|

市场调查报告书

商品编码

1876793

免疫疗法药物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Immunotherapy Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

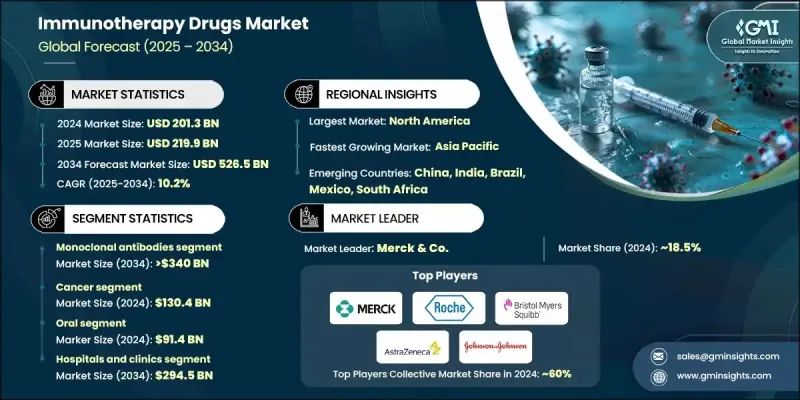

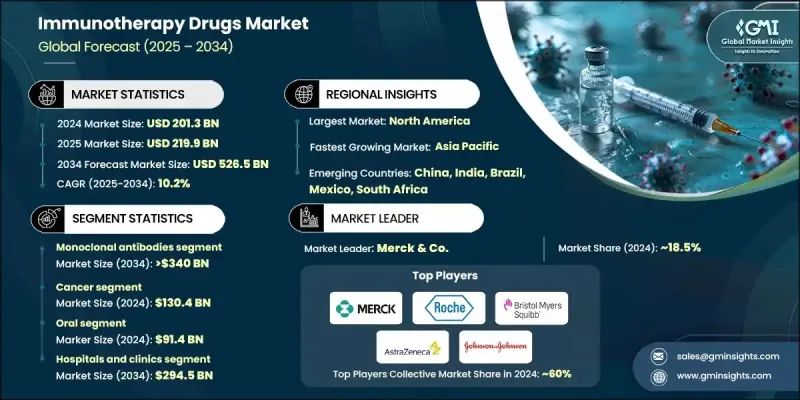

2024年全球免疫疗法药物市场价值为2013亿美元,预计到2034年将以10.2%的复合年增长率增长至5265亿美元。

慢性疾病(包括癌症、自体免疫疾病和传染病)的盛行率上升,以及抗体工程技术的持续创新,共同推动了市场扩张。 CAR-T细胞疗法、双特异性抗体和免疫检查点抑制剂等先进治疗技术正在改变治疗模式,与传统疗法相比,它们具有更高的疗效和安全性。人工智慧正在加速药物研发,而生物标记驱动的临床开发则提高了患者筛选率和治疗成功率。随着基于基因和分子谱设计的疗法在全球范围内获得认可,精准医疗和个人化医疗的持续发展也进一步促进了市场成长。基于新抗原的疫苗和生物标记指导的治疗方案等新兴方法正在快速发展,这得益于基因组学、蛋白质组学和诊断工具的进步,这些进步改善了监测和治疗效果。免疫疗法药物旨在透过活化或抑制免疫反应来帮助人体对抗各种疾病,其作用机制是透过生物工程物质(例如抗体或蛋白质)。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2013亿美元 |

| 预测值 | 5265亿美元 |

| 复合年增长率 | 10.2% |

2024年,单株抗体市场占63.3%的市场份额,预计到2034年将达到3,400亿美元,年复合成长率达10.4%。慢性病发病率的不断上升持续推动着对标靶生物製剂的强劲需求。与传统药物相比,单株抗体具有更高的选择性和更低的副作用,已成为治疗的基石。它们针对特定分子路径的能力使其成为现代医学疗法中不可或缺的一部分,并使其成为全球免疫疗法开发中最有价值的组成部分之一。

预计到2024年,癌症领域市场规模将达到1,304亿美元,继续维持在全球免疫疗法药物市场的领先地位。全球癌症病例的激增以及先进生物疗法的不断发展是市场扩张的关键因素。包括免疫检查点调节剂、单株抗体和新一代细胞疗法在内的创新疗法,透过提高患者存活率和缓解率,重新定义了肿瘤治疗。自体免疫疾病领域也呈现快速成长,因为治疗重点正从普遍的免疫抑制转向精准靶向的生物疗法,从而更好地控制疾病并减少不良反应。

预计到2024年,美国免疫疗法药物市场规模将达到831亿美元,巩固其在全球研发和临床创新领域的领先地位。美国拥有强大的生技新创公司、製药巨头以及联邦政府的大力支持,这为新型免疫疗法的快速商业化提供了有力保障。安进、辉瑞和强生等公司的持续投资正在拓展下一代生物製剂和细胞疗法的研发管线,许多在研新药的获批也凸显了美国致力于加速免疫疗法发展的决心。

全球免疫疗法药物市场的主要参与者包括百时美施贵宝、阿斯特捷利康、吉利德科学、罗氏、强生、诺华、葛兰素史克、赛诺菲、默克、莫德纳、辉瑞、安进、Kite Pharma、Adaptimmune Therapeutics 和 Bluebird Bio。这些关键企业正采取多元化策略来提升其全球影响力并增强竞争力。它们正在扩大针对新型免疫路径的研究项目,并投资于下一代生物製剂,例如双特异性抗体和 CAR-T 平台。策略联盟、併购使它们能够获得尖端技术并加速临床开发进程。此外,各公司也专注于区域扩张,尤其是在新兴经济体,以增加患者获得先进疗法的机会。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 慢性病盛行率上升

- 抗体工程技术进步

- 对个人化和标靶治疗的需求日益增长

- 拓展至非肿瘤领域

- 产业陷阱与挑战

- 成本高且取得途径有限

- 患者反应和抗药性存在个体差异

- 市场机会

- 分散式製造和区域中心

- 个人化新抗原疫苗

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 定价分析

- 临床试验分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依药物类型划分,2021-2034年

- 主要趋势

- 单株抗体

- 疫苗

- 干扰素α和β

- 白血球介素

- 其他药物类型

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 癌症

- 自体免疫疾病

- 传染病

- 其他应用

第七章:市场估计与预测:依给药途径划分,2021-2034年

- 主要趋势

- 静脉

- 皮下

- 口服

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 癌症研究机构

- 製药和生物技术公司

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Adaptimmune Therapeutics

- Amgen

- AstraZeneca

- Bristol Myers Squibb

- Bluebird Bio

- F. Hoffmann La Roche

- GlaxoSmithKline

- Gilead Sciences

- Johnson & Johnson

- Kite Pharma

- Merck & Co.

- Moderna

- Novartis

- Pfizer

- Sanofi

The Global Immunotherapy Drugs Market was valued at USD 201.3 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 526.5 billion by 2034.

The market expansion is influenced by the rising prevalence of chronic illnesses, including cancer, autoimmune, and infectious diseases, coupled with continuous innovation in antibody engineering. Advanced therapeutic technologies such as CAR-T cell therapy, bispecific antibodies, and immune checkpoint inhibitors are transforming treatment paradigms, offering improved efficacy and safety over conventional therapies. Artificial intelligence is accelerating drug discovery, while biomarker-driven clinical development is enhancing patient selection and treatment success rates. The ongoing shift toward precision and personalized medicine continues to strengthen market growth, as therapies designed around genetic and molecular profiles gain global acceptance. Emerging approaches such as neoantigen-based vaccines and biomarker-guided regimens are advancing rapidly, supported by progress in genomics, proteomics, and diagnostic tools that improve monitoring and outcomes. Immunotherapy drugs are designed to modify or regulate immune responses, helping the body combat various diseases through either immune activation or suppression mechanisms using biologically engineered substances such as antibodies or proteins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $201.3 Billion |

| Forecast Value | $526.5 Billion |

| CAGR | 10.2% |

The monoclonal antibodies segment accounted for 63.3% share in 2024 and is expected to reach USD 340 billion by 2034, growing at a CAGR of 10.4%. The rising incidence of chronic conditions continues to drive strong demand for targeted biologics. Monoclonal antibodies have become a cornerstone of treatment due to their superior selectivity and reduced side effects compared to traditional pharmaceuticals. Their ability to target specific molecular pathways has made them indispensable in modern medical therapies and positioned them as one of the most valuable components of immunotherapy development worldwide.

The cancer segment generated USD 130.4 billion in 2024, maintaining its position as the leading therapeutic area within the global immunotherapy drugs market. The surge in global cancer cases and the ongoing evolution of advanced biological therapies are central to market expansion. Innovative treatments, including immune checkpoint modulators, monoclonal antibodies, and next-generation cell therapies, have redefined oncology care by improving patient survival and response rates. The autoimmune disease segment is also recording rapid growth as the focus shifts from generalized immune suppression to precision-targeted biologic therapies, resulting in better disease management and fewer adverse effects.

U.S. Immunotherapy Drugs Market reached USD 83.1 billion in 2024, reinforcing its global leadership position in research, development, and clinical innovation. The country's ecosystem of biotechnology startups, pharmaceutical giants, and strong federal support enables rapid commercialization of novel immunotherapies. Ongoing investments by companies such as Amgen, Pfizer, and Johnson & Johnson are expanding the pipeline of next-generation biologics and cellular therapies, with numerous investigational new drug approvals highlighting the nation's commitment to accelerating immunotherapy advancements.

Major participants in the Global Immunotherapy Drugs Market include Bristol Myers Squibb, AstraZeneca, Gilead Sciences, F. Hoffmann La Roche, Johnson & Johnson, Novartis, GlaxoSmithKline, Sanofi, Merck & Co., Moderna, Pfizer, Amgen, Kite Pharma, Adaptimmune Therapeutics, and Bluebird Bio. Key companies in the Global Immunotherapy Drugs Market are employing diverse strategies to enhance their global presence and strengthen competitiveness. They are expanding R&D programs targeting novel immune pathways and investing in next-generation biologics such as bispecific antibodies and CAR-T platforms. Strategic alliances, mergers, and acquisitions are enabling them to access cutting-edge technologies and accelerate clinical development timelines. Firms are also focusing on regional expansion, particularly in emerging economies, to increase access to advanced treatments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Technological advancement in antibody engineering

- 3.2.1.3 Growing demand for personalized and targeted therapies

- 3.2.1.4 Expansion into non-oncology applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and limited accessibility

- 3.2.2.2 Variable patient response and resistance

- 3.2.3 Market opportunities

- 3.2.3.1 Decentralized manufacturing and regional hubs

- 3.2.3.2 Personalized neoantigen vaccines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Monoclonal antibodies

- 5.3 Vaccines

- 5.4 Interferons alpha & beta

- 5.5 Interleukins

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cancer

- 6.3 Autoimmune diseases

- 6.4 Infectious diseases

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Intravenous

- 7.3 Subcutaneous

- 7.4 Oral

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Cancer research institutes

- 8.4 Pharmaceutical and biotechnology companies

- 8.5 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adaptimmune Therapeutics

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Bristol Myers Squibb

- 10.5 Bluebird Bio

- 10.6 F. Hoffmann La Roche

- 10.7 GlaxoSmithKline

- 10.8 Gilead Sciences

- 10.9 Johnson & Johnson

- 10.10 Kite Pharma

- 10.11 Merck & Co.

- 10.12 Moderna

- 10.13 Novartis

- 10.14 Pfizer

- 10.15 Sanofi