|

市场调查报告书

商品编码

1876639

公用事业通讯市场机会、成长驱动因素、产业趋势分析及预测(2025-2034 年)Utility Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

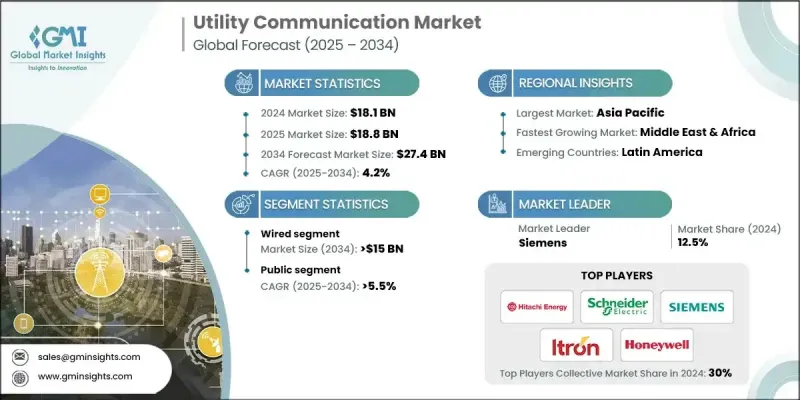

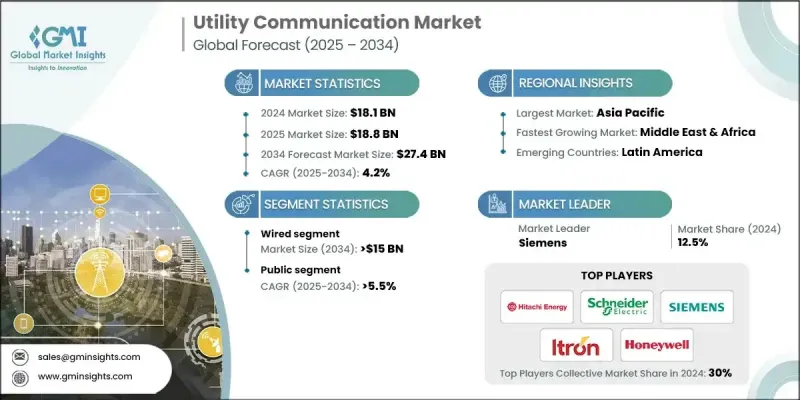

2024 年全球公用事业通讯市场价值为 181 亿美元,预计到 2034 年将以 4.2% 的复合年增长率增长至 274 亿美元。

推动这一市场扩张的,是政府主导的各项倡议,这些倡议旨在推广先进的通讯技术,例如专用LTE/5G网路、光纤、射频网状网路以及基于物联网的遥测系统。这些技术在建构更智慧、更互联的公用事业网路中发挥着至关重要的作用,从而支援再生能源併网和电网现代化。随着全球电气化和清洁能源专案在永续发展议程的推动下加速推进,公用事业通讯系统对于高效的电力分配和监控变得不可或缺。欧盟的数位化路线图和美国联邦政府的资助计画等政策,正引导大量投资涌入现代电网通讯基础设施。这包括自动计量、电网自动化和专用网路部署等倡议,这些倡议能够增强安全性、可扩展性和即时运行可视性。向分散式电力系统转型以及分散式能源的整合,正在公用事业生态系统中催生新的通讯需求。随着智慧电网的演进,公用事业公司越来越依赖无缝的资料连接来协调发电、储能和用电环节的运行,从而确保全球电网的可靠性和效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 181亿美元 |

| 预测值 | 274亿美元 |

| 复合年增长率 | 4.2% |

预计到2034年,有线通讯市场规模将达到150亿美元,主要归功于这些系统带来的许多营运优势。包括光纤、乙太网路和电力线通讯在内的有线技术构成了关键电网基础设施的骨干。它们提供卓越的频宽、低延迟和高抗干扰能力,使其成为变电站自动化、SCADA系统和广域电网管理等应用中即时控制的关键要素。其强大的性能和可靠性是推动公用事业营运中对其需求持续成长的关键因素。

预计到2034年,公共事业板块的复合年增长率将达到5.5%。由于公共事业部门负责大规模的电力传输和分配网络,因此在通讯领域中扮演着至关重要的角色。为了维持效率和可靠性,这些机构高度依赖先进的通讯系统,以实现有效的电网监控、自动化和维护。智慧电网技术的持续推广,包括智慧变电站和高阶计量基础设施,凸显了能够大规模处理复杂互联电力系统的通讯平台的重要性日益增长。

2024年,美国公用事业通讯市场规模预计达37亿美元。美国透过大规模采用智慧电网解决方案,并在先进的政策和资金机制的支持下,继续在塑造市场方向方面发挥领导作用。全美各地的公用事业公司都在大力投资有线和无线通讯网络,以提高电网可靠性、支援需求响应计划并管理分散式能源。美国的监管框架鼓励创新,同时强调网路安全和营运效率。

全球公用事业通讯市场的主要企业包括Itron, Inc.、思科系统、施耐德电气、西门子、摩托罗拉解决方案、Doxim、日立能源、霍尼韦尔、Ribbon Communications、Utility Communications Inc.、Hexagon、Kontron、Zenner International、Hexaware Technologies和Morcom International。这些企业正采取多种策略来巩固其竞争地位。许多企业专注于产品创新,并整合物联网、人工智慧驱动的分析和专用5G网路等下一代技术,以提高公用事业的营运效率和连接性。它们也积极寻求与公用事业供应商和政府进行策略合作,以实施智慧电网专案和大规模通讯升级。此外,各公司透过併购和研发投资来拓展业务范围,从而增强其全球影响力和技术实力。同时,它们也致力于开发网路安全增强型解决方案,以保护关键基础设施。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 新兴机会与趋势

- 数位化与物联网集成

- 新兴市场渗透

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准描述

- 策略仪錶板

- 创新与技术格局

第五章:市场规模及预测:依技术划分,2021-2034年

- 主要趋势

- 有线

- 无线的

第六章:市场规模及预测:依公用事业划分,2021-2034年

- 主要趋势

- 民众

- 私人的

第七章:市场规模及预测:依组件划分,2021-2034年

- 主要趋势

- 硬体

- 软体

第八章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 民众

- 私人输配电

- 石油和天然气公用事业

- 其他的

第九章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- Cisco System

- Doxim

- Hexagon

- Hexaware Technologies

- Hitachi Energy

- Honeywell

- Itron, Inc.

- Kontron

- Morcom International

- Motorola Solutions

- Ribbon Communications

- Schneider Electric

- Siemens

- Utility Communications Inc.

- Zenner International

The Global Utility Communication Market was valued at USD 18.1 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 27.4 billion by 2034.

The expansion of this market is driven by government-led initiatives promoting advanced communication technologies such as private LTE/5G networks, fiber optics, RF mesh, and IoT-based telemetry systems. These technologies play a critical role in enabling smarter, more connected utility networks that support renewable integration and grid modernization. As global electrification and clean energy projects accelerate under sustainability agendas across regions, utility communication systems are becoming indispensable for efficient power distribution and monitoring. Policies like the EU's digitalization roadmap and U.S. federal funding programs are channeling significant investments into modern grid communication infrastructure. This includes initiatives such as automated metering, grid automation, and private network deployments that enhance security, scalability, and real-time operational visibility. The ongoing transition toward decentralized power systems, coupled with the integration of distributed energy resources, is creating new communication demands within the utility ecosystem. As smart grids evolve, utilities are increasingly relying on seamless data connectivity to coordinate operations across generation, storage, and consumption points, ensuring grid reliability and efficiency on a global scale.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.1 Billion |

| Forecast Value | $27.4 Billion |

| CAGR | 4.2% |

The wired communication segment is expected to reach USD 15 billion by 2034, attributed to the multiple operational benefits these systems offer. Wired technologies, including fiber optics, Ethernet, and power line communication, form the backbone of critical grid infrastructure. They provide superior bandwidth, low latency, and high resistance to interference, making them essential for real-time control in applications such as substation automation, SCADA systems, and wide-area grid management. Their robust performance and reliability are key factors driving their sustained demand in utility operations.

The public utility segment is forecasted to grow at a CAGR of 5.5% through 2034. Public utilities hold a pivotal role in the communication landscape due to their responsibility for large-scale power transmission and distribution networks. To maintain efficiency and reliability, these entities rely heavily on advanced communication systems that enable effective grid supervision, automation, and maintenance. The continuous rollout of smart grid technologies, including intelligent substations and advanced metering infrastructure, underscores the growing importance of communication platforms that can handle complex, interconnected power systems at scale.

U.S. Utility Communication Market was valued at USD 3.7 billion in 2024. The United States continues to play a leading role in shaping the market's direction through large-scale adoption of smart grid solutions supported by progressive policies and funding mechanisms. Utilities across the country are investing heavily in both wired and wireless communication networks to enhance grid reliability, support demand response initiatives, and manage distributed energy resources. The U.S. regulatory framework encourages innovation while emphasizing cybersecurity and operational efficiency.

Prominent companies operating in the Global Utility Communication Market include Itron, Inc., Cisco Systems, Schneider Electric, Siemens, Motorola Solutions, Doxim, Hitachi Energy, Honeywell, Ribbon Communications, Utility Communications Inc., Hexagon, Kontron, Zenner International, Hexaware Technologies, and Morcom International. Companies in the Utility Communication Market are employing multiple strategies to solidify their competitive position. Many are focusing on product innovation and integrating next-generation technologies such as IoT, AI-driven analytics, and private 5G networks to improve operational efficiency and connectivity for utilities. Strategic collaborations with utility providers and governments are being pursued to implement smart grid projects and large-scale communication upgrades. Firms are expanding their portfolios through mergers, acquisitions, and R&D investments to strengthen their global presence and technological capabilities. Additionally, emphasis is being placed on developing cybersecurity-enhanced solutions to protect critical infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization & IoT integration

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by Region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Wired

- 5.3 Wireless

Chapter 6 Market Size and Forecast, By Utility, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Public

- 6.3 Private

Chapter 7 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Hardware

- 7.3 Software

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Public

- 8.3 Private transmission & distribution

- 8.4 Oil & gas utilities

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Cisco System

- 10.2 Doxim

- 10.3 Hexagon

- 10.4 Hexaware Technologies

- 10.5 Hitachi Energy

- 10.6 Honeywell

- 10.7 Itron, Inc.

- 10.8 Kontron

- 10.9 Morcom International

- 10.10 Motorola Solutions

- 10.11 Ribbon Communications

- 10.12 Schneider Electric

- 10.13 Siemens

- 10.14 Utility Communications Inc.

- 10.15 Zenner International