|

市场调查报告书

商品编码

1892666

固态电池电解液市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Solid State Battery Electrolyte Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

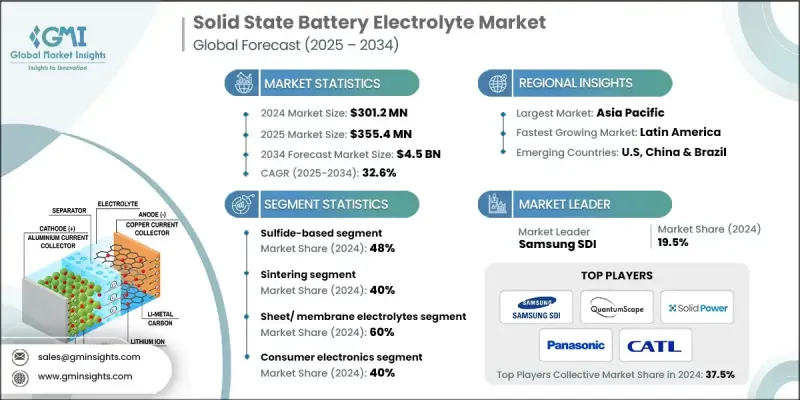

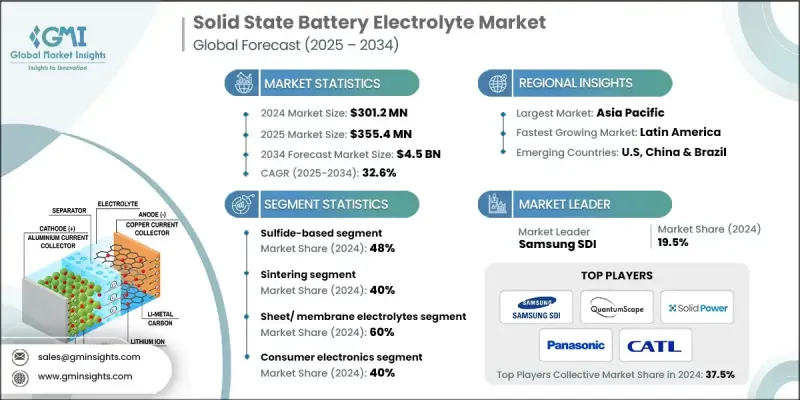

2024 年全球固态电池电解液市值为 3.012 亿美元,预计到 2034 年将以 32.6% 的复合年增长率增长至 45 亿美元。

预计亚太地区将实现最快成长,其中中国在硫化物和聚合物电解质领域的投资处于领先地位,北美和欧洲紧随其后。拉丁美洲和中东及非洲地区也展现出强劲潜力,这得益于丰富的锂资源、电动车的日益普及以及国内可再生能源计划的推进,这些因素将推动新增产能。技术进步、大规模电池製造以及监管支援正在加速固态电解质在全球的应用。计算筛选和机器学习正被用来发现具有高离子电导率和增强电化学稳定性的材料。界面工程、晶界优化以及锂金属负极的保护涂层等创新技术正在提升安全性、循环寿命和能量密度,使其在电动车、消费性电子产品和储能係统等领域得到更广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.012亿美元 |

| 预测值 | 45亿美元 |

| 复合年增长率 | 32.6% |

2024年,氧化物电解质市场规模达8,430万美元。这些材料具有优异的机械强度、电化学稳定性和与锂金属负极的兼容性,使其成为汽车和消费性电子产品的理想选择。然而,其较高的烧结温度和固有的脆性使其製造过程较为复杂。

由于薄膜电解质具有轻质结构、高体积能量密度和均匀的离子传输等优点,预计到2024年,其市场规模将达到6,020万美元。这些薄膜通常采用物理气相沉积(PVD)或原子层沉积(ALD)技术製备,以获得无缺陷的均匀薄膜,但规模化生产成本高且极具挑战性。

预计2024年,北美固态电池电解液市场将占30%的份额。该地区的成长得益于电动车普及率的提高、储能需求的增加以及消费性电子产品应用的普及。美国市场受惠于政府支持的专案和资金支持,以及QuantumScape、Solid Power和Factorial Energy等公司的投资。加拿大则透过与公共研究机构和大学合作建立原型规模的生产设施,为市场发展做出贡献。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 全球汽车原始设备製造商正在加速采用固态电池

- 不可燃固态电解质可提高安全性并降低热风险

- 锂金属负极可实现更高的能量密度和更长的电动车续航里程。

- 产业陷阱与挑战

- 固-固界面电阻限制了功率密度和循环性能

- 从实验室到GWh量产的製造规模化仍然十分复杂。

- 市场机会

- 储能係统需求成长推动了固定式固态应用的发展。

- 消费性电子产品的微型化创造了高价值、紧凑型电池应用

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)

(註:贸易统计仅针对重点国家提供)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料类型划分,2021-2034年

- 氧化物基固体电解质

- 石榴石型(LLZO)

- NASICON 型(LATP、LAGP)

- 钙钛矿型(LLTO)

- LiPON(磷氧氮化锂)

- 硫化物基固态电解质

- 银硫铁矿族 (Li6PS5X)

- LGPS系列(Li10GeP2S12及其衍生产品)

- 硫代-LISICON(Li3PS4、Li4-xGe1-xPxS4)

- 聚合物基固态电解质

- 聚环氧乙烷(PEO)

- PC(聚碳酸酯)和 PAN(聚丙烯腈)

- 复合聚合物电解质(CPEs)

- 混合电解质(聚合物+无机物)

- 卤化物基固体电解质

- 氯化物基(Li3YCl6、Li3InCl6、Li2ZrCl6)

- 溴化物基(Li3YBr6)

- 混合卤化物体系(Li3Y(Br3Cl3))

第六章:市场估算与预测:依製造流程划分,2021-2034年

- 物理气相沉积(PVD)和原子层沉积(ALD)

- 胶带成型和网版印刷

- 烧结和热压

- 传统烧结

- 热压

- 放电等离子烧结(SPS)

- 冷烧结

- 溶液浇铸和聚合物加工

第七章:市场估计与预测:依外型尺寸划分,2021-2034年

- 薄膜电解质(<10 μm)

- 片状/膜状电解质(10-100 μm)

- 块状/颗粒状电解质(>100 μm)

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 电动车

- 消费性电子产品

- 储能係统

- 医疗器材

- 航太与国防

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Ampcera Inc.

- Blue Solutions SAS

- Contemporary Amperex Technology Co., Limited (CATL)

- Idemitsu Kosan Co., Ltd.

- Ionic Materials Inc.

- Murata Manufacturing Co., Ltd.

- Panasonic Holdings Corporation

- QuantumScape Corporation

- SAMSUNG SDI

- Solid Power Inc.

The Global Solid State Battery Electrolyte Market was valued at USD 301.2 million in 2024 and is estimated to grow at a CAGR of 32.6% to reach USD 4.5 billion by 2034.

The Asia-Pacific region is expected to see the fastest growth, with China leading investments in sulfide and polymer electrolytes, followed by notable activity in North America and Europe. Latin America and the Middle East & Africa also show strong potential due to abundant lithium resources, rising electric vehicle adoption, and domestic renewable energy initiatives, which will drive new production capacity. Technological advancements, large-scale battery manufacturing, and regulatory support are accelerating the adoption of solid-state electrolytes worldwide. Computational screening and machine learning are being leveraged to discover materials with high ionic conductivity and enhanced electrochemical stability. Innovations such as interface engineering, grain boundary optimization, and protective coatings for lithium metal anodes are improving safety, cycle life, and energy density, enabling broader applications in electric vehicles, consumer electronics, and energy storage systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $301.2 Million |

| Forecast Value | $4.5 Billion |

| CAGR | 32.6% |

In 2024, the oxide electrolytes segment accounted for USD 84.3 million. These materials offer exceptional mechanical strength, electrochemical stability, and compatibility with lithium metal anodes, making them ideal for automotive and consumer electronics applications. However, high sintering temperatures and inherent brittleness make their manufacturing complex.

The thin-film electrolytes segment was valued at USD 60.2 million in 2024 owing to their lightweight structure, high volumetric energy density, and uniform ion transport. These films are produced through physical vapor deposition (PVD) or atomic layer deposition (ALD) to achieve defect-free, homogeneous layers, though scaling production is costly and challenging.

North America Solid State Battery Electrolyte Market accounted for a 30% share in 2024. Growth in the region is supported by rising electric vehicle adoption, energy storage demand, and consumer electronics applications. The U.S. market benefits from government-backed programs and funding initiatives, alongside investments from companies such as QuantumScape, Solid Power, and Factorial Energy. Canada contributes through collaborative prototype-scale production facilities involving public research institutions and universities.

Key players in the Global Solid State Battery Electrolyte Market include CATL (Contemporary Amperex Technology Co., Limited), Panasonic Holdings Corporation, QuantumScape Corporation, Solid Power Inc., SAMSUNG SDI, Ampcera Inc., Blue Solutions SAS, Idemitsu Kosan Co., Ltd., Ionic Materials Inc., and Murata Manufacturing Co., Ltd. Companies in the Solid State Battery Electrolyte Market strengthen their presence through strategic R&D investments to enhance ionic conductivity, electrochemical stability, and compatibility with lithium metal anodes. They are forming partnerships with automakers, consumer electronics manufacturers, and energy storage providers to accelerate adoption. Additionally, firms focus on scaling production capabilities, pilot programs, and supply chain optimization while leveraging government incentives and funding initiatives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Manufacturing Process

- 2.2.4 Form Factor

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Automotive OEMs accelerating adoption of solid-state batteries globally

- 3.2.1.2 Non-flammable solid electrolytes enhance safety and reduce thermal risks

- 3.2.1.3 Lithium metal anodes enable higher energy density and extended EV range

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Solid-solid interface resistance limits power density and cycling performance

- 3.2.2.2 Manufacturing scale-up from lab to GWh production remains complex

- 3.2.3 Market opportunities

- 3.2.3.1 Energy storage systems demand growth drives stationary solid-state applications

- 3.2.3.2 Consumer electronics miniaturization creates high-value, compact battery applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oxide-Based Solid Electrolytes

- 5.2.1 Garnet-type (LLZO)

- 5.2.2 NASICON-type (LATP, LAGP)

- 5.2.3 Perovskite-type (LLTO)

- 5.2.4 LiPON (Lithium Phosphorus Oxynitride)

- 5.3 Sulfide-Based Solid Electrolytes

- 5.3.1 Argyrodite Family (Li6PS5X)

- 5.3.2 LGPS Family (Li10GeP2S12 & Derivatives)

- 5.3.3 Thio-LISICON (Li3PS4, Li4-xGe1-xPxS4)

- 5.4 Polymer-Based Solid Electrolytes

- 5.4.1 PEO (Polyethylene Oxide)

- 5.4.2 PC (Polycarbonate) & PAN (Polyacrylonitrile)

- 5.4.3 Composite Polymer Electrolytes (CPEs)

- 5.4.4 Hybrid Electrolytes (Polymer + Inorganic)

- 5.5 Halide-Based Solid Electrolytes

- 5.5.1 Chloride-based (Li3YCl6, Li3InCl6, Li2ZrCl6)

- 5.5.2 Bromide-based (Li3YBr6)

- 5.5.3 Mixed Halide Systems (Li3Y(Br3Cl3))

Chapter 6 Market Estimates and Forecast, By Manufacturing Process, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Physical Vapor Deposition (PVD) & Atomic Layer Deposition (ALD)

- 6.3 Tape casting & screen printing

- 6.4 Sintering & hot pressing

- 6.4.1 Conventional sintering

- 6.4.2 Hot pressing

- 6.4.3 Spark Plasma Sintering (SPS)

- 6.4.4 Cold sintering

- 6.5 Solution casting & polymer processing

Chapter 7 Market Estimates and Forecast, By Form Factor, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Thin-film electrolytes (<10 μm)

- 7.3 Sheet/membrane electrolytes (10-100 μm)

- 7.4 Bulk/pellet electrolytes (>100 μm)

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric vehicles

- 8.3 Consumer electronics

- 8.4 Energy storage systems

- 8.5 Medical devices

- 8.6 Aerospace & defense

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Ampcera Inc.

- 10.2 Blue Solutions SAS

- 10.3 Contemporary Amperex Technology Co., Limited (CATL)

- 10.4 Idemitsu Kosan Co., Ltd.

- 10.5 Ionic Materials Inc.

- 10.6 Murata Manufacturing Co., Ltd.

- 10.7 Panasonic Holdings Corporation

- 10.8 QuantumScape Corporation

- 10.9 SAMSUNG SDI

- 10.10 Solid Power Inc.