|

市场调查报告书

商品编码

1876820

植物萃取物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Botanical Extracts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

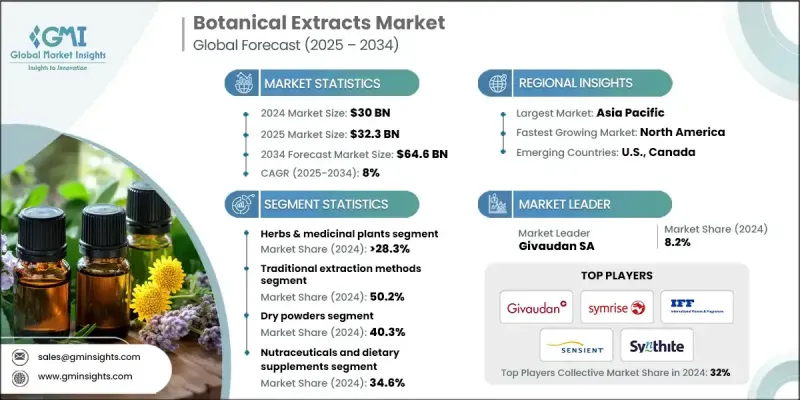

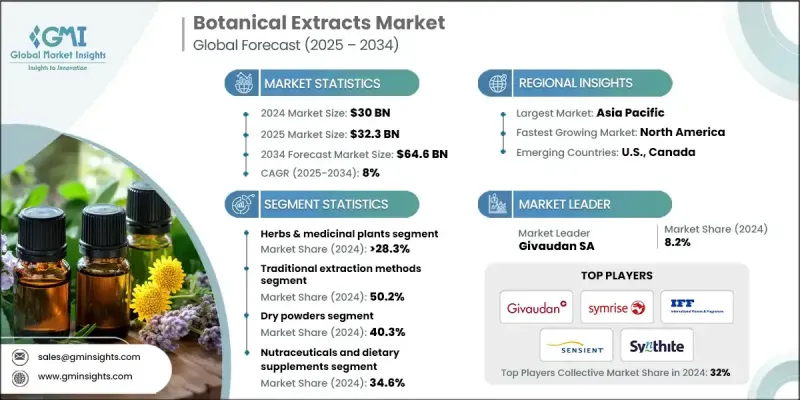

2024 年全球植物萃取物市场价值为 300 亿美元,预计到 2034 年将以 8% 的复合年增长率增长至 646 亿美元。

市场扩张的驱动力在于消费者对天然和植物来源成分日益增长的偏好。人们对合成添加剂健康影响的认识不断提高,促使植物萃取物的使用日益增多。植物萃取物可用作天然香料和抗氧化剂,并在食品、饮料、化妆品和膳食补充剂等领域发挥治疗功效。这些源自植物的萃取物透过其药理活性,在促进整体健康和福祉方面发挥着至关重要的作用。在个人护理行业,植物萃取物因其抗衰老、抗炎和舒缓肌肤的功效而被广泛应用,这与消费者对天然护肤配方日益增长的需求相契合。此外,植物萃取物的应用范围还涵盖草药、药品和营养保健品,有助于增强免疫力、改善消化系统健康和提升整体活力。植物萃取物也是功能性食品和传统药物的重要组成部分,使其成为用途最广泛的天然成分之一。配方方面的持续创新,以及全球对清洁标籤和永续产品的趋势,预计将进一步提升植物萃取物在多个行业中的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 300亿美元 |

| 预测值 | 646亿美元 |

| 复合年增长率 | 8% |

2024年,草药和药用植物市场份额为28.3%,预计到2034年将以8.4%的复合年增长率增长。该细分市场之所以能保持其主导地位,得益于其数百年的传统应用历史,以及科学研究和监管机构认可的不断提高。这些植物持续受到追求整体健康和天然疗效的消费者的青睐。

超临界流体萃取领域预计到2034年将以7.8%的复合年增长率成长。这种先进的萃取过程能够生产无溶剂残留的高品质萃取物,并可精确控制纯度和浓度。其高效性和环保性使其成为高价值应用领域(尤其是製药和高端化妆品领域)的首选技术。

2024年,北美植物萃取物市场占据34.8%的市场份额,预计到2034年将维持8.2%的复合年增长率。美国在北美市场占据主导地位,2024年市场规模达81亿美元。该地区的成长主要得益于消费者对天然、有机和永续产品的日益关注。注重健康的消费者越来越多地选择富含植物成分的草药补充剂和功能性食品。完善的监管框架以及提取和加工技术的进步,进一步推动了北美市场的扩张。

全球植物提取物市场的主要参与者包括 Synthite Industries、奇华顿 (Givaudan SA)、Kerry Group plc、Nexira、Arjuna Natural、Sensient Technologies、Sabinsa Corporation、IFF、Blue Sky Botanics、Martin Bauer Group、Kalsec Inc.、Ransom Naturals、Dohler GmbH、Symrise AG 和 Indena SpA。这些企业正致力于创新、产能扩张和策略合作,以巩固其市场份额。各公司正投资先进的萃取技术,以提高植物化合物的产量、纯度和永续性。许多公司正在透过开发用于食品、化妆品和营养保健品领域的标准化和特定应用萃取物来拓展产品组合。与研究机构和原材料供应商的合作有助于提高可追溯性和品质控制。此外,市场领导者正在采用环保的加工方法和清洁标籤认证,以吸引具有环保意识的消费者,从而确保更强的品牌差异化和全球竞争力。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 来源

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依来源划分,2021-2034年

- 主要趋势

- 香料和调味料

- 辣椒萃取物

- 生姜和姜黄萃取物

- 其他香料萃取物

- 草药和药用植物

- 适应原草药(南非醉茄、人参)

- 传统药用草药

- 烹饪和芳香草药

- 水果和浆果

- 富含抗氧化剂的浆果萃取物

- 柑橘类水果萃取物

- 热带及异域水果萃取物

- 花朵和花瓣

- 玫瑰及花卉萃取物

- 洋甘菊和金盏花萃取物

- 其他花卉萃取物

- 茶树和咖啡树

- 绿茶和红茶萃取物

- 咖啡樱桃与咖啡豆萃取物

- 特种茶萃取物

- 叶子和枝叶

- 芦荟和多肉植物萃取物

- 薄荷和芳香叶萃取物

- 其他叶片萃取物

- 根和根茎

- 人参和适应原根萃取物

- 姜黄和生姜根萃取物

- 其他根茎萃取物

- 海洋和藻类

- 螺旋藻和绿藻萃取物

- 海藻和海带萃取物

- 其他海洋植物萃取物

第六章:市场估算与预测:依撷取技术划分,2021-2034年

- 主要趋势

- 传统萃取方法

- 超临界流体萃取

- 先进溶剂萃取

- 绿色萃取技术

- 机械萃取方法

第七章:市场估计与预测:依形式划分,2021-2034年

- 关键趋势

- 干粉

- 液体萃取物

- 软萃取物

- 胶囊形式

- 油基萃取物

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 营养保健品和膳食补充剂

- 胶囊和片剂

- 功能性成分应用

- 运动营养产品

- 功能性食品和饮料

- 强化食品

- 健康能量饮料

- 功能性零食和能量棒

- 药品和草药

- 活性药物成分

- 药用辅料

- 传统草药

- 化妆品及个人护理

- 保养品

- 护髮应用

- 彩妆和香水

- 食品加工与保藏

- 天然防腐剂

- 增味剂

- 天然色素

- 动物饲料和宠物营养

- 牲畜饲料添加剂

- 宠物营养补充品

- 兽医应用

- 工业应用

- 香氛与芳香疗法

- 清洁用品

- 其他工业用途

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Arjuna Natural

- Blue Sky Botanics

- Dohler GmbH

- Givaudan SA

- IFF

- Indena SpA

- Kalsec Inc.

- Kerry Group plc

- Martin Bauer Group

- Nexira

- Ransom Naturals

- Sabinsa Corporation

- Sensient Technologies

- Symrise AG

- Synthite Industries

The Global Botanical Extracts Market was valued at USD 30 billion in 2024 and is estimated to grow at a CAGR of 8% to reach USD 64.6 billion by 2034.

Market expansion is driven by the increasing consumer inclination toward natural and plant-derived ingredients. Growing awareness about the health impacts of synthetic additives has encouraged the use of botanical extracts, which serve as natural flavoring agents and antioxidants with therapeutic advantages across food, beverages, cosmetics, and dietary supplements. These extracts, sourced from plants, play an essential role in promoting overall health and wellness through their pharmacological activity. In the personal care industry, they are widely incorporated for their anti-aging, anti-inflammatory, and skin-calming benefits, aligning with the growing demand for natural skincare formulations. Furthermore, their applications span herbal medicine, pharmaceuticals, and nutraceuticals, contributing to enhanced immunity, digestive health, and overall vitality. Botanical extracts are also integral to functional foods and traditional medicines, making them one of the most versatile natural ingredients. The continuous innovation in formulations, along with the global shift toward clean-label and sustainable products, is expected to further elevate the role of botanical extracts in multiple industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30 Billion |

| Forecast Value | $64.6 Billion |

| CAGR | 8% |

The herbs and medicinal plants segment held a 28.3% share in 2024 and is anticipated to grow at a CAGR of 8.4% through 2034. This segment maintains its dominance due to centuries of traditional use and increasing validation through scientific studies and regulatory endorsements. These plants continue to gain traction among consumers seeking holistic wellness and naturally derived therapeutic benefits.

The supercritical fluid extraction segment will grow at a 7.8% CAGR through 2034. This advanced extraction process enables the production of premium-quality extracts without solvent residues and provides precise control over purity and concentration. Its efficiency and eco-friendly nature make it the preferred technology for high-value applications, particularly in pharmaceuticals and luxury cosmetics.

North America Botanical Extracts Market accounted for 34.8% share in 2024 and is expected to maintain an 8.2% CAGR through 2034. The U.S. dominated the regional market with a valuation of USD 8.1 billion in 2024. The region's growth is primarily driven by rising consumer awareness regarding natural, organic, and sustainable products. Health-conscious consumers are increasingly turning to herbal supplements and functional foods enriched with botanical ingredients. Strong regulatory frameworks, coupled with technological advancements in extraction and processing, are further promoting market expansion in North America.

Leading players operating in the Global Botanical Extracts Market include Synthite Industries, Givaudan SA, Kerry Group plc, Nexira, Arjuna Natural, Sensient Technologies, Sabinsa Corporation, IFF, Blue Sky Botanics, Martin Bauer Group, Kalsec Inc., Ransom Naturals, Dohler GmbH, Symrise AG, and Indena S.p.A. Key players in the Global Botanical Extracts Market are focusing on innovation, capacity expansion, and strategic partnerships to strengthen their market footprint. Companies are investing in advanced extraction technologies to enhance the yield, purity, and sustainability of botanical compounds. Many are expanding their product portfolios by developing standardized and application-specific extracts for food, cosmetics, and nutraceutical sectors. Collaborations with research institutions and raw material suppliers are helping improve traceability and quality control. Additionally, market leaders are adopting eco-friendly processing methods and clean-label certifications to appeal to environmentally conscious consumers, ensuring stronger brand differentiation and global competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Sources

- 2.2.3 Extraction technology

- 2.2.4 Form

- 2.2.5 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By source

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Spices & seasonings

- 5.2.1 Capsicum & pepper extracts

- 5.2.2 Ginger & turmeric extracts

- 5.2.3 Other spice extracts

- 5.3 Herbs & medicinal plants

- 5.3.1 Adaptogenic herbs (ashwagandha, ginseng)

- 5.3.2 Traditional medicinal herbs

- 5.3.3 Culinary & aromatic herbs

- 5.4 Fruits & berries

- 5.4.1 Antioxidant-rich berry extracts

- 5.4.2 Citrus fruit extracts

- 5.4.3 Tropical & exotic fruit extracts

- 5.5 Flowers & petals

- 5.5.1 Rose & floral extracts

- 5.5.2 Chamomile & calendula extracts

- 5.5.3 Other flower extracts

- 5.6 Tea & coffee plants

- 5.6.1 Green tea & black tea extracts

- 5.6.2 Coffee cherry & bean extracts

- 5.6.3 Specialty tea extracts

- 5.7 Leaves & foliage

- 5.7.1 Aloe vera & succulent extracts

- 5.7.2 Mint & aromatic leaf extracts

- 5.7.3 Other leaf extracts

- 5.8 Roots & rhizomes

- 5.8.1 Ginseng & adaptogenic root extracts

- 5.8.2 Turmeric & ginger root extracts

- 5.8.3 Other root & rhizome extracts

- 5.9 Marine & algae

- 5.9.1 Spirulina & chlorella extracts

- 5.9.2 Seaweed & kelp extracts

- 5.9.3 Other marine plant extracts

Chapter 6 Market Estimates and Forecast, By Extraction Technology, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Traditional extraction methods

- 6.3 Supercritical fluid extraction

- 6.4 Advanced solvent extraction

- 6.5 Green extraction technologies

- 6.6 Mechanical extraction methods

Chapter 7 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trend

- 7.2 Dry powders

- 7.3 Liquid extracts

- 7.4 Soft extracts

- 7.5 Encapsulated forms

- 7.6 Oil-based extracts

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Nutraceuticals & dietary supplements

- 8.2.1 Capsules & tablets

- 8.2.2 Functional ingredient applications

- 8.2.3 Sports nutrition products

- 8.3 Functional foods & beverages

- 8.3.1 Fortified foods

- 8.3.2 Health & energy drinks

- 8.3.3 Functional snacks & bars

- 8.4 Pharmaceuticals & herbal medicine

- 8.4.1 Active pharmaceutical ingredients

- 8.4.2 Pharmaceutical excipients

- 8.4.3 Traditional & herbal medicine

- 8.5 Cosmetics & personal care

- 8.5.1 Skincare products

- 8.5.2 Haircare applications

- 8.5.3 Color cosmetics & fragrances

- 8.6 Food processing & preservation

- 8.6.1 Natural preservatives

- 8.6.2 Flavor enhancers

- 8.6.3 Natural colorants

- 8.7 Animal feed & pet nutrition

- 8.7.1 Livestock feed additives

- 8.7.2 Pet supplements

- 8.7.3 Veterinary applications

- 8.8 Industrial applications

- 8.8.1 Fragrances & aromatherapy

- 8.8.2 Cleaning products

- 8.8.3 Other industrial uses

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arjuna Natural

- 10.2 Blue Sky Botanics

- 10.3 Dohler GmbH

- 10.4 Givaudan SA

- 10.5 IFF

- 10.6 Indena S.p.A.

- 10.7 Kalsec Inc.

- 10.8 Kerry Group plc

- 10.9 Martin Bauer Group

- 10.10 Nexira

- 10.11 Ransom Naturals

- 10.12 Sabinsa Corporation

- 10.13 Sensient Technologies

- 10.14 Symrise AG

- 10.15 Synthite Industries