|

市场调查报告书

商品编码

1876571

非气雾剂体香喷雾市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Non-Aerosol Body Mist Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

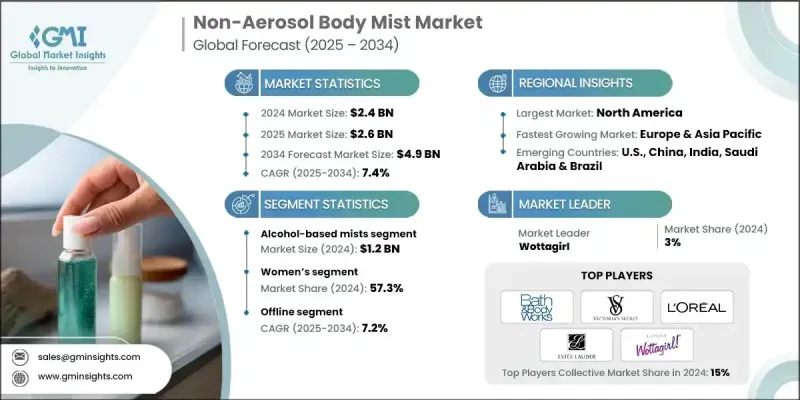

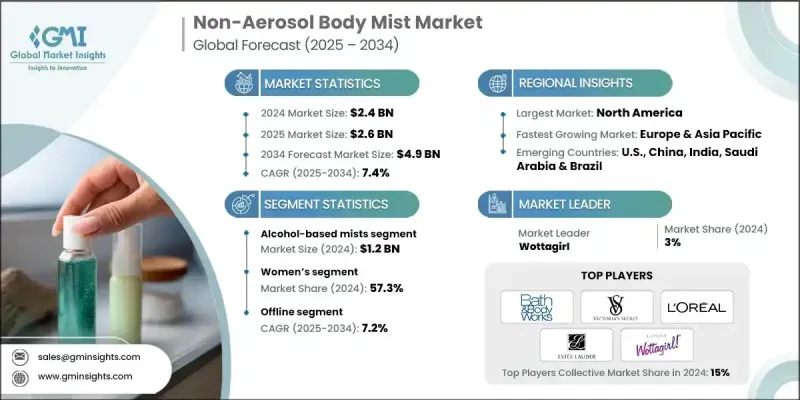

2024 年全球非气雾剂身体喷雾市场价值为 24 亿美元,预计到 2034 年将以 7.4% 的复合年增长率增长至 49 亿美元。

随着消费者越来越倾向于选择亲肤且注重健康的个人护理产品,而非通常含有酒精和合成推进剂的传统气雾剂,非气雾剂香体喷雾市场正在不断扩张。这类产品通常以水为基底,并富含植物萃取物、维生素和保湿成分,例如甘油或芦荟。这些配方不仅带来怡人的香气,还能滋养和保湿肌肤,即使是敏感肌肤也适用。这一趋势与「清洁美容」运动不谋而合,该运动强调安全、透明和无毒的成分。根据美国环境工作小组(EWG)的数据显示,73%的美国消费者现在更倾向于选择含有天然或无毒成分的个人护理产品。此外,健康和自我照护运动也提升了香体喷雾的功能,使其不再只是香氛,而是成为提升情绪健康和促进放鬆及自我表达的日常仪式的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 49亿美元 |

| 复合年增长率 | 7.4% |

2024年,女性市场占据57.3%的市场份额,预计到2034年将以7.3%的复合年增长率成长。女性对个人护理和香氛产品的需求持续增长,这主要得益于她们对美容护肤和健康生活方式的重视。非气雾型身体喷雾配方温和,具有护肤功效,能够满足女性消费者对保湿、舒缓、成分纯净且带有香味的产品的需求。

2024年,线下分销通路市占率为60.1%,预计2025年至2034年将以7.2%的复合年增长率成长。实体零售店透过店内促销、产品展示和季节性陈列,大幅提升品牌知名度,增强消费者互动,促进衝动消费。许多品牌也利用独家零售合作关係和体验式行销活动来吸引客流,培养品牌忠诚度。

2024年美国非气雾剂香体喷雾市场规模为6.752亿美元,预计到2034年将以7.5%的复合年增长率成长。美国消费者越来越多地将香体喷雾融入日常护理程序中,他们欣赏其轻盈清爽的触感和亲肤的特性。这些产品为传统香水提供了一种用途广泛、轻鬆随意的选择,并迎合了香氛迭搭和自我表达等潮流。日益兴起的健康和自我照护概念进一步巩固了香体喷雾作为提升情绪健康的产品的市场地位。

全球非气雾型身体喷雾市场的主要企业包括露华浓 (Revlon Inc.)、迪奥 (Dior)、维多利亚的秘密 (Victoria's Secret)、欧莱雅 (L'Oreal)、Sol de Janeiro、美体小铺 (The Body Shop)、雅诗兰黛 (Estee Lauder)、香奈儿 (Chanel)、Opakmhit. Provence)、Bath & Body Works、资生堂 (Shiseido Company, Limited)、宝洁 (Procter & Gamble) 与联合利华 (Unilever)。这些企业正致力于产品创新、成分透明化和永续发展,以巩固其市场地位。各大品牌纷纷推出采用天然、纯素和无毒成分的配方,以吸引註重健康的消费者。许多公司正透过线上线下零售通路拓展业务,同时投资体验式行销活动和独家合作,以提升品牌知名度和忠诚度。透过香型多样性、保湿功效和多功能用途等产品差异化策略,有助于吸引不同的消费族群。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 健康亲肤配方

- 健康与自我照护趋势

- 高端化及多用途配方

- 产业陷阱与挑战

- 市场饱和与差异化难题

- 消费者关注皮肤敏感性和酒精使用问题

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 关键成分分析

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 酒精喷雾

- 水性喷雾

- 油性喷雾

第六章:市场估计与预测:依香水类别划分,2021-2034年

- 主要趋势

- 花的

- 果味

- 柑橘

- 其他(辣味、木香等)

第七章:市场估价与预测:依包装规格划分,2021-2034年

- 主要趋势

- 30-60毫升

- 100-150毫升

- 200-300毫升

第八章:市场估算与预测:依包装类型划分,2021-2034年

- 主要趋势

- 塑胶瓶

- 玻璃瓶

- 可重复灌装瓶

第九章:市场估计与预测:依价格划分,2021-2034年

- 主要趋势

- 低的

- 中等的

- 高的

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 主要趋势

- 女性

- 男人

- 男女通用的

第十一章:市场估价与预测:依配销通路划分,2021-2034年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市/大型超市

- 专卖店/大型零售店

- 便利商店(百货公司、独立商店)

第十二章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十三章:公司简介

- Bath & Body Works

- Chanel

- Coty Inc.

- Dior

- Estee Lauder

- L'Occitane en Provence

- L'Oreal

- Pacifica Beauty

- Procter & Gamble

- Revlon Inc.

- Shiseido Company, Limited

- Sol de Janeiro

- The Body Shop

- Unilever

- Victoria's Secret

The Global Non-Aerosol Body Mist Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 4.9 billion by 2034.

The market is expanding as consumers increasingly prefer skin-friendly and health-conscious personal care products over traditional aerosol sprays, which often contain alcohol and synthetic propellants. Non-aerosol body mists are typically water-based and enriched with botanical extracts, vitamins, and moisturizing agents such as glycerin or aloe. These formulations not only provide a pleasant fragrance but also nourish and hydrate the skin, making them suitable even for sensitive skin types. This trend aligns with the clean beauty movement, which emphasizes safe, transparent, and non-toxic ingredients. According to the Environmental Working Group (EWG), 73% of U.S. consumers now prefer personal care products made with natural or non-toxic components. Additionally, the wellness and self-care movement has elevated body mists beyond simple fragrance, positioning them as tools for emotional well-being and daily rituals that promote relaxation and self-expression.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 7.4% |

The women's segment held a 57.3% share in 2024 and is expected to grow at a CAGR of 7.3% through 2034. Women continue to drive personal care and fragrance product demand due to their greater engagement in beauty routines and wellness-focused lifestyles. Non-aerosol body mists, with their gentle formulations and skin benefits, meet the needs of female consumers seeking products that offer hydration, soothing effects, and clean ingredients alongside fragrance.

The offline distribution channels segment held 60.1% share in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2034. Physical retail stores provide strong brand visibility through in-store promotions, product demonstrations, and seasonal displays, which enhance consumer engagement and encourage impulse purchases. Many brands also leverage exclusive retail partnerships and experiential marketing initiatives to attract foot traffic and cultivate brand loyalty.

U.S. Non-Aerosol Body Mist Market was valued at USD 675.2 million in 2024 and is expected to grow at a CAGR of 7.5% through 2034. U.S. consumers increasingly incorporate body mists into daily grooming routines, appreciating their lightweight, refreshing feel and skin-friendly properties. These products offer a versatile, casual alternative to traditional perfumes and support trends such as scent layering and self-expression. The growing wellness and self-care movement has further solidified its position as products that enhance emotional well-being.

Key companies operating in the Global Non-Aerosol Body Mist Market include Revlon Inc., Dior, Victoria's Secret, L'Oreal, Sol de Janeiro, The Body Shop, Estee Lauder, Chanel, Coty Inc., Pacifica Beauty, L'Occitane en Provence, Bath & Body Works, Shiseido Company, Limited, Procter & Gamble, and Unilever. Companies in the Non-Aerosol Body Mist Market are focusing on product innovation, ingredient transparency, and sustainability to strengthen their market position. Brands are introducing formulations with natural, vegan, and non-toxic ingredients to appeal to health-conscious consumers. Many firms are expanding their presence through offline and online retail channels while investing in experiential marketing campaigns and exclusive partnerships to enhance visibility and brand loyalty. Product differentiation through scent variety, moisturization benefits, and multifunctional uses helps attract diverse consumer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fragrance

- 2.2.4 Pack size

- 2.2.5 Packaging

- 2.2.6 Price

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Health- & skin-friendly formulations

- 3.2.1.2 Wellness & self-care trend

- 3.2.1.3 Premiumization & multipurpose formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Market saturation & differentiation difficulties

- 3.2.2.2 Consumer concerns over skin sensitivity & alcohol use

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Key ingredient analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Regulatory landscape

- 3.8.1 Standards and compliance requirements

- 3.8.2 Regional regulatory frameworks

- 3.8.3 Certification standards

- 3.9 Trade statistics

- 3.9.1 Major importing countries

- 3.9.2 Major exporting countries

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behavior

- 3.12.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Alcohol-based mists

- 5.3 Water-based mists

- 5.4 Oil-based mists

Chapter 6 Market Estimates & Forecast, By Fragrance, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Floral

- 6.3 Fruity

- 6.4 Citrus

- 6.5 Others (spicy, woody, etc.)

Chapter 7 Market Estimates & Forecast, By Pack Size, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 30-60 ml

- 7.3 100-150 ml

- 7.4 200-300 ml

Chapter 8 Market Estimates & Forecast, By Packaging, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Plastic bottles

- 8.3 Glass bottles

- 8.4 Refillable bottles

Chapter 9 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Women

- 10.3 Men

- 10.4 Unisex

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company websites

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarkets

- 11.3.2 Specialty stores/ mega retail stores

- 11.3.3 Convenience stores (departmental, independent)

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Indonesia

- 12.4.7 Malaysia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Bath & Body Works

- 13.2 Chanel

- 13.3 Coty Inc.

- 13.4 Dior

- 13.5 Estee Lauder

- 13.6 L’Occitane en Provence

- 13.7 L'Oreal

- 13.8 Pacifica Beauty

- 13.9 Procter & Gamble

- 13.10 Revlon Inc.

- 13.11 Shiseido Company, Limited

- 13.12 Sol de Janeiro

- 13.13 The Body Shop

- 13.14 Unilever

- 13.15 Victoria's Secret