|

市场调查报告书

商品编码

1876559

个人化癌症疫苗市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Personalized Cancer Vaccine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

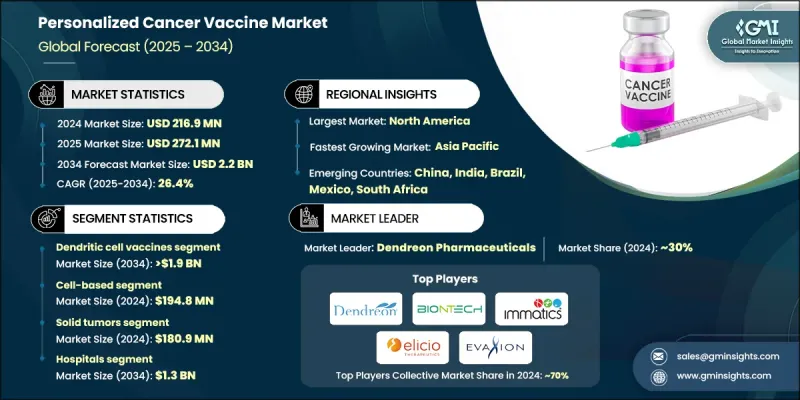

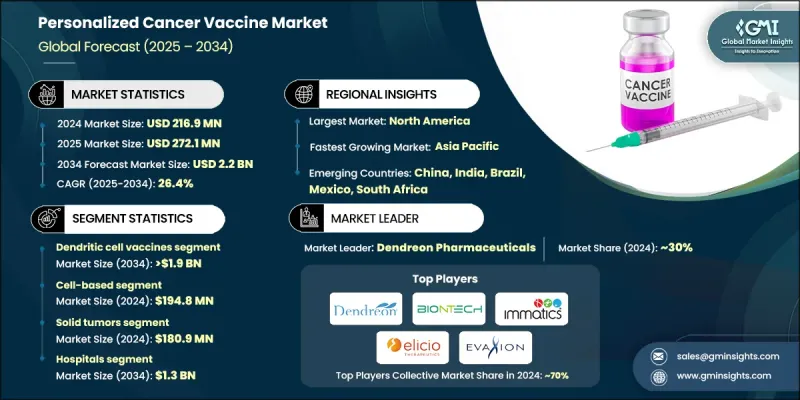

2024 年全球个人化癌症疫苗市场价值为 2.169 亿美元,预计到 2034 年将以 26.4% 的复合年增长率增长至 22 亿美元。

这一快速增长是由全球癌症发病率的不断上升以及基因组学、精准医疗和免疫疗法的进步共同推动的。新一代定序 (NGS) 和基因组分析使临床医生能够识别肿瘤特异性新抗原,这对于开发患者特异性疫苗至关重要。定序成本的下降使得这些技术在临床实务中更容易获得应用。个人化癌症疫苗能够训练患者的免疫系统识别并攻击其特有的癌细胞,为传统疗法提供了一种标靶替代方案。全球癌症病例的增加、人口老化以及医疗保健支出的成长正在推动市场对个人化疫苗的需求,尤其是在北美和亚太地区,这些地区先进的诊断和医疗基础设施为个人化治疗提供了支持。这些疫苗的发展与精准医疗、免疫疗法和个人化患者护理的更广泛趋势相契合。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.169亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 26.4% |

2024年,树突细胞疫苗市占率占85.5%,预计到2034年将达到19亿美元。树突细胞是高效的抗原呈现细胞,能够诱发强烈的T细胞反应,因此是个人化癌症疫苗的理想选择。树突细胞疫苗具有标靶作用,可最大限度地减少脱靶效应,并改善患者预后。

2024年,实体瘤领域创造了1.809亿美元的收入。实体瘤是超过一半正在进行的个人化癌症疫苗试验的核心,包括黑色素瘤、非小细胞肺癌、胶质母细胞瘤和胰臟癌。积极的临床结果正在加速监管审批并推动疫苗应用,验证了这些疫苗在实体肿瘤治疗中的有效性。

预计到2034年,医院领域的市场规模将达到13亿美元。医院是疫苗接种、病患监测和临床试验的主要场所,因此也是提供个人化癌症疫苗最值得信赖和最高效的管道。医院在诊断和综合护理方面发挥着至关重要的作用,使其成为以患者为中心的治疗路径中不可或缺的一部分。

预计到2024年,北美个人化癌症疫苗市占率将达到46.2%。该地区开展了全球近一半的此类疫苗临床试验,主要针对黑色素瘤、非小细胞肺癌和胶质母细胞瘤。在公私合作、联邦拨款和创投的支持下,各大生技公司正大力投资北美地区的研发工作。

全球个人化癌症疫苗市场的主要参与者包括Immunomic Therapeutics、BioNTech、Elicio Therapeutics、Immatics、Takis Biotech、Candel Therapeutics、VacV Biotherapeutics、Agenus、Moderna、OSE Immunalotherutics、Evax Biotech、Dendmonangenetechs、Dendendelion、Imionet Biotechintra、Dendonanas。这些公司正在实施多种策略以巩固其市场地位。他们大力投资研发,以提高疫苗效力、优化抗原选择并改进患者特异性配方。与学术机构、医院和生物技术合作伙伴的策略合作有助于加速临床验证和监管批准。各公司正透过合作和授权协议拓展地域版图,以进入新兴市场。此外,他们还利用数位化工具、人工智慧和基因组分析来简化疫苗设计并缩短生产週期。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 基因组学和测序技术的进步

- 人工智慧与生物资讯学的融合日益加深

- 全球癌症和慢性疾病的盛行率不断上升

- 精准医疗的趋势日益增强

- 产业陷阱与挑战

- 高昂的生产成本

- 复杂的监管环境

- 市场机会

- 拓展至预防肿瘤学领域

- 临床试验项目日益增多

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 临床试验分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依疫苗类型划分,2021-2034年

- 主要趋势

- 树突细胞疫苗

- 基于mRNA的疫苗

- 基于胜肽的疫苗

- 基于新抗原的疫苗

- 其他疫苗类型

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 基于细胞

- mRNA PCV

- 其他技术

第七章:市场估算与预测:依指示剂划分,2021-2034年

- 主要趋势

- 实体肿瘤

- 血液系统恶性肿瘤

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 癌症研究中心

- 生物技术和製药公司

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- BioNTech

- Moderna

- Immatics

- Candel Therapeutics

- Elicio Therapeutics

- Evaxion Biotech

- Immunomic Therapeutics

- Imugene

- Infinitopes

- OSE Immunotherapeutics

- Takis Biotech

- VacV Biotherapeutics

- ImmunityBio

- Agenus

- Dendreon Pharmaceuticals

The Global Personalized Cancer Vaccine Market was valued at USD 216.9 million in 2024 and is estimated to grow at a CAGR of 26.4% to reach USD 2.2 billion by 2034.

This rapid growth is driven by the increasing prevalence of cancer worldwide, coupled with advancements in genomics, precision medicine, and immunotherapy. Next-generation sequencing (NGS) and genomic profiling allow clinicians to identify tumor-specific neoantigens, which are critical for developing patient-specific vaccines. Declining sequencing costs have made these technologies more accessible in clinical practice. Personalized cancer vaccines train a patient's immune system to recognize and attack their unique cancer cells, offering a targeted alternative to conventional therapies. The rise in cancer cases, aging populations, and growing healthcare expenditure globally are fueling demand, particularly in North America and the Asia-Pacific, where advanced diagnostic and healthcare infrastructure support personalized treatments. These vaccines align with the broader shift toward precision medicine, immunotherapy, and individualized patient care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $216.9 Million |

| Forecast Value | $2.2 Billion |

| CAGR | 26.4% |

The dendritic cell vaccine segment accounted for an 85.5% share in 2024 and is expected to reach USD 1.9 billion by 2034. Dendritic cells are highly effective antigen-presenting cells capable of eliciting strong T-cell responses, making them ideal for personalized cancer vaccines. DC vaccines provide targeted action, minimize off-target effects, and enhance patient outcomes.

The solid tumors segment generated USD 180.9 million in 2024. Solid tumors are central to more than half of ongoing personalized cancer vaccine trials, including melanoma, non-small cell lung cancer, glioblastoma, and pancreatic cancer. Positive clinical outcomes are accelerating regulatory approvals and driving adoption, validating the efficacy of these vaccines in solid tumor treatment.

The hospitals segment is expected to reach USD 1.3 billion by 2034. Hospitals are the primary sites for vaccine administration, patient monitoring, and clinical trials, positioning them as the most trusted and efficient channels for delivering personalized cancer vaccines. Their role in diagnostics and integrated care makes them essential in patient-centric treatment pathways.

North America Personalized Cancer Vaccine Market held a 46.2% share in 2024. The region hosts nearly half of the global clinical trials for these vaccines, focusing on melanoma, NSCLC, and glioblastoma. Major biotech companies are heavily investing in research and development in North America, supported by public-private partnerships, federal grants, and venture capital funding.

Prominent players in the Global Personalized Cancer Vaccine Market include Immunomic Therapeutics, BioNTech, Elicio Therapeutics, Immatics, Takis Biotech, Candel Therapeutics, VacV Biotherapeutics, Agenus, Moderna, OSE Immunotherapeutics, Evaxion Biotech, Dendreon Pharmaceuticals, ImmunityBio, Infinitopes, and Imugene. Companies in the Personalized Cancer Vaccine Market are implementing multiple strategies to strengthen their market position. They are investing heavily in research and development to enhance vaccine efficacy, optimize antigen selection, and improve patient-specific formulations. Strategic collaborations with academic institutions, hospitals, and biotechnology partners help accelerate clinical validation and regulatory approvals. Firms are expanding geographic footprints through partnerships and licensing agreements to access emerging markets. Additionally, they are leveraging digital tools, AI, and genomic analytics to streamline vaccine design and reduce production timelines.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vaccine type trends

- 2.2.3 Technology area trends

- 2.2.4 Indication trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in genomics and sequencing technologies

- 3.2.1.2 Increasing integration of artificial intelligence and bioinformatics

- 3.2.1.3 Growing prevalence of cancer and chronic diseases globally

- 3.2.1.4 Increasing shift towards precision medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Complex regulatory landscape

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into preventive oncology

- 3.2.3.2 Growing pipeline of clinical trials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dendritic cell vaccines

- 5.3 mRNA-based vaccines

- 5.4 Peptide-based vaccines

- 5.5 Neoantigen-based vaccines

- 5.6 Other vaccine types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cell-based

- 6.3 mRNA PCV

- 6.4 Other technologies

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Solid tumors

- 7.3 Hematological malignancies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Cancer research centers

- 8.4 Biotechnology and pharmaceutical companies

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 BioNTech

- 10.2 Moderna

- 10.3 Immatics

- 10.4 Candel Therapeutics

- 10.5 Elicio Therapeutics

- 10.6 Evaxion Biotech

- 10.7 Immunomic Therapeutics

- 10.8 Imugene

- 10.9 Infinitopes

- 10.10 OSE Immunotherapeutics

- 10.11 Takis Biotech

- 10.12 VacV Biotherapeutics

- 10.13 ImmunityBio

- 10.14 Agenus

- 10.15 Dendreon Pharmaceuticals