|

市场调查报告书

商品编码

1876589

面向消费应用的4D列印服务市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)4D Printing Services for Consumer Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

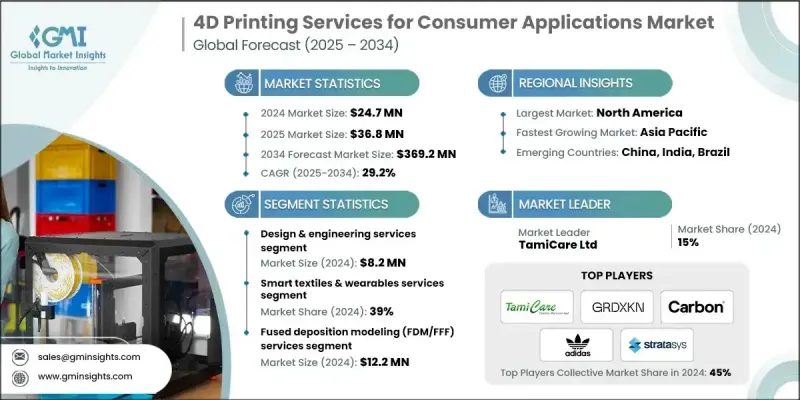

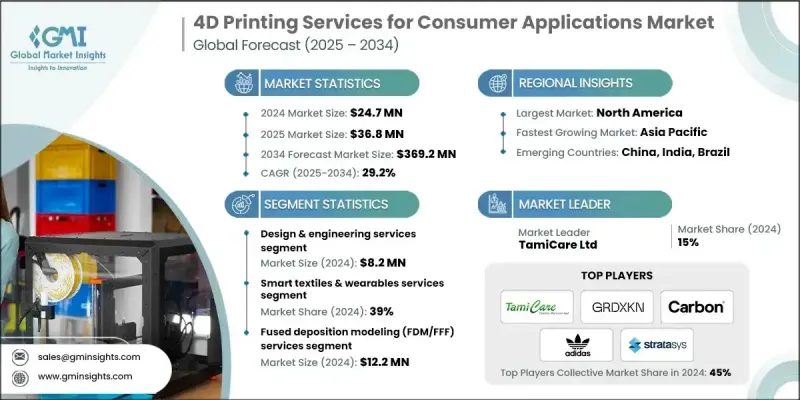

2024 年全球消费应用 4D 列印服务市值为 2,470 万美元,预计到 2034 年将以 29.2% 的复合年增长率增长至 3.692 亿美元。

4D列印在消费领域的成长潜力在于人们对自适应、个人化和永续产品日益增长的兴趣。与传统的3D列印不同,4D列印采用智慧材料,能够根据温度、光照或湿度等环境因素改变自身形状和功能。这项技术正在为自适应服装、自组装家具和响应式家居产品等领域的消费创新铺平道路。随着技术的不断进步,研究机构、新创公司和成熟的技术供应商正在探索旨在提升功能性和效率的新材料和生产流程。随着可扩展性和成本相关问题的逐步缓解,市场正逐步从概念开发过渡到实际应用。消费者对互动式和可客製化产品的需求日益增长,预计将推动4D列印技术在日常消费领域得到更广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2470万美元 |

| 预测值 | 3.692亿美元 |

| 复合年增长率 | 29.2% |

2024年,设计和工程服务领域创造了820万美元的收入。该领域的领先地位归功于专案合作数量的增加以及对材料科学、相变力学和产品设计等专业知识的需求。随着产业向更复杂的应用领域发展,服务供应商正在提升自身的技术能力,以满足不断变化的客户需求。对合约製造服务日益增长的兴趣表明,市场正开始向生产规模化营运转型,凸显了其走向商业成熟的进程。

智慧纺织品和穿戴式装置领域预计在2024年将占据39%的市场。该领域涵盖了旨在适应环境刺激或用户特定需求的高级纺织品应用。功能性服装、医用纺织品和自适应时尚单品等产品正越来越多地利用4D列印技术来提升舒适性、功能性和效率。在时尚、健身和科技融合的推动下,消费者对响应式穿戴装置的兴趣日益浓厚,为该领域创造了不断增长的商业机会。

美国面向消费应用的4D列印服务市场占84%的份额,预计2024年市场规模将达到800万美元。北美仍然是先进材料和增材製造技术研究、创新和商业化的领先中心。该地区受益于强大的研发投入、活跃的学术合作以及政府鼓励技术转移和产业发展的支持性倡议。其先进的基础设施、智慧财产权保护以及对下一代製造的投入,使其成为推动面向消费市场的4D列印服务扩张的关键力量。

参与全球消费应用4D列印服务市场的知名企业包括Carbon, Inc.、Nervous System Inc.、TamiCare Ltd.、惠普公司、三菱化学株式会社、Formlabs Inc.、Stratasys Ltd.、GRDXKN、麻省理工学院自组装实验室以及阿迪达斯创新实验室。这些行业参与者专注于研发、合作和材料创新,以提供专为消费者量身定制的先进4D列印解决方案。在消费应用4D列印服务市场营运的企业正致力于创新与合作,以巩固其全球影响力。许多企业正大力投资研发,以提升智慧材料的性能并增强其变形反应能力。技术供应商、研究机构以及时尚或消费品品牌之间的合作,正在加速自适应产品的商业化。各公司也强调永续的製造流程和可扩展的生产方法,以满足不断增长的消费者需求。拓展服务范围,涵盖设计咨询、原型製作和合约製造,也是一项关键策略。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 消费品的客製化与智慧适应性

- 智慧材料和印刷技术的进步

- 对永续和功能性设计的需求日益增长

- 产业陷阱与挑战

- 生产成本高且可扩展性有限

- 缺乏标准化和监管框架

- 机会

- 融入穿戴式科技和智慧纺织品

- 拓展至家庭自动化和智慧家具领域

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依服务类型划分,2021-2034年

- 主要趋势

- 设计与工程服务

- 合约製造服务

- 材料开发服务

- 软体和数位服务

- 监理合规咨询

- 维护和支援服务

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 熔融沈积成型(FDM/FFF)服务

- 立体光刻(SLA/DLP)服务

- 直接墨水书写 (DIW) 服务

- 混合多技术服务

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 智慧纺织品和穿戴式装置服务

- 食品应用服务

- 消费性电子服务

- 家具及家居用品服务

- 个人医疗保健设备服务

第八章:市场估算与预测:依服务交付模式划分,2021-2034年

- 主要趋势

- 按需服务

- 订阅式服务

- 基于专案的服务

- 託管服务

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Stratasys Ltd.

- Carbon, Inc.

- HP Inc.

- Formlabs Inc.

- GRDXKN

- Mitsubishi Chemical Corporation

- Adidas AG - Innovation Lab

- Nervous System Inc.

- Self-Assembly Lab (MIT)

- TamiCare Ltd.

The Global 4D Printing Services for Consumer Applications Market was valued at USD 24.7 million in 2024 and is estimated to grow at a CAGR of 29.2% to reach USD 369.2 million by 2034.

The growth potential of 4D printing in consumer applications lies in the increasing interest in adaptive, personalized, and sustainable products. Unlike conventional 3D printing, 4D printing utilizes smart materials capable of transforming their shapes and functions in response to environmental factors such as temperature, light, or humidity. This technology is paving the way for consumer-oriented innovations in areas like adaptive apparel, self-assembling furniture, and responsive home products. As advancements continue, research institutions, startups, and established technology providers are exploring new materials and production processes aimed at improving functionality and efficiency. The market is gradually transitioning from conceptual development to practical implementation as issues related to scalability and cost have begun to ease. The growing consumer appetite for interactive and customizable products is expected to drive wider adoption of 4D printing technologies in the everyday consumer space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.7 Million |

| Forecast Value | $369.2 Million |

| CAGR | 29.2% |

In 2024, the design and engineering services segment generated USD 8.2 million. This segment's leadership is attributed to the increasing number of project collaborations and the need for specialized expertise in materials science, transformation mechanics, and product design. Service providers are enhancing their technical capabilities to support evolving client demands as the industry progresses toward more complex applications. The growing interest in contract manufacturing services signals that the market is beginning to move toward production-scale operations, highlighting its path toward commercial maturity.

The smart textiles and wearables segment held a 39% share in 2024. This segment includes advanced textile applications designed to adapt to environmental stimuli or user-specific conditions. Products such as performance-based clothing, medical textiles, and adaptive fashion items are increasingly leveraging 4D printing technologies to deliver comfort, functionality, and efficiency. Consumer interest in responsive wearables is expanding, driven by the convergence of fashion, fitness, and technology, creating a growing commercial opportunity within this category.

U.S. 4D Printing Services for Consumer Applications Market held 84% share, generating USD 8 million in 2024. North America remains a leading hub for research, innovation, and commercialization of advanced materials and additive manufacturing technologies. The region benefits from strong investment in R&D, robust academic collaboration, and supportive government initiatives that encourage technology transfer and industrial development. Its advanced infrastructure, intellectual property protections, and commitment to next-generation manufacturing have positioned it as a key player in driving the expansion of 4D printing services for consumer markets.

Prominent companies participating in the Global 4D Printing Services for Consumer Applications Market include Carbon, Inc., Nervous System Inc., TamiCare Ltd., HP Inc., Mitsubishi Chemical Corporation, Formlabs Inc., Stratasys Ltd., GRDXKN, Self-Assembly Lab (MIT), and Adidas AG - Innovation Lab. These industry players are focusing on research, partnerships, and material innovations to deliver advanced 4D printing solutions tailored for consumer use. Companies operating in the 4D Printing Services for Consumer Applications Market are focusing on innovation and collaboration to strengthen their global presence. Many are investing heavily in research and development to advance smart material capabilities and improve shape-shifting responsiveness. Partnerships between technology providers, research institutions, and fashion or consumer goods brands are enabling faster commercialization of adaptive products. Firms are also emphasizing sustainable manufacturing processes and scalable production methods to meet growing consumer demand. Expanding service portfolios to include design consulting, prototyping, and contract manufacturing is another key strategy.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service type

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Service delivery model

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Customization and smart adaptability of consumer products

- 3.2.1.2 Advancements in smart materials and printing technologies

- 3.2.1.3 Growing demand for sustainable and functional design

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High production costs and limited scalability

- 3.2.2.2 Lack of standardization and regulatory frameworks

- 3.2.3 Opportunities

- 3.2.3.1 Integration into wearable technology and smart textiles

- 3.2.3.2 Expansion into home automation and smart furniture

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Design & engineering services

- 5.3 Contract manufacturing services

- 5.4 Material development services

- 5.5 Software & digital services

- 5.6 Regulatory compliance consulting

- 5.7 Maintenance & support services

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Fused deposition modeling (FDM/FFF) services

- 6.3 Stereolithography (SLA/DLP) services

- 6.4 Direct ink writing (DIW) services

- 6.5 Hybrid multi-technology services

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Smart textiles & wearables services

- 7.3 Food application services

- 7.4 Consumer electronics services

- 7.5 Furniture & home goods services

- 7.6 Personal healthcare device services

Chapter 8 Market Estimates and Forecast, By Service Delivery Model, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 On-demand services

- 8.3 Subscription-based services

- 8.4 Project-based services

- 8.5 Managed services

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Stratasys Ltd.

- 10.2 Carbon, Inc.

- 10.3 HP Inc.

- 10.4 Formlabs Inc.

- 10.5 GRDXKN

- 10.6 Mitsubishi Chemical Corporation

- 10.7 Adidas AG - Innovation Lab

- 10.8 Nervous System Inc.

- 10.9 Self-Assembly Lab (MIT)

- 10.10 TamiCare Ltd.