|

市场调查报告书

商品编码

1876646

产后出血管理器材市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Postpartum Hemorrhage Management Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

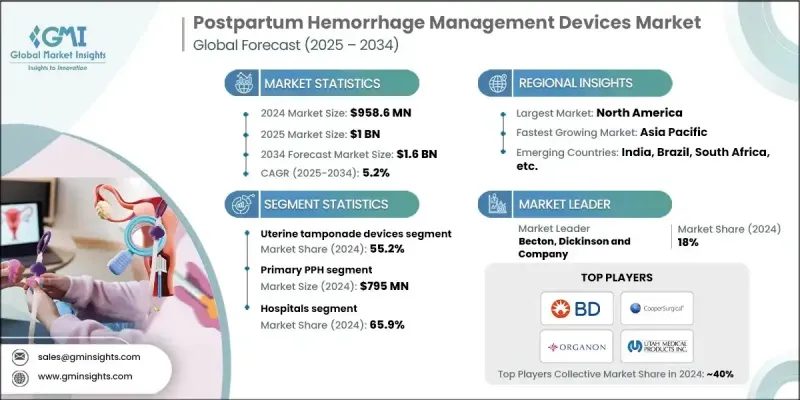

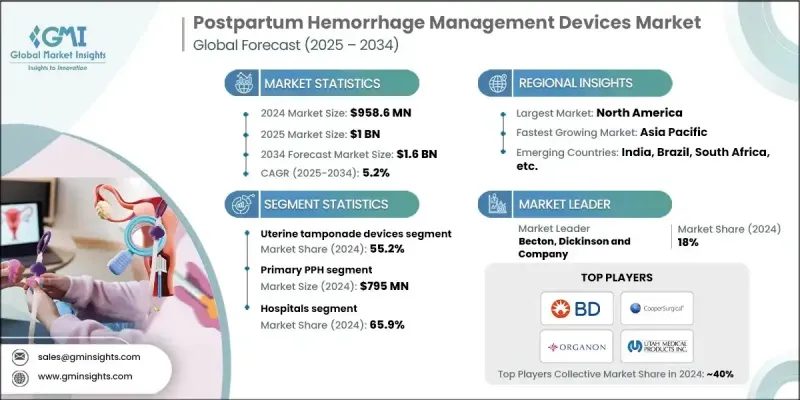

2024 年全球产后出血管理设备市场价值为 9.586 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 16 亿美元。

随着全球产后出血发生率的上升和孕产妇健康意识的增强,产后出血管理产业持续发展。设备创新快速发展、紧急产科护理的日益普及以及旨在预防分娩併发症的教育宣传活动不断加强,也推动了市场需求的成长。这些努力透过扩大孕产妇护理技术的普及范围、加强与医疗系统的合作以及提高整体应用率,为製造商创造了更有利的市场环境。人工智慧驱动的分析工具、数位连接、便携式设备和其他技术进步的日益融合,预计将在未来几年加速产后出血管理设备的发展。产后出血管理设备旨在控制分娩后的过度出血,并有助于降低产科急症的孕产妇死亡率。由于子宫球囊系统的高效性、微创性和经证实的有效性,临床团队越来越依赖该系统。其良好的安全性和可靠的性能使其在全球医疗机构中的应用日益广泛。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.586亿美元 |

| 预测值 | 16亿美元 |

| 复合年增长率 | 5.2% |

2024年,子宫填塞器械市占率达到55.2%,这主要得益于子宫收缩无力、贫血等疾病的高发生率,以及政府为改善孕产妇健康状况所采取的各项措施。这些器械透过施加子宫内压力来控制严重出血,通常可以减少手术的必要性,并迅速稳定患者病情。

2024年,继发性产后出血的市场规模预计为1.636亿美元。继发性产后出血是指在分娩后24小时至12週内发生的出血,通常与感染、组织残留或伤口癒合延迟有关。这类出血往往需要影像检查,并使用子宫收缩剂或手术治疗。虽然继发性产后出血不如原发性产后出血常见,但其预后更为复杂,凸显了长期孕产妇健康规划和预防保健策略的重要性。

2024年,美国产后出血管理器材市场规模预计将达3.308亿美元。该国产后出血的高发生率持续推高了产品需求。由于监管力度强、医院体系完善以及民众对孕产妇健康的高度重视,美国仍是产后出血管理器械的主要应用国家之一。公共措施和私人投资正在扩大这些器材的普及范围,并促进进一步的创新。

产后出血管理器械市场的主要参与者包括贝克顿·迪金森公司 (Becton, Dickinson and Company)、PREGNA INTERNATIONAL、CooperSurgical、SINAPI、CELOX MEDICAL、ORGANON、STERIMED、ZOEX NIASG、3rd Stone Design、UTAH MEDICAL PRODUCTS, INC. 和 MedGyn。参与产后出血管理器材市场竞争的公司正致力于采取多项策略性措施来提升其全球地位。许多公司正加大对先进产品工程的投资,以提高产品的可靠性、便携性和病人安全性。各机构正在扩大研发项目,以推出能够更快部署并降低干预风险的新型器械设计。加强与医院和孕产妇保健网络的合作关係,以及拓展在已开发地区和新兴地区的销售管道,仍是各公司的首要任务。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 全球产后出血发生率不断上升

- 加强对孕产妇死亡率的认识宣导活动

- 产后出血管理设备的技术进步

- 产业陷阱与挑战

- 资源匮乏环境下的设备取得受限

- 新设备审批的监理延误

- 机会

- 将人工智慧应用于预测性孕产妇健康分析

- 增加对孕产妇健康计画的拨款

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 投资环境

- 2024年定价分析

- 报销方案

- 永续性和环境考量

- 临床证据与结果分析

- 波特的分析

- PESTEL 分析

- 差距分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 子宫填塞装置

- 球囊填塞

- 真空诱导装置

- 非气动防震衣(NASG)

- 预填充注射系统

第六章:市场估计与预测:依病患类型划分,2021-2034年

- 主要趋势

- 原发性产后出血

- 继发性产后出血

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 孕产中心

- 门诊手术中心

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 3rd Stone Design

- Becton, Dickinson and Company

- CELOX MEDICAL

- CooperSurgical

- MedGyn

- ORGANON

- PREGNA INTERNATIONAL

- SINAPI

- STERIMED

- UTAH MEDICAL PRODUCTS, INC.

- ZOEX NIASG

The Global Postpartum Hemorrhage Management Devices Market was valued at USD 958.6 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 1.6 billion by 2034.

The industry continues to advance as the worldwide occurrence of postpartum hemorrhage climbs and awareness of maternal health strengthens. Demand is also influenced by rapid progress in device innovation, growing use of emergency obstetric care, and heightened educational campaigns focused on preventing childbirth complications. These efforts are helping create a more supportive environment for manufacturers by expanding access to maternal care technologies, building stronger collaborations with healthcare systems, and improving overall adoption. Increasing integration of AI-driven analytical tools, digital connectivity, portable equipment, and other technological enhancements is expected to accelerate development over the coming years. Postpartum hemorrhage management devices are designed to control excessive bleeding after childbirth and contribute to reducing maternal mortality during obstetric emergencies. Clinical teams increasingly rely on uterine balloon systems due to their efficiency, minimally invasive nature, and proven effectiveness. Strong safety results and dependable performance continue to broaden their acceptance in healthcare facilities worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $958.6 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 5.2% |

The uterine tamponade segment held a 55.2% share in 2024, supported by high rates of conditions such as uterine atony and anemia, as well as governmental measures aimed at improving maternal outcomes. These devices deliver internal uterine pressure to manage severe bleeding and can often reduce the need for surgical procedures while stabilizing patients rapidly.

The secondary postpartum hemorrhage segment was valued at USD 163.6 million in 2024. Defined as bleeding occurring more than 24 hours and up to 12 weeks after childbirth, this form of hemorrhage is generally associated with infection, retained tissue, or delayed healing. Diagnostic imaging and treatment using uterotonic medications or surgical options are often required. Although less common than primary postpartum hemorrhage, the secondary category is linked to more complex outcomes and highlights the importance of long-term maternal health planning and preventive-care strategies.

United States Postpartum Hemorrhage Management Devices Market generated USD 330.8 million in 2024. The country's high prevalence of postpartum hemorrhage continues to elevate product demand. The U.S. remains one of the leading adopters of PPH devices due to strong regulatory oversight, a widely developed hospital system, and extensive awareness of maternal health priorities. Public initiatives and private investment in maternal care are broadening access to these devices and stimulating further innovation.

Key Postpartum Hemorrhage Management Devices Market participants include Becton, Dickinson and Company, PREGNA INTERNATIONAL, CooperSurgical, SINAPI, CELOX MEDICAL, ORGANON, STERIMED, ZOEX NIASG, 3rd Stone Design, UTAH MEDICAL PRODUCTS, INC., and MedGyn. Companies competing in the postpartum hemorrhage management devices market are focusing on several strategic actions to enhance their global standing. Many firms are channeling investment toward advanced product engineering to improve reliability, portability, and patient safety. Organizations are expanding R&D programs to introduce new device designs that offer quicker deployment and reduced intervention risks. Strengthening relationships with hospitals and maternal care networks remains a priority, along with broadening distribution in both developed and emerging regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Patient type trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of postpartum hemorrhage globally

- 3.2.1.2 Increasing maternal mortality awareness campaigns

- 3.2.1.3 Technological advancements in PPH management devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited access to devices in low-resource settings

- 3.2.2.2 Regulatory delays for new device approvals

- 3.2.3 Opportunities

- 3.2.3.1 Integration of AI for predictive maternal health analytics

- 3.2.3.2 Increased funding for maternal health programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Pricing analysis, 2024

- 3.8 Reimbursement scenario

- 3.9 Sustainability & environmental considerations

- 3.10 Clinical evidence & outcomes analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Uterine tamponade devices

- 5.2.1 Balloon tamponade

- 5.2.2 Vacuum-induced devices

- 5.3 Non-pneumatic anti-shock garments (NASG)

- 5.4 Prefilled injection system

Chapter 6 Market Estimates and Forecast, By Patient Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Primary PPH

- 6.3 Secondary PPH

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Maternity & birthing centers

- 7.4 Ambulatory surgical centers

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3rd Stone Design

- 9.2 Becton, Dickinson and Company

- 9.3 CELOX MEDICAL

- 9.4 CooperSurgical

- 9.5 MedGyn

- 9.6 ORGANON

- 9.7 PREGNA INTERNATIONAL

- 9.8 SINAPI

- 9.9 STERIMED

- 9.10 UTAH MEDICAL PRODUCTS, INC.

- 9.11 ZOEX NIASG