|

市场调查报告书

商品编码

1876617

富勒烯基特种化学品市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Fullerene-Based Specialty Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

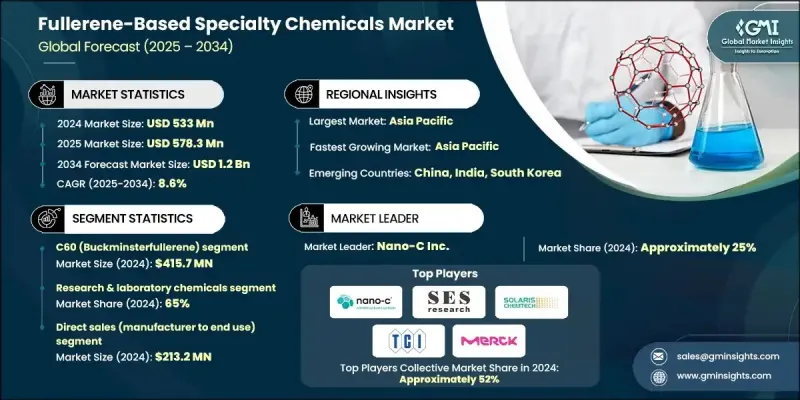

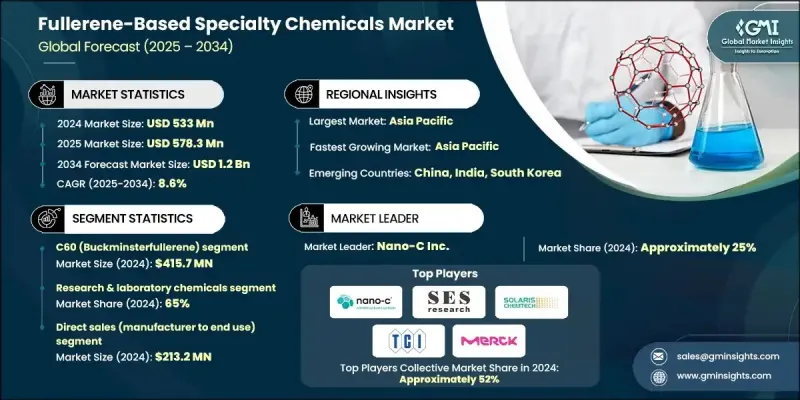

2024 年全球富勒烯基特种化学品市场价值为 5.33 亿美元,预计到 2034 年将以 8.6% 的复合年增长率增长至 12 亿美元。

成长动能主要得益于有机光伏(OPV)及相关电子应用领域不断扩大的机会,而富勒烯功能化和合成技术的显着进步也为此提供了有力支撑。 C60和C70富勒烯溶解性、稳定性和电子受体性能的提升,正加速其在有机电子和能源系统中的应用。奈米技术研究经费的充足投入,以及监管架构和政策激励措施的日益完善,持续拓展富勒烯基材料在能源、电子和製药研发领域的应用范围。随着对高性能奈米材料需求的不断增长,富勒烯及其衍生物在下一代装置、柔性电子元件和先进化学配方等领域的巨大潜力日益受到认可。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.33亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 8.6% |

2024年,电子和有机光伏(OPV)领域创造了1.173亿美元的收入,占市场份额的22%。该领域持续蓬勃发展,得益于有机电子技术的进步以及溶液加工型富勒烯衍生物的日益普及,这些进步确保了装置可扩展性和性能的提升。这些先进材料在柔性节能技术中的应用,正在推动多个产业对这些材料的需求。

2024 年,直销通路价值 2.132 亿美元,占 40% 的市场份额,预计到 2034 年将以 8.6% 的复合年增长率成长。由于富勒烯产品的高度专业化特性,该通路仍占据主导地位。富勒烯产品通常需要客製化规格、严格的品质控制,以及製造商与最终用户(如研究机构、电子公司和製药公司)之间的密切合作。

2024年,亚太地区富勒烯基特种化学品市场规模达2.559亿美元,市占率48%。预计该地区在2025年至2034年间将以10.2%的复合年增长率成长。强劲的成长得益于该地区强大的电子製造能力、完善的化学品供应体係以及政府积极推动奈米材料和下一代光伏技术研究的倡议。中国、日本、韩国和印度在生产和创新方面仍处于领先地位,这得益于其充满活力的新创企业生态系统和先进的研发项目。

全球富勒烯基特种化学品市场的主要参与者包括Nano-C Inc.、SES Research Inc.、Solaris Chem、TCI(东京化成工业株式会社)、Sigma-Aldrich / Merck KGaA、American Elements、Strem Chemicals、Ossila、Alfa Aesar(赛默飞世尔科技)、Aberial Carbon Corporation。这些公司积极投资研发,以提升材料性能并拓展应用领域。他们正透过建立策略合作关係和长期供应协议来提高生产效率并确保产品品质的稳定性。一些企业正透过开发高纯度和功能化衍生物来丰富其产品组合,以满足先进电子和光伏应用领域不断变化的需求。此外,许多公司也在优化其分销网络,专注于与关键终端用户建立直接合作关係,以提供客製化解决方案和技术支援。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 陷阱与挑战

- 机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按产品规格

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- C60(富勒烯)

- 95%纯度等级

- 99%纯度

- 纯度99.5%级

- 纯度99.9%

- C70富勒烯

- 标准级

- 高纯度

- 官能化富勒烯衍生物

- PCBM([6,6]-苯基-C61-丁酸甲酯)

- ICBA(茚-C60双加成物)

- 水溶性富勒烯衍生物

- 客製化功能化衍生物

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 研究和实验室化学品

- 学术与大学研究

- 药物研发应用

- 材料科学研究

- 政府研究机构

- 商业研究服务

- 电子与有机光伏

- 有机光伏(OPV)应用

- 半导体应用

- 电子元件集成

- 显示技术应用

- 专业工业应用

- 先进催化剂应用

- 特种涂料及材料

- 摩擦学应用

- 小众工业用途

- 合约研究与客製合成

- 医药合约研究

- 科技公司研发支持

- 客製化衍生品开发

- 专业研究化学服务

第七章:市场估计与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接销售(製造商对最终用户)

- 化学品分销商

- 特种化学品供应商

- 线上化学品市场

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Nano-C Inc.

- SES Research Inc.

- Solaris Chem

- TCI (Tokyo Chemical Industry)

- Sigma-Aldrich / Merck KGaA

- American Elements

- Strem Chemicals

- Ossila

- Alfa Aesar (Thermo Fisher)

- Frontier Carbon Corporation

- ACS Material

- Abvigen Inc.

The Global Fullerene-Based Specialty Chemicals Market was valued at USD 533 million in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 1.2 billion by 2034.

Growth momentum is primarily driven by expanding opportunities in organic photovoltaics (OPV) and related electronic applications, supported by significant advancements in fullerene functionalization and synthesis. Enhanced solubility, stability, and electron-accepting properties of C-60 and C-70 fullerenes are accelerating their integration into organic electronics and energy systems. The strong research funding for nanotechnology, coupled with maturing regulatory frameworks and policy incentives, continues to expand the scope of fullerene-based materials across energy, electronics, and pharmaceutical R&D. As the demand for high-performance nanomaterials rises, fullerenes and their derivatives are increasingly recognized for their potential in next-generation devices, flexible electronics, and advanced chemical formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $533 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 8.6% |

In 2024, the electronics and OPV segment generated USD 117.3 million, representing a 22% share. The segment continues to thrive on advancements in organic electronics and the growing adoption of solution-processable fullerene derivatives that ensure improved scalability and device performance. The use of these advanced materials in flexible and energy-efficient technologies is fueling further demand across multiple sectors.

The direct sales channel was valued at USD 213.2 million in 2024, captured a 40% share, and is forecast to grow at an 8.6% CAGR through 2034. This channel remains dominant due to the highly specialized nature of fullerene products, which often require tailored specifications, rigorous quality control, and close collaboration between manufacturers and end users such as research organizations, electronics firms, and pharmaceutical companies.

Asia-Pacific Fullerene-Based Specialty Chemicals Market generated USD 255.9 million and held a 48% share in 2024. The region is expected to grow at a 10.2% CAGR during 2025-2034. Strong growth is supported by robust electronics manufacturing capabilities, an extensive chemical supply infrastructure, and active government initiatives promoting nanomaterials and next-generation photovoltaic research. China, Japan, South Korea, and India remain at the forefront of production and innovation, supported by dynamic start-up ecosystems and advanced R&D programs.

Key players operating in the Global Fullerene-Based Specialty Chemicals Market include Nano-C Inc., SES Research Inc., Solaris Chem, TCI (Tokyo Chemical Industry), Sigma-Aldrich / Merck KGaA, American Elements, Strem Chemicals, Ossila, Alfa Aesar (Thermo Fisher), Frontier Carbon Corporation, ACS Material, and Abvigen Inc. Companies in the Fullerene-Based Specialty Chemicals Market are actively investing in research and development to enhance material performance and expand their application base. Strategic collaborations and long-term supply agreements are being formed to strengthen production efficiency and ensure consistent product quality. Several players are diversifying their product portfolios by developing high-purity and functionalized derivatives to meet the evolving needs of advanced electronic and photovoltaic applications. Many firms are also optimizing their distribution networks, focusing on direct partnerships with key end users to provide customized solutions and technical support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 Distribution Channel trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 C60 (buckminsterfullerene)

- 5.2.1 95% purity grade

- 5.2.2 99% purity grade

- 5.2.3 99.5% purity grade

- 5.2.4 99.9% purity grade

- 5.3 C70 fullerene

- 5.3.1 Standard grade

- 5.3.2 High purity grade

- 5.4 Functionalized Fullerene Derivatives

- 5.4.1 PCBM ([6,6]-Phenyl-C61-butyric Acid Methyl Ester)

- 5.4.2 ICBA (Indene-C60 Bisadduct)

- 5.4.3 Water-soluble fullerene derivatives

- 5.4.4 Custom functionalized derivatives

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Research & laboratory chemicals

- 6.2.1 Academic & university research

- 6.2.2 Pharmaceutical R&D applications

- 6.2.3 Material science research

- 6.2.4 Government research institutes

- 6.2.5 Commercial research services

- 6.3 Electronics & organic photovoltaics

- 6.3.1 Organic photovoltaic (OPV) applications

- 6.3.2 Semiconductor applications

- 6.3.3 Electronic component integration

- 6.3.4 Display technology applications

- 6.4 Specialty industrial applications

- 6.4.1 Advanced catalyst applications

- 6.4.2 Specialty coatings & materials

- 6.4.3 Tribological applications

- 6.4.4 Niche industrial uses

- 6.5 Contract research & custom synthesis

- 6.5.1 Pharmaceutical contract research

- 6.5.2 Technology company R&D support

- 6.5.3 Custom derivative development

- 6.5.4 Specialized research chemical services

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales (manufacturer to end use)

- 7.3 Chemical distributors

- 7.4 Specialty chemical suppliers

- 7.5 Online chemical marketplaces

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Nano-C Inc.

- 9.2 SES Research Inc.

- 9.3 Solaris Chem

- 9.4 TCI (Tokyo Chemical Industry)

- 9.5 Sigma-Aldrich / Merck KGaA

- 9.6 American Elements

- 9.7 Strem Chemicals

- 9.8 Ossila

- 9.9 Alfa Aesar (Thermo Fisher)

- 9.10 Frontier Carbon Corporation

- 9.11 ACS Material

- 9.12 Abvigen Inc.