|

市场调查报告书

商品编码

1876627

电动车充电负载管理系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Electric Vehicle Charging Load Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

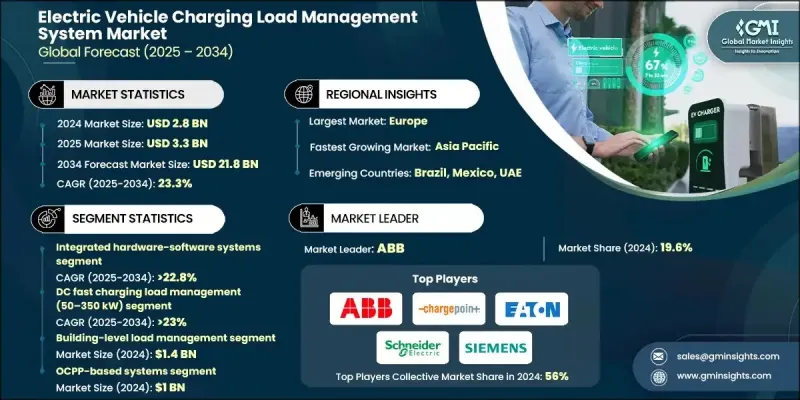

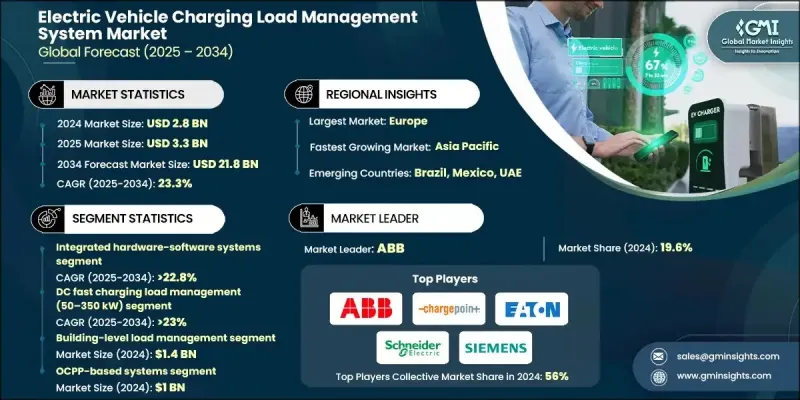

2024 年全球电动车充电负载管理系统市场价值为 28 亿美元,预计到 2034 年将以 23.3% 的复合年增长率成长至 218 亿美元。

电动车的快速普及、电动车保有量的不断扩大以及对智慧能源管理解决方案日益增长的需求,共同推动了市场成长。随着充电基础设施、电网连接和储能係统的进步,各利益相关方正致力于最大限度地提高营运效率、整合智慧电网解决方案并优化负载分配,以确保充电网路的可靠性和成本效益。该产业正朝着互联、自动化和数据驱动的营运模式发展,不仅改变了传统的能源管理方式,也重新定义了充电网路的监控和维护方式。对数位平台、预测性能源调度和人工智慧控制系统的投资不断增加,为建构更具可扩展性、弹性和效率的电动车充电生态系统创造了机会。物联网连接的充电站、基于人工智慧的负载平衡解决方案以及云端能源管理平台的日益普及,正在重塑整个产业格局。这些技术有助于即时监控电网需求、预测负载分配,并实现公用事业公司、充电营运商和车队管理人员之间的无缝协调。透过利用智慧电錶、远端资讯处理和人工智慧分析,营运商可以提高能源效率,降低峰值负载压力,降低营运成本,从而打造更智慧、更具弹性的充电网路。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 218亿美元 |

| 复合年增长率 | 23.3% |

2024年,软硬体一体化系统市占率占比达37%,预计2025年至2034年将以22.8%的复合年增长率成长。该细分市场透过将智慧充电器、动态负载控制器、储能介面和通讯模组整合到统一平台中,对于确保电动车的最佳充电、电网可靠性和能源效率至关重要。高压充电网路日益复杂,对人工智慧驱动的控制演算法、先进的监控技术和熟练的操作人员的需求也随之增加,以实现精准的能源分配。

直流快速充电负载管理领域(50-350千瓦)在2024年占据36%的市场份额,预计到2034年将以23%的复合年增长率成长。该领域的成长主要得益于大容量充电器的部署、对缩短电动车充电时间的需求以及对电网优化智慧负载平衡解决方案的需求。营运商正大力投资人工智慧驱动的负载优化、预测性调度、即时监控和云端管理平台,以提高充电器利用率、缓解高峰需求压力并提升营运效率。

预计2024年,德国电动车充电负载管理系统市场规模将达到2.878亿美元,占31%的市场。德国拥有强大的工业实力、智慧电网应用的领先地位以及先进的高功率充电技术。德国的发展趋势包括基于人工智慧的负载平衡、即时快速充电桩监控、预测性能源管理以及在商业、公共和车队充电网路中整合车网互动(V2G)技术。

电动车充电负载管理系统市场的主要参与者包括 Wallbox NV、Enel X、ABB、EV Connect、伊顿公司、特斯拉、施耐德电气、ChargePoint Holdings、西门子股份公司和壳牌充电解决方案。这些公司致力于技术创新、策略合作和地理扩张,以巩固其市场地位。他们投资研发,开发基于人工智慧、云端和物联网的解决方案,以优化能源利用和负载分配。与公用事业公司、车队营运商和政府专案的合作有助于更快地渗透市场并遵守不断变化的法规。各公司正在扩展基础设施和服务网络,以提高可及性和营运效率。併购和联盟有助于产品组合多元化、增强技术能力并巩固市场占有率。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 电动车普及率上升及车队规模扩张

- 先进的充电基础设施

- 物联网与人工智慧集成

- 电网可靠性和能源效率

- 产业陷阱与挑战

- 高额基础建设投资

- 整合的复杂性

- 市场机会

- 预测性和远端管理服务

- 永续发展和循环经济倡议

- 软体驱动与人工智慧赋能的解决方案

- 公私合营基础建设

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 政府政策促进电动车普及

- 电网规范与能源管理标准

- 减排和可持续发展法规

- 安全和高压系统合规性

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 人工智慧驱动的负载优化

- 物联网赋能的监控与连接

- 云端整合管理平台

- 基于标准的通讯协议

- 价格趋势

- 按地区

- 副产品

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 最佳情况

- 未来展望与策略建议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依技术架构划分,2021-2034年

- 主要趋势

- 整合硬体-软体系统

- 基于硬体的负载管理系统

- 基于软体的负载管理系统

第六章:市场估算与预测:依功率管理等级划分,2021-2034年

- 主要趋势

- 楼宇级负载管理

- 面板级负载管理

- 电路级负载管理

- 电网级负载管理

第七章:市场估算与预测:依通讯协定划分,2021-2034年

- 主要趋势

- 基于OCPP的系统

- 基于 ISO 15118 的系统

- 专有协定係统

- 基于IEEE 5的系统

第八章:市场估算与预测:依功率等级划分,2021-2034年

- 主要趋势

- 直流快速充电负载管理(50-350千瓦)

- 二级交流负载管理(3.3-22千瓦)

- 1 级交流负载管理(≤1.9 kW)

- 兆瓦级充电系统负载管理(>1兆瓦)

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 公共收费

- 车队充电

- 住宅收费

- 其他的

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十一章:公司简介

- Global Player

- ABB

- BP Pulse

- ChargePoint Holdings

- Eaton Corporation

- Schneider Electric SE

- Shell Recharge Solutions

- Siemens AG

- Tesla

- Regional Player

- Allego NV

- EV Connect

- EVBox (ENGIE)

- Gridserve Holdings

- gridX GmbH

- InstaVolt Limited

- SWTCH Energy

- Virta

- Wallbox

- 新兴参与者

- Ampcontrol Pty

- Bolt.Earth

- CyberSwitching

- Enphase Energy

- Wevo Energy

The Global Electric Vehicle Charging Load Management System Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 23.3% to reach USD 21.8 billion by 2034.

The market's growth is propelled by the rapid rise of electric vehicle adoption, expanding EV fleets, and the increasing requirement for intelligent energy management solutions. As charging infrastructure, grid connectivity, and energy storage systems advance, stakeholders are focusing on maximizing operational efficiency, integrating smart grid solutions, and optimizing load distribution to ensure reliable and cost-effective charging networks. The sector is moving toward connected, automated, and data-driven operations, transforming conventional approaches to energy management and redefining how charging networks are monitored and maintained. Rising investments in digital platforms, predictive energy scheduling, and AI-enabled control systems are creating opportunities for more scalable, resilient, and efficient EV charging ecosystems. The increasing deployment of IoT-connected charging stations, AI-based load balancing solutions, and cloud-enabled energy management platforms is reshaping the industry. These technologies facilitate real-time monitoring of grid demand, predictive load allocation, and seamless coordination between utilities, charging operators, and fleet managers. By leveraging smart meters, telematics, and AI analytics, operators can enhance energy efficiency, reduce peak load stress, and lower operational costs, enabling a smarter, more resilient charging network.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $21.8 Billion |

| CAGR | 23.3% |

The integrated hardware-software systems segment accounted for 37% share in 2024 and is expected to grow at a CAGR of 22.8% from 2025 to 2034. This segment is central to ensuring optimal EV charging, grid reliability, and energy efficiency by combining smart chargers, dynamic load controllers, energy storage interfaces, and communication modules into unified platforms. The rising complexity of high-voltage charging networks has increased demand for AI-driven control algorithms, advanced monitoring, and skilled operators to manage precise energy distribution.

The DC fast charging load management segment (50-350 kW) held 36% share in 2024 and is forecasted to grow at a CAGR of 23% through 2034. Growth in this segment is fueled by the deployment of high-capacity chargers, the need for reduced EV charging times, and the demand for grid-optimized, smart load balancing solutions. Operators are investing heavily in AI-powered load optimization, predictive scheduling, real-time monitoring, and cloud management platforms to enhance charger utilization, ease peak demand pressure, and improve operational efficiency.

Germany Electric Vehicle Charging Load Management System Market generated USD 287.8 million and held a 31% share in 2024. The country benefits from strong industrial capabilities, leadership in smart grid adoption, and advanced high-power charging technologies. Trends in Germany include AI-based load balancing, real-time fast charger monitoring, predictive energy management, and vehicle-to-grid (V2G) integration across commercial, public, and fleet charging networks.

Key players in the Electric Vehicle Charging Load Management System Market include Wallbox N.V., Enel X, ABB, EV Connect, Eaton Corporation, Tesla, Schneider Electric SE, ChargePoint Holdings, Siemens AG, and Shell Recharge Solutions. Companies in the Electric Vehicle Charging Load Management System Market are focusing on technological innovation, strategic partnerships, and geographic expansion to strengthen their market presence. They invest in R&D to develop AI-driven, cloud-based, and IoT-enabled solutions that optimize energy use and load distribution. Collaborations with utilities, fleet operators, and government programs allow faster market penetration and compliance with evolving regulations. Firms are expanding infrastructure and service networks to improve accessibility and operational efficiency. Mergers, acquisitions, and alliances help diversify product portfolios, enhance technological capabilities, and consolidate market share.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology Architecture

- 2.2.3 Power Management Level

- 2.2.4 Communication Protocol

- 2.2.5 Power Rating

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising EV adoption & fleet expansion

- 3.2.1.2 Advanced charging infrastructure

- 3.2.1.3 IoT & AI integration

- 3.2.1.4 Grid reliability & energy efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure investment

- 3.2.2.2 Complexity of integration

- 3.2.3 Market opportunities

- 3.2.3.1 Predictive & remote management services

- 3.2.3.2 Sustainability & circular economy initiatives

- 3.2.3.3 Software-driven and AI-enabled solutions

- 3.2.3.4 Public-private infrastructure expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Government policies promoting EV adoption

- 3.4.2 Grid codes and energy management standards

- 3.4.3 Emission reduction and sustainability regulations

- 3.4.4 Safety and high-voltage system compliance

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 AI-powered load optimization

- 3.7.2 IoT-enabled monitoring and connectivity

- 3.7.3 Cloud-integrated management platforms

- 3.7.4 Standards-based communication protocols

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Future Outlook & Strategic Recommendations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Technology Architecture, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Integrated hardware-software system

- 5.3 Hardware-based load management system

- 5.4 Software-based load management system

Chapter 6 Market Estimates & Forecast, By Power Management Level, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Building-level load management

- 6.3 Panel-level load management

- 6.4 Circuit-level load management

- 6.5 Grid-level load management

Chapter 7 Market Estimates & Forecast, By Communication Protocol, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 OCPP-based system

- 7.3 ISO 15118-based system

- 7.4 Proprietary protocol system

- 7.5 IEEE 2030.5-based system

Chapter 8 Market Estimates & Forecast, By Power Rating, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 DC fast charging load management (50-350 kW)

- 8.3 Level 2 ac load management (3.3-22 kW)

- 8.4 Level 1 ac load management (≤1.9 kW)

- 8.5 Megawatt charging system load management (>1 MW)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Public charging

- 9.3 Fleet charging

- 9.4 Residential charging

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 ABB

- 11.1.2 BP Pulse

- 11.1.3 ChargePoint Holdings

- 11.1.4 Eaton Corporation

- 11.1.5 Schneider Electric SE

- 11.1.6 Shell Recharge Solutions

- 11.1.7 Siemens AG

- 11.1.8 Tesla

- 11.2 Regional Player

- 11.2.1 Allego N.V.

- 11.2.2 EV Connect

- 11.2.3 EVBox (ENGIE)

- 11.2.4 Gridserve Holdings

- 11.2.5 gridX GmbH

- 11.2.6 InstaVolt Limited

- 11.2.7 SWTCH Energy

- 11.2.8 Virta

- 11.2.9 Wallbox

- 11.3 Emerging Players

- 11.3.1 Ampcontrol Pty

- 11.3.2 Bolt.Earth

- 11.3.3 CyberSwitching

- 11.3.4 Enphase Energy

- 11.3.5 Wevo Energy