|

市场调查报告书

商品编码

1876598

现场太阳能电子燃料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)On-site Solar E-Fuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

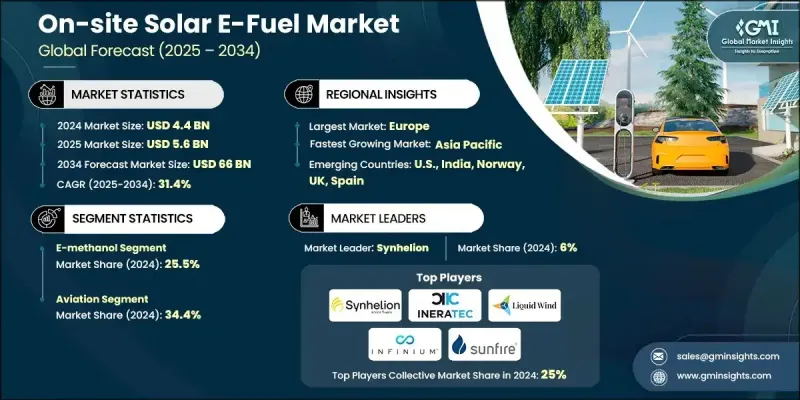

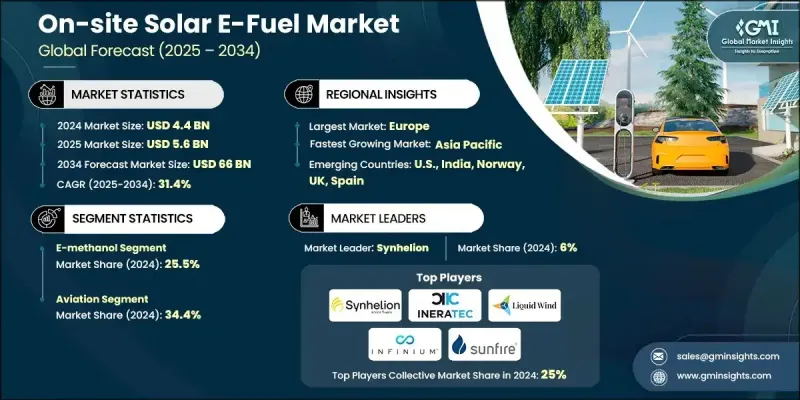

2024 年全球现场太阳能电子燃料市场价值为 44 亿美元,预计到 2034 年将以 31.4% 的复合年增长率增长至 660 亿美元。

全球对航空、重型运输和海运等挑战性产业的脱碳承诺日益增强,推动了对太阳能衍生再生电子燃料的需求。这些产业的电气化路径有限,因此合成燃料成为实现净零排放目标的关键解决方案。包括碳定价和燃料掺混强制令在内的全球监管框架正在加速向清洁能源转型。太阳能电子燃料利用再生太阳能将二氧化碳和水转化为碳氢化合物,符合环境和能源安全目标。太阳能製液製程(例如太阳能热化学转化和电化学转化)的持续技术进步正在提高系统效率和商业可行性。固体氧化物电解槽和高温反应器等先进技术的应用,能够将太阳能直接转化为合成气,然后将其提炼成液体燃料。将碳捕获系统与太阳能电子燃料设施结合,有助于建立闭环碳循环,在减少排放的同时确保可靠的碳原料供应。这种整合符合循环碳经济原则,并提升了电子燃料生产的整体永续性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 660亿美元 |

| 复合年增长率 | 31.4% |

2024年,电子甲醇市占率达到25.5%,预计到2034年将以31.7%的复合年增长率成长。其快速扩张主要得益于工业和船舶脱碳应用领域对电子甲醇需求的不断增长。作为一种首选的太阳能电子燃料,电子甲醇在储存、运输和引擎相容性方面具有优势。将电解和二氧化碳利用相结合的大规模生产项目,为寻求再生能源解决方案的高排放产业提供了一种切实可行且可扩展的替代方案。

预计到2034年,汽车产业将以33%的年增长率成长,因为太阳能衍生的电子燃料正逐渐成为内燃机汽车脱碳的可行过渡方案。汽车製造商和能源开发商正积极投资建设示范设施,以评估现场太阳能电子燃料技术的可扩展性和成本效益,尤其是在太阳能资源丰富的地区。

美国现场太阳能电子燃料市场预计在2024年达到10亿美元规模。在联邦政府激励措施和企业永续发展目标的支持下,美国太阳能电子燃料计画正蓬勃发展。美国《通货膨胀控制法案》及其相关政策,以及各州的再生能源强制规定,显着加速了太阳能製氢和电转液系统的普及应用。

全球现场太阳能电燃料市场的主要企业包括Carbon Recycling International、Spark e-Fuels、Aether Fuels、Synhelion、INERATEC、马士基、Circularity Fuels、Liquid Wind、Dioxycle、MAN Energy Solutions、Sunfire、Renewable Hydrogen Canada、Prometheus Fuels、Fuels、FuelszFuxS、SIntel、Eelel、Meleltys、Aelty Energys、Fuelsz素、iIntel、Eelelss、Aeltys、游泳szanz、Orates、kIntel) Energy。这些领导企业正致力于策略合作、技术整合和产能扩张,以巩固其市场地位。许多公司正与能源生产商和工业终端用户结盟,共同开发商业规模的太阳能电燃料工厂。对先进电解槽系统、太阳能反应器效率和二氧化碳利用技术的投资,正在提升生产性能和成本竞争力。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争性标竿分析

- 战略仪錶板

- 创新与技术格局

第五章:市场规模及预测:依技术划分,2021-2034年

- 主要趋势

- 费托合成

- eRWGS

- 其他的

第六章:市场规模及预测:依产品划分,2021-2034年

- 主要趋势

- 电子汽油

- 电动柴油

- 电子煤油

- 乙醇

- 乙醇

- 其他的

第七章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 汽车

- 海洋

- 航空

- 工业的

- 其他的

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 挪威

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABEL Energy

- Aether Fuels

- Andes Mining & Energy

- Brineworks

- Carbon Recycling International

- Circularity Fuels

- Dioxycle

- ETFuels

- Infinium

- INERATEC

- Liquid Wind

- Lydian Labs

- MAN Energy Solutions

- Maersk

- Oxylus Energy

- Prometheus Fuels

- ReIntegrate

- Renewable Hydrogen Canada

- Spark e-Fuels

- Sunfire

- Synhelion

The Global On-site Solar E-Fuel Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 31.4% to reach USD 66 billion by 2034.

The growing global commitment to decarbonization across challenging sectors such as aviation, heavy transportation, and maritime industries is driving the demand for renewable e-fuels derived from solar energy. These industries have limited pathways to electrification, making synthetic fuels an essential solution to achieving net-zero goals. Worldwide regulatory frameworks, including carbon pricing and fuel-blending mandates, are accelerating the shift toward cleaner energy. Solar-based e-fuels convert carbon dioxide and water into hydrocarbons using renewable solar power, aligning with both environmental and energy security objectives. Continuous technological progress in solar-to-liquid processes, such as solar thermochemical and electrochemical conversion, is improving system efficiency and commercial feasibility. The use of advanced technologies like solid oxide electrolyzers and high-temperature reactors enables direct conversion of solar energy into synthesis gas, which is later refined into liquid fuels. Coupling carbon capture systems with solar e-fuel facilities helps establish a closed carbon cycle, reducing emissions while ensuring a reliable carbon feedstock supply. This integration supports circular carbon economy principles and boosts the overall sustainability of e-fuel production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $66 Billion |

| CAGR | 31.4% |

The e-methanol segment held a 25.5% share in 2024 and is forecast to grow at a CAGR of 31.7% through 2034. Its rapid expansion is fueled by increasing adoption across industrial and marine decarbonization applications. As a preferred solar-based e-fuel, E-Methanol offers advantages in storage, transport, and engine compatibility. Large-scale production projects integrating electrolysis and CO2 utilization offer a practical, scalable alternative for emission-intensive sectors seeking renewable solutions.

The automotive segment is expected to grow at a 33% rate by 2034, as solar-derived e-fuels emerge as a viable transitional option for decarbonizing internal combustion engine (ICE) vehicles. Automakers and energy developers are actively investing in demonstration facilities to assess the scalability and cost-effectiveness of on-site solar e-fuel technologies, particularly in regions with high solar potential.

United States On-site Solar E-Fuel Market generated USD 1 billion in 2024. The country is experiencing a surge in solar-based e-fuel projects supported by federal incentives and corporate sustainability targets. Policies under the U.S. Inflation Reduction Act, along with renewable energy mandates across states, have significantly accelerated the adoption of solar hydrogen and Power-to-Liquid systems.

Prominent companies operating in the Global On-site Solar E-Fuel Market include Carbon Recycling International, Spark e-Fuels, Aether Fuels, Synhelion, INERATEC, Maersk, Circularity Fuels, Liquid Wind, Dioxycle, MAN Energy Solutions, Sunfire, Renewable Hydrogen Canada, Prometheus Fuels, Oxylus Energy, ReIntegrate, Lydian Labs, ABEL Energy, Brineworks, ETFuels, and Andes Mining & Energy. Leading players in the On-site Solar E-Fuel Market are focusing on strategic partnerships, technology integration, and capacity expansion to strengthen their market presence. Many companies are forming alliances with energy producers and industrial end-users to co-develop commercial-scale solar e-fuel plants. Investments in advanced electrolyzer systems, solar reactor efficiency, and CO2 utilization technologies are enhancing production performance and cost competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Technology trends

- 2.1.3 Product trends

- 2.1.4 Application trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Fischer-Tropsch

- 5.3 eRWGS

- 5.4 Others

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 E-Gasoline

- 6.3 E-Diesel

- 6.4 E-Kerosene

- 6.5 Ethanol

- 6.6 E-Methanol

- 6.7 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Marine

- 7.4 Aviation

- 7.5 Industrial

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Norway

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABEL Energy

- 9.2 Aether Fuels

- 9.3 Andes Mining & Energy

- 9.4 Brineworks

- 9.5 Carbon Recycling International

- 9.6 Circularity Fuels

- 9.7 Dioxycle

- 9.8 ETFuels

- 9.9 Infinium

- 9.10 INERATEC

- 9.11 Liquid Wind

- 9.12 Lydian Labs

- 9.13 MAN Energy Solutions

- 9.14 Maersk

- 9.15 Oxylus Energy

- 9.16 Prometheus Fuels

- 9.17 ReIntegrate

- 9.18 Renewable Hydrogen Canada

- 9.19 Spark e-Fuels

- 9.20 Sunfire

- 9.21 Synhelion