|

市场调查报告书

商品编码

1885821

张量处理单元 (TPU) 市场机会、成长驱动因素、产业趋势分析及预测(2025-2034 年)Tensor Processing Unit (TPU) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

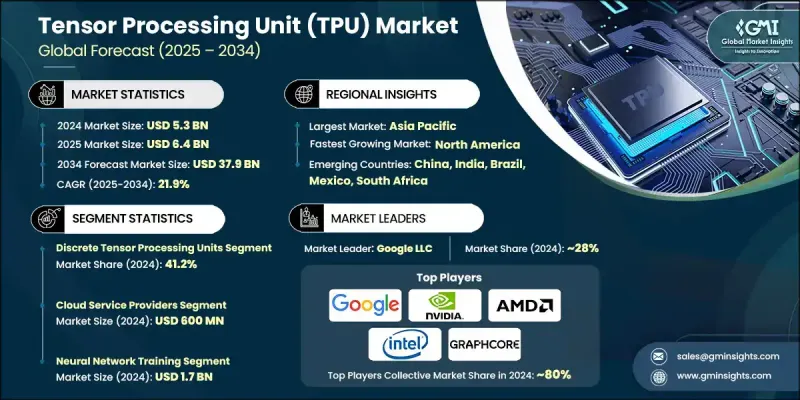

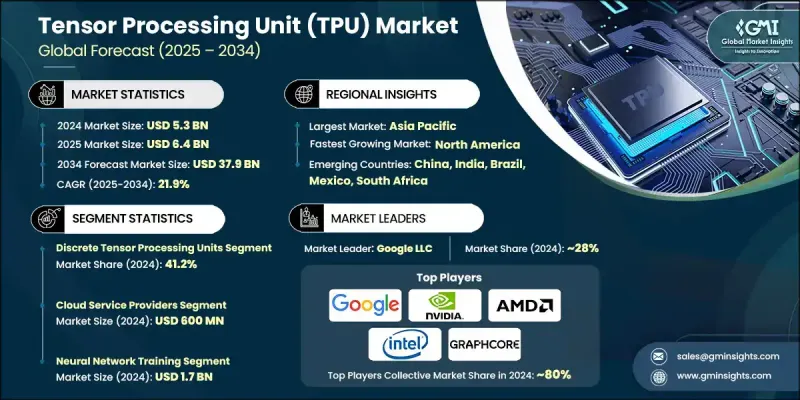

2024 年全球张量处理单元 (TPU) 市值为 53 亿美元,预计到 2034 年将以 21.9% 的复合年增长率增长至 379 亿美元。

人工智慧 (AI) 和机器学习 (ML) 在医疗保健、金融、汽车和机器人等行业的广泛应用推动了这一成长。 TPU 提供高速处理和节能效能,使其非常适合深度学习应用。云端运算基础设施的快速扩张和对即时分析日益增长的需求进一步加速了 TPU 的普及。各行各业对可扩展、高效能 AI 解决方案的需求日益增长,而 TPU 正成为现代资料中心和边缘运算框架不可或缺的一部分。 TPU 针对深度学习工作负载进行了最佳化,可提供更快的训练和推理速度,这对于即时决策和智慧自动化至关重要。领先的云端服务供应商正在将 TPU 嵌入到其平台中,使企业能够有效地利用 AI。随着企业向云端系统转型,像 TPU 这样的高效能、高能源效率处理器对于降低营运成本和加速资料处理至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53亿美元 |

| 预测值 | 379亿美元 |

| 复合年增长率 | 21.9% |

到2024年,离散张量处理单元(TPU)市占率将达到41.2%。离散TPU凭藉其卓越的性能和处理复杂AI任务的灵活性而占据主导地位。这些独立单元专为深度学习工作负载而设计,可为企业和资料中心应用提供高运算吞吐量和可扩展性。它们无需依赖CPU或GPU即可相容于各种硬体配置,这增强了它们在大规模AI训练和推理中的适用性,从而推动了其在云端运算和高效能运算环境中的广泛应用。

预计到2024年,云端服务供应商市场规模将达6亿美元。这些供应商凭藉其为企业和开发者提供的可扩展、高效能人工智慧基础设施,占据了市场主导地位。透过将TPU整合到云端平台中,他们无需大量前期投资即可经济高效地存取先进的机器学习功能。凭藉强大的全球资料中心和对多种人工智慧框架的支持,云端服务供应商正在加速各行业人工智慧的普及应用。基于TPU的云端服务的持续创新进一步巩固了他们在市场上的领先地位。

2024年,北美张量处理单元(TPU)市占率达40.2%。该地区的成长主要得益于对高效能运算的需求不断增长,以支援人工智慧和机器学习应用。云端服务、资料中心的扩张以及深度学习技术的进步是主要的成长因素。领先科技公司对TPU基础设施的投资正在推动人工智慧工作负载的成长。此外,医疗保健、金融和汽车等行业对节能处理和即时资料处理的需求日益增长,也促进了北美市场的扩张。

全球张量处理单元 (TPU) 市场的主要参与者包括 SambaNova Systems, Inc.、Arm Holdings plc、Graphcore Ltd.、华为技术有限公司、Tenstorrent Inc.、富士通有限公司、亚马逊网络服务公司、英特尔公司、寒武纪科技有限公司、微软公司、高通技术公司、百度公司、有限责任公司、寒武纪科技公司、微软公司、高通技术公司、百度公司、有限责任公司、DIBence公司Inc.、惠普企业公司、Synopsys, Inc. 和英伟达公司。这些企业正利用多种策略来巩固其市场地位。它们大力投资研发,以提升 TPU 的性能和能源效率。策略合作、併购拓展了它们的市场覆盖范围,并实现了与云端平台和企业平台的整合。此外,这些企业也致力于拓展产品组合,以满足多样化的人工智慧和机器学习需求。优先考虑永续性和节能解决方案有助于提升竞争力。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 对人工智慧和机器学习应用的需求不断增长

- 云端运算服务的日益普及

- 对深度学习技术的投资不断增加

- 半导体技术的进步

- 需要强大的运算能力来处理大规模资料处理任务

- 产业陷阱与挑战

- TPU硬体的初始投资成本较高

- TPU程式设计领域熟练专业人员数量有限

- 市场机会

- 新兴经济体TPU市场的扩张

- 为特定产业开发客製化TPU解决方案

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 我们

- 加拿大

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

- 技术格局

- 当前趋势

- 新兴技术

- 管道分析

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 离散张量处理单元

- 晶圆级人工智慧处理器

- 智慧处理单元

- 整合神经处理单元

第六章:市场估算与预测:依最终用途产业划分,2021-2034年

- 主要趋势

- 政府与国防

- 研究机构

- 云端服务供应商

- 企业技术

- 其他的

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 神经网路训练

- 人工智慧推理处理

- 科学计算

- 边缘人工智慧

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Google LLC (USA)

- NVIDIA Corporation (USA)

- Advanced Micro Devices, Inc. (AMD) (USA)

- Intel Corporation (USA)

- Microsoft Corporation (USA)

- Amazon Web Services, Inc. (USA)

- Huawei Technologies Co., Ltd. (China)

- Alibaba Group Holding Limited (China)

- Baidu, Inc. (China)

- Graphcore Ltd. (UK)

- SambaNova Systems, Inc. (USA)

- Tenstorrent Inc. (Canada)

- Cambricon Technologies Corporation Limited (China)

- Qualcomm Technologies, Inc. (USA)

- IBM Corporation (USA)

- Arm Holdings plc (UK)

- Cadence Design Systems, Inc. (USA)

- Synopsys, Inc. (USA)

- Fujitsu Limited (Japan)

- Hewlett Packard Enterprise Company (USA)

The Global Tensor Processing Unit (TPU) Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 21.9% to reach USD 37.9 billion by 2034.

The growth is fueled by the widespread adoption of artificial intelligence (AI) and machine learning (ML) across sectors such as healthcare, finance, automotive, and robotics. TPUs provide high-speed processing and energy-efficient performance, making them highly suited for deep learning applications. The rapid expansion of cloud computing infrastructure and the rising demand for real-time analytics are further accelerating TPU adoption. Industries increasingly require scalable, high-performance AI solutions, and TPUs are becoming integral to modern data centers and edge computing frameworks. Optimized for deep learning workloads, TPUs deliver faster training and inference times, essential for real-time decision-making and intelligent automation. Leading cloud service providers are embedding TPUs into their platforms, enabling enterprises to leverage AI efficiently. As businesses transition to cloud-based systems, high-performance and energy-efficient processors like TPUs are critical for reducing operational costs and accelerating data processing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $37.9 Billion |

| CAGR | 21.9% |

The discrete tensor processing units segment accounted for a 41.2% share in 2024. Discrete TPUs dominate due to their exceptional performance and flexibility in managing complex AI tasks. These standalone units are engineered for deep learning workloads, offering high computational throughput and scalability for enterprise and data center applications. Their compatibility with diverse hardware setups without relying on CPUs or GPUs enhances their suitability for large-scale AI training and inference, driving widespread adoption across cloud and high-performance computing environments.

The cloud service providers segment generated USD 600 million in 2024. These providers hold a dominant position as they offer scalable, high-performance AI infrastructure for businesses and developers. By integrating TPUs into cloud platforms, they provide cost-effective access to advanced machine learning capabilities without requiring significant upfront investment. With robust global data centers and support for multiple AI frameworks, cloud service providers are accelerating AI adoption across industries. Continuous innovation in TPU-based cloud services strengthens their leadership in the market.

North America Tensor Processing Unit (TPU) Market held a 40.2% share in 2024. Growth in this region is driven by increasing demand for high-performance computing to support AI and machine learning applications. The expansion of cloud-based services, data centers, and advancements in deep learning technologies are major growth factors. Investments by leading tech companies in TPU infrastructure are boosting AI workloads. Furthermore, the growing need for energy-efficient processing and real-time data handling in sectors such as healthcare, finance, and automotive is enhancing market expansion in North America.

Key players in the Global Tensor Processing Unit (TPU) Market include SambaNova Systems, Inc., Arm Holdings plc, Graphcore Ltd., Huawei Technologies Co., Ltd., Tenstorrent Inc., Fujitsu Limited, Amazon Web Services, Inc., Intel Corporation, Cambricon Technologies Corporation Limited, Microsoft Corporation, Qualcomm Technologies, Inc., Baidu, Inc., Google LLC, Advanced Micro Devices, Inc. (AMD), IBM Corporation, Alibaba Group Holding Limited, Cadence Design Systems, Inc., Hewlett Packard Enterprise Company, Synopsys, Inc., and NVIDIA Corporation. Companies in the Global Tensor Processing Unit (TPU) Market are leveraging multiple strategies to strengthen their foothold. They are heavily investing in research and development to enhance TPU performance and energy efficiency. Strategic partnerships, mergers, and acquisitions expand their market reach and enable integration with cloud and enterprise platforms. Companies are also focusing on broadening their product portfolios to meet diverse AI and machine learning requirements. Prioritizing sustainability and energy-efficient solutions improves competitiveness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Trends

- 2.2.2 End use Industry Trends

- 2.2.3 Application Trends

- 2.2.4 Regional Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for artificial intelligence and machine learning applications

- 3.2.1.2 Growing adoption of cloud computing services

- 3.2.1.3 Rising investments in deep learning technologies

- 3.2.1.4 Advancements in semiconductor technology

- 3.2.1.5 Need for high computational power for handling large-scale data processing tasks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment cost for TPU hardware

- 3.2.2.2 Limited availability of skilled professionals in TPU programming

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of TPU market in emerging economies

- 3.2.3.2 Development of customized TPU solutions for specific industries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Discrete Tensor Processing Units

- 5.3 Wafer-Scale AI Processors

- 5.4 Intelligence Processing Units

- 5.5 Integrated Neural Processing Units

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Government & Defense

- 6.3 Research Institutions

- 6.4 Cloud Service Providers

- 6.5 Enterprise Technology

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Neural Network Training

- 7.3 AI Inference Processing

- 7.4 Scientific Computing

- 7.5 Edge AI

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Google LLC (USA)

- 9.2 NVIDIA Corporation (USA)

- 9.3 Advanced Micro Devices, Inc. (AMD) (USA)

- 9.4 Intel Corporation (USA)

- 9.5 Microsoft Corporation (USA)

- 9.6 Amazon Web Services, Inc. (USA)

- 9.7 Huawei Technologies Co., Ltd. (China)

- 9.8 Alibaba Group Holding Limited (China)

- 9.9 Baidu, Inc. (China)

- 9.10 Graphcore Ltd. (UK)

- 9.11 SambaNova Systems, Inc. (USA)

- 9.12 Tenstorrent Inc. (Canada)

- 9.13 Cambricon Technologies Corporation Limited (China)

- 9.14 Qualcomm Technologies, Inc. (USA)

- 9.15 IBM Corporation (USA)

- 9.16 Arm Holdings plc (UK)

- 9.17 Cadence Design Systems, Inc. (USA)

- 9.18 Synopsys, Inc. (USA)

- 9.19 Fujitsu Limited (Japan)

- 9.20 Hewlett Packard Enterprise Company (USA)