|

市场调查报告书

商品编码

1876807

医疗无人机配送服务市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Medical Drone Delivery Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

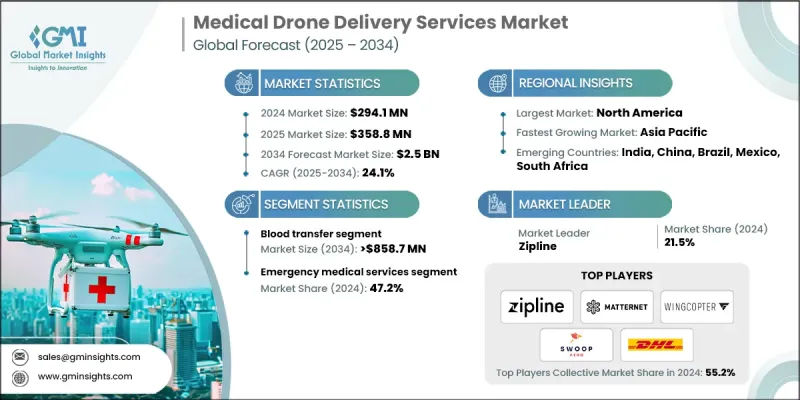

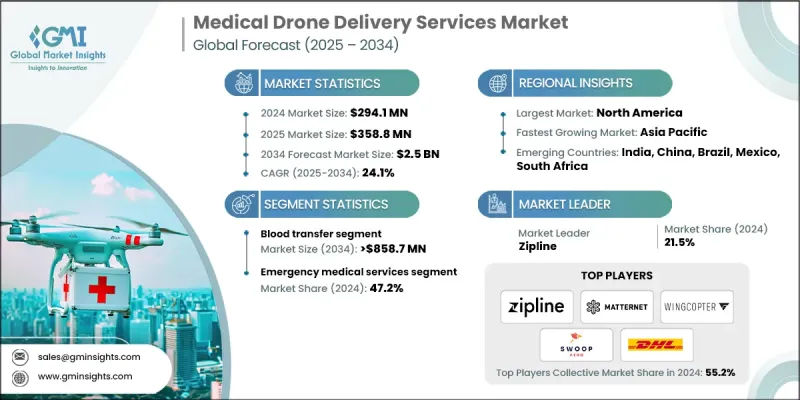

2024 年全球医疗无人机配送服务市场价值为 2.941 亿美元,预计到 2034 年将以 24.1% 的复合年增长率增长至 25 亿美元。

市场成长的驱动力包括:对快速医疗物资配送日益增长的需求、有利的政府监管政策、技术进步以及无人机在医疗物流领域应用的不断广泛。医疗无人机配送服务为医院、血库、製药公司和医疗服务供应商提供创新解决方案,大幅提升配送速度、营运效率和病患疗效。这些解决方案包括自主无人机、混合动力垂直起降飞机以及能够运输血液、疫苗、实验室样本和药品的整合式配送平台。透过大幅缩短配送时间,这些服务有助于医疗服务提供者提升病患照护水准。此外,完善的监管框架和政府试点计画也透过简化空域管理和为商业医疗无人机营运提供资金支持,推动了该领域的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.941亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 24.1% |

无人机设计的技术进步,包括自主导航、混合动力垂直起降能力、更大的有效载荷能力以及冷链集成,使得敏感医疗用品能够安全高效地运输。医疗无人机配送服务依靠无人机快速运送血液、疫苗、实验室样本和药品,为医院、急救服务机构和医疗保健提供者提供支持,同时改善患者治疗效果和营运物流。

由于紧急情况和偏远地区对快速送血的迫切需求,预计到2024年,血液运输领域将占据35.9%的市场份额。医院、血库和急诊中心之间快速可靠的血液运输对于手术、创伤救治和紧急输血至关重要,因为任何延误都可能危及生命。血液运输与急救医疗服务领域合计占总市场价值的81.4%以上。与传统公路运输相比,无人机显着缩短了响应时间,而人工智慧路线优化、自主导航和即时监控等功能则确保了即使在拥挤的城市地区或偏远地区也能安全精准地完成配送。

2024年,北美医疗无人机配送服务市占率将达到33.2%,这得益于该地区在技术、经济和监管方面的优势。该地区拥有先进的无人机创新技术,例如自主导航、混合动力垂直起降飞机、人工智慧驱动的路线规划以及物联网赋能的有效载荷监控,从而确保血液、疫苗、实验室样本和药品的快速安全配送。

全球医疗无人机配送服务市场的主要参与者包括Matternet、Volansi、Wingcopter、DHL、Apian、Air Taurus、MightyFly、Wing(Alphabet旗下公司)、Flirtey/SkyDrop、Draganfly和Zipline。这些公司正透过多种策略巩固其市场地位。他们投资先进的无人机技术,包括人工智慧导航、混合动力垂直起降和有效载荷监控系统,以提高效率和可靠性。与医院、血库和製药公司建立策略伙伴关係有助于扩大服务覆盖范围并建立信任。此外,各公司也积极参与政府试点项目,以获得监管支持并儘早获得市场认可。併购则用于整合技术和扩大营运规模。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 医疗无人机在医疗保健产业的应用日益广泛

- 政府措施数量不断增加

- 技术进步

- 公众接受度不断提高

- 产业陷阱与挑战

- 医疗无人机相关併发症

- 市场机会

- 扩大偏远和农村地区的医疗保健服务

- 与智慧医疗基础设施的整合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 技术格局

- 当前技术趋势

- 自主无人机导航系统可实现医疗物资的精准配送

- 适用于灵活城市和乡村作业的混合垂直起降无人机

- 利用物联网进行追踪与监控,实现即时配送更新

- 新兴技术

- 将区块链技术应用于安全、透明、可追溯的医疗用品物流。

- 利用无人机集群技术同时向多个地点进行配送。

- 用于障碍物侦测和自动避障的先进感测器

- 当前技术趋势

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 无人机网路扩展与智慧医院和医疗保健基础设施相结合

- 紧急医疗服务和远距医疗服务采用率不断提高

- 监管协调和空域管理,以支援大规模运营

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新服务类型推出

- 扩张计划

第五章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 血液转移

- 药物/药品转移

- 疫苗接种计划

- 实验室样品

- 其他应用

第六章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 紧急医疗服务

- 血库

- 其他最终用途

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Air Taurus

- Apian

- DHL

- Draganfly

- Flirtey /SkyDrop

- Matternet

- MightyFly

- Swoop Aero

- Volansi

- Wing (Alphabet)

- Wingcopter

- Zipline

The Global Medical Drone Delivery Services Market was valued at USD 294.1 million in 2024 and is estimated to grow at a CAGR of 24.1% to reach USD 2.5 billion by 2034.

The market is driven by the growing need for rapid medical deliveries, favorable government regulations, technological advancements, and increasing adoption of drones in healthcare logistics. Medical drone delivery services offer innovative solutions to hospitals, blood banks, pharmaceutical companies, and healthcare providers, improving delivery speed, operational efficiency, and patient outcomes. These solutions include autonomous drones, hybrid VTOL aircraft, and integrated delivery platforms capable of transporting blood, vaccines, laboratory samples, and medications. By drastically reducing delivery times, these services help healthcare providers enhance patient care. Supportive regulatory frameworks and government pilot programs are also fueling growth by streamlining airspace management and providing funding for commercial medical drone operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $294.1 Million |

| Forecast Value | $2.5 Billion |

| CAGR | 24.1% |

Technological progress in drone design, including autonomous navigation, hybrid VTOL capabilities, expanded payload capacity, and cold-chain integration, allows sensitive medical supplies to be transported safely and efficiently. Medical drone delivery services rely on unmanned aerial vehicles to move blood, vaccines, lab specimens, and pharmaceuticals quickly, supporting hospitals, emergency services, and healthcare providers while improving patient outcomes and operational logistics.

The blood transfer segment held a 35.9% share in 2024, owing to the critical demand for rapid blood delivery in emergencies and remote regions. Quick, reliable blood transport between hospitals, blood banks, and emergency medical centers is essential for surgeries, trauma care, and urgent transfusions, where delays can be life-threatening. Combined with the emergency medical services segment, the two largest categories accounted for over 81.4% of the total market value. Drones significantly reduce response times compared to traditional road transport, while features like AI-based route optimization, autonomous navigation, and real-time monitoring ensure secure and precise deliveries, even in crowded urban areas or remote locations.

North America Medical Drone Delivery Services Market held a 33.2% share in 2024, benefiting from technological, economic, and regulatory advantages. The region features advanced drone innovations such as autonomous navigation, hybrid VTOL aircraft, AI-powered route planning, and IoT-enabled payload monitoring, ensuring the rapid and safe delivery of blood, vaccines, laboratory specimens, and medications.

Key players operating in the Global Medical Drone Delivery Services Market include Matternet, Volansi, Wingcopter, DHL, Apian, Air Taurus, MightyFly, Wing (Alphabet), Flirtey/SkyDrop, Draganfly, and Zipline. Companies in the Medical Drone Delivery Services Market are strengthening their presence through several strategies. They are investing in advanced drone technologies, including AI navigation, hybrid VTOL, and payload monitoring systems, to enhance efficiency and reliability. Strategic partnerships with hospitals, blood banks, and pharmaceutical firms help expand service coverage and build trust. Firms are also participating in government pilot programs to secure regulatory support and gain early market adoption. Mergers and acquisitions are used to integrate technologies and scale operations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing application of medical drone in the healthcare industry

- 3.2.1.2 Rising number of government initiatives

- 3.2.1.3 Technological advancements

- 3.2.1.4 Growing public acceptance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with medical drone

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in remote and rural healthcare access

- 3.2.3.2 Integration with smart healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Autonomous drone navigation systems enabling precise delivery of medical supplies

- 3.5.1.2 Hybrid VTOL (vertical take-off and landing) drones for flexible urban and rural operations

- 3.5.1.3 IoT-enabled tracking and monitoring for real-time delivery updates

- 3.5.2 Emerging technologies

- 3.5.2.1 Integration of blockchain for secure, transparent, and traceable medical supply logistics.

- 3.5.2.2 Swarm drone technology for simultaneous deliveries to multiple locations.

- 3.5.2.3 Advanced sensors for obstacle detection and automated collision avoidance

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Expansion of drone networks integrated with smart hospitals and healthcare infrastructure

- 3.9.2 Increased adoption in emergency medical services and remote healthcare delivery

- 3.9.3 Regulatory harmonization and airspace management to support large-scale operations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood transfer

- 5.3 Drugs/pharmaceutical transfer

- 5.4 Vaccination program

- 5.5 Lab sample

- 5.6 Other applications

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Emergency medical services

- 6.3 Blood banks

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Air Taurus

- 8.2 Apian

- 8.3 DHL

- 8.4 Draganfly

- 8.5 Flirtey /SkyDrop

- 8.6 Matternet

- 8.7 MightyFly

- 8.8 Swoop Aero

- 8.9 Volansi

- 8.10 Wing (Alphabet)

- 8.11 Wingcopter

- 8.12 Zipline