|

市场调查报告书

商品编码

1885823

航太复合材料碳纤维回收市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Carbon Fiber Recycling from Aerospace Composites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

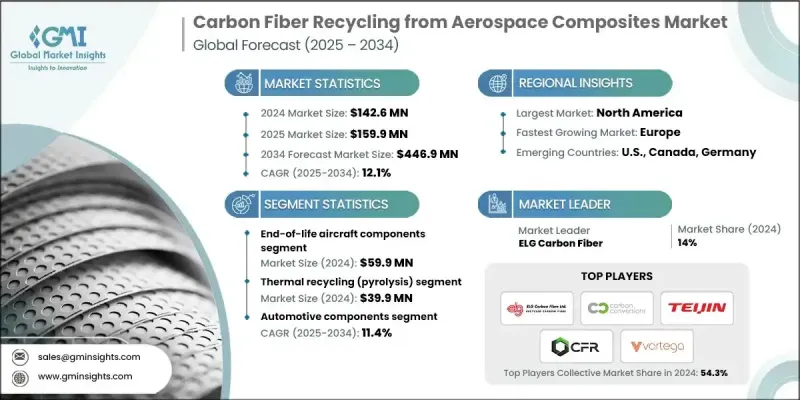

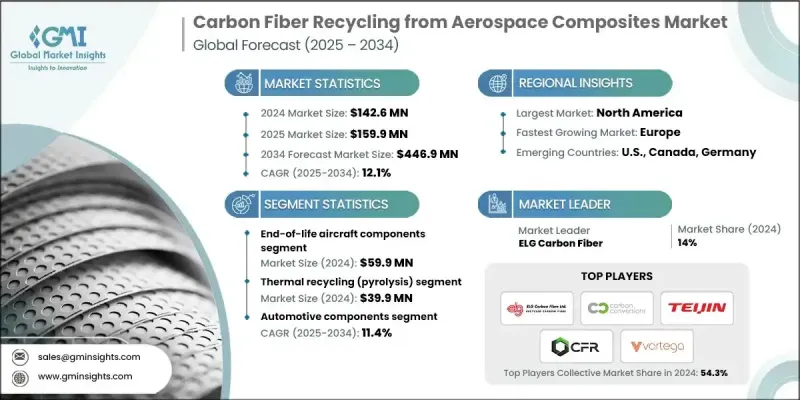

2024 年全球航太复合材料碳纤维回收市场价值为 1.426 亿美元,预计到 2034 年将以 12.1% 的复合年增长率增长至 4.469 亿美元。

回收技术的快速发展使得再生碳纤维更具成本效益且品质更高,从而促进了其在航太及相关领域的更广泛应用。在显着降低能耗的同时保持机械强度的新方法正在加速其商业化应用,并提升製程的可持续性。不断扩大的回收基础设施和日益成熟的工业能力为处理飞机退役产生的复合材料废料提供了支援。全球对循环製造的重视、更严格的环境目标以及更强有力的监管指导也在推动对先进回收系统的投资。废旧复合材料的日益增多以及将其转化为高价值再生纤维的技术可行性,为大规模应用创造了有利条件。随着回收技术的进步和供应链整合效率的提高,再生碳纤维正成为航太、汽车和工业应用领域日益重要的策略材料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.426亿美元 |

| 预测值 | 4.469亿美元 |

| 复合年增长率 | 12.1% |

2024年,报废飞机零件创造了5,990万美元的收入。退役飞机包含大量碳纤维结构,例如机身部件、机翼组件和尾翼部件,使其成为极具价值的回收材料来源。全球老旧机队加速退役,持续扩大原料供应,凸显了这项材料流在回收的重要性。

2024年,包括热解在内的热回收技术市场规模达3,990万美元。该方法占据主导地位,因为它能够可靠地提取高品质纤维,且不会损害其结构特性。其可扩展性、处理大批量复合材料的能力以及相对较低的营运成本,使其成为最具商业可行性的技术。系统的持续改进和能量回收方法的优化进一步提升了其经济效益。虽然其他製程也能回收高纯度纤维,但其高昂的成本限制了其广泛应用,因此热回收技术巩固了其作为领先工业解决方案的地位。

受强劲的航太製造业活动和不断扩大的回收能力推动,北美航空航太复合材料碳纤维回收市场在2024年预计将达到5,200万美元。该地区受益于众多原始设备製造商(OEM)、一级供应商和新兴回收企业的集中,这些企业不断提升了自身的生产能力。不断扩大的商业设施和持续的研究项目增强了国内供应,而下游产业的需求则进一步推动了区域成长。

活跃于航太复合材料碳纤维回收市场的关键企业包括东丽先进复合材料公司(东丽集团)、ELG碳纤维公司、三菱化学公司、Carbon Conversions公司、SGL Carbon公司、Carbon Fiber Recycling (CFR)公司、帝人株式会社、Carbon Fiber Conversions GmbH公司、 航太 . Corporation。这些企业透过扩大产能、采用先进的回收技术以及投资节能製程(以维持纤维强度)来提升自身的竞争力。许多企业寻求与航太原始设备製造商(OEM)建立策略合作伙伴关係,以确保稳定的原料供应,并将回收材料整合到下一代零件中。改善製程自动化、降低营运成本以及扩展连续回收系统等措施有助于提高产品可靠性。此外,各企业也致力于制定认证标准,以确保回收纤维符合航空航天级性能要求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 提高飞机退役率

- 永续发展法规与循环经济目标

- 回收製程的技术进步

- 产业陷阱与挑战

- 再生碳纤维的机械性质不一致

- 缺乏标准化和认证框架

- 市场机会

- 航太领域对轻质材料的需求日益增长

- 政府激励措施和绿色采购政策

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 原料来源

- 科技

- 应用

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依原料来源划分,2021-2034年

- 主要趋势

- 报废飞机部件

- 已退役的机身段

- 机翼和尾翼结构

- 内装板和配件

- 引擎罩和短舱

- 生产废料

- 预浸料边角料和修剪物

- 有缺陷或不合格的铺层

- 高压釜废料和固化废弃物

- MRO(维修、修理和大修)废弃物

- 更换或维修面板

- 大修造成的复合材料零件损坏

- 改造后的剩余零件

- 原型製作和研发废料

- 测试开发批次的零件

- 未经认证的实验性组件

- 其他的

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 机械回收

- 碎纸

- 研磨和磨削

- 颗粒化

- 热回收(热解)

- 常规热解(惰性气体)

- 微波辅助热解

- 流体化床热解

- 化学回收(溶剂分解/解聚)

- 酸/碱催化溶剂分解

- 醇解和糖解作用方法

- 超临界流体溶剂分解

- 超临界流体处理

- 超临界二氧化碳

- 超临界水氧化

- 其他的

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 汽车零件

- 汽车结构件

- 车身面板和外部组件

- 室内应用

- 电子製造

- 电路板应用

- 电子外壳和机箱

- 热管理元件

- 基础设施应用

- 电网组件

- 建筑材料

- 交通基础设施

- 体育用品和消费品

- 休閒设备

- 消费性电子产品

- 其他的

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Mitsubishi Chemical

- ELG Carbon Fibre

- Carbon Fiber Conversions GmbH

- Carbon Fiber Recycling (CFR)

- Carbon Conversions

- Teijin Limited

- SGL Carbon

- Toray Advanced Composites(Toray Group)

- Westlake Corporation

- Vartega Inc

The Global Carbon Fiber Recycling from Aerospace Composites Market was valued at USD 142.6 million in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 446.9 million by 2034.

Rapid progress in recovery technologies is making recycled carbon fiber more cost-effective and higher in quality, encouraging its wider use in aerospace and related sectors. New methods that significantly reduce energy consumption while preserving mechanical strength are accelerating commercial adoption and improving process sustainability. Expanding recycling infrastructure and maturing industrial capabilities support the rising volume of composite waste generated from aircraft decommissioning. Global emphasis on circular manufacturing, stricter environmental targets, and stronger regulatory direction are also driving investments in advanced recycling systems. The increasing availability of end-of-life composite materials and the technical viability of converting them into high-value secondary fibers are creating favorable conditions for large-scale deployment. As recycling technologies evolve and supply chains integrate more efficiently, recycled carbon fiber is becoming an increasingly strategic material for aerospace, automotive, and industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $142.6 Million |

| Forecast Value | $446.9 Million |

| CAGR | 12.1% |

The end-of-life aircraft components generated USD 59.9 million in 2024. Retired aircraft contain substantial quantities of carbon-fiber-based structures such as fuselage elements, wing assemblies, and tail components, making them a valuable source for recovery. The accelerating retirement cycle of older fleets worldwide continues to expand feedstock supply, reinforcing the importance of this material stream in recycling operations.

Thermal recycling, including pyrolysis, reached USD 39.9 million in 2024. This method dominates because it reliably extracts high-quality fibers without undermining their structural characteristics. Its scalability, ability to process large composite volumes, and comparatively low operational costs position it as the most commercially feasible technique. Continuous system advancements and improved energy-recovery approaches further enhance its economic performance. While alternative processes can recover fibers with high purity, their elevated costs limit broad adoption, solidifying thermal recycling as the leading industrial solution.

North America Carbon Fiber Recycling from Aerospace Composites Market captured USD 52 million in 2024, owing to strong aerospace manufacturing activity and expanding recycling capacities. The region benefits from a strong concentration of OEMs, Tier-1 suppliers, and emerging recyclers, increasing their production capabilities. Expanding commercial facilities and ongoing research initiatives strengthen domestic supply, while demand from downstream sectors reinforces regional growth.

Key companies active in the Carbon Fiber Recycling from Aerospace Composites Market include Toray Advanced Composites (Toray Group), ELG Carbon Fibre, Mitsubishi Chemical, Carbon Conversions, SGL Carbon, Carbon Fiber Recycling (CFR), Teijin Limited, Carbon Fiber Conversions GmbH, Westlake Corporation, and Vartega Inc. Companies operating in Carbon Fiber Recycling from Aerospace Composites Market enhance their competitive position by scaling production capacity, adopting advanced recovery technologies, and investing in energy-efficient processes that preserve fiber strength. Many pursue strategic partnerships with aerospace OEMs to secure consistent feedstock and integrate recycled materials into next-generation components. Efforts to improve process automation, reduce operational costs, and expand continuous recycling systems help increase output reliability. Organizations also focus on establishing certification standards, ensuring recycled fibers meet aerospace-grade performance requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Feedstock Source

- 2.2.3 Technology

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing aircraft decommissioning rates

- 3.2.1.2 Sustainability regulations and circular economy goals

- 3.2.1.3 Technological advancements in recycling processes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Inconsistent mechanical properties of recycled carbon fiber

- 3.2.2.2 Lack of standardization and certification frameworks

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for lightweight materials in aerospace

- 3.2.3.2 Government incentives and green procurement policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Feedstock Source

- 3.7.3 Technology

- 3.7.4 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Feedstock Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 End-of-Life Aircraft Components

- 5.2.1 Retired fuselage sections

- 5.2.2 Wing and tail structures

- 5.2.3 Interior panels and fixtures

- 5.2.4 Engine cowls and nacelles

- 5.3 Production Scrap

- 5.3.1 Prepreg offcuts and trimmings

- 5.3.2 Defective or rejected layups

- 5.3.3 Autoclave rejects and cured waste

- 5.4 MRO (Maintenance, Repair & Overhaul) Waste

- 5.4.1 Replaced or repaired panels

- 5.4.2 Damaged composite parts from overhaul

- 5.4.3 Residual parts from retrofitting

- 5.5 Prototyping and R&D Scrap

- 5.5.1 Test parts from development batches

- 5.5.2 Non-certified experimental components

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Mechanical recycling

- 6.2.1 Shredding

- 6.2.2 Milling and grinding

- 6.2.3 Granulation

- 6.3 Thermal Recycling (Pyrolysis)

- 6.3.1 Conventional pyrolysis (inert gas)

- 6.3.2 Microwave-assisted pyrolysis

- 6.3.3 Fluidized bed pyrolysis

- 6.4 Chemical Recycling (Solvolysis / Depolymerization)

- 6.4.1 Acid/base catalyzed solvolysis

- 6.4.2 Alcoholysis and glycolysis methods

- 6.4.3 Supercritical fluid solvolysis

- 6.5 Supercritical fluid processing

- 6.5.1 Supercritical CO2

- 6.5.2 Supercritical water oxidation

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive components

- 7.2.1 Structural automotive parts

- 7.2.2 Body panels & exterior components

- 7.2.3 Interior applications

- 7.3 Electronics manufacturing

- 7.3.1 Circuit board applications

- 7.3.2 Electronic housings & enclosures

- 7.3.3 Thermal management components

- 7.4 Infrastructure applications

- 7.4.1 Electrical grid components

- 7.4.2 Construction & building materials

- 7.4.3 Transportation infrastructure

- 7.5 Sporting goods & consumer products

- 7.5.1 Recreational equipment

- 7.5.2 Consumer electronics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Mitsubishi Chemical

- 9.2 ELG Carbon Fibre

- 9.3 Carbon Fiber Conversions GmbH

- 9.4 Carbon Fiber Recycling (CFR)

- 9.5 Carbon Conversions

- 9.6 Teijin Limited

- 9.7 SGL Carbon

- 9.8 Toray Advanced Composites(Toray Group)

- 9.9 Westlake Corporation

- 9.10 Vartega Inc