|

市场调查报告书

商品编码

1885783

机器人包装系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Robotic Packaging System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

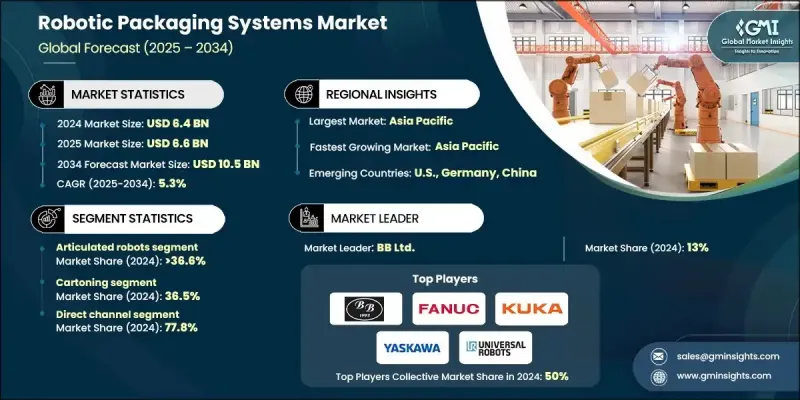

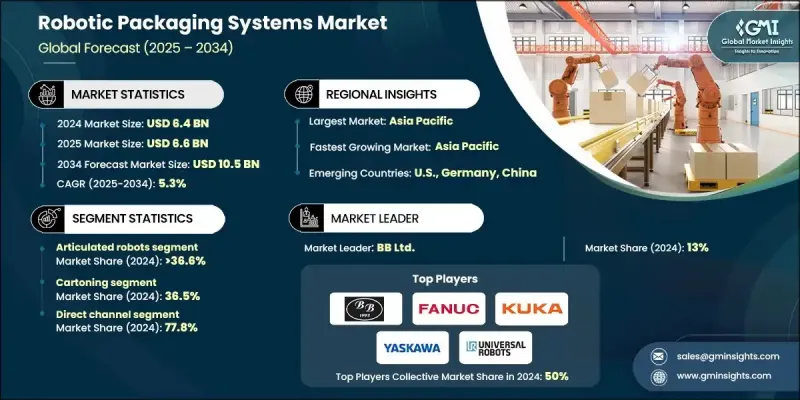

2024 年全球机器人包装系统市场价值为 64 亿美元,预计到 2034 年将以 5.3% 的复合年增长率增长至 105 亿美元。

自动化技术的快速发展推动了包装产业的成长。机器视觉、人工智慧、柔性抓取工具和协作机器人等技术的进步,使包装作业更加快速、安全和精准。工业4.0功能的深度集成,使机器人能够与互联设备协同工作,从而实现生产线的预测性维护和即时优化。随着製造商采用可灵活部署到不同工作流程并以最小停机时间重新编程的系统,协作机器人的应用日益普及。这些解决方案增强了人机交互,有助于提高生产效率、改善工作场所安全性并提升可靠性。现代机器人包装平台融合了先进的视觉系统、机器学习驱动的最佳化、物联网远端监控和云端分析,从而最大限度地延长正常运行时间和提高营运效率。这种技术融合支援持续的效能提升,并使製造商能够根据即时生产资料即时调整包装流程。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 64亿美元 |

| 预测值 | 105亿美元 |

| 复合年增长率 | 5.3% |

2024年,关节型机器人市占率达到36.6%,预计2034年将以5.9%的复合年增长率成长。这类机器人擅长包装环境,能胜任需要多轴运动和灵活操控的工作。其结构灵活性使其能够在单一自动化系统中适应各种产品形状和包装形式,从而满足不断变化的生产需求。预计的成长凸显了市场对能够满足不断变化的自动化需求的高性能係统的日益增长的需求。

2024年,包装材料市场规模预计将达21亿美元。该市场涵盖一系列包装技术,旨在确保产品在整个运输链中的安全。自动化包装系统可实现薄膜均匀涂覆、提高货物稳定性并减少材料用量,从而提高效率并最大限度地减少分销过程中的产品损坏。

亚太地区机器人包装系统市场预计在2024年达到28亿美元。该地区的成长得益于强劲的製造业活动、政府对自动化日益增长的支持以及不断上涨的劳动力成本,这些因素都促使机器人技术得到更广泛的应用。消费品、汽车和电子产业的大批量生产环境对该地区的成长尤为重要。随着各行业采用更先进的自动化系统来实现包装作业的现代化,中国仍然是该地区需求的主要贡献者。

全球机器人包装系统市场的主要参与者包括ABB有限公司、Brenton Engineering、斗山机器人、发那科株式会社、克朗斯股份公司、库卡股份公司、三菱电机、欧姆龙株式会社、施耐德电气、Standard Bots、史陶比尔、Syntegon Technology、TechMan Robot、Universal Robots以及安川电机/Motoman。参与机器人包装系统市场的企业采取多种策略措施来巩固其市场地位。许多企业加强研发投入,以提高机器人的精度、速度和多功能性,同时整合先进的感测器和人工智慧驱动的分析技术。製造商正在扩展模组化和灵活的产品线,以实现轻鬆客製化和快速换型。与系统整合商和终端用户行业的策略合作有助于拓宽应用范围,并支援客製化的自动化解决方案。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 劳动成本上升和劳动短缺

- 对效率、品质、速度和可扩展性的需求

- 技术进步和自动化推动

- 产业陷阱与挑战

- 初始投资和资本成本高

- 整合复杂性和遗留系统/员工技能差距

- 产品/包装形式的多样性及灵活性需求

- 机会

- 包装机器人市场快速成长

- 在食品、饮料和消费品领域不断扩大应用

- 对灵活、模组化和经济高效的系统的需求不断增长

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按机器人类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依机器人类型划分,2021-2034年

- 主要趋势

- 关节机器人(6轴)

- SCARA机器人

- Delta机器人

- 笛卡儿/龙门机器人

- 协作机器人(Cobots)

- 圆柱形机器人

- 移动机器人(AMR/AGV)

第六章:市场估价与预测:依包装类型划分,2021-2034年

- 主要趋势

- 装盒

- 包装

- 托盘堆迭

- 装瓶

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 拣选和放置操作

- 托盘堆迭和卸垛

- 装箱和托盘包装

- 物料搬运

- 灌装和分发

- 密封和封盖

- 标籤和编码

- 检验与品质管制

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 餐饮

- 医药与医疗保健

- 消费品和化妆品

- 汽车

- 电学

- 物流与电子商务

- 化工及工业

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十一章:公司简介

- ABB Ltd.

- Brenton Engineering

- Doosan Robotics

- FANUC Corporation

- Krones AG

- KUKA AG

- Mitsubishi Electric

- Omron Corporation

- Schneider Electric

- Standard Bots

- Staubli

- Syntegon Technology

- TechMan Robot

- Universal Robots

- Yaskawa Electric / Motoman

The Global Robotic Packaging Systems Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 10.5 billion by 2034.

Growth is driven by rapid advancements in automation technologies, where machine vision, artificial intelligence, flexible gripping tools, and collaborative robotics are making packaging operations faster, safer, and more precise. Greater integration of Industry 4.0 capabilities allows robots to coordinate with connected devices, enabling predictive maintenance and real-time optimization across production lines. Collaborative robots continue to gain traction as manufacturers adopt flexible systems that can be redeployed across different workflows and reprogrammed with minimal downtime. These solutions enhance human-robot interaction and contribute to better throughput, improved workplace safety, and higher reliability. Modern robotic packaging platforms now combine advanced vision systems, machine-learning-powered optimization, IoT-enabled remote monitoring, and cloud-driven analytics to maximize uptime and operational efficiency. This technological convergence supports continuous performance improvements and allows manufacturers to adjust packaging processes instantly based on live production data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $10.5 Billion |

| CAGR | 5.3% |

The articulated robotics segment held a 36.6% share in 2024 and is forecast to grow at a CAGR of 5.9% through 2034. These robots excel in packaging environments requiring multiple axes of motion and adaptable handling capabilities. Their structural flexibility enables them to accommodate varied product shapes and packaging formats within a single automated setup, making them suitable for operations that deal with shifting production requirements. Their projected growth underscores rising demand for highly capable systems that can meet evolving automation needs.

The wrapping segment generated USD 2.1 billion in 2024. This segment includes a range of wrapping technologies designed to ensure product protection throughout the transportation chain. Automated wrapping systems deliver consistent film application, improved load stabilization, and reduced material usage, which supports efficiency and minimizes product damage throughout distribution.

Asia Pacific Robotic Packaging Systems Market generated USD 2.8 billion in 2024. Expansion in this region is supported by strong manufacturing activity, increased government support for automation, and rising labor costs that encourage wider adoption of robotics. The region's growth is particularly influenced by high-volume production environments across consumer goods, automotive, and electronics sectors. China remains the leading contributor to regional demand as industries modernize their packaging operations with more advanced automation systems.

Key companies active in the Global Robotic Packaging Systems Market include ABB Ltd., Brenton Engineering, Doosan Robotics, FANUC Corporation, Krones AG, KUKA AG, Mitsubishi Electric, Omron Corporation, Schneider Electric, Standard Bots, Staubli, Syntegon Technology, TechMan Robot, Universal Robots, and Yaskawa Electric / Motoman. Companies participating in the Robotic Packaging Systems Market implement a variety of strategic measures to strengthen their market position. Many invest in R&D to enhance robotic precision, speed, and multi-functionality while integrating advanced sensors and AI-driven analytics. Manufacturers are expanding modular and flexible product lines that allow easy customization and faster changeovers. Strategic partnerships with system integrators and end-use industries help broaden application reach and support tailored automation solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Robot type

- 2.2.3 Packaging type

- 2.2.4 Application

- 2.2.5 End Use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising labor costs & labor shortage

- 3.2.1.2 Need for efficiency, quality, speed & scalability

- 3.2.1.3 Technological advancement & automation push

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment & capital cost

- 3.2.2.2 Integration complexity & legacy systems/workforce skill gap

- 3.2.2.3 Variability in product/pack formats & flexibility needs

- 3.2.3 Opportunities

- 3.2.3.1 Rapid market growth in packaging robotics

- 3.2.3.2 Expanding use in food, beverage, and consumer goods sectors

- 3.2.3.3 Rising demand for flexible, modular, and cost-efficient systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Robot type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Robot Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Articulated robots (6-axis)

- 5.3 SCARA robots

- 5.4 Delta robots

- 5.5 Cartesian/gantry robots

- 5.6 Collaborative robots (Cobots)

- 5.7 Cylindrical robots

- 5.8 Mobile robots (AMRs/AGVs)

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Cartoning

- 6.3 Wrapping

- 6.4 Palletizing

- 6.5 Bottling

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Pick & place operations

- 7.3 Palletizing & depalletizing

- 7.4 Case packing & tray packing

- 7.5 Material handling

- 7.6 Filling & dispensing

- 7.7 Sealing & capping

- 7.8 Labeling & coding

- 7.9 Inspection & quality control

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals & healthcare

- 8.4 Consumer goods & cosmetics

- 8.5 Automotive

- 8.6 Electronics & electrical

- 8.7 Logistics & e-commerce

- 8.8 Chemicals & Industrials

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ABB Ltd.

- 11.2 Brenton Engineering

- 11.3 Doosan Robotics

- 11.4 FANUC Corporation

- 11.5 Krones AG

- 11.6 KUKA AG

- 11.7 Mitsubishi Electric

- 11.8 Omron Corporation

- 11.9 Schneider Electric

- 11.10 Standard Bots

- 11.11 Staubli

- 11.12 Syntegon Technology

- 11.13 TechMan Robot

- 11.14 Universal Robots

- 11.15 Yaskawa Electric / Motoman