|

市场调查报告书

商品编码

1885788

基于区块链的医疗记录系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Blockchain-based Medical Record System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

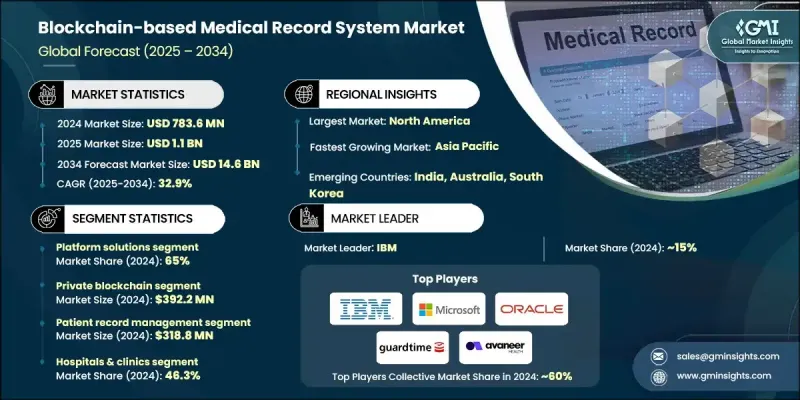

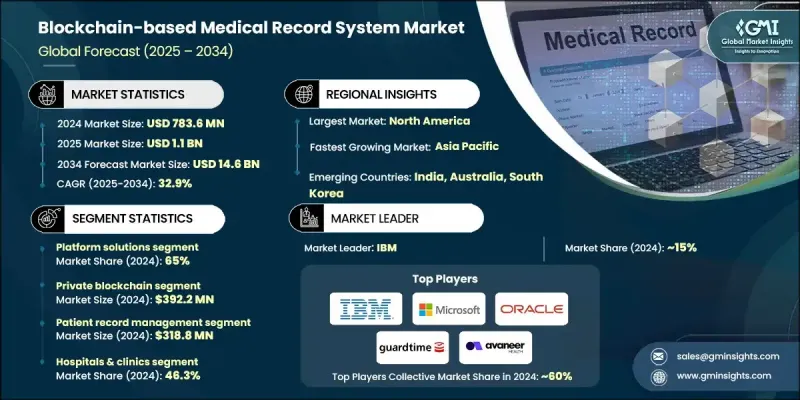

2024 年全球基于区块链的医疗记录系统市场价值为 7.836 亿美元,预计到 2034 年将以 32.9% 的复合年增长率增长至 146 亿美元。

市场成长的驱动因素包括:对以患者为中心的医疗模式的日益重视、对无缝医疗资料互通性的需求,以及网路安全漏洞带来的成本和风险不断增加。电子健康记录 (EHR) 和整合互通性解决方案的普及,正在加速对安全、透明资料管理的需求。区块链技术在临床试验中也越来越受欢迎,用于确保资料的完整性、透明度和可审计性。医疗服务提供者优先考虑能够赋予患者对其个人资料控制权,同时实现安全、基于许可的资料共享的解决方案。区块链的去中心化架构和加密保护能够减少漏洞、降低网路风险,并为医疗机构提供高水准的资料安全性、合规性和营运效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.836亿美元 |

| 预测值 | 146亿美元 |

| 复合年增长率 | 32.9% |

到 2024 年,平台解决方案领域占据了 65% 的市场。这些平台为医疗资料的安全储存、加密和去中心化存取提供了底层基础设施,实现了医院、保险公司和患者之间的互通性,同时遵守了 HIPAA 和 GDPR 等隐私法规。

2024年,私有区块链市场规模达3.922亿美元。私有区块链限制只有授权用户才能访问,提供高速交易、更高安全性和集中控制,使其成为管理敏感患者资讯的医疗机构的理想选择。医院和保险公司倾向于使用私人网络,以符合监管框架并确保资料机密性。

2024年,北美基于区块链的医疗记录系统市占率达到60.1%,预计在预测期内将维持显着成长。该地区强大的医疗基础设施、严格的监管以及对数位医疗和远距医疗解决方案的早期应用,推动了对支援区块链的互通医疗记录系统的需求。医院、保险公司和研究机构为保护患者资料、减少诈欺和实现无缝资料共享而进行的投资,进一步促进了市场成长。

全球基于区块链的医疗记录系统市场的主要参与者包括微软、甲骨文公司、IBM、Avaneer HEALTH、burstIQ、Chronicled、embleema、Factom、Guardtime、Patientory Inc.、SOLULAB 和 SOLVE CARE。各公司致力于区块链架构和资料加密方面的创新,以增强安全性、互通性和患者对医疗记录的控制权。与医院、保险公司和医疗技术提供者建立策略合作伙伴关係,使各公司能够将区块链解决方案无缝整合到现有的医疗保健生态系统中。对平台可扩展性、云端整合和人工智慧分析的研发投入,增强了产品功能并促进了应用。市场参与者也在进行区域扩张,瞄准资料隐私法规严格的高需求地区。併购有助于整合技术、拓展产品组合併提升竞争地位。各公司强调合规性,遵守 HIPAA 和 GDPR 法规,并获得相关认证,以确保客户对系统的可靠性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 医疗保健资料外洩事件及网路安全成本不断上升

- 以病人为中心的照护模式的需求日益增长

- 远距医疗和远距护理的兴起

- 对无缝健康资料互通性的需求日益增长

- 产业陷阱与挑战

- 监管的不确定性和合规性问题

- 技术可扩展性和技能短缺

- 机会

- 人工智慧与区块链融合助力进阶分析

- 与物联网医疗和远端监控系统的集成

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术与创新格局

- 去中心化身分认同和自主解决方案

- 零知识证明与隐私保护技术

- 抗量子密码学与安全

- 边缘运算与物联网集成

- 智能合约的演进与自动化

- 投资环境

- 医疗服务模式转型

- 新兴用例

- 波特的分析

- PESTEL 分析

- 差距分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 平台解决方案

- 服务

第六章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 私有区块链

- 联盟/许可型区块链

- 公共区块链

- 混合区块链

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 病患记录管理

- 临床试验资料共享

- 保险索赔和诈欺检测

- 其他应用

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院和诊所

- 製药公司

- 保险公司

- 其他最终用途

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 世界其他地区(RoW)

第十章:公司简介

- Avaneer HEALTH

- burstIQ

- Chronicled

- embleema

- Factom

- Guardtime

- IBM

- Microsoft

- Oracle Corporation

- patientory inc.

- SOLULAB

- SOLVE CARE

The Global Blockchain-based Medical Record System Market was valued at USD 783.6 million in 2024 and is estimated to grow at a CAGR of 32.9% to reach USD 14.6 billion by 2034.

Market growth is fueled by the rising focus on patient-centric care models, the need for seamless healthcare data interoperability, and the increasing costs and risks associated with cybersecurity breaches. The adoption of electronic health records (EHR) and integrated interoperability solutions is accelerating demand for secure, transparent data management. Blockchain technology is also gaining traction in clinical trials for ensuring data integrity, transparency, and auditability. Healthcare providers are prioritizing solutions that empower patients with control over their personal data while enabling secure, permission-based sharing. The decentralized architecture and cryptographic protection of blockchain reduce vulnerabilities, mitigate cyber risks, and provide healthcare organizations with a high level of data security, compliance assurance, and operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $783.6 Million |

| Forecast Value | $14.6 Billion |

| CAGR | 32.9% |

The platform solutions segment held a share of 65% in 2024. These platforms provide the underlying infrastructure for secure storage, encryption, and decentralized access of medical data, enabling interoperability between hospitals, insurers, and patients while adhering to privacy regulations like HIPAA and GDPR.

The private blockchain segment generated USD 392.2 million in 2024. Private blockchains restrict access to authorized users, offering high transaction speed, greater security, and centralized control, which makes them ideal for healthcare organizations managing sensitive patient information. Hospitals and insurers prefer private networks for compliance with regulatory frameworks and to ensure data confidentiality.

North America Blockchain-based Medical Record System Market held 60.1% share in 2024 and is expected to maintain significant growth during the forecast period. The region's strong healthcare infrastructure, strict regulations, and early adoption of digital health and telehealth solutions are driving demand for blockchain-enabled interoperable medical record systems. Investments from hospitals, insurers, and research institutions to protect patient data, reduce fraud, and enable seamless data sharing have further strengthened market growth.

Key players in the Global Blockchain-based Medical Record System Market include Microsoft, Oracle Corporation, IBM, Avaneer HEALTH, burstIQ, Chronicled, embleema, Factom, Guardtime, Patientory Inc., SOLULAB, and SOLVE CARE. Companies are focusing on innovation in blockchain architecture and data encryption to enhance security, interoperability, and patient control over medical records. Strategic partnerships with hospitals, insurers, and health-tech providers allow companies to integrate blockchain solutions seamlessly into existing healthcare ecosystems. Investment in R&D for platform scalability, cloud integration, and AI-enabled analytics strengthens product offerings and supports adoption. Market players are also expanding regionally, targeting high-demand areas with strict data privacy regulations. Mergers and acquisitions help consolidate technology, broaden portfolios, and improve competitive positioning. Companies emphasize regulatory compliance, HIPAA and GDPR adherence, and certification to assure clients of system reliability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Offering trends

- 2.2.3 Type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising healthcare data breaches & cybersecurity costs

- 3.2.1.2 Growing demand for patient-centric care models

- 3.2.1.3 Rise in telehealth and remote care

- 3.2.1.4 Increasing need for seamless health data interoperability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory uncertainty and compliance concerns

- 3.2.2.2 Technical scalability and skill shortage

- 3.2.3 Opportunities

- 3.2.3.1 AI-blockchain convergence for advanced analytics

- 3.2.3.2 Integration with IoMT and remote monitoring systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Decentralized identity & self-sovereign solutions

- 3.5.2 Zero-knowledge proofs & privacy-preserving technologies

- 3.5.3 Quantum-resistant cryptography & security

- 3.5.4 Edge computing & IoT integration

- 3.5.5 Smart contract evolution & automation

- 3.6 Investment landscape

- 3.7 Healthcare delivery model transformation

- 3.8 Emerging use cases

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

- 3.12 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Offering, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Platform solutions

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Private blockchain

- 6.3 Consortium/Permissioned blockchain

- 6.4 Public blockchain

- 6.5 Hybrid blockchain

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Patient record management

- 7.3 Clinical trial data sharing

- 7.4 Insurance claim & fraud detection

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Pharmaceutical companies

- 8.4 Insurance providers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Rest of the world (RoW)

Chapter 10 Company Profiles

- 10.1 Avaneer HEALTH

- 10.2 burstIQ

- 10.3 Chronicled

- 10.4 embleema

- 10.5 Factom

- 10.6 Guardtime

- 10.7 IBM

- 10.8 Microsoft

- 10.9 Oracle Corporation

- 10.10 patientory inc.

- 10.11 SOLULAB

- 10.12 SOLVE CARE