|

市场调查报告书

商品编码

1885861

地中海大气水发生器市场机会、成长驱动因素、产业趋势分析及2025-2034年预测Mediterranean Atmospheric Water Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

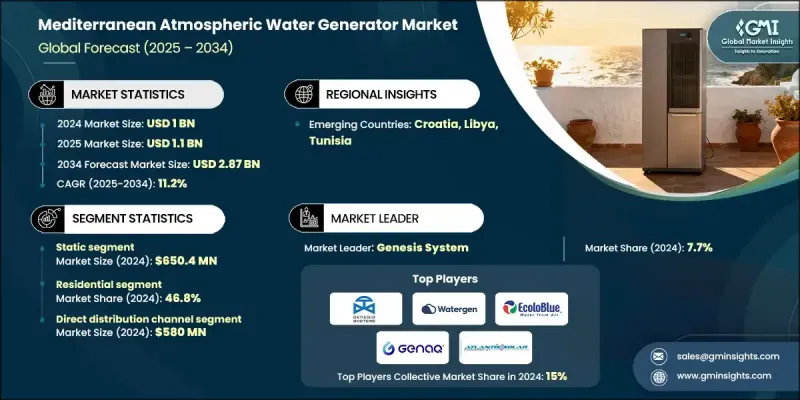

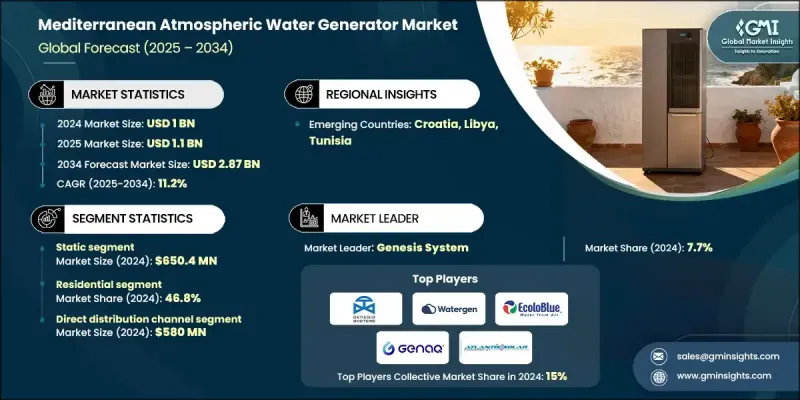

2024 年地中海大气水发生器市场价值为 10 亿美元,预计到 2034 年将以 11.2% 的复合年增长率增长至 28.7 亿美元。

由于气温上升、降雨不规则和地下水位下降,该地区面临持续的水资源压力,市政供水和农业系统承受巨大压力。人口成长和旅游业加剧了用水需求,促使政府、企业和家庭寻求替代水源。大气製水机(AWG)透过直接从空气中製取饮用水,提供了分散式解决方案,有助于减少对传统供水系统的依赖。政策制定者和私部门利害关係人日益重视永续水资源管理和气候适应能力,推动了AWG在家庭、旅馆和工业设施中的应用。在众多技术中,冷却冷凝技术因其稳定的产量和可扩展性而占据主导地位。这些系统透过冷却循环从环境空气中冷凝水分,确保在典型的地中海沿岸中高湿度条件下可靠地生产水,使AWG成为区域水安全的关键工具。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10亿美元 |

| 预测值 | 28.7亿美元 |

| 复合年增长率 | 11.2% |

2024年,固定式空气製水机市场规模达6.504亿美元。固定式空气製水机是永久安装的设备,旨在从环境空气中提取水分,与便携式机型相比,其特点是持续输出量更大、容量更高。这些系统通常安装在住宅、商业或工业场所,利用冷却冷凝技术将空气中的水分转化为饮用水。由于其可靠性高、输出量大,固定式设备尤其适用于湿度适中的地中海地区,可提供持续的用水供应。

2024年,住宅市场占据了46.8%的份额。越来越多的家庭用户寻求使用空气製水机(AWG)作为分散式饮用水源,从而摆脱对市政供水的依赖,尤其是在易受干旱或供水中断影响的地区。住宅用空气製水机通常结构紧凑、节能高效,日产水量为20-100公升,具体产量取决于湿度和温度。人们对永续性和自给自足的日益重视正在推动家用空气製水系统的需求成长。

中东大气製水机市场占据57.2%的市场份额,预计2024年市场规模将达到5.767亿美元。这一增长主要受长期缺水问题以及干旱气候和淡水资源有限国家对永续解决方案的需求所驱动。大气製水机提供了一种分散式、经济高效的替代方案,可取代高能耗的传统海水淡化方法。各国政府和企业日益将大气製水机视为该地区水安全规划的战略组成部分。

地中海大气製水机市场的主要参与者包括Airwater Company、Atlantis Solar、A1RWATER、Agua De Sol、Beyond Water、EcoloBlue、Genaq Technologies、Genesis Systems、HAZAGUA、Island Sky Corp、Saba Technology、SolarDew、Source Global、Watergen和Aquasol。为了巩固市场地位,各公司正致力于产品创新,提高能源效率和产水量,以满足住宅、商业和工业用户日益增长的需求。与政府和私营部门的策略合作正在拓展干旱地区的部署机会。各公司正投资于在地化生产和售后服务,以提高产品的可及性和可靠性。行销活动着重强调永续性优势、摆脱对市政供水的依赖以及紧急用水保障,以吸引具有环保意识的消费者。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 淡水资源极度短缺

- 成熟的冷却冷凝技术

- 支持性的监管环境

- 产业陷阱与挑战

- 高额的资金和能源需求

- 技术复杂性与维护

- 机会

- 智慧家庭集成

- 混合动力和再生能源动力系统

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 主要趋势

- 静止的

- 移动的

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 基于冷凝的系统

- 基于干燥剂的系统

- 先进技术

- MOF技术

- 太阳能热集成

- 水利农业整合系统

第七章:市场估算与预测:依能源类型划分,2021-2034年

- 主要趋势

- 太阳能驱动

- 并网

- 混合再生能源

- 碳负系统

第八章:市场估算与预测:依产能划分,2021-2034年

- 主要趋势

- 1升-500升

- 500升-1000升

- 1000升-5000升

- 5000升以上

第九章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 独立式水发生器

- 农业综合系统

- 食品生产设施

- 温室应用

第十章:市场估计与预测:依最终用途划分,2021-2034年

- 主要趋势

- 住宅

- 商业的

- 工业的

第十一章:市场估价与预测:依配销通路划分,2021-2034年

- 主要趋势

- 直接的

- 间接

第十二章:市场估算与预测:依国家划分,2021-2034年

- 主要趋势

- 欧洲

- 义大利

- 西班牙

- 法国

- 克罗埃西亚

- 北非

- 摩洛哥

- 阿尔及利亚

- 利比亚

- 突尼西亚

- 埃及

- 中东

- 赛普勒斯

- 以色列

- 黎巴嫩

- 巴勒斯坦

- 叙利亚

- 土耳其

第十三章:公司简介

- A1RWATER

- Agua De Sol

- Airwater Company

- Aquasol

- Atlantis Solar

- Beyond Water

- EcoloBlue

- Genaq Technologies

- Genesis Systems

- HAZAGUA

- Island Sky Corp

- Saba Technology

- SolarDew

- Source Global

- Watergen

Mediterranean Atmospheric Water Generator Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 2.87 billion by 2034.

The region faces persistent water stress due to rising temperatures, irregular rainfall, and declining aquifer levels, putting pressure on municipal water supplies and agricultural systems. Population growth and tourism intensify water demand, prompting governments, businesses, and households to explore alternative water sources. Atmospheric water generators (AWGs) offer a decentralized solution by producing potable water directly from air, helping mitigate reliance on conventional water systems. Policymakers and private stakeholders are increasingly emphasizing sustainable water management and climate resilience, driving AWG adoption in homes, hotels, and industrial facilities. Among the technologies, cooling-condensation dominates due to its consistent output and scalability. By condensing moisture from ambient air through refrigeration cycles, these systems ensure reliable water production in the moderate to high humidity conditions typical of the Mediterranean coast, making AWGs a crucial tool for regional water security.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.87 Billion |

| CAGR | 11.2% |

In 2024, the static type segment generated USD 650.4 million. Static AWGs are permanently installed units designed to extract water from ambient air, differing from portable models in their sustained output and higher capacity. These systems are typically fixed in residential, commercial, or industrial premises and use cooling-condensation to convert air moisture into drinking water. Due to their reliability and higher output, static units are particularly suitable for Mediterranean regions with moderate humidity levels, providing continuous water availability.

The residential segment held a 46.8% share in 2024. Homeowners increasingly seek AWGs as a decentralized source of potable water, offering independence from municipal supplies, particularly in areas prone to drought or supply interruptions. Residential units are generally compact, energy-efficient, and capable of producing 20-100 liters of water daily, depending on humidity and temperature. The growing focus on sustainability and self-sufficiency is fueling demand for home-based AWG systems.

The Middle East Atmospheric Water Generator Market held a 57.2% share, generating USD 576.7 million in 2024. This growth is driven by chronic water scarcity and the demand for sustainable solutions in countries with arid climates and limited freshwater resources. AWGs provide a decentralized, cost-effective alternative to traditional desalination methods, which are energy-intensive. Governments and businesses increasingly view AWGs as a strategic component of water security planning across the region.

Key players operating in the Mediterranean Atmospheric Water Generator Market include Airwater Company, Atlantis Solar, A1RWATER, Agua De Sol, Beyond Water, EcoloBlue, Genaq Technologies, Genesis Systems, HAZAGUA, Island Sky Corp, Saba Technology, SolarDew, Source Global, Watergen, and Aquasol. To strengthen their presence, companies are focusing on product innovation, enhancing energy efficiency, and water output to meet the growing needs of residential, commercial, and industrial users. Strategic partnerships with governments and the private sectors are expanding deployment opportunities in drought-prone areas. Firms are investing in localized manufacturing and after-sales support to improve accessibility and reliability. Marketing campaigns highlight sustainability benefits, independence from municipal supplies, and emergency water security, appealing to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Energy source

- 2.2.5 Capacity

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Acute freshwater scarcity

- 3.2.1.2 Mature cooling-condensation technology

- 3.2.1.3 Supportive regulatory environment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and energy requirements

- 3.2.2.2 Technical complexity and maintenance

- 3.2.3 Opportunities

- 3.2.3.1 Smart-home integration

- 3.2.3.2 Hybrid and renewable-powered systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Static

- 5.3 Mobile

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Condensation-based systems

- 6.3 Desiccant-based systems

- 6.4 Advanced technologies

- 6.5 MOF technology

- 6.6 Solar-thermal integration

- 6.7 Integrated water-agriculture systems

Chapter 7 Market Estimates and Forecast, By Energy Source, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Solar-powered

- 7.3 Grid-connected

- 7.4 Hybrid renewable

- 7.5 Carbon negative systems

Chapter 8 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 1L-500L

- 8.3 500L-1000L

- 8.4 1000L-5000L

- 8.5 Above 5000L

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Standalone water generation

- 9.3 Agriculture-integrated systems

- 9.4 Food production facilities

- 9.5 Greenhouse applications

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.4 Industrial

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates and Forecast, By Countries, 2021 - 2034 (USD Million) (Thousand Units)

- 12.1 Key trends

- 12.2 Europe

- 12.2.1 Italy

- 12.2.2 Spain

- 12.2.3 France

- 12.2.4 Croatia

- 12.3 North Africa

- 12.3.1 Morocco

- 12.3.2 Algeria

- 12.3.3 Libya

- 12.3.4 Tunisia

- 12.3.5 Egypt

- 12.4 Middle East

- 12.4.1 Cyprus

- 12.4.2 Israel

- 12.4.3 Lebanon

- 12.4.4 Palestine

- 12.4.5 Syria

- 12.4.6 Turkey

Chapter 13 Company Profiles

- 13.1 A1RWATER

- 13.2 Agua De Sol

- 13.3 Airwater Company

- 13.4 Aquasol

- 13.5 Atlantis Solar

- 13.6 Beyond Water

- 13.7 EcoloBlue

- 13.8 Genaq Technologies

- 13.9 Genesis Systems

- 13.10 HAZAGUA

- 13.11 Island Sky Corp

- 13.12 Saba Technology

- 13.13 SolarDew

- 13.14 Source Global

- 13.15 Watergen