|

市场调查报告书

商品编码

1876785

牙科植体及基台系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Dental Implants and Abutment Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

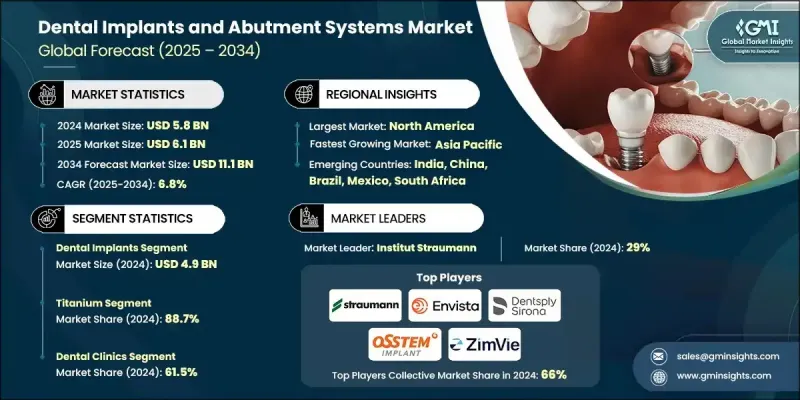

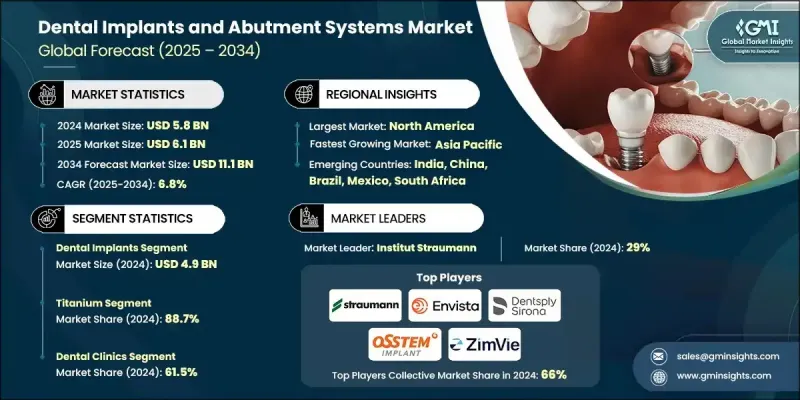

2024 年全球牙科植体和基台系统市场价值为 58 亿美元,预计到 2034 年将以 6.8% 的复合年增长率增长至 111 亿美元。

全球老龄人口的成长、牙科疾病盛行率的上升以及人们对美容牙科需求的日益增长,共同推动了植牙市场的发展。已开发地区植体材料和技术的进步也促进了市场扩张。随着年龄的增长,人们面临牙齿脱落、牙龈疾病和骨质疏鬆等风险,因此对修復性牙科解决方案的需求也越来越大。植牙和基台系统旨在取代缺失的牙齿,恢復牙齿的功能和美观。植体是一种由钛或氧化锆製成的人工牙根,透过手术植入下颚骨,用于支撑牙冠、牙桥或义齿。基台将义齿与植体连接起来,为缺失的牙齿提供持久、稳定且外观自然的替代方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 58亿美元 |

| 预测值 | 111亿美元 |

| 复合年增长率 | 6.8% |

牙植体市场分为植体和基台系统两大类。由于植体具有优异的生物相容性和与骨组织整合的能力,预计到2024年,植体市场规模将达到49亿美元。植体为牙科修復体提供稳定的基础,能够复製天然牙齿的功能和外观。

到2024年,牙科诊所市占率将达到61.5%。它们是植牙手术的主要场所,并且正日益整合数位化工作流程和客製化植牙解决方案。患者对个人化护理和高品质治疗的期望不断提高,使得牙科诊所在植牙和基台系统的推广和成功应用方面发挥着至关重要的作用。

2024年北美牙科植体和基台系统市场规模为23亿美元,预计2034年将达42亿美元。该地区市场成长的主要驱动因素包括牙科疾病的高发生率、口腔健康意识的提高以及创新牙科技术的应用。数位化工作流程、微创技术和客製化基台的进步正在推动北美地区牙科植体和基台系统的普及。

牙科植体和基台系统市场的主要参与者包括Cortex、AB Dental Devices、Bicon、Envista Holdings Corporation、Biotem、Dentsply Sirona、Osstem Implant、ZimVie、Adin Dental Implant Systems、Dentalpoint、Ziacom、HenryCos. Solutions、BioHorizons、Ditron Dental和BioThread Dental Implant Systems。这些公司正采取多种策略来巩固其市场地位。他们专注于持续的研发,以改善植体材料、设计和手术技术,从而提升产品性能和患者疗效。与牙科诊所、医院和分销商的策略合作有助于扩大市场覆盖范围并改善服务交付。此外,各公司也正在投资数位化技术,以提供客製化和微创解决方案。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 全球老年人口基数不断扩大

- 全球牙科疾病盛行率不断上升

- 全球对美容牙科的需求不断增长

- 已开发国家植入技术的进步

- 产业陷阱与挑战

- 有限的报销政策

- 植牙治疗费用高昂

- 市场机会

- 转向微创手术

- 新兴国家牙科旅游的扩张

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术进步

- 当前技术趋势

- 新兴技术

- 供应链分析

- 报销方案

- 2024年定价分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 植牙

- 锥形植体

- 平行壁植体

- 桥台系统

- 股票桥墩

- 客製化基台

- 基台固定螺丝

第六章:市场估算与预测:依材料划分,2021-2034年

- 主要趋势

- 钛

- 锆

- 其他材料

第七章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 牙医诊所

- 其他最终用途

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Dentsply Sirona

- AB Dental Devices

- Adin Dental Implant Systems

- Bicon

- Cortex

- AVINENT Science and Material

- Envista Holdings Corporation

- Henry Schein

- Institut Straumann

- Osstem Implant

- ZimVie

- Biotem

- Dentium USA

- Ziacom

- Dynamic Abutment Solutions

- Keystone Dental Group

- BHI Implants

- Dentalpoint

- Ditron Dental

- Cowellmedi

- TAV Dental

- BioHorizons

- National Dentex Labs

- Glidewell

- BioThread Dental Implant Systems

The Global Dental Implants and Abutment Systems Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 11.1 billion by 2034.

The growth is fueled by the rising elderly population worldwide, the increasing prevalence of dental disorders, and the growing demand for cosmetic dentistry. Technological advancements in implant materials and procedures in developed regions are also contributing to market expansion. As individuals age, they face greater risks of tooth loss, gum disease, and bone degradation, creating a strong demand for restorative dental solutions. Dental implants and abutment systems are designed to replace missing teeth, restoring both function and aesthetics. A dental implant serves as an artificial tooth root made from titanium or zirconia, surgically positioned in the jawbone to support crowns, bridges, or dentures. The abutment connects the prosthetic tooth to the implant, providing a durable, stable, and natural-looking replacement for lost teeth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 6.8% |

The market is divided into dental implants and abutment systems, with dental implants generating USD 4.9 billion in 2024 owing to their excellent biocompatibility and ability to integrate with bone tissue. Dental implants act as stable foundations for dental prosthetics, replicating the function and appearance of natural teeth.

The dental clinics segment held a 61.5% share in 2024. They serve as the primary point for implant procedures and are increasingly integrating digital workflows and customized implant solutions. Rising patient expectations for personalized care and high-quality treatments make dental clinics central to the adoption and success of dental implants and abutment systems.

North America Dental Implants and Abutment Systems Market generated USD 2.3 billion in 2024 and is projected to reach USD 4.2 billion by 2034. Growth in this region is driven by the high prevalence of dental disorders, growing oral health awareness, and the adoption of innovative dental technologies. Advances in digital workflows, minimally invasive techniques, and customized abutments are boosting the uptake of dental implants and abutment systems across North America.

Key players in the Dental Implants and Abutment Systems Market include Cortex, A.B. Dental Devices, Bicon, Envista Holdings Corporation, Biotem, Dentsply Sirona, Osstem Implant, ZimVie, Adin Dental Implant Systems, Dentalpoint, Ziacom, Henry Schein, TAV Dental, Institut Straumann, Glidewell, Keystone Dental Group, Cowellmedi, Dentium USA, Dynamic Abutment Solutions, BioHorizons, Ditron Dental, and BioThread Dental Implant Systems. Companies in the Dental Implants and Abutment Systems Market are pursuing several strategies to strengthen their market position. They focus on continuous research and development to improve implant materials, designs, and surgical techniques, enhancing product performance and patient outcomes. Strategic collaborations with dental clinics, hospitals, and distributors help expand market reach and improve service delivery. Companies are also investing in digital technologies for customized and minimally invasive solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding elderly population base across the globe

- 3.2.1.2 Growing prevalence of dental disorders worldwide

- 3.2.1.3 Rising demand for cosmetic dentistry across the world

- 3.2.1.4 Advancements in implant technology in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited reimbursement policies

- 3.2.2.2 High cost of dental implant treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Shift towards minimally invasive procedures

- 3.2.3.2 Expansion of dental tourism in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dental implants

- 5.2.1 Tapered implants

- 5.2.2 Parallel-walled implants

- 5.3 Abutment systems

- 5.3.1 Stock abutments

- 5.3.2 Custom abutments

- 5.3.3 Abutments fixation screws

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Zirconium

- 6.4 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Dental clinics

- 7.4 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Dentsply Sirona

- 9.2 A.B. Dental Devices

- 9.3 Adin Dental Implant Systems

- 9.4 Bicon

- 9.5 Cortex

- 9.6 AVINENT Science and Material

- 9.7 Envista Holdings Corporation

- 9.8 Henry Schein

- 9.9 Institut Straumann

- 9.10 Osstem Implant

- 9.11 ZimVie

- 9.12 Biotem

- 9.13 Dentium USA

- 9.14 Ziacom

- 9.15 Dynamic Abutment Solutions

- 9.16 Keystone Dental Group

- 9.17 BHI Implants

- 9.18 Dentalpoint

- 9.19 Ditron Dental

- 9.20 Cowellmedi

- 9.21 TAV Dental

- 9.22 BioHorizons

- 9.23 National Dentex Labs

- 9.24 Glidewell

- 9.25 BioThread Dental Implant Systems