|

市场调查报告书

商品编码

1876814

滑雪装备市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Ski Gear and Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

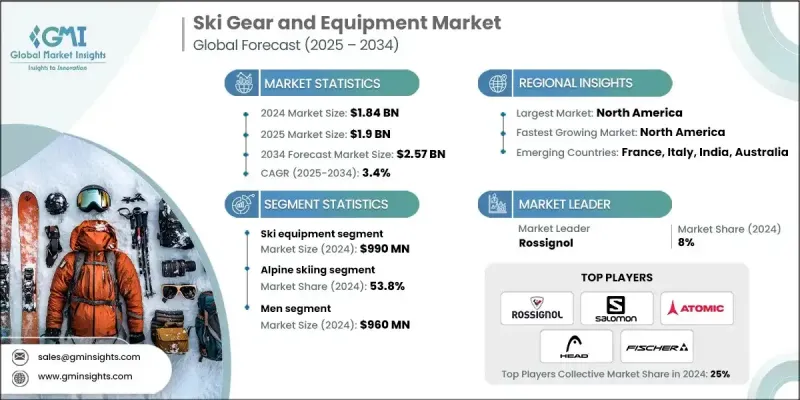

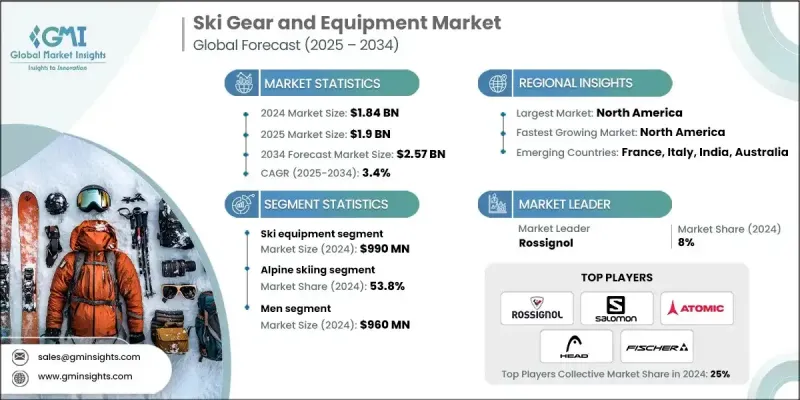

2024 年全球滑雪装备市场价值为 18.4 亿美元,预计到 2034 年将以 3.4% 的复合年增长率增长至 25.7 亿美元。

人们对冬季休閒活动的日益热情正在推动市场扩张,滑雪、雪鞋行走和其他冬季运动在更广泛的人群中越来越受欢迎。青少年参与度持续上升,越来越多的女性和家庭也因数位平台曝光度的提高和生活方式的转变而参与冬季运动。各国政府透过培训计画和设施升级来推广这些活动,进一步增强了消费者的参与。人们生活方式的转变,尤其是积极、户外生活方式的兴起,以及探险旅行的蓬勃发展,都增强了滑雪对寻求独特体验的旅行者的吸引力。成熟和新兴滑雪胜地的度假村开发和现代化也加速了对滑雪装备的需求。随着越来越多的消费者将安全、性能和舒适度放在首位,滑雪装备製造商也不断推出先进的装备、材料和技术。在这些因素的推动下,滑雪装备市场在全球休閒和竞技运动领域的影响力持续扩大。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18.4亿美元 |

| 预测值 | 25.7亿美元 |

| 复合年增长率 | 3.4% |

2024年,滑雪装备市场规模达9.9亿美元。随着各大品牌优先考虑以提升安全性、符合人体工学的贴合度和稳定性能为核心的设计改进,产品创新持续发展。头盔、雪镜和其他防护装备如今都采用了整合技术、升级涂层和改进的通风系统,以提升使用者的舒适度。滑雪板固定器和雪鞋的改进,包括精准的脱扣机制和可调节的贴合组件,正被追求更高操控性和稳定性的滑雪爱好者和专业运动员广泛采用。

2024年,高山滑雪占了53.8%的市场份额,成为业界的领头羊。这个细分市场之所以持续保持影响力,是因为它拥有庞大的全球受众群体,并涵盖了多种休閒和竞技形式。高山滑雪在许多山区有着深厚的文化底蕴,并且常常是冬季运动新手入门的理想选择。其经久不衰的受欢迎程度持续支撑着对高山滑雪专用装备的稳定需求,使其成为各大品牌和零售商重点关注的领域。

美国滑雪装备市场占84.7%的市场份额,预计2024年市场规模将达5.9亿美元。这一强劲的市场地位反映了美国成熟的冬季运动社群以及众多设施完善的滑雪胜地。消费者群体涵盖休閒爱好者到专业运动员,他们都十分注重装备的耐用性、安全性和高端技术。消费者对永续装备材料和科技驱动型装备功能的持续关注,推动了产业的成长;同时,室内滑雪设施的兴起也让城市居民有机会接触到这项运动,并扩大了市场参与度。

滑雪装备市场的主要竞争公司包括 Blizzard、Nordica、Salomon Group、Atomic Austria、Black Crows Skis、Burton Snowboards、Dynastar、Rossignol Group、Elan、Scott Sports、Fischer Sports、K2 Sports、Head Sport、Marker Volkl(Tecnica Group 公司)以及 Tecnica Group。这些公司正透过投资先进材料、改进安全功能和提升性能技术来巩固其市场地位。许多公司正在拓展产品客製化选项,提供量身定制的尺寸和可调节的装备,以吸引更广泛的用户群。与滑雪学校、运动员和度假村经营者建立合作关係,有助于品牌提升知名度并加速产品推广。永续性是另一个重点,各公司正致力于整合回收材料和采用环保的生产方式,以吸引具有环保意识的消费者。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 冬季运动日益普及

- 滑雪旅游和基础设施的扩张

- 技术进步

- 产业陷阱与挑战

- 季节性和气候依赖性

- 设备和差旅费用高昂

- 机会

- 租赁和订阅模式

- 产品创新与客製化

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 滑雪装备

- 滑雪板固定器

- 滑雪靴

- 滑雪杖

- 滑雪头盔

- 滑雪镜

- 滑雪手套和连指手套

- 其他(滑雪包和滑雪背带等)

- 防护装备

- 头盔

- 面罩

- 护膝

- 其他(背部保护器等)

- 滑雪服

- 夹克

- 裤子

- 基础层

- 滑雪袜

- 其他(保暖手套和连指手套等)

第六章:市场估算与预测:依运动类型划分,2021-2034年

- 主要趋势

- 高山滑雪

- 越野滑雪

- 自由式滑雪

- 滑雪旅行

- 其他的

第七章:市场估计与预测:依价格划分,2021-2034年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 男人

- 女性

- 孩子们

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 在线的

- 电子商务平台

- 公司网站

- 离线

- 百货公司

- 专业体育用品店

- 运动用品零售商

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Atomic Austria

- Black Crows Skis

- Blizzard

- Burton Snowboards

- Dynastar

- Elan

- Fischer Sports

- Head Sport

- K2 Sports

- Marker Volkl (part of Tecnica Group)

- Nordica

- Rossignol

- Salomon

- Scott Sports

- Tecnica

The Global Ski Gear and Equipment Market was valued at USD 1.84 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 2.57 billion by 2034.

Growing enthusiasm for winter recreation is playing a key role in expanding the market as skiing, snowshoeing, and other cold-weather activities gain traction across broader demographics. Youth participation continues to rise, and an increasing number of women and families are engaging with winter sports due to heightened visibility across digital platforms and evolving lifestyle trends. Governments promoting these activities through training programs and upgraded facilities are further contributing to stronger consumer engagement. The shift toward active, outdoor-focused lifestyles, combined with a booming interest in adventure travel, has strengthened skiing's appeal among travelers looking for unique experiences. Resort development and modernization across both established and emerging ski destinations are also accelerating equipment demand. As more consumers prioritize safety, performance, and comfort, ski manufacturers are responding with advanced gear, materials, and technologies. With these dynamics in place, the ski gear market continues to expand its influence across recreational and competitive sports communities worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.84 Billion |

| Forecast Value | $2.57 Billion |

| CAGR | 3.4% |

In 2024, the ski equipment segment generated USD 990 million. Product innovation continues to evolve as brands prioritize design improvements centered around enhanced safety, ergonomic fit, and consistent performance. Helmets, goggles, and other protective gear now feature integrated technology, upgraded coatings, and improved ventilation systems to support user comfort. Advancements in bindings and boots, including precision release mechanisms and adjustable fit components, are being adopted widely by both dedicated enthusiasts and professional athletes seeking elevated control and stability on the slopes.

Alpine skiing accounted for a 53.8% share in 2024, representing the leading category within the industry. This segment remains influential because it resonates with a large global audience and supports numerous recreational and competitive formats. Alpine skiing holds a deep cultural connection in many mountainous regions and frequently serves as an entry point for newcomers exploring winter sport activities. Its long-standing popularity continues to sustain consistent demand for alpine-specific equipment, making it a vital focus area for major brands and retailers.

U.S. Ski Gear and Equipment Market held 84.7% share and generated USD 590 million in 2024. This strong position reflects the country's established winter sports community and widespread access to well-developed ski destinations. Consumer segments range from casual participants to high-performance athletes, all placing emphasis on durability, safety enhancements, and premium technology. Ongoing interest in sustainable gear materials and tech-driven equipment features is helping support industry growth, while indoor skiing facilities are introducing the sport to urban populations and broadening overall market participation.

Major companies competing in the Ski Gear and Equipment Market include Blizzard, Nordica, Salomon Group, Atomic Austria, Black Crows Skis, Burton Snowboards, Dynastar, Rossignol Group, Elan, Scott Sports, Fischer Sports, K2 Sports, Head Sport, Marker Volkl (part of Tecnica Group), and Tecnica Group. Companies in the ski gear and equipment market are strengthening their foothold by investing in advanced materials, improved safety features, and performance-enhancing technologies. Many are expanding product customization options, offering tailored fits and adjustable equipment to appeal to broader user groups. Partnerships with ski schools, athletes, and resort operators help brands boost visibility and accelerate product adoption. Sustainability is another focal point, with firms integrating recycled inputs and eco-focused manufacturing practices to attract environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Sport type

- 2.2.4 Price

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising popularity of winter sports

- 3.2.1.2 Expansion of ski tourism and infrastructure

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Seasonality and climate dependency

- 3.2.2.2 High cost of equipment and travel

- 3.2.3 Opportunities

- 3.2.3.1 Rental and subscription models

- 3.2.3.2 Product innovation and customization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Ski equipment

- 5.2.1 Ski bindings

- 5.2.2 Ski boots

- 5.2.3 Ski poles

- 5.2.4 Ski helmets

- 5.2.5 Ski goggles

- 5.2.6 Ski gloves & mittens

- 5.2.7 Others (ski bags & carriers, etc)

- 5.3 Protective gear

- 5.3.1 Helmets

- 5.3.2 Face guards

- 5.3.3 Knee pads

- 5.3.4 Others (back protectors, etc)

- 5.4 Ski apparel

- 5.4.1 Jackets

- 5.4.2 Pants

- 5.4.3 Base layers

- 5.4.4 Ski socks

- 5.4.5 Others (insulated gloves and mittens, etc)

Chapter 6 Market Estimates and Forecast, By Sport Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Alpine skiing

- 6.3 Cross-country skiing

- 6.4 Freestyle skiing

- 6.5 Ski touring

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Men

- 8.3 Women

- 8.4 Kids

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce platform

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Department stores

- 9.3.2 Specialty sports stores

- 9.3.3 Sporting good retailers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Atomic Austria

- 11.2 Black Crows Skis

- 11.3 Blizzard

- 11.4 Burton Snowboards

- 11.5 Dynastar

- 11.6 Elan

- 11.7 Fischer Sports

- 11.8 Head Sport

- 11.9 K2 Sports

- 11.10 Marker Volkl (part of Tecnica Group)

- 11.11 Nordica

- 11.12 Rossignol

- 11.13 Salomon

- 11.14 Scott Sports

- 11.15 Tecnica