|

市场调查报告书

商品编码

1885857

饮料玻璃回收市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Beverage Glass Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

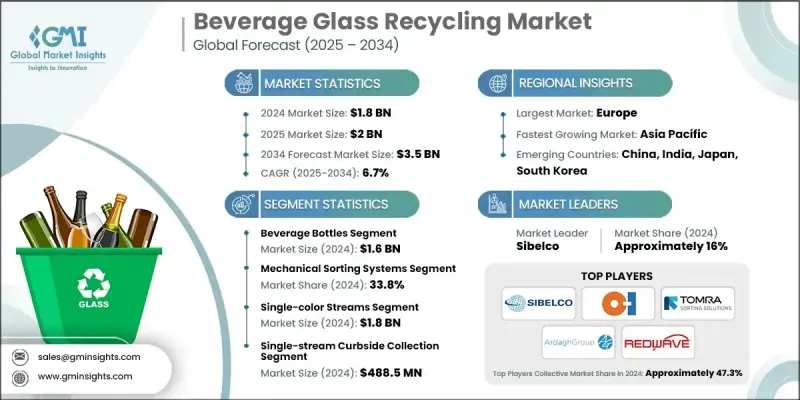

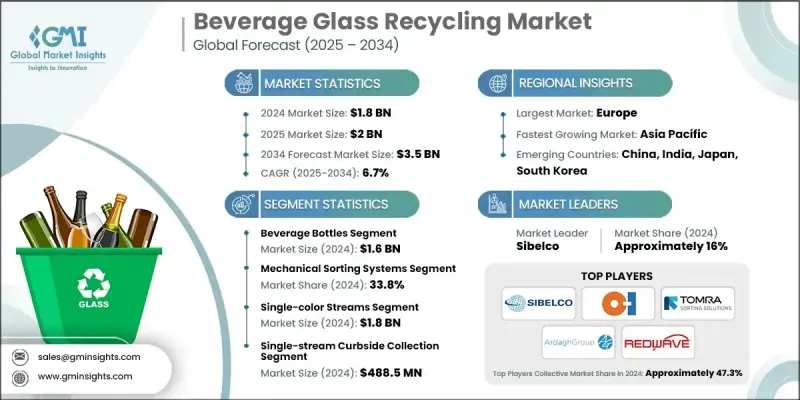

2024 年全球饮料玻璃回收市场价值为 18 亿美元,预计到 2034 年将以 6.7% 的复合年增长率增长至 35 亿美元。

饮料玻璃回收已成为循环经济框架的关键组成部分,它透过机械筛选、光学分选和先进的清洗技术,将消费后的酒精和非酒精饮料瓶罐转化为高品质的碎玻璃。这种精炼后的碎玻璃保持了原生玻璃的性能特征,因此在製造业中得到广泛应用。欧洲凭藉其健全的监管体系、高回收率和确保原料品质稳定的完善系统,仍然是领先的地区。北美地区儘管回收模式各异,但仍维持稳健成长,新的政策发展不断提升回收效率。同时,亚太地区正受惠于人口密度、主要品牌需求的成长以及政府支持的永续发展措施而快速发展。与可追溯性和数位化验证系统相关的监管进步正在透过提高透明度和激励回收商提升资料品质并确保可靠的再生材料认证来重塑市场结构。支持性的资金机制也加强了回收企业与玻璃製造商之间的长期供应合约。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 35亿美元 |

| 复合年增长率 | 6.7% |

2024年,机械分选系统市场规模达6.225亿美元,占市占率的33.8%。这些系统之所以能保持领先地位,是因为它们性能可靠、处理量稳定、分离精度高。其耐用的设计、自动化处理能力和高效的筛选流程,使其特别适用于大规模混合物料处理作业,在这些作业中,稳定的性能至关重要。

2024年,单色玻璃流市场规模达18亿美元,占96%的市场份额,预计2025年至2034年复合年增长率将达到6.6%。由于其卓越的品质和易于加工的特性,单色玻璃流在颜色分选领域占据主导地位。可控的颜色分选能够提高熔体效率、减少污染并提升再生玻璃的价值,使其成为高端製造工艺和闭环回收应用的理想选择,尤其适用于那些对颜色均匀性和纯度要求较高的应用。

预计2025年至2034年,北美饮料玻璃回收市场将以6.3%的复合年增长率成长。企业对永续包装的日益重视以及循环经济策略的广泛应用,持续推动饮料、食品分销和高端包装领域对高品质再生玻璃的需求。此外,对环境问题的日益关注以及向更先进的回收基础设施的转型,也促进了从原生玻璃生产到再生玻璃替代品的长期转变。

全球饮料玻璃回收市场的主要企业包括 Sibelco、OI(欧文斯-伊利诺伊公司)、TOMRA Sorting Solutions、Ardagh Group、REDWAVE、Sesotec GmbH、Reiling Group、SCHOTT AG、Visy Glass、Vetropack Group、Gallo Glass Company、Momentum Recycling、Mid America Recycling 和 Ripple Glass。这些企业依靠多种策略来增强竞争力并扩大市场份额。许多企业正在投资尖端的光学分选系统、即时监控工具和自动化污染检测技术,以提供更高纯度的碎玻璃。与饮料品牌和容器製造商建立策略合作伙伴关係有助于确保长期供应合约和稳定的收入来源。此外,各企业也正在采用数位追踪和资料整合技术,以支援再生材料成分验证和法规遵循。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 陷阱与挑战

- 机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按容器类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依货柜类型划分,2021-2034年

- 主要趋势

- 饮料瓶

- 啤酒瓶(棕色、绿色、透明)

- 葡萄酒瓶(波尔多、勃根地、莱茵风格)

- 烈酒瓶

- 软性饮料和水瓶

- 饮料罐

- 果汁和冰沙罐

- 特种饮料容器

- 梅森罐式饮料

- 广口容器应用

第六章:市场估算与预测:依加工技术类型划分,2021-2034年

- 主要趋势

- 机械分类系统

- 光学分选技术

- 磁分离和涡流分离

- 基于人工智慧的机器人分类

- 先进的清洁和选矿系统

第七章:市场估计与预测:依玻璃颜色划分,2021-2034年

- 主要趋势

- 单色流

- 燧石/透明玻璃(纯度95-100%)

- 琥珀色玻璃(纯度90-100%)

- 绿色玻璃(纯度70-100%)

- 特殊颜色(蓝色、黑色、其他)

- 混合颜色的溪流

- 双色混合

- 三色混合(3-mix)

第八章:市场估算与预测:依收集系统类型划分,2021-2034年

- 主要趋势

- 单流路边收集

- 双流路边收集

- 存款回馈系统(DRS)

- 投放中心和便利项目

- 商业收款系统

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Sibelco

- OI (Owens-Illinois)

- TOMRA Sorting Solutions

- Ardagh Group

- REDWAVE

- Sesotec GmbH

- Reiling Group

- SCHOTT AG

- Visy Glass

- Vetropack Group

- Gallo Glass Company

- Momentum Recycling

- Mid America Recycling

- Ripple Glass

The Global Beverage Glass Recycling Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 3.5 billion by 2034.

Beverage glass recycling has become a key component of circular economy frameworks, as it transforms post-consumer bottles and jars from alcoholic and non-alcoholic beverages into high-quality cullet through mechanical screening, optical sorting, and advanced cleaning technologies. This refined cullet maintains the performance characteristics of virgin glass, supporting its widespread use in manufacturing. Europe remains the leading region due to strong regulatory structures, high recovery rates, and established systems that ensure consistent input quality. North America shows solid growth despite variations in collection models, and new policy developments continue to enhance recovery efficiency. Meanwhile, the Asia Pacific region is expanding rapidly thanks to population density, rising demand from major brands, and government-backed sustainability measures. Regulatory advancements related to traceability and digital verification systems are shaping market structures by promoting transparency and incentivizing recyclers to improve data quality and ensure reliable recycled-content certification. Supportive funding mechanisms also strengthen long-term supply contracts between recycling operations and glass manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 6.7% |

The mechanical sorting systems segment generated USD 622.5 million in 2024 and accounted for a 33.8% share. These systems remain dominant because they offer reliable performance, consistent throughput, and high separation accuracy. Their durable design, automated handling capabilities, and efficient screening processes make them particularly effective for large-scale operations managing high volumes of mixed materials, where consistent performance is essential.

The single-color streams segment accounted for USD 1.8 billion in 2024 and held a substantial share of 96%, with an expected CAGR of 6.6% from 2025 to 2034. These streams lead the color-separation segment due to the superior quality and processing ease they provide. Controlled color sorting improves melt efficiency, reduces contamination, and enhances the value of recycled glass, making this method ideal for premium manufacturing processes and closed-loop recycling applications that depend on uniform color and high purity.

North America Beverage Glass Recycling Market is projected to grow at a CAGR of 6.3% from 2025 to 2034. Increasing corporate commitments to sustainable packaging and broader adoption of circular strategies continue to push demand for high-quality recycled glass in beverages, food distribution, and premium packaging. Environmental concerns and the transition toward more advanced recycling infrastructure also support the long-term shift from virgin glass production to recycled alternatives.

Key companies active in the Global Beverage Glass Recycling Market include Sibelco, O-I (Owens-Illinois), TOMRA Sorting Solutions, Ardagh Group, REDWAVE, Sesotec GmbH, Reiling Group, SCHOTT AG, Visy Glass, Vetropack Group, Gallo Glass Company, Momentum Recycling, Mid America Recycling, and Ripple Glass. Companies in the Beverage Glass Recycling Market rely on several strategies to reinforce their competitiveness and expand market presence. Many are investing in cutting-edge optical sorting systems, real-time monitoring tools, and automated contamination detection to deliver higher-purity cullet. Strategic partnerships with beverage brands and container manufacturers help secure long-term supply contracts and stable revenue streams. Firms are also adopting digital tracking and data-integration technologies that support recycled-content verification and regulatory compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Container type

- 2.2.2 Processing technology type

- 2.2.3 Glass color

- 2.2.4 Collection system type

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By container type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Container Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Beverage bottles

- 5.2.1 Beer bottles (brown, green, clear)

- 5.2.2 Wine bottles (bordeaux, burgundy, rhine styles)

- 5.2.3 Spirit & liquor bottles

- 5.2.4 Soft drink & water bottles

- 5.3 Beverage jars

- 5.3.1 Juice & smoothie jars

- 5.3.2 Specialty beverage containers

- 5.3.3 Mason jar style beverages

- 5.3.4 Wide-mouth container applications

Chapter 6 Market Estimates and Forecast, By Processing Technology Type, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Mechanical sorting systems

- 6.3 Optical sorting technology

- 6.4 Magnetic & eddy current separation

- 6.5 AI-based robotic sorting

- 6.6 Advanced cleaning & beneficiation systems

Chapter 7 Market Estimates and Forecast, By Glass Color, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Single-color streams

- 7.2.1 Flint/clear glass (95-100% purity)

- 7.2.2 Amber glass (90-100% purity)

- 7.2.3 Green glass (70-100% purity)

- 7.2.4 Specialty colors (blue, black, other)

- 7.3 Mixed-color streams

- 7.3.1 Two-color mixes

- 7.3.2 Three-color mixed (3-mix)

Chapter 8 Market Estimates and Forecast, By Collection System Type, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Single-stream curbside collection

- 8.3 Dual-stream curbside collection

- 8.4 Deposit return systems (DRS)

- 8.5 Drop-off centers & convenience programs

- 8.6 Commercial collection systems

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Sibelco

- 10.2 O-I (Owens-Illinois)

- 10.3 TOMRA Sorting Solutions

- 10.4 Ardagh Group

- 10.5 REDWAVE

- 10.6 Sesotec GmbH

- 10.7 Reiling Group

- 10.8 SCHOTT AG

- 10.9 Visy Glass

- 10.10 Vetropack Group

- 10.11 Gallo Glass Company

- 10.12 Momentum Recycling

- 10.13 Mid America Recycling

- 10.14 Ripple Glass