|

市场调查报告书

商品编码

1885925

医疗产品市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Medical Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

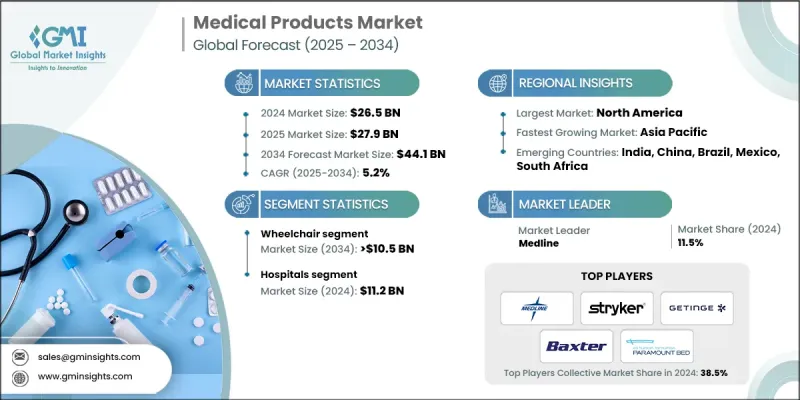

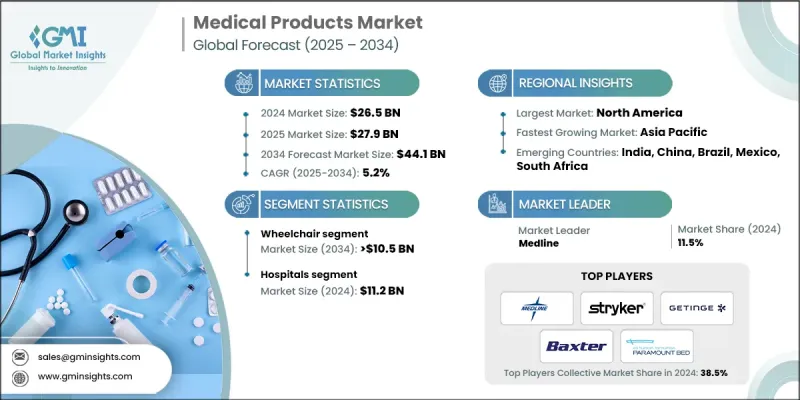

2024 年全球医疗产品市场价值为 265 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 441 亿美元。

市场扩张的驱动因素包括人口老化、残疾人数增加以及对先进的行动辅助、骨科和家庭医疗保健解决方案日益增长的需求。医疗产品为医院、诊所和家庭护理服务机构提供创新工具和设备,旨在提高病患安全、舒适度和营运效率。主要产品包括医用床、移动辅助设备、患者搬运设备和骨科支撑,所有这些产品都旨在增强康復效果、提高舒适度和整体生活品质。技术创新在该市场中发挥关键作用,智慧病床、符合人体工学的骨科支撑、电动移动设备和数位监测系统在改善患者疗效和安全性的同时,也简化了临床工作流程。物联网和智慧感测器的整合实现了远端患者监测和远端康復,从而拓展了家庭护理的机会。此外,已开发地区和新兴地区对医疗保健基础设施的持续投入也促进了医疗产品的广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 265亿美元 |

| 预测值 | 441亿美元 |

| 复合年增长率 | 5.2% |

预计到2034年,医用床市场将以4.5%的复合年增长率成长,而轮椅市场仍将保持领先。轮椅分为手动和电动两种类型,其需求不断增长的驱动因素包括老年人、慢性病患者和受伤者行动不便的情况。人们对无障碍标准和復健方案的认识不断提高,推动了医院、长期照护机构和家庭护理环境中手动和电动轮椅的普及。

2025年至2034年间,医院业务部门占27.9%,营收达112亿美元。医院是先进病患照护解决方案、復健设备和手术辅助设备的主要需求方。为满足日益严格的医疗标准,医院不断升级设备,因此需要医用床、病患搬运工具、助行器和矫形支架等。

2024年,北美医疗产品市占率达33.3%。该地区受益于人口结构、技术和经济等多方面因素的共同作用。人口老化、慢性病和行动不便的增加,催生了对医用床、助行器、矫形支架和居家护理解决方案的强劲需求。先进的医疗基础设施,以及对医院、诊所和长期护理机构的大量投资,也促进了技术先进的医疗产品的广泛应用。

全球医疗产品市场的主要参与者包括Pride Mobility Products、Medline、Gendron、Baxter、Sunrise Medical、Cardinal Health、Stryker Corporation、INTCO MEDICAL TECHNOLOGY、Paramount Bed、Getinge AB、GF Health Products、Compass Health Brands、Antano Group、Invacare Corporation Bed、Getinge AB、GF Health Products、Compass Health Brands、Antano Group、Invacare Corporation和Malvestio。医疗产品市场的企业正透过创新、拓展产品组合和加大研发投入来提升病患疗效,巩固自身市场地位。策略合作和收购有助于扩大地域覆盖范围和分销网络。各企业致力于开发技术先进且符合人体工学的解决方案,以在竞争激烈的市场环境中脱颖而出。永续发展措施、提升客户服务、遵守全球医疗保健标准,都有助于增强品牌信誉。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 老年人口基数不断增加

- 残疾人数和道路交通事故数量不断增加

- 技术进步

- 增加对医疗基础建设和医疗设施的投资

- 产业陷阱与挑战

- 严格的监管

- 该设备成本高昂

- 市场机会

- 家庭医疗保健和远距復健的拓展

- 新兴经济体需求不断成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 技术格局

- 当前技术趋势

- 智慧病床,可调节位置并具备病人监护功能

- 电动且符合人体工学的轮椅,增强行动能力

- 物联网赋能的病患搬运与復健设备

- 新兴技术

- 人工智慧驱动的患者监测和预测分析

- 用于远距復健的物联网连接矫形支架。

- 语音控制与自动化医院病床系统

- 当前技术趋势

- 差距分析

- 2024年产品定价分析

- 报销方案

- 品牌分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 家庭医疗保健和远距復健解决方案的扩展

- 智慧、互联、以病人为中心的医疗产品

- 采用节能、低维护的设备

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 轮椅

- 手动轮椅

- 折迭式手动轮椅

- 硬架手动轮椅

- 电动轮椅

- 医用床

- 病床

- 检查床

- 按摩床

- 担架床

- 其他医疗床

- 沃克

- 双手持助行器

- 单手助行器

- 浴室辅助产品

- 便盆

- 浴缸座椅

- 淋浴座椅

- 其他浴室辅助产品

- 骨科

- 颈托支撑

- 肩部支撑

- 手臂吊带

- 腕部夹板

- 腹部束带

- 孕妇腰带

- 弹性绷带

- 空中护盾步行者

- 护膝

- 其他产品

第六章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 门诊手术中心

- 家庭医疗保健

- 其他最终用途

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Antano Group

- Baxter

- Cardinal Health

- Compass Health Brands

- Gendron

- Getinge AB

- GF Health Products

- INTCO MEDICAL TECHNOLOGY

- Invacare Corporation

- Malvestio Spa

- Medline

- Paramount Bed

- Pride Mobility Products

- Stryker Corporation

- Sunrise Medical

The Global Medical Products Market was valued at USD 26.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 44.1 billion by 2034.

Market expansion is driven by an aging population, increasing prevalence of disabilities, and rising demand for advanced mobility, orthopedic, and home healthcare solutions. Medical products provide innovative tools and equipment for hospitals, clinics, and home care services, aimed at improving patient safety, comfort, and operational efficiency. Key offerings include medical beds, mobility aids, patient handling equipment, and orthopedic supports, all designed to enhance rehabilitation, comfort, and overall quality of life. Technological innovation plays a pivotal role in this market, with smart hospital beds, ergonomic orthopedic supports, powered mobility devices, and digital monitoring systems improving patient outcomes and safety while streamlining clinical workflows. The integration of IoT and smart sensors allows remote patient monitoring and tele-rehabilitation, expanding opportunities in home care. Additionally, increasing investments in healthcare infrastructure across developed and emerging regions are supporting widespread adoption of medical products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.5 Billion |

| Forecast Value | $44.1 Billion |

| CAGR | 5.2% |

The medical beds segment is projected to grow at a CAGR of 4.5% through 2034, while the wheelchairs segment remains the market leader. Wheelchairs are divided into manual and powered types, with rising demand fueled by mobility impairments from aging, chronic conditions, and injuries. Awareness of accessibility standards and rehabilitation protocols is driving adoption of both manual and powered wheelchairs across hospitals, long-term care facilities, and home care environments.

The hospitals segment held a 27.9% share and generated USD 11.2 billion during 2025-2034. Hospitals drive demand for advanced patient care solutions, rehabilitation devices, and surgical support equipment. Continuous upgrades to meet stringent healthcare standards necessitate medical beds, patient handling tools, mobility aids, and orthopedic supports.

North America Medical Products Market held a 33.3% share in 2024. The region benefits from a combination of demographic, technological, and economic factors. An aging population with increasing chronic illnesses and mobility limitations creates strong demand for medical beds, mobility devices, orthopedic supports, and home care solutions. Advanced healthcare infrastructure, along with substantial investments in hospitals, clinics, and long-term care facilities, supports widespread adoption of technologically advanced medical products.

Key players in the Global Medical Products Market include Pride Mobility Products, Medline, Gendron, Baxter, Sunrise Medical, Cardinal Health, Stryker Corporation, INTCO MEDICAL TECHNOLOGY, Paramount Bed, Getinge AB, GF Health Products, Compass Health Brands, Antano Group, Invacare Corporation, and Malvestio Spa. Companies in the Medical Products Market are strengthening their presence through innovation, expanding product portfolios, and investing in R&D to improve patient outcomes. Strategic partnerships and acquisitions help broaden geographic reach and distribution networks. Businesses are focusing on developing technologically advanced and ergonomic solutions to differentiate themselves in the competitive landscape. Sustainability initiatives, enhanced customer service, and compliance with global healthcare standards reinforce brand credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population base

- 3.2.1.2 Rising number of disabilities and road accidents

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing investments in healthcare infrastructural development and healthcare facilities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulations

- 3.2.2.2 High cost of the device

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in home healthcare and tele-rehabilitation

- 3.2.3.2 Increasing demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Smart hospital beds with adjustable positions and patient monitoring

- 3.5.1.2 Powered and ergonomic wheelchairs for enhanced mobility

- 3.5.1.3 IoT-enabled patient handling and rehabilitation devices

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-driven patient monitoring and predictive analytics

- 3.5.2.2 IoT-connected orthopedic supports for remote rehabilitation.

- 3.5.2.3 Voice-controlled and automated hospital bed systems

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Pricing analysis, by product, 2024

- 3.8 Reimbursement scenario

- 3.9 Brand analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.12.1 Expansion of home healthcare and tele-rehabilitation solutions

- 3.12.2 Smart, connected, and patient-centric medical products

- 3.12.3 Adoption of energy-efficient, low-maintenance devices

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launch

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wheelchairs

- 5.2.1 Manual wheelchair

- 5.2.2 Folding frame manual wheelchairs

- 5.2.3 Rigid frame manual wheelchairs

- 5.2.4 Powered wheelchair

- 5.3 Medical beds

- 5.3.1 Patient beds

- 5.3.2 Examination beds

- 5.3.3 Massage beds

- 5.3.4 Gurney beds

- 5.3.5 Other medical beds

- 5.4 Walkers

- 5.4.1 Double handed walkers

- 5.4.2 Single handed walkers

- 5.5 Bathroom assistive products

- 5.5.1 Commodes

- 5.5.2 Bathtub seats

- 5.5.3 Shower seats

- 5.5.4 Other bathroom assistive products

- 5.6 Orthopedics

- 5.6.1 Cervical collar support

- 5.6.2 Shoulder support

- 5.6.3 Arm sling

- 5.6.4 Wrist splint

- 5.6.5 Abdominal binder

- 5.6.6 Maternity belt

- 5.6.7 Elastic bandage

- 5.6.8 Air shield walker

- 5.6.9 Knee support

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Home healthcare

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Antano Group

- 8.2 Baxter

- 8.3 Cardinal Health

- 8.4 Compass Health Brands

- 8.5 Gendron

- 8.6 Getinge AB

- 8.7 GF Health Products

- 8.8 INTCO MEDICAL TECHNOLOGY

- 8.9 Invacare Corporation

- 8.10 Malvestio Spa

- 8.11 Medline

- 8.12 Paramount Bed

- 8.13 Pride Mobility Products

- 8.14 Stryker Corporation

- 8.15 Sunrise Medical