|

市场调查报告书

商品编码

1885822

硬体在环 (HIL) 测试市场机会、成长驱动因素、产业趋势分析及预测(2025-2034 年)Hardware-in-the-Loop (HIL) Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

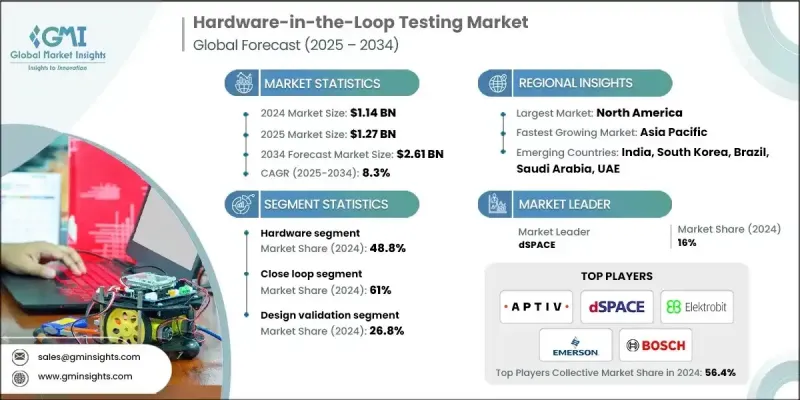

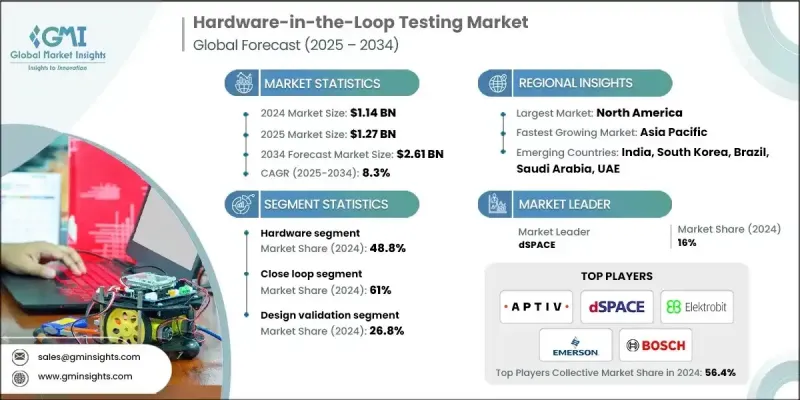

2024 年全球硬体在环 (HIL) 测试市场价值为 11.4 亿美元,预计到 2034 年将以 8.3% 的复合年增长率增长至 26.1 亿美元。

快速向先进控制架构的转变以及对更快产品验证的需求,凸显了对能够模拟高度复杂系统行为的即时模拟环境的迫切需求。硬体在环 (HIL) 平台支援持续软体验证、广泛的多领域测试以及更早地检测运行故障,使其成为现代工程工作流程中不可或缺的一部分。随着开发週期的加速,解决方案供应商正在拓展其技术能力,扩展即时运算资源,增加更高密度的 I/O 闆卡,并深化与软体工具链的合作。这些改进旨在满足电动车、航空研究和下一代能源系统等领域日益增长的需求。企业越来越依赖 HIL 测试来评估高压架构、推进装置和併网设备在热、老化和负载波动条件下的性能,而无需将实际设备置于风险之中。这种发展趋势使 HIL 技术成为多个工业领域先进验证实践的核心推动力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11.4亿美元 |

| 预测值 | 26.1亿美元 |

| 复合年增长率 | 8.3% |

2024年,硬体部分占据48.8%的市场份额,预计到2034年将以7.1%的复合年增长率成长。其重要性源自于对高效能实体组件的需求,包括即时运算单元、通道丰富的介面模组、可程式处理器、专用负载单元和功率密集测试平台。这些系统能够提供微秒级的精确效能,用于验证关键运作环境中使用的控制器和嵌入式逻辑。交通运输、国防和能源等产业依赖这些硬体平台来检验电力推进系统、安全控制器和先进保护技术的实际运作。

2024年,闭环测试占据了61%的市场份额,预计从2025年到2034年将以8%的年增长率成长。这种方法之所以保持主导地位,是因为它能够实现实体组件和虚拟模型之间的无缝交互,从而创建一个能够模拟实际运行情况的动态测试週期。工程师利用闭环测试系统,在高度逼真的条件下安全地检验控制单元、电气系统和智慧功能的性能,而无需将实体原型暴露于实际运作风险之中。

2024年,北美硬体在环(HIL)测试市场规模达3.553亿美元。该国市场的成长得益于自动化技术的持续进步、电动车的发展以及高度模组化车辆架构的广泛应用。美国企业正在扩展验证项目,以满足不断变化的安全、合规和数位系统完整性标准。电池开发、电气化平台和下一代动力传动系统的显着进步,正在加速HIL环境的普及,从而降低与实体原型相关的成本并缩短工程週期。

硬体在环 (HIL) 测试市场的主要参与者包括 Aptiv、dSPACE、Elektrobit、Emerson、IPG Automotive、Lynx Software Technologies、MathWorks、Robert Bosch、Typhoon HIL 和 Vector Informatik。硬体在环测试市场中,各公司采取的关键策略是深化技术研发并加强协作开发。供应商正在投资增强型即时运算丛集、更高容量的介面板和先进的处理架构,以支援日益复杂的模拟。许多组织正在与软体平台建立联盟,以确保建模、测试和自动化工作流程之间的无缝整合。此外,各公司也正在扩大生产能力、拓展服务组合,并推出模组化 HIL 系统,以满足不断变化的设计需求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 硅和核心技术供应商

- 平台和系统供应商

- 软体和模型提供者

- 系统整合商和专业服务

- 利润率分析

- 硅和核心技术供应商

- 平台和系统供应商

- 软体和模型提供者

- 系统整合商和服务

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 生态系统破坏

- 供应商格局

- 产业影响因素

- 成长驱动因素

- 电动车普及及电池系统验证要求分析

- ADAS/自动驾驶汽车的复杂性与软体定义车辆架构

- 监理要求与功能安全标准(ISO 26262、IEC 61508、DO-178C)

- 电力电子与再生能源併网

- 降低成本势在必行,虚拟验证已证明其投资报酬率。

- 产业陷阱与挑战

- 中小企业资本投入高,投资回收期长

- 熟练劳动力短缺和知识移转挑战

- 模型保真度和验证挑战

- 市场机会

- 基于云端的硬体在环测试和硬体在环即服务 (HILaaS)

- AI/ML驱动的测试自动化与场景生成

- 数位孪生整合和生命週期验证

- 亚太市场扩张和本地化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美监管格局

- 美国:联邦和州级要求

- 加拿大:与美国标准协调

- 欧洲监管格局

- 欧盟:全面的型式认可和网路安全强制性要求

- 英国:脱欧后的监管差异

- 亚太地区监管环境

- 中国:国内标准和资料本地化

- 日本:品质标准与汽车卓越性

- 印度:新兴市场,监管快速演变

- 韩国:先进技术和出口导向企业

- 拉丁美洲监管格局

- 巴西:具有本地化要求的区域领导者

- 墨西哥:美墨加协定整合及汽车製造中心

- 中东和非洲监管环境

- 阿联酋和沙乌地阿拉伯:雄心勃勃的技术应用

- 南非:区域製造业中心

- 跨区域监理趋势及其策略意义

- 北美监管格局

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 基于FPGA加速的即时模拟平台

- 基于模型的设计(MBD)和模拟工具链

- 基于模组化 PXI/EtherCAT 的 HIL 架构

- 认证的安全与合规工具链

- 新兴技术

- 云端原生硬体在环平台和硬体在环即服务 (HILaaS)

- AI/ML驱动的测试自动化与场景生成

- 用于生命週期验证的数位孪生集成

- 网路安全验证与安全OTA更新测试

- 当前技术趋势

- 专利分析

- 成本細項分析

- 贸易流分析

- 进口市场动态

- 全球进口模式

- 贸易壁垒和本地化

- 出口市场结构

- 出口障碍和激励措施

- 贸易流趋势及其策略意义

- 进口市场动态

- 永续性和环境方面

- 可持续实践的采纳

- 废弃物减量创新

- 能源效率优化

- 环境倡议的影响

- 用例

- 铁鸟测试

- 飞弹研发

- 自主无人机测试

- ADAS和自动驾驶

- 电动出行和电动驱动

- 电网

- 车辆动力学

- 虚拟车辆

- 测试台

- 实际驾驶排放量(RDE)

- 最佳情况

- 全生命週期数位孪生-硬体在环集成

- 面向全球协作的云端原生 HILaaS

- AI/ML驱动的自主验证

- PHIL 用于再生能源併网

- 模组化、可升级、循环式硬体在环架构

- HIL市场主要竞争对手使用的FPGA系统

- 性能与应用契合度

- 可扩展性、模组化和生命週期成本

- 监管与认证优势

- 生态系与整合

- 区域和监管差异

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 硬体

- 输入/输出介面

- 基于 PCIe 的 I/O 介面

- 标准 PCIe 卡

- 高速资料撷取模组

- 客製化的FPGA整合PCIe解决方案

- 基于FPGA的I/O解决方案

- 基于英特尔(Altera)Arria的介面模组

- 基于 Xilinx Zynq 的介面模组

- FPGA I/O 扩充板

- 即时逻辑控制与讯号调理接口

- 基于乙太网路和 EtherCAT 的接口

- 工业乙太网路(千兆乙太网路、万兆乙太网路、支援TSN)

- EtherCAT 主/从模组

- 使用 EtherCAT 的分散式 I/O 节点

- 时间同步通讯模组

- 基于 PCIe 的 I/O 介面

- 处理器

- 即时模拟器

- 数据采集系统

- 其他的

- 输入/输出介面

- 软体

- 服务

- 专业服务

- 託管服务

第六章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 开环

- 闭环

第七章:市场估算与预测:依测试阶段划分,2021-2034年

- 主要趋势

- 设计验证

- 整合测试

- 验收测试

- 製造测试

- 性能测试

- 其他的

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 航太

- 防御

- 铁路

- 电力电子

- 汽车

- 医疗器材

- 再生能源系统

- 电信和网路

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- 全球参与者

- MathWorks

- National Instruments

- dSPACE

- Vector Informatik

- Spirent Communications

- Wind River

- Robert Bosch

- Emerson

- 区域玩家

- ADVANTECH

- APTIV

- Wabtec

- ETAS

- Hinduja Tech

- Elektrobit

- 小众/新兴玩家

- ADD2

- Concurrent Real-Time

- IPG Automotive

- Lynx Software Technologies

- Opal-RT Technologies

- Plexim

- RealTime Wave

- Speedgoat

- Typhoon HIL

The Global Hardware-in-the-Loop (HIL) Testing Market was valued at USD 1.14 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 2.61 billion by 2034.

The rapid shift toward advanced control architectures and the push for faster product validation have amplified the need for real-time simulation environments that can mirror highly complex system behaviors. HIL platforms support continuous software verification, broad multi-domain testing, and earlier detection of operational faults, making them an essential part of modern engineering workflows. With development cycles accelerating, solution providers are broadening their technical capabilities, scaling real-time computing resources, adding higher-density I/O boards, and deepening cooperation with software toolchains. These enhancements cater to rising demand in electric mobility, aviation research, and next-generation energy systems. Companies are increasingly relying on HIL testing to evaluate high-voltage architectures, propulsion units, and grid-connected equipment under thermal, aging, and fluctuating load conditions without placing actual devices at risk. This evolution positions HIL technology as a core enabler for advanced verification practices across multiple industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.14 Billion |

| Forecast Value | $2.61 Billion |

| CAGR | 8.3% |

The hardware segment held 48.8% share in 2024 and is projected to grow at a 7.1% CAGR through 2034. Its prominence stems from the need for high-performance physical components, including real-time computing units, channel-rich interface modules, programmable processors, specialized load units, and power-focused rigs. These systems deliver precise, microsecond-level performance needed to validate controllers and embedded logic used in critical operational environments. Industries such as transportation, defense, and energy rely on these hardware platforms to examine real-world behavior of electric propulsion systems, safety-driven controllers, and advanced protection technologies.

The closed-loop category held a 61% share in 2024 and is projected to grow at 8% from 2025 to 2034. This approach remains dominant because it enables seamless interaction between physical components and virtual models, creating a dynamic test cycle that mirrors operational behavior. Engineers use closed-loop setups to safely examine the performance of control units, electrified systems, and intelligent functions under highly realistic conditions without exposing physical prototypes to operational hazards.

North America Hardware-in-the-Loop (HIL) Testing Market generated USD 355.3 million in 2024. The country's growth is supported by continued progress in automated technologies, electric mobility development, and the wider adoption of highly modular vehicle architectures. Companies in the US are expanding validation programs to meet evolving standards in safety, compliance, and digital system integrity. Significant advancements in battery development, electrified platforms, and next-generation drivetrain systems are helping accelerate the adoption of HIL environments to reduce costs tied to physical prototyping and to shorten engineering timelines.

Prominent participants in the Hardware-in-the-Loop (HIL) Testing Market include Aptiv, dSPACE, Elektrobit, Emerson, IPG Automotive, Lynx Software Technologies, MathWorks, Robert Bosch, Typhoon HIL, and Vector Informatik. Key strategies used by companies in the hardware-in-the-loop testing market focus on expanding technological depth and strengthening collaborative development. Providers are investing in enhanced real-time computing clusters, higher-capacity interface boards, and advanced processing architectures to support increasingly complex simulations. Many organizations are forming alliances with software platforms to ensure seamless integration across modeling, testing, and automation workflows. Firms are also scaling production capabilities, broadening service portfolios, and introducing modular HIL systems that accommodate evolving design demands.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Offering

- 2.2.4 Testing phase

- 2.2.5 End use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Silicon & Core Technology Providers

- 3.1.1.2 Platform & System Suppliers

- 3.1.1.3 Software & Model Providers

- 3.1.1.4 System Integrators & Professional Services

- 3.1.2 Profit margin analysis

- 3.1.2.1 Silicon & Core Technology Providers

- 3.1.2.2 Platform & System Suppliers

- 3.1.2.3 Software & Model Providers

- 3.1.2.4 System Integrators & Services

- 3.1.3 Cost Structure

- 3.1.4 Value Addition at Each Stage

- 3.1.5 Factors Affecting the Value Chain

- 3.1.6 Ecosystem Disruptions

- 3.1.1 Supplier landscape

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 electric vehicle proliferation and battery system validation requirements analysis

- 3.2.1.2 ADAS/autonomous vehicle complexity and software-defined vehicle architecture

- 3.2.1.3 regulatory mandates and functional safety standards (ISO 26262, IEC 61508, DO-178C)

- 3.2.1.4 power electronics and renewable energy grid integration

- 3.2.1.5 cost reduction imperative and demonstrated ROI from virtual validation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment and extended payback periods for SMEs

- 3.2.2.2 Skilled workforce shortage and knowledge transfer challenges

- 3.2.2.3 Model fidelity and validation challenges

- 3.2.3 Market Opportunities

- 3.2.3.1 Cloud-based HIL and hardware-in-the-loop-as-a-service (HILaaS)

- 3.2.3.2 AI/ML-driven test automation and scenario generation

- 3.2.3.3 Digital twin integration and lifecycle validation

- 3.2.3.4 Asia-pacific market expansion and localization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America Regulatory Landscape

- 3.4.1.1 United States: Federal and State-Level Requirements

- 3.4.1.2 Canada: Harmonization with U.S. Standards

- 3.4.2 Europe Regulatory Landscape

- 3.4.2.1 European Union: comprehensive type approval and cybersecurity mandates

- 3.4.2.2 United Kingdom: post-brexit regulatory divergence

- 3.4.3 Asia Pacific Regulatory Landscape

- 3.4.3.1 China: domestic standards and data localization

- 3.4.3.2 Japan: quality standards and automotive excellence

- 3.4.3.3 India: emerging market with rapid regulatory evolution

- 3.4.3.4 South korea: advanced technology and export focus

- 3.4.4 Latin America Regulatory Landscape

- 3.4.4.1 Brazil: regional leader with localization requirements

- 3.4.4.2 Mexico: USMCA integration and automotive manufacturing hub

- 3.4.5 Middle East & Africa Regulatory Landscape

- 3.4.5.1 UAE & Saudi Arabia: ambitious technology adoption

- 3.4.5.2 South Africa: regional manufacturing hub

- 3.4.6 Cross-regional regulatory trends and strategic implications

- 3.4.1 North America Regulatory Landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 FPGA-accelerated real-time simulation platforms

- 3.7.1.2 Model-based design (MBD) & simulation toolchains

- 3.7.1.3 Modular PXI/EtherCAT-based HIL architectures

- 3.7.1.4 Certified safety & compliance toolchains

- 3.7.2 Emerging technologies

- 3.7.2.1 Cloud-native HIL platforms & hil-as-a-service (HILaaS)

- 3.7.2.2 AI/ML-driven test automation & scenario generation

- 3.7.2.3 Digital twin integration for lifecycle validation

- 3.7.2.4 Cybersecurity validation & secure OTA update testing

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Trade flow analysis

- 3.10.1 Import market dynamics

- 3.10.1.1 Global import patterns

- 3.10.1.2 Trade barriers and localization

- 3.10.2 Export market structure

- 3.10.3 Export barriers and incentives

- 3.10.4 Trade flow trends & strategic implications

- 3.10.1 Import market dynamics

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practice adoption

- 3.11.2 Waste reduction innovation

- 3.11.3 Energy efficiency optimization

- 3.11.4 Environmental initiative impact

- 3.12 Use cases

- 3.12.1 Iron bird testing

- 3.12.2 Missile development

- 3.12.3 Autonomous drone testing

- 3.12.4 ADAS and autonomous driving

- 3.12.5 Electromobility and electric drives

- 3.12.6 Power grids

- 3.12.7 Vehicle dynamics

- 3.12.8 Virtual vehicle

- 3.12.9 Test benches

- 3.12.10 Real driving emissions (RDE)

- 3.13 Best case scenarios

- 3.13.1 Full lifecycle digital twin-HIL integration

- 3.13.2 Cloud-native HILaaS for global collaboration

- 3.13.3 AI/ML-driven autonomous validation

- 3.13.4 PHIL for renewable grid integration

- 3.13.5 Modular, upgradable, circular HIL architectures

- 3.14 FPGA systems used by major competitors in HIL market

- 3.14.1 Performance & application fit

- 3.14.2 Scalability, modularity & lifecycle cost

- 3.14.3 Regulatory & certification advantage

- 3.14.4 Ecosystem & integration

- 3.14.5 Regional & regulatory differentiation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 I/O interfaces

- 5.2.1.1 PCIe-based I/O interfaces

- 5.2.1.1.1 Standard PCIe cards

- 5.2.1.1.2 High-speed DAQ modules

- 5.2.1.1.3 Custom FPGA-integrated PCIe solutions

- 5.2.1.2 FPGA-based I/O solutions

- 5.2.1.2.1 Intel (Altera) Arria-based interface modules

- 5.2.1.2.2 Xilinx Zynq-based interface modules

- 5.2.1.2.3 FPGA I/O expansion boards

- 5.2.1.2.4 Real-time logic control & signal conditioning interfaces

- 5.2.1.3 Ethernet-based and EtherCAT interfaces

- 5.2.1.3.1 Industrial ethernet (GigE, 10GigE, TSN-enabled)

- 5.2.1.3.2 EtherCAT master/slave modules

- 5.2.1.3.3 Distributed I/O nodes with EtherCAT

- 5.2.1.3.4 Time-synchronized communication modules

- 5.2.1.1 PCIe-based I/O interfaces

- 5.2.2 Processors

- 5.2.3 Real-time simulators

- 5.2.4 Data acquisition systems

- 5.2.5 Others

- 5.2.1 I/O interfaces

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.1.1 Open loop

- 6.1.2 Close loop

Chapter 7 Market Estimates & Forecast, By Testing phase, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Design validation

- 7.3 Integration testing

- 7.4 Acceptance testing

- 7.5 Manufacturing testing

- 7.6 Performance testing

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Aerospace

- 8.3 Defence

- 8.4 Railway

- 8.5 Power electronics

- 8.6 Automotive

- 8.7 Medical devices

- 8.8 Renewable energy systems

- 8.9 Telecom and networking

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 MathWorks

- 10.1.2 National Instruments

- 10.1.3 dSPACE

- 10.1.4 Vector Informatik

- 10.1.5 Spirent Communications

- 10.1.6 Wind River

- 10.1.7 Robert Bosch

- 10.1.8 Emerson

- 10.2 Regional players

- 10.2.1 ADVANTECH

- 10.2.2 APTIV

- 10.2.3 Wabtec

- 10.2.4 ETAS

- 10.2.5 Hinduja Tech

- 10.2.6 Elektrobit

- 10.3 Niche/emerging players

- 10.3.1 ADD2

- 10.3.2 Concurrent Real-Time

- 10.3.3 IPG Automotive

- 10.3.4 Lynx Software Technologies

- 10.3.5 Opal-RT Technologies

- 10.3.6 Plexim

- 10.3.7 RealTime Wave

- 10.3.8 Speedgoat

- 10.3.9 Typhoon HIL