|

市场调查报告书

商品编码

1885840

工业过滤系统市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Industrial Filtration System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

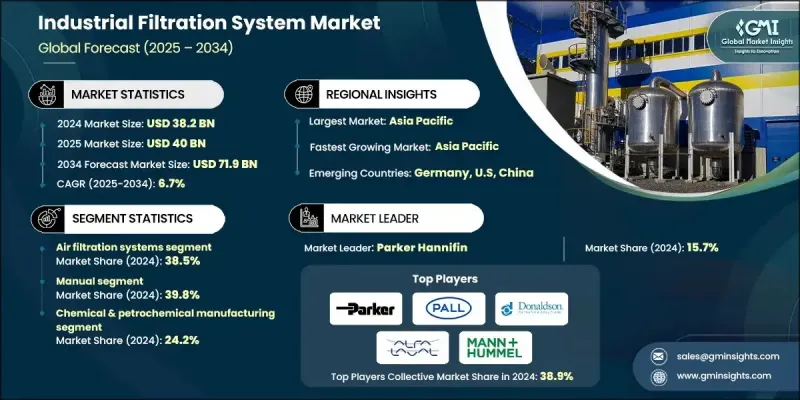

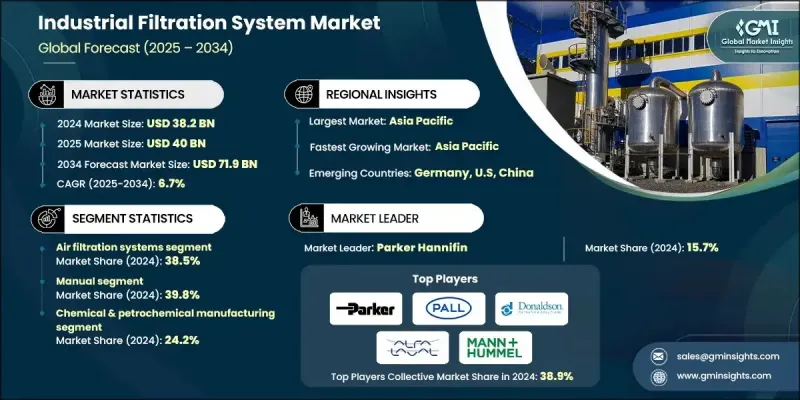

2024 年全球工业过滤系统市场价值为 382 亿美元,预计到 2034 年将以 6.7% 的复合年增长率增长至 719 亿美元。

随着监管预期不断变化、客户需求不断演进以及技术持续升级重塑工业运营,市场正快速发展。环境永续性已成为创新的核心驱动力,製造商致力于研发环保过滤材料、降低能耗,并设计能够支援长期环境目标的系统。高性能过滤介质日益受到关注,其耐久性更强、精度更高,应用范围更广,尤其适用于腐蚀性、高温或高压环境的行业。材料科学的进步不断延长过滤寿命并提高可靠性,促使各行业投资于能够确保符合日益严格的环境标准的系统。这些进步正在影响全球工业设施的资本配置、现代化策略和基础设施升级。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 382亿美元 |

| 预测值 | 719亿美元 |

| 复合年增长率 | 6.7% |

2024年,空气过滤产品市占率达到38.5%,预计2025年至2034年将以7.4%的复合年增长率成长。该细分市场之所以占据领先地位,是因为全球对排放控制、工作场所安全要求和环境准则的日益关注,这些都要求采用先进的空气过滤解决方案。主要地区的监管框架持续影响对高效系统的投资,这些系统旨在保护工人并减少工业污染物。

2024年,半自动过滤系统市场规模达到107亿美元,占市占率的28%,预计2034年将以6.9%的复合年增长率成长。这些系统将自动化监控功能与操作员管理的维护相结合,提供了一种混合模式,既提高了效率,也保留了对关键功能的人工监督。需要稳定可靠性能的产业高度依赖这些系统来支援可靠的过滤和合规标准。

2024年,北美工业过滤系统市场规模达到107亿美元,市占率为28%,预计2034年将以6.9%的复合年增长率成长。该地区的成长主要得益于设备更新换代、基础设施升级和监管力度加大。由于严格的环境法规、老化的工业设施以及不断增长的生产活动对高效过滤技术的需求,美国是该地区消费的主要驱动力。遵守国家和州级指导方针仍然是影响工业设施投资重点的重要因素。

工业过滤系统市场的领导者包括派克汉尼汾公司 (Parker Hannifin Corporation)、颇尔公司 (Pall Corporation)、唐纳森公司 (Donaldson Company, Inc.)、Ahlstrom-Munksjo、伊顿公司 (Eaton Corporation Plc)、3M公司 (3M Company)、Lenntech BV、滨特尔公司 (Pair Ltd. AB)、康斐尔集团 (Camfil Group)、过滤集团公司 (Filtration Group Corporation)、曼胡默尔集团 (MANN+HUMMEL Group)、弗罗伊登贝格过滤技术公司 (Freudenberg Filtration Technologies) 和康明斯过滤公司 (Cummins Filtration)。主要产业参与者透过拓展过滤产品组合、加强材料创新以及投资先进节能设计来巩固其竞争地位。许多公司加快研发步伐,推出具有更长使用寿命、更高效率和更低营运成本的系统。策略性收购、全球分销合作伙伴关係以及设施扩建有助于扩大地域覆盖范围并加快市场渗透。各公司也致力于开发符合不断变化的环境和工作场所安全法规的过滤技术,确保最终用户能够无缝合规。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 监管合规性和环境标准

- 工业成长和製程强化

- 技术进步与整合

- 产业陷阱与挑战

- 资本投资和营运成本

- 复杂性与劳动力需求的整合

- 供应炼和报废管理

- 机会

- 可持续和节能的解决方案

- 进阶应用扩充

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 监管环境

- 标准和合规要求

- 区域监理框架

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 空气过滤系统

- 高效能空气滤清器(HEPA 和 Ulpa 滤网)

- 静电集尘器

- 布袋除尘器和除尘器

- 滤芯和板式过滤器

- 薄膜过滤系统

- 微滤(MF)

- 超滤(UF)

- 奈米过滤(NF)

- 逆渗透(RO)

- 陶瓷薄膜过滤器

- 碳化硅(SIC)膜

- 氧化铝基膜

- 氧化锆和氧化钛膜

- 压力驱动过滤

- 滤压机

- 滤芯和袋式过滤器

- 真空过滤系统

- 离子交换与吸附系统

- 活性碳系统

- 离子交换树脂

- 分子筛及特种吸附剂

第六章:市场估算与预测:依自动化程度划分,2021-2034年

- 主要趋势

- 手动的

- 半自动

- 自动的

- 物联网赋能智慧系统

第七章:市场估计与预测:依压力范围划分,2021-2034年

- 主要趋势

- 低压(<50 psi)

- 中等压力(50-500 psi)

- 高压(>500 psi)

第八章:市场估算与预测:依粒径范围划分,2021-2034年

- 主要趋势

- 粗过滤(>10微米)

- 精细过滤(1-10微米)

- 超细(<1 μm)

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 空气污染控制

- 水和废水处理

- 製程过滤

- 采矿和尾矿管理

- 洁净室与无菌应用

- 液压油和润滑油过滤

- 压缩空气处理

- 气体净化

- 溶剂和催化剂回收

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 主要趋势

- 化学和石油化学製造

- 製药与生物技术

- 食品饮料加工

- 采矿和金属

- 发电

- 纸浆和造纸

- 汽车製造

- 航太与国防

- 石油和天然气

- 钢铁和基础金属

- 其他的

第十一章:市场估计与预测:按地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- 3M Company

- Ahlstrom-Munksjo

- Alfa Laval AB

- Camfil Group

- Cummins Filtration

- Donaldson Company, Inc.

- Eaton Corporation Plc

- Filtration Group Corporation

- Freudenberg Filtration Technologies

- Lenntech BV

- MANN+HUMMEL Group

- Pall Corporation

- Parker Hannifin Corporation

- Pentair Plc

- WL Gore & Associates, Inc.

The Global Industrial Filtration System Market was valued at USD 38.2 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 71.9 billion by 2034.

The market is advancing rapidly as shifting regulatory expectations, evolving customer demands, and ongoing technology upgrades reshape industrial operations. Environmental sustainability has become a central driver of innovation as manufacturers focus on eco-conscious filtration materials, reduced energy consumption, and system designs that support long-term environmental goals. Rising interest in high-performance filtration media is enabling stronger durability, greater precision, and wider applicability across industries dealing with corrosive, high-temperature, or high-pressure environments. Improvements in material science continue to extend filtration lifespan and reliability, encouraging industries to invest in systems that ensure compliance with increasingly strict environmental standards. These advancements are influencing capital allocation, modernization strategies, and infrastructure upgrades across global industrial facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $38.2 Billion |

| Forecast Value | $71.9 Billion |

| CAGR | 6.7% |

The air filtration category held a 38.5% share in 2024 and is anticipated to grow at a 7.4% CAGR from 2025 to 2034. This segment leads due to increasing global attention on emission controls, workplace safety requirements, and environmental guidelines that demand advanced air filtration solutions. Regulatory frameworks in major regions continue to influence investment in higher-efficiency systems designed to protect workers and reduce industrial pollutants.

The semi-automatic filtration systems generated USD 10.7 billion in 2024, accounting for a 28% share, and are expected to grow at a CAGR of 6.9% through 2034. These systems integrate automated monitoring features with operator-managed maintenance, offering a hybrid model that enhances efficiency while maintaining human oversight of essential functions. Industries that require consistent, validated performance rely heavily on these systems to support dependable filtration and compliance standards.

North America Industrial Filtration System Market reached USD 10.7 billion in 2024 with a 28% share and is expected to register a 6.9% CAGR through 2034. Growth in this region is supported by replacement demand, infrastructure upgrades, and regulatory enforcement. The United States drives most of the regional consumption due to strict environmental regulations, aging industrial assets, and increasing production activity that requires robust filtration technologies. Compliance with national and state-level guidelines continues to shape investment priorities across industrial facilities.

Leading companies in the Industrial Filtration System Market include Parker Hannifin Corporation, Pall Corporation, Donaldson Company, Inc., Ahlstrom-Munksjo, Eaton Corporation Plc, 3M Company, Lenntech B.V., Pentair Plc, W. L. Gore & Associates, Inc., Alfa Laval AB, Camfil Group, Filtration Group Corporation, MANN+HUMMEL Group, Freudenberg Filtration Technologies, and Cummins Filtration. Major industry players strengthen their competitive standing by expanding filtration portfolios, enhancing material innovation, and investing in advanced, energy-efficient designs. Many companies accelerate R&D to introduce systems with extended durability, improved efficiency, and reduced operational costs. Strategic acquisitions, global distribution partnerships, and facility expansions support broader geographic reach and faster market penetration. Firms also focus on developing filtration technologies that align with evolving environmental and workplace safety regulations, ensuring seamless compliance for end users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Automation level

- 2.2.4 Pressure range

- 2.2.5 Particle size range

- 2.2.6 Application

- 2.2.7 End Use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory compliance and environmental standards

- 3.2.1.2 Industrial growth and process intensification

- 3.2.1.3 Technological advancement integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Capital investment and operational costs

- 3.2.2.2 Integration of complexity and workforce requirements

- 3.2.2.3 Supply chain and end-of-life management

- 3.2.3 Opportunities

- 3.2.3.1 Sustainable and energy-efficient solutions

- 3.2.3.2 Advanced application expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Air filtration systems

- 5.2.1 Hepa & Ulpa filters

- 5.2.2 Electrostatic precipitators

- 5.2.3 Baghouse & dust collectors

- 5.2.4 Cartridge & panel filters

- 5.3 Membrane filtration systems

- 5.3.1 Microfiltration (MF)

- 5.3.2 Ultrafiltration (UF)

- 5.3.3 Nanofiltration (NF)

- 5.3.4 Reverse osmosis (RO)

- 5.4 Ceramic membrane filters

- 5.4.1 Silicon carbide (SIC) membranes

- 5.4.2 Alumina-based membranes

- 5.4.3 Zirconia & titania membranes

- 5.5 Pressure-driven filtration

- 5.5.1 Filter presses

- 5.5.2 Cartridge & bag filters

- 5.5.3 Vacuum filtration systems

- 5.6 Ion exchange & adsorption systems

- 5.6.1 Activated carbon systems

- 5.6.2 Ion exchange resins

- 5.6.3 Molecular sieves & specialty adsorbents

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Automatic

- 6.5 IoT enables smart system

Chapter 7 Market Estimates & Forecast, By Pressure Range, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low-pressure (<50 psi)

- 7.3 medium pressure (50-500 psi)

- 7.4 high-pressure (>500 psi)

Chapter 8 Market Estimates & Forecast, By Particle Size Range, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Coarse filtration (>10 im)

- 8.3 Fine filtration (1-10 μm)

- 8.4 Ultrafine (<1 μm)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Air pollution control

- 9.3 Water & wastewater treatment

- 9.4 Process filtration

- 9.5 Mining & tailings management

- 9.6 Cleanroom & sterile applications

- 9.7 Hydraulic & lubricant filtration

- 9.8 Compressed air treatment

- 9.9 Gas purification

- 9.10 Solvent & catalyst recovery

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Chemical & petrochemical manufacturing

- 10.3 Pharmaceutical & biotechnology

- 10.4 Food & beverage processing

- 10.5 Mining & metals

- 10.6 Power generation

- 10.7 Pulp & paper

- 10.8 Automotive manufacturing

- 10.9 Aerospace & defense

- 10.10 Oil & gas

- 10.11 Steel & primary metals

- 10.12 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 3M Company

- 12.2 Ahlstrom-Munksjo

- 12.3 Alfa Laval AB

- 12.4 Camfil Group

- 12.5 Cummins Filtration

- 12.6 Donaldson Company, Inc.

- 12.7 Eaton Corporation Plc

- 12.8 Filtration Group Corporation

- 12.9 Freudenberg Filtration Technologies

- 12.10 Lenntech B.V.

- 12.11 MANN+HUMMEL Group

- 12.12 Pall Corporation

- 12.13 Parker Hannifin Corporation

- 12.14 Pentair Plc

- 12.15 W. L. Gore & Associates, Inc.