|

市场调查报告书

商品编码

1885828

钻井液市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Drilling Fluid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

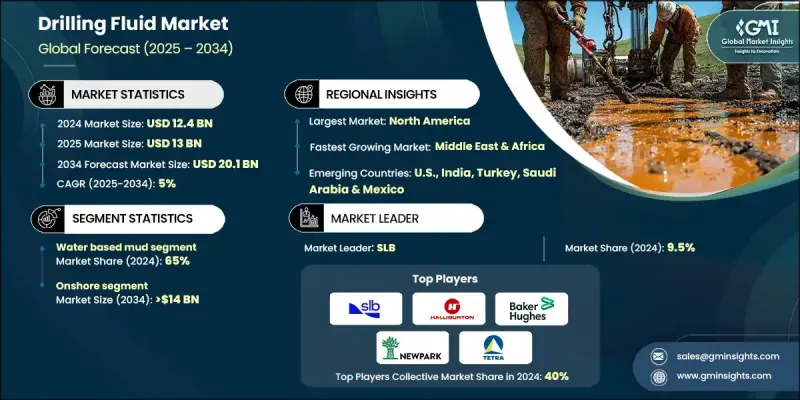

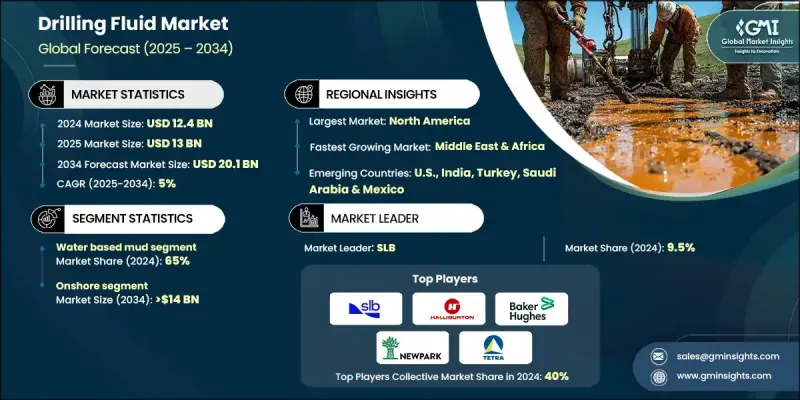

2024 年全球钻井液市场价值为 124 亿美元,预计到 2034 年将以 5% 的复合年增长率增长至 201 亿美元。

产业扩张的驱动力来自日益严格的环境合规要求以及对作业效率和油井完整性的日益重视。现代钻井作业越来越多地采用环保高性能流体系统,以提高钻井效率并最大限度地减少地层损害,从而兼顾永续发展目标和作业效率。钻井液,无论是水基、油基或合成的,都是用于油气勘探的工程化学配方,其作用包括冷却和润滑钻头、将岩屑输送到地面以及维持井眼稳定性。钻井液的作用已从基本的循环系统发展成为控制井孔压力、优化性能和提高成本效益的策略工具。可重复使用和可回收的配方带来了额外的经济优势,进一步巩固了其在现代钻井作业中的关键地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 124亿美元 |

| 预测值 | 201亿美元 |

| 复合年增长率 | 5% |

2024年,水基泥浆市占率达到65%,预计到2034年将以5%的复合年增长率成长。其适应性强且环境友好,使其成为浅井和中深井的首选。对永续钻井实践的重视以及监管机构对低毒性钻井液的支持,将继续推动水性泥浆的应用和市场成长。

2024年,陆上钻井液市占率达到75.3%,预计到2034年将达到140亿美元。陆上作业需要经济高效且环保的钻井液,而陆上勘探计画的大量发展也推动了对钻井液的持续需求。随着各国国内油气产量的增加,油井开发规模扩大,为钻井液供应商创造了稳定的机会,并促进了市场扩张。

预计2024年,美国钻井液市占率将达72%,市场规模将达43亿美元。监管合规以及政府对环保钻井液的激励措施,共同推动了市场发展。国内油气资源丰富盆地的生产重点提升,带动了对高性能钻井液的强劲需求,也为供应商带来了持续的成长机会。

全球钻井液市场的主要参与者包括Stellar Drilling Fluids、Eco Drilling Fluids、Baker Hughes、Universal Performance Chemicals、Di-Corp、INEOS、Newpark Drilling Fluids、Halliburton、BCS Fluids、Cargill Energy、Gumpro Drilling Fluids、Halliburton、BCS Fluids、Cargill Energy、Gumpro Drilling Fluids、Tetra Technologies. Fluids、Ingevity、Supreme Drilling Fluid Chemicals和SumiSaujana。钻井液市场的企业正优先考虑创新,以开发环保且高性能的钻井液配方。对研发的投入确保了钻井液能够满足不断变化的监管标准,同时提高井眼稳定性和钻井效率。与钻井承包商、服务提供者和油田营运商建立策略合作伙伴关係,可以扩大市场准入并加强供应链。各公司正在利用可重复使用和可回收的钻井液技术来降低营运成本,并吸引註重永续发展的客户。向高成长地区进行地理扩张,可以确保获得新兴钻井计画的机会。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 原物料供应及采购分析

- 製造能力评估

- 供应链韧性与风险因素

- 配电网路分析

- 监管环境

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

- 钻井液成本结构分析

- 新兴机会与趋势

- 数位化与物联网集成

- 投资分析及未来展望

第四章:竞争格局

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪錶板

- 策略倡议

- 重要伙伴关係与合作

- 主要併购活动

- 产品创新与发布

- 市场扩张策略

- 竞争性标竿分析

- 创新与永续发展格局

第五章:市场规模及预测:依产品类型划分,2021-2034年

- 主要趋势

- 水基泥

- 油基泥浆

- 合成泥浆

- 其他的

第六章:市场规模及预测:依应用领域划分,2021-2034年

- 主要趋势

- 陆上

- 离岸

第七章:市场规模及预测:依油井类型划分,2021-2034年

- 主要趋势

- 传统的

- 高温高压

第八章:市场规模及预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 土耳其

- 罗马尼亚

- 英国

- 义大利

- 俄罗斯

- 荷兰

- 挪威

- 亚太地区

- 中国

- 日本

- 印尼

- 印度

- 澳洲

- 泰国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 阿尔及利亚

- 利比亚

- 奈及利亚

- 科威特

- 阿曼

- 拉丁美洲

- 巴西

- 墨西哥

- 哥伦比亚

- 阿根廷

第九章:公司简介

- AES Drilling Fluids

- Baker Hughes

- BCS Fluids

- Cargill

- CES Energy Solutions Corp

- Chevron Phillips Chemical Company

- Di-Corp

- Eco Drilling Fluids

- Gumpro Drilling Fluids

- Halliburton

- INEOS

- Ingevity

- International Drilling Fluids

- National Energy Services Reunited Corp

- Newpark Drilling Fluids

- SLB

- Stellar Drilling Fluids

- SumiSaujana

- SUPREME DRILLING FLUID CHEMICALS

- Universal Performance Chemicals

The Global Drilling Fluid Market was valued at USD 12.4 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 20.1 billion by 2034.

Industry expansion is driven by rising environmental compliance requirements and an increased focus on operational efficiency and well integrity. Modern drilling operations are increasingly utilizing eco-friendly, high-performance fluid systems to enhance drilling outcomes while minimizing formation damage, supporting both sustainability objectives and operational efficiency. Drilling fluids, whether water-based, oil-based, or synthetic, are engineered chemical formulations used in oil and gas exploration to cool and lubricate the drill bit, transport cuttings to the surface, and maintain wellbore stability. Their role has evolved beyond basic circulation to a strategic tool for wellbore pressure control, performance optimization, and cost efficiency. Reusable and recyclable formulations have created additional economic advantages, reinforcing their position as critical assets in modern drilling operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.4 Billion |

| Forecast Value | $20.1 Billion |

| CAGR | 5% |

The water-based mud segment accounted for a 65% share in 2024 and is projected to grow at 5% CAGR through 2034. Its adaptability and environmentally friendly nature make it the preferred choice for shallow and medium-depth wells. The emphasis on sustainable drilling practices and regulatory support for low-toxicity fluids will continue to drive adoption and market growth.

The onshore drilling fluid segment captured a 75.3% share in 2024 and is expected to reach USD 14 billion by 2034. Onshore operations favor cost-effective, environmentally safe fluids, fueling consistent demand due to the volume of land-based exploration projects. As countries increase domestic oil and gas production, well development expands, creating steady opportunities for drilling fluid suppliers and supporting market expansion.

U.S. Drilling Fluid Market held a 72% share in 2024, generating USD 4.3 billion. Regulatory compliance, combined with government incentives for greener fluids, has enhanced the market landscape. High demand for high-performance drilling fluids is being driven by a focus on domestic oil and gas production in prolific basins, ensuring continuous growth opportunities for suppliers.

Key players in the Global Drilling Fluid Market include Stellar Drilling Fluids, Eco Drilling Fluids, Baker Hughes, Universal Performance Chemicals, Di-Corp, INEOS, Newpark Drilling Fluids, Halliburton, BCS Fluids, Cargill, Gumpro Drilling Fluids, Tetra Technologies, Chevron Phillips Chemical Company, CES Energy Solutions Corp, AES Drilling Fluids, Ingevity, Supreme Drilling Fluid Chemicals, and SumiSaujana. Companies in the Drilling Fluid Market are prioritizing innovation to develop environmentally friendly and high-performance fluid formulations. Investment in research and development ensures that fluids meet evolving regulatory standards while enhancing wellbore stability and drilling efficiency. Strategic partnerships with drilling contractors, service providers, and oilfield operators expand market access and strengthen supply chains. Firms are leveraging reusable and recyclable fluid technologies to reduce operational costs and appeal to sustainability-focused clients. Geographic expansion into high-growth regions ensures access to emerging drilling projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product type trends

- 2.4 Application trends

- 2.5 Well type trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of drilling fluid

- 3.8 Emerging opportunities & trends

- 3.9 Digitalization & IoT integration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Water based mud

- 5.3 Oil based mud

- 5.4 Synthetic based mud

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Well Type, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 HPHT

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Turkey

- 8.3.3 Romania

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Netherlands

- 8.3.8 Norway

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 Indonesia

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Thailand

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 Algeria

- 8.5.6 Libya

- 8.5.7 Nigeria

- 8.5.8 Kuwait

- 8.5.9 Oman

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Colombia

- 8.6.4 Argentina

Chapter 9 Company Profiles

- 9.1 AES Drilling Fluids

- 9.2 Baker Hughes

- 9.3 BCS Fluids

- 9.4 Cargill

- 9.5 CES Energy Solutions Corp

- 9.6 Chevron Phillips Chemical Company

- 9.7 Di-Corp

- 9.8 Eco Drilling Fluids

- 9.9 Gumpro Drilling Fluids

- 9.10 Halliburton

- 9.11 INEOS

- 9.12 Ingevity

- 9.13 International Drilling Fluids

- 9.14 National Energy Services Reunited Corp

- 9.15 Newpark Drilling Fluids

- 9.16 SLB

- 9.17 Stellar Drilling Fluids

- 9.18 SumiSaujana

- 9.19 SUPREME DRILLING FLUID CHEMICALS

- 9.20 Universal Performance Chemicals