|

市场调查报告书

商品编码

1885863

风扇马达市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Fan Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

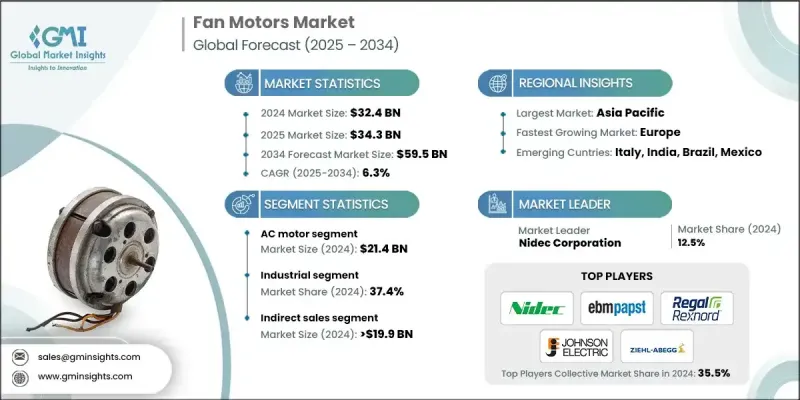

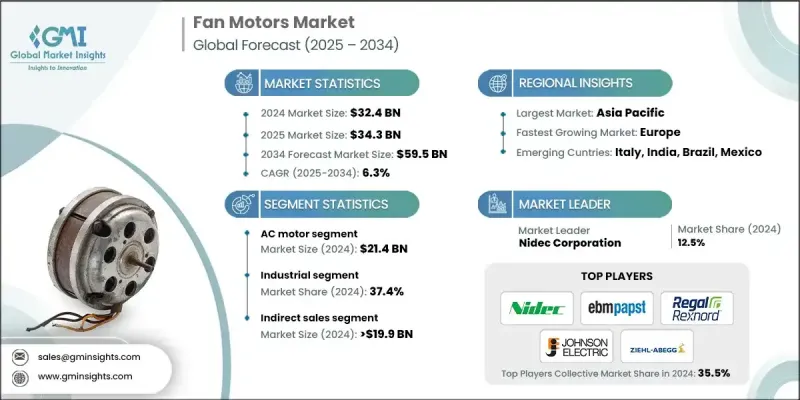

2024 年全球风扇马达市场价值为 324 亿美元,预计到 2034 年将以 6.3% 的复合年增长率增长至 595 亿美元。

儘管产业持续成长,但仍面临着与价格敏感型消费者相关的挑战,尤其是在新兴地区,小型製造商面临着在不牺牲性能的前提下保持低价的压力。随着政府政策日益严格和消费者期望不断提高,永续技术的应用加速,风扇马达的需求也稳定转向节能型产品。欧盟的能源指令也加大了对马达设计能源效率标准的要求。同时,降噪已成为产品的重要考量因素,因为消费者越来越倾向于选择噪音较低的电器。製造商正致力于采用先进的工程技术来满足这些期望,同时保持产品的性能和耐用性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 324亿美元 |

| 预测值 | 595亿美元 |

| 复合年增长率 | 6.3% |

2024年,交流电机市场规模预计将达214亿美元。由于价格实惠、经久耐用且应用广泛,交流电机仍然是最常用的马达类型。此外,由于其初始成本较低且维护需求较少,交流马达在大型应用中也继续占据主导地位。

2024年,产业领域占37.4%的市场份额,成为最具影响力的终端用户类别。工业生产过程中,通风、冷却、空气处理和生产流程高度依赖风扇和电机,导致电力消耗巨大。高效能马达技术已成为工业环境中不可或缺的一部分,优化能源利用能够直接降低营运成本。

2024年,美国风扇马达市占率达74.3%。该地区各公司正加大对先进电机技术的投资,旨在提高效率并降低资源消耗。产业组织也持续强调,随着製造商响应全球能源效率标准以及客户对环保解决方案日益增长的需求,永续马达设计的重要性日益凸显。

全球风扇马达市场的主要参与者包括Ametek、Emerson Electric、ebm papst、Fantech、Johnson Electric、Mitsumi Electric、Nidec、New York Blower、Orion Fans、Revcor、Sanyo Denki、Sunon、TECO Westinghouse、Toshiba和ZIEHL-ABEGG。风扇马达产业的企业正透过加速开发符合全球市场日益严格的能源法规的高效能马达来增强其竞争地位。许多企业正在扩展其产品组合,提供低噪音、紧凑型和数位化控制的马达解决方案,以满足工业和住宅应用的需求。对自动化、智慧製造和优化供应链系统的投资使企业能够在降低生产成本的同时提高产品品质。一些製造商也致力于长期永续发展,例如采用可回收材料、减少碳足迹以及设计具有更高生命週期效率的马达。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 节能家电的需求不断成长

- 技术进步

- 智慧家庭设备的成长

- 产业陷阱与挑战

- 成本考量

- 消费者偏好的转变

- 机会

- 对永续性的需求日益增长

- 人工智慧的技术进步

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计

- 主要进口国

- 主要出口国

- 风险评估与缓解

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依类型划分,2021-2034年

- 直流马达

- 交流马达

- EC Motors

第六章:市场估算与预测:依功率等级划分,2021-2034年

- 小型马达(小于0.5马力)

- 中型马达(0.5 至 5 马力)

- 大型马达(大于 5 马力)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 暖通空调

- 汽车

- 工业的

- 电子冷却

- 家用电器

第八章:市场估算与预测:依配销通路划分,2021-2034年

- 直接的

- 间接

第九章:市场估计与预测:依地区划分,2021-2034年

- 钥匙

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Ametek

- Emerson Electric

- ebm-papst

- Fantech

- Johnson Electric

- Mitsumi Electric

- Nidec

- New York Blower

- Orion Fans

- Revcor

- Sanyo Denki

- Sunon

- TECO Westinghouse

- Toshiba

- ZIEHL-ABEGG

The Global Fan Motors Market was valued at USD 32.4 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 59.5 billion by 2034.

While the industry continues to grow, it still faces challenges tied to cost-sensitive buyers, particularly in emerging regions where smaller manufacturers operate under pressure to keep prices low without compromising on performance. Demand for fan motors has steadily shifted toward energy-efficient models as tighter government policies and growing consumer expectations accelerate the adoption of sustainable technologies. The European Union's energy directives have also intensified the push toward higher efficiency standards across electric motor designs. At the same time, noise reduction has become a defining product priority, as consumers increasingly favor quieter appliances. Manufacturers are focusing on advanced engineering techniques to meet these expectations while maintaining performance and durability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.4 Billion |

| Forecast Value | $59.5 Billion |

| CAGR | 6.3% |

The AC motor segment generated USD 21.4 billion in 2024. These motors remain the most used type due to their affordability, durability, and broad operational versatility. They continue to dominate large-scale applications because of their lower initial cost and reduced maintenance requirements.

The industrial sector held a 37.4% share in 2024, making it the most influential end-use category. Industrial operations rely heavily on fans and motors for ventilation, cooling, air handling, and production processes, leading to substantial electricity consumption. High-efficiency motor technologies have become essential across industrial environments, where optimized energy use directly supports lower operating costs.

U.S. Fan Motors Market held 74.3% share in 2024. Companies across the region are increasingly directing investments toward advanced motor technologies designed to enhance efficiency and reduce resource consumption. Industry organizations also continue to highlight the rising prioritization of sustainable motor designs as manufacturers respond to global efficiency standards and customers' growing preference for environmentally conscious solutions.

Major players active in the Global Fan Motors Market include Ametek, Emerson Electric, ebm papst, Fantech, Johnson Electric, Mitsumi Electric, Nidec, New York Blower, Orion Fans, Revcor, Sanyo Denki, Sunon, TECO Westinghouse, Toshiba, and ZIEHL-ABEGG. Companies in the fan motors industry are strengthening their competitive positions by accelerating the development of high-efficiency motors that comply with tightening energy regulations across global markets. Many are expanding their portfolios with low-noise, compact, and digitally controlled motor solutions tailored to both industrial and residential applications. Investments in automation, smart manufacturing, and optimized supply chain systems are enabling firms to reduce production costs while improving product quality. Several manufacturers are also focusing on long-term sustainability by incorporating recyclable materials, reducing carbon footprints, and designing motors with enhanced lifecycle efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Power Rating

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for energy efficient appliances

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growth of smart home devices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Cost concerns

- 3.2.2.2 Shift in consumer preferences

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for sustainability

- 3.2.3.2 Technological advancements in AI

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Risk assessment and mitigation

- 3.10 Gap Analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 DC Motors

- 5.2 AC Motors

- 5.3 EC Motors

Chapter 6 Market Estimates & Forecast, By Power Ratings, 2021-2034 (USD Million) (Million Units)

- 6.1 Small Motors (Less than 0.5 HP)

- 6.2 Medium Motors (Between 0.5 and 5 HP)

- 6.3 Large Motors (Greater than 5 HP)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Million Units)

- 7.1 HVAC

- 7.2 Automotive

- 7.3 Industrial

- 7.4 Electronics cooling

- 7.5 Appliances

Chapter 8 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Million) (Million Units)

- 8.1 Direct

- 8.2 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Units)

- 9.1 Key

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ametek

- 10.2 Emerson Electric

- 10.3 ebm-papst

- 10.4 Fantech

- 10.5 Johnson Electric

- 10.6 Mitsumi Electric

- 10.7 Nidec

- 10.8 New York Blower

- 10.9 Orion Fans

- 10.10 Revcor

- 10.11 Sanyo Denki

- 10.12 Sunon

- 10.13 TECO Westinghouse

- 10.14 Toshiba

- 10.15 ZIEHL-ABEGG