|

市场调查报告书

商品编码

1885799

微生物组调节剂市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Microbiome Modulators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

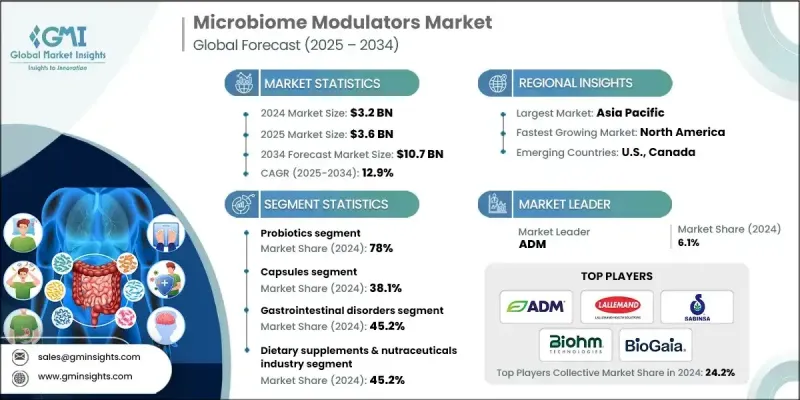

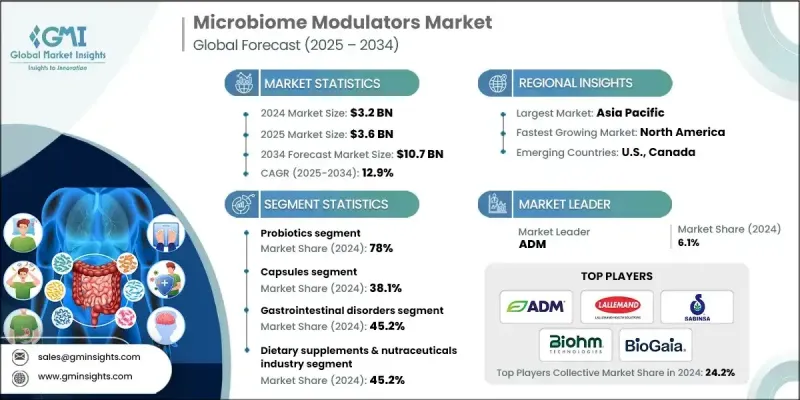

2024 年全球微生物组调节剂市场价值为 32 亿美元,预计到 2034 年将以 12.9% 的复合年增长率增长至 107 亿美元。

随着科学界和商业界对人体微生物组的兴趣日益浓厚,市场持续扩张,凸显了微生物平衡在维持长期健康方面的重要作用。益生菌、益生元、合生元和后生元等微生物组调节剂旨在支持和恢復可能因生活方式因素、压力、抗生素暴露或不良饮食习惯而失衡的微生物平衡。这些产品与消化舒适、增强免疫力、降低发炎以及改善与糖尿病和肥胖等疾病相关的代谢结果的关联日益紧密。随着消费者倾向于天然的预防性解决方案和个人化营养,针对微生物组的产品需求在膳食补充剂、功能性食品和健康配方等领域正加速成长。微生物组科学的不断进步,加上健康意识的不断提高,持续推动产品创新和细分市场的多元化,确保市场持续发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 107亿美元 |

| 复合年增长率 | 12.9% |

益生菌产品占了78%的市场份额,预计到2034年将以12.9%的复合年增长率成长。菌株的持续研发和专业配方不断强化了益生菌在免疫支持、消化调节和整体健康方面的应用。随着消费者兴趣的增长,益生菌在膳食补充剂、功能性饮料和强化食品中的应用也不断扩展。

2024年,胶囊剂市占率占比达38.1%,预计2025年至2034年将以13%的复合年增长率成长。胶囊因服用方便、易于吞嚥以及能提高敏感生物体稳定性的保护屏障,仍是首选的给药方式。这种剂型可支持靶向释放,使其非常适用于膳食补充剂和药品。

北美微生物组调节剂市场预计到2024年将占据30.2%的市场份额,这主要得益于人们对肠道健康及其对整体健康影响的日益关注。该地区的消费者越来越多地购买富含益生菌和益生元的产品,推动了膳食补充剂、食品和饮料等相关产品的需求成长。

微生物组调节剂市场的主要参与者包括AB-Biotics、Ritual、4D Pharma Plc、BioGaia、DSM-Firmenich、Sabinsa Corporation、ADM、Biohm Technologies、Modulate Biosystems、Second Genome, Inc.、Ferring、Lallemand Health Solutions和TCI Co., Ltd.。为了巩固市场地位,微生物组调节剂市场的企业正采取以科学验证、多元化产品发布和拓展分销网络为核心的策略。许多公司正在投资先进的菌株研究和临床试验,以证实其健康功效并提升信誉度。与食品、饮料和膳食补充剂生产商的合作有助于拓宽应用领域,同时,个人化配方的开发也正在满足日益增长的针对性健康解决方案的需求。此外,各公司还透过加强电子商务管道、优化供应链以及进行策略合作来扩大其全球影响力,从而加速创新并确保符合监管要求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 益生菌

- 益生元

- 合生元

- 后生元

- 活体生物治疗产品(LBPs)

- 噬菌体疗法

第六章:市场估算与预测:依形式划分,2021-2034年

- 主要趋势

- 胶囊

- 片剂

- 粉末

- 液体

- 其他的

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 传染病

- 胃肠道疾病

- 免疫系统疾病

- 癌症治疗

- 代谢性疾病

- 皮肤病

第八章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 製药与生物技术

- 膳食补充品和营养保健品

- 餐饮

- 动物饲料与营养

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- AB-Biotics, SA

- ADM

- BioGaia

- Biohm Technologies

- DSM-Firmenich

- Ferring

- Lallemand Health Solutions

- Modulate Biosystems

- Ritual

- Sabinsa Corporation

- Second Genome, Inc.

- TCI Co., Ltd.

- 4D Pharma Plc

The Global Microbiome Modulators Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 12.9% to reach USD 10.7 billion by 2034.

The market continues to expand as scientific and commercial interest in the human microbiome strengthens, highlighting the essential role of microbial balance in maintaining long-term health. Microbiome modulators such as probiotics, prebiotics, synbiotics, and postbiotics are designed to support and restore microbial harmony that may be disrupted by lifestyle factors, stress, antibiotic exposure, or poor dietary patterns. These products are increasingly associated with digestive comfort, immune reinforcement, lowered inflammation, and improved metabolic outcomes linked to conditions such as diabetes and obesity. As consumers gravitate toward natural, preventive solutions and personalized nutrition, demand for microbiome-focused products is accelerating across supplements, functional foods, and wellness formulations. Ongoing advancements in microbiome science, combined with rising health consciousness, continue to broaden product innovation and segment diversity, ensuring sustained market progression.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 12.9% |

The probiotics segment held a 78% share and is set to grow at a CAGR of 12.9% through 2034. Continuous strain development and specialized formulations are reinforcing their use in immune support, digestive regulation, and overall wellness. Their integration into dietary supplements, functional beverages, and fortified foods is expanding as consumer interest rises.

The capsules segment accounted for a 38.1% share in 2024 and is forecast to grow at a CAGR of 13% from 2025 to 2034. Capsules remain a preferred delivery mode due to convenience, ease of ingestion, and their protective barrier that improves the stability of sensitive organisms. This format supports targeted release, making it highly suitable for both supplement and pharmaceutical applications.

North America Microbiome Modulators Market captured 30.2% share in 2024, backed by growing awareness about gut health and its influence on overall wellness. Consumers across the region are increasingly purchasing probiotic and prebiotic-enriched products, driving reinforced demand across supplements, foods, and beverages.

Key players active in the Microbiome Modulators Market include AB-Biotics, SA, Ritual, 4D Pharma Plc, BioGaia, DSM-Firmenich, Sabinsa Corporation, ADM, Biohm Technologies, Modulate Biosystems, Second Genome, Inc., Ferring, Lallemand Health Solutions, and TCI Co., Ltd. To strengthen their position, companies in the Microbiome Modulators Market are adopting strategies centered on scientific validation, diversified product launches, and expanded distribution networks. Many firms are investing in advanced strain research and clinical studies to substantiate health claims and enhance credibility. Partnerships with food, beverage, and supplement manufacturers are helping broaden application possibilities, while personalized formulations are being developed to meet the rising demand for targeted wellness solutions. Companies are also expanding their global reach by strengthening e-commerce channels, optimizing supply chains, and engaging in strategic collaborations to accelerate innovation and regulatory compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End Use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Probiotics

- 5.3 Prebiotics

- 5.4 Synbiotics

- 5.5 Postbiotics

- 5.6 Live biotherapeutic products (LBPs)

- 5.7 Bacteriophage therapies

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Capsules

- 6.3 Tablets

- 6.4 Powders

- 6.5 Liquids

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Infectious diseases

- 7.3 Gastrointestinal disorders

- 7.4 Immune system disorders

- 7.5 Cancer therapy

- 7.6 Metabolic diseases

- 7.7 Dermatological conditions

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical & biotechnology

- 8.3 Dietary supplements & nutraceuticals

- 8.4 Food & beverage

- 8.5 Animal feed & nutrition

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AB-Biotics, SA

- 10.2 ADM

- 10.3 BioGaia

- 10.4 Biohm Technologies

- 10.5 DSM-Firmenich

- 10.6 Ferring

- 10.7 Lallemand Health Solutions

- 10.8 Modulate Biosystems

- 10.9 Ritual

- 10.10 Sabinsa Corporation

- 10.11 Second Genome, Inc.

- 10.12 TCI Co., Ltd.

- 10.13 4D Pharma Plc