|

市场调查报告书

商品编码

1885903

中空纤维膜市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Hollow Fiber Membrane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

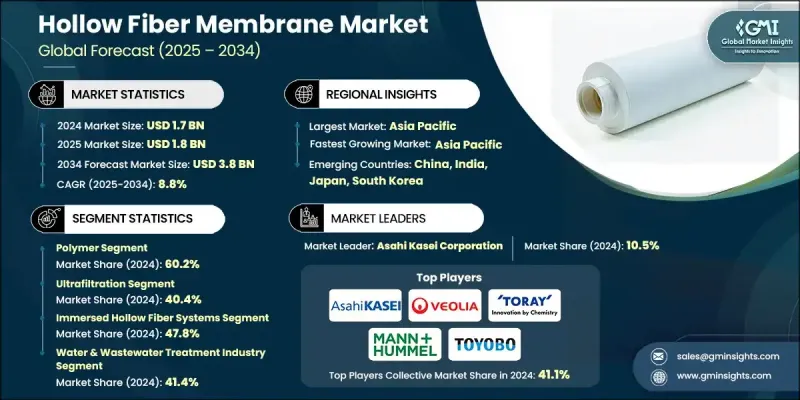

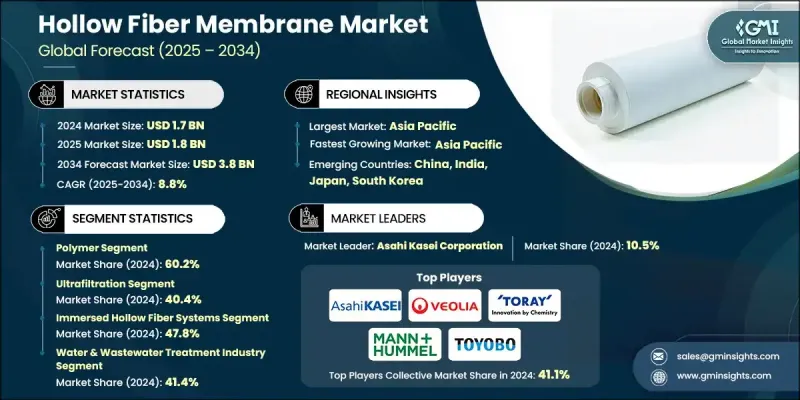

2024 年全球中空纤维膜市场价值为 17 亿美元,预计到 2034 年将以 8.8% 的复合年增长率增长至 38 亿美元。

中空纤维膜最初是为实验室规模应用而设计的,如今已成为基础设施和生命维持系统的关键组件,并受到日益严格的监管。医疗保健和工业领域的安全性和有效性标准,以及其作为处理难降解污染物的领先技术的认可,推动了中空纤维膜的广泛应用。该行业依靠先进的聚合物化学和高精度製造过程来生产具有严格控制的孔隙结构的薄膜。高准入门槛,包括监管批准、巨额资金投入和专业技术知识,往往有利于那些拥有成熟业绩记录的垂直整合型企业。市场参与者大致可分为三类:专注于医疗保健领域、注重合规性的公司;提供经济高效且耐用解决方案的工业供应商;以及拥有多元化跨应用产品组合的多领域企业。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 8.8% |

2024年,聚合物膜市占率达到60.2%,预计到2034年将以8.5%的复合年增长率成长。由于其成本效益高、用途广泛且易于生产,聚合物薄膜在水处理、透析和工业流程等领域的广泛应用使其成为主流材料选择。技术进步进一步提高了聚合物薄膜的渗透性、耐久性和抗污染性,加速了市场成长。

2024年,超滤技术领域的市占率达到40.4%,预计2025年至2034年间将以9.1%的复合年增长率成长。超滤膜能够高效分离水和液体中的病毒、蛋白质和其他高分子量化合物,这推动了市场对其需求的成长。工业和市政运作中水资源循环利用的日益普及也进一步促进了超滤技术的应用。其较低的能耗和营运成本使其成为各种应用领域越来越受欢迎的选择。

2024年,欧洲中空纤维膜市场规模预计将达到3.025亿美元。欧洲市场既趋于成熟,又面临不断变化的需求,这主要得益于日益严格的环境法规和永续发展措施。废水排放和水质标准的相关法规,使得市政、工业和医疗保健等行业对高效膜过滤解决方案的需求日益增长。德国、英国和法国是推动此技术应用的主要国家,这些国家的节水和污染控制计画为市场扩张提供了强力支撑。

全球中空纤维膜市场的主要企业包括旭化成株式会社、Kovalus Separation Solutions、Polymem France、三菱化学株式会社、杜邦公司、NX Filtration、Oxymo Technology、曼胡默尔公司、东丽株式会社、PHILOS Co., Ltd、Theway Membranes、紫木工业股份有限公司、九间高会公司、PHILOS Co., Ltd、Theway Membranes、紫树工业股份有限公司、九 Technologies公司科技有限公司、九版高薄膜技术有限公司、九头工业有限公司Ltd.、东洋纺株式会社、LG化学、Medica Group、威立雅集团和Zena Membranes。这些领导者致力于拓展产品组合,涵盖医疗保健和工业应用领域,加大研发投入以提高薄膜的性能和耐久性,并建立策略联盟以增强分销网络。许多企业也采用成本优化技术,扩大产能,并利用监管认证来提升信誉度。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依材料类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料类型划分,2021-2034年

- 主要趋势

- 聚合物

- 聚砜(PS)

- 聚醚砜(PES)

- 聚偏二氟乙烯(PVDF)

- 聚丙烯腈(PAN)

- 聚酰亚胺(PI)

- 其他聚合物

- 陶瓷製品

- 合成的

第六章:市场估算与预测:依过滤类型划分,2021-2034年

- 主要趋势

- 微滤

- 超滤

- 奈米过滤

- 逆渗透

第七章:市场估计与预测:依技术配置划分,2021-2034年

- 主要趋势

- 浸没式中空纤维系统

- 切向流过滤(TFF)

- 死端过滤

- 真空膜蒸馏

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 水和废水处理

- 製药与生物技术

- 食品饮料加工

- 化学加工

- 血液净化/血液透析

- 环境保护

- 气体分离与回收

- 其他的

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 市政

- 工业的

- 製造业

- 发电

- 石油和天然气

- 卫生保健

- 餐饮

- 其他的

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十一章:公司简介

- Asahi Kasei Corporation

- Kovalus Separation Solutions

- Polymem France

- Mitsubishi Chemical Corporation

- DuPont

- NX Filtration

- Oxymo Technology

- Mann+Hummel

- Toray Industries, Inc.

- PHILOS Co., Ltd

- Theway Membranes

- Zig Sheng Industrial Co., Ltd

- Jiuwu Hi-Tech Membrane Technology

- Aquabrane Water Technologies Pvt. Ltd.

- Toyobo

- LG Chem

- Medica Group

- Veolia

- Zena Membranes

The Global Hollow Fiber Membrane Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 3.8 billion by 2034.

Hollow fiber membranes, initially designed for laboratory-scale applications, have become critical components in infrastructure and life-support systems, supported by growing regulatory oversight. Their adoption is driven by safety and efficacy standards for healthcare and industrial use, coupled with recognition as leading technologies for treating challenging contaminants. The industry relies on advanced polymer chemistry and highly precise manufacturing to create membranes with tightly controlled pore structures. High entry barriers, including regulatory approvals, substantial capital requirements, and specialized technical knowledge, tend to favor established, vertically integrated firms with proven track records. Market players can be broadly categorized into healthcare-focused companies emphasizing compliance, industrial providers delivering cost-efficient and durable solutions, and multi-segment players with diverse cross-application portfolios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 8.8% |

The polymer membranes segment held 60.2% share in 2024 and is expected to grow at a CAGR of 8.5% through 2034. Their broad application across water treatment, dialysis, and industrial processes makes them the dominant material choice due to cost-effectiveness, versatility, and ease of production. Technological advancements have further improved their permeability, durability, and resistance to fouling, accelerating market growth.

The ultrafiltration technology segment held a 40.4% share in 2024 and is projected to grow at a CAGR of 9.1% during 2025-2034. The demand for ultrafiltration membranes is fueled by their efficiency in separating viruses, proteins, and other high-molecular-weight compounds from water and fluids. Growing initiatives for water recycling and reuse in industrial and municipal operations have further increased the adoption of ultrafiltration. Its lower energy requirements and operational costs make it an increasingly preferred choice for various applications.

Europe Hollow Fiber Membrane Market generated USD 302.5 million in 2024. The market in Europe combines maturity with evolving demands, driven by stringent environmental regulations and sustainability initiatives. Regulations on waste discharge and water quality standards have intensified the need for efficient membrane filtration solutions in municipal, industrial, and healthcare sectors. Key countries driving adoption include Germany, the UK, and France, where water conservation and pollution control programs support market expansion.

Major companies in the Global Hollow Fiber Membrane Market include Asahi Kasei Corporation, Kovalus Separation Solutions, Polymem France, Mitsubishi Chemical Corporation, DuPont, NX Filtration, Oxymo Technology, Mann+Hummel, Toray Industries, Inc., PHILOS Co., Ltd, Theway Membranes, Zig Sheng Industrial Co., Ltd, Jiuwu Hi-Tech Membrane Technology, Aquabrane Water Technologies Pvt. Ltd., Toyobo, LG Chem, Medica Group, Veolia, and Zena Membranes. Leading companies in the Global Hollow Fiber Membrane Market focus on strategies such as expanding their product portfolios across healthcare and industrial applications, investing in R&D to improve membrane performance and durability, and forming strategic alliances to enhance distribution networks. Many are adopting cost optimization techniques, scaling up production capacity, and leveraging regulatory certifications to strengthen credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Filtration type

- 2.2.4 Technology configuration

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By material type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Million) (Thousand Square Meter)

- 5.1 Key trends

- 5.2 Polymer

- 5.2.1 Polysulfone (PS)

- 5.2.2 Polyethersulfone (PES)

- 5.2.3 Polyvinylidene Fluoride (PVDF)

- 5.2.4 Polyacrylonitrile (PAN)

- 5.2.5 Polyimide (PI)

- 5.2.6 Other Polymers

- 5.3 Ceramic

- 5.4 Composite

Chapter 6 Market Estimates and Forecast, By Filtration Type, 2021-2034 (USD Million) (Thousand Square Meter)

- 6.1 Key trends

- 6.2 Microfiltration

- 6.3 Ultrafiltration

- 6.4 Nanofiltration

- 6.5 Reverse osmosis

Chapter 7 Market Estimates and Forecast, By Technology Configuration, 2021-2034 (USD Million) (Thousand Square Meter)

- 7.1 Key trends

- 7.2 Immersed hollow fiber systems

- 7.3 Tangential flow filtration (TFF)

- 7.4 Dead-end filtration

- 7.5 Vacuum membrane distillation

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Thousand Square Meter)

- 8.1 Key trends

- 8.2 Water & wastewater treatment

- 8.3 Pharmaceutical & biotechnology

- 8.4 Food & beverage processing

- 8.5 Chemical processing

- 8.6 Blood purification/hemodialysis

- 8.7 Environmental protection

- 8.8 Gas separation & recovery

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Thousand Square Meter)

- 9.1 Key trends

- 9.2 Municipal

- 9.3 Industrial

- 9.3.1 Manufacturing

- 9.3.2 Power generation

- 9.3.3 Oil & gas

- 9.4 Healthcare

- 9.5 Food & beverage

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Thousand Square Meter)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Asahi Kasei Corporation

- 11.2 Kovalus Separation Solutions

- 11.3 Polymem France

- 11.4 Mitsubishi Chemical Corporation

- 11.5 DuPont

- 11.6 NX Filtration

- 11.7 Oxymo Technology

- 11.8 Mann+Hummel

- 11.9 Toray Industries, Inc.

- 11.10 PHILOS Co., Ltd

- 11.11 Theway Membranes

- 11.12 Zig Sheng Industrial Co., Ltd

- 11.13 Jiuwu Hi-Tech Membrane Technology

- 11.14 Aquabrane Water Technologies Pvt. Ltd.

- 11.15 Toyobo

- 11.16 LG Chem

- 11.17 Medica Group

- 11.18 Veolia

- 11.19 Zena Membranes