inc.

- 8.18 Toyobo Co. Ltd.

- 8.19 UBE Industries Ltd.

- 8.20 Wuhan China Star Optoelectronics

- 8.21 Yousan Technology Co. Ltd.

- 8.22 3M Company