|

市场调查报告书

商品编码

1876613

3D列印外科器械材料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)3D Printed Surgical Instrument Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

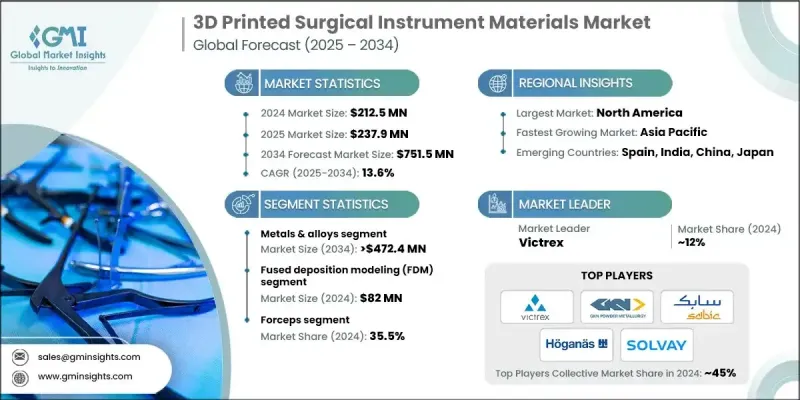

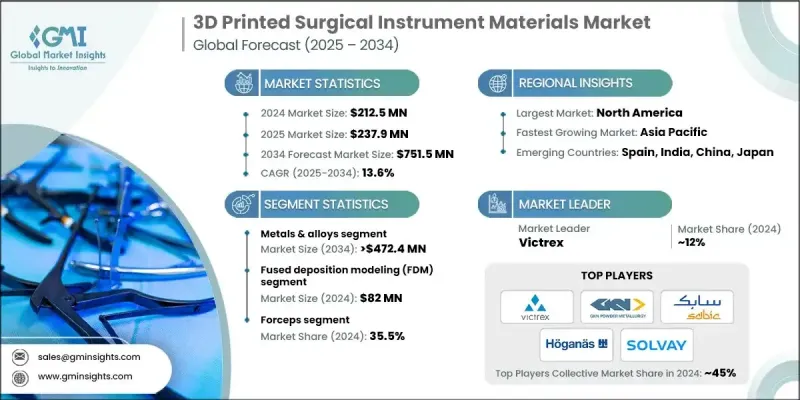

2024 年全球 3D 列印外科器械材料市场价值为 2.125 亿美元,预计到 2034 年将以 13.6% 的复合年增长率增长至 7.515 亿美元。

市场扩张的驱动力来自生物相容性和可消毒材料的持续进步、对患者定製手术器械需求的增长、医疗机构对3D列印技术的日益普及,以及微创和复杂手术的日益增多。 3D列印手术器械的材料包括金属、聚合物和复合材料,用于製造手术刀、镊子、钳子和牵开器等工具。这些材料必须确保高机械强度、可消毒性和生物相容性。外科医生越来越倾向于使用客製化器械来提高手术精度和改善患者预后。积层製造技术能够实现精确设计、符合人体工学的客製化以及经济高效的生产。轻质、耐用且可消毒的金属、聚合物和复合材料的不断创新正在拓展3D列印技术在医疗保健领域的应用,并支持专用手术工具的快速发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.125亿美元 |

| 预测值 | 7.515亿美元 |

| 复合年增长率 | 13.6% |

由于金属及合金具有卓越的机械强度、精度和良好的消毒相容性,预计到2024年,该细分市场将占据62.6%的市场份额。钛、不銹钢和钴铬合金等材料具有优异的抗拉强度、耐磨性和长期耐久性,使其成为重复手术应用的理想选择。这些特性确保了其在高压手术环境中的可靠性,从而推动了其广泛应用。

2024年,熔融沈积成型(FDM)市场规模达到8,200万美元,预计2034年将以13.5%的复合年增长率成长。 FDM技术具有极高的成本效益,能够快速製作原型并实现手术器械的早期生产。其操作简便、维护成本低,且易于整合到医院和手术中心,从而能够按需列印客製化工具,在加快研发速度的同时降低成本。

2024年,北美3D列印手术器械材料市场将占据42.2%的市场份额,这主要得益于先进的医疗基础设施、设备齐全的医院以及采用增材製造技术进行外科手术的研究机构。政府、学术界和私人企业对3D列印研究的大量投资,以及生物相容性聚合物和金属合金的持续创新,正在推动该地区市场的成长。

全球3D列印手术器械材料市场的主要参与者包括3D SYSTEMS、Apium、Arkema、Ensinger、EOS、Evonik、Formlabs、GKN Powder Metallurgy、Hoganas、INDO-MIM、RENISHAW、SABIC、SOLVAY、Stratasys和Victrex。这些公司正透过投资研发,开发先进的生物相容性和可灭菌材料,以巩固其市场地位。他们专注于开发可客製化的、针对特定患者的解决方案,并拓展产品组合,以满足复杂的手术需求。与医院、医疗器材製造商和学术机构的策略合作,有助于扩大市场覆盖率和提升产品应用率。此外,各公司也正在利用积层製造创新技术来降低生产成本、提高精准度并加速器材研发。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 对客製化和病患专用手术器械的需求日益增长。

- 生物相容性和可消毒3D列印材料的进展

- 积层製造技术在医疗保健领域的应用日益广泛

- 医疗3D列印研发领域的投资不断成长

- 产业陷阱与挑战

- 标准化程度有限以及监管方面的挑战

- 某些聚合物的机械强度限制

- 市场机会

- 拓展新兴医疗保健市场

- 将人工智慧和模拟工具整合到设计最佳化中

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 消费者洞察

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料分类,2021-2034年

- 主要趋势

- 金属及合金

- 聚合物

- 可生物降解聚合物

- 其他材料

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 熔融沈积成型(FDM)

- 选择性雷射烧结(SLS)

- 立体光刻(SLA)

- 其他技术

第七章:市场估计与预测:依仪器类型划分,2021-2034年

- 主要趋势

- 钳子

- 夹具

- 牵开器

- 手术刀

- 其他乐器

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 排

第九章:公司简介

- 3D SYSTEMS

- Apium

- Arkema

- Ensinger

- EOS

- Evonik

- Formlabs

- GKN Powder Metallurgy

- Hoganas

- INDO-MIM

- RENISHAW

- SABIC

- SOLVAY

- Stratasys

- Victrex

The Global 3D Printed Surgical Instrument Materials Market was valued at USD 212.5 million in 2024 and is estimated to grow at a CAGR of 13.6% to reach USD 751.5 million by 2034.

Market expansion is fueled by ongoing advancements in biocompatible and sterilizable materials, rising demand for patient-specific surgical instruments, increasing adoption of 3D printing across healthcare facilities, and the growing prevalence of minimally invasive and complex surgical procedures. 3D printed surgical instrument materials include metals, polymers, and composites used to fabricate tools such as scalpels, forceps, clamps, and retractors. These materials must ensure high mechanical strength, sterilizability, and biocompatibility. Surgeons are increasingly seeking customized instruments to enhance surgical accuracy and patient outcomes. Additive manufacturing enables precise design, ergonomic customization, and cost-effective production. Continuous innovation in lightweight, durable, and sterilizable metals, polymers, and composite materials is broadening the application of 3D printing in healthcare, supporting the rapid development of specialized surgical tools.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $212.5 Million |

| Forecast Value | $751.5 Million |

| CAGR | 13.6% |

The metals & alloys segment held a 62.6% share in 2024 owing to their exceptional mechanical strength, precision, and sterilization compatibility. Materials such as titanium, stainless steel, and cobalt-chrome offer superior tensile strength, wear resistance, and long-term durability, making them ideal for repeated surgical use. These properties ensure reliability in high-stress surgical environments, driving their widespread adoption.

The fused deposition modeling (FDM) segment was valued at USD 82 million in 2024 and is expected to grow at a CAGR of 13.5% through 2034. FDM is highly cost-effective, enabling rapid prototyping and early-stage production of surgical instruments. Its simplicity, low maintenance, and ease of integration into hospitals and surgical centers facilitate on-demand printing of customized tools, accelerating development while reducing costs.

North America 3D Printed Surgical Instrument Materials Market held a 42.2% share in 2024, supported by advanced healthcare infrastructure, well-equipped hospitals, and research institutions adopting additive manufacturing for surgical applications. Substantial investments by governments, academia, and private enterprises in 3D printing research, along with continuous innovation in biocompatible polymers and metal alloys, are driving regional growth.

Key players operating in the Global 3D Printed Surgical Instrument Materials Market include 3D SYSTEMS, Apium, Arkema, Ensinger, EOS, Evonik, Formlabs, GKN Powder Metallurgy, Hoganas, INDO-MIM, RENISHAW, SABIC, SOLVAY, Stratasys, and Victrex. Companies in the 3D Printed Surgical Instrument Materials Market are strengthening their position by investing in research and development to create advanced biocompatible and sterilizable materials. They are focusing on developing customizable, patient-specific solutions and expanding their product portfolios to cater to complex surgical requirements. Strategic collaborations with hospitals, medical device manufacturers, and academic institutions enhance market reach and adoption. Firms are also leveraging additive manufacturing innovations to reduce production costs, improve precision, and accelerate instrument development.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Material trends

- 2.2.3 Technology trends

- 2.2.4 Instruments trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for customized and patient-specific surgical instruments

- 3.2.1.2 Advancements in biocompatible and sterilizable 3D printing materials

- 3.2.1.3 Increasing adoption of additive manufacturing in healthcare

- 3.2.1.4 Rising investments in medical 3D printing R&D

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited standardization and regulatory challenges

- 3.2.2.2 Mechanical strength limitations of certain polymers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging healthcare markets

- 3.2.3.2 Integration of AI and simulation tools in design optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Consumer insights

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Metals & alloys

- 5.3 Polymers

- 5.4 Biodegradable polymer

- 5.5 Other materials

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fused deposition modeling (FDM)

- 6.3 Selective laser sintering (SLS)

- 6.4 Stereolithography (SLA)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Instruments, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Forceps

- 7.3 Clamps

- 7.4 Retractors

- 7.5 Scalpels

- 7.6 Other instruments

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 RoW

Chapter 9 Company Profiles

- 9.1 3D SYSTEMS

- 9.2 Apium

- 9.3 Arkema

- 9.4 Ensinger

- 9.5 EOS

- 9.6 Evonik

- 9.7 Formlabs

- 9.8 GKN Powder Metallurgy

- 9.9 Hoganas

- 9.10 INDO-MIM

- 9.11 RENISHAW

- 9.12 SABIC

- 9.13 SOLVAY

- 9.14 Stratasys

- 9.15 Victrex