|

市场调查报告书

商品编码

1892701

无线电动汽车电池监测市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Wireless EV Battery Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

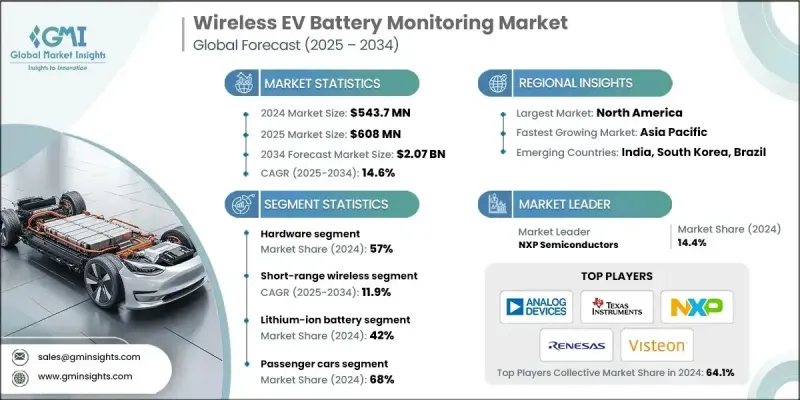

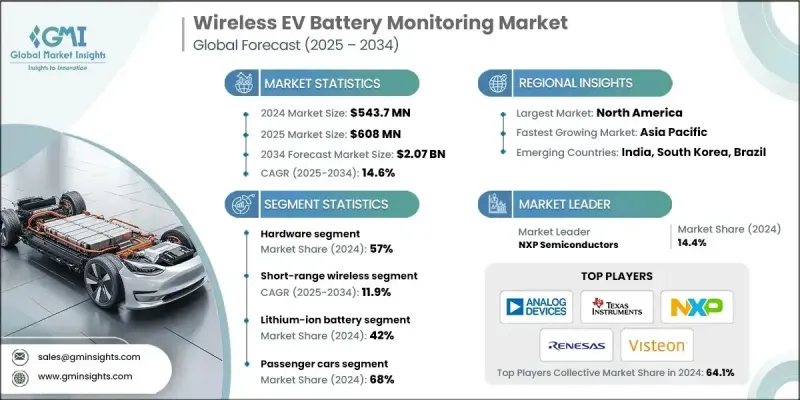

2024 年全球无线电动汽车电池监控市场价值为 5.437 亿美元,预计到 2034 年将以 14.6% 的复合年增长率增长至 20.7 亿美元。

汽车产业正不断重新设计电动车平台,以减轻重量、提高能量密度并实现模组化电池配置。无线电池监控无需繁重的布线,加快了组装速度,并支援灵活的模组化架构,使其成为下一代电动车平台的首选解决方案。软体定义车辆需要更深入的资料视觉性、安全的云端连接和空中升级功能。无线电池管理系统 (BMS) 提供丰富的遥测和预测分析支持,从而实现高级安全建模和高效的能源管理。转型为资料驱动架构的原始设备製造商 (OEM) 发现,无线监控符合其策略目标。此外,对用于电网、家庭和工业储能应用的二手电动车电池进行监控也日益重要。无线解决方案降低了整合复杂性,最大限度地降低了成本,并满足了车队和个人消费者对适应性储能监控、智慧充电解决方案和优化能源输送日益增长的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.437亿美元 |

| 预测值 | 20.7亿美元 |

| 复合年增长率 | 14.6% |

到 2024 年,硬体领域将占据 57% 的市场。电池电气化程度的提高和高容量电池组复杂性的增加,推动了对能够承受恶劣汽车环境的坚固耐用的感测器节点、网关模组、天线和处理单元的需求。

预计到2034年,短距离无线通讯市场将以11.9%的复合年增长率成长。蓝牙、低功耗蓝牙(BLE)和其他低功耗短距离协定对于电池组内部通讯仍然至关重要,它们能够提供稳定的资料传输、低能耗以及与模组化设计的兼容性。这些技术能够有效应对电磁干扰、电池单元数量增加以及严格的安全标准等挑战。

美国无线电动汽车电池监控市场占75.8%的市场份额,预计2024年市场规模将达到1.426亿美元。强而有力的联邦和州政府措施正在加速电动车的普及,相关计画为电动车购买和充电基础设施建设提供激励措施。降低电池成本和加快充电速度的政策目标进一步推动了对先进监控技术的需求。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 加速全球电动车普及

- 电池安全与监测的监管要求

- 降低成本势在必行

- 重量和体积优化

- 热失控安全隐患

- 产业陷阱与挑战

- 高昂的初始实施成本与研发投资

- 缺乏标准化和互通性

- 市场机会

- 用于更高效热失控检测的多模态感测器融合

- 具有能量收集功能的能量自主无线节点

- 人工智慧驱动的预测性维护与预判

- 区块链助力电池安全护照及追溯

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 市场定价策略与经济学

- 定价模式比较(资本支出与营运支出、订阅与永久授权)

- 成本加成定价策略与价值定价策略

- 批量折扣和阶梯定价结构

- 区域定价差异和在地化因素

- 按客户细分市场进行的单位经济效益和利润率分析

- 投资报酬率 (ROI) 和投资回收期计算

- 捆绑销售和交叉销售机会

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 碳足迹评估

- 循环经济一体化

- 电子垃圾管理要求

- 绿色製造倡议

- 系统架构分析

- 电池监控要求

- 透过化学方法

- 透过申请

- 电池外形尺寸及监控方面的意义

- 电池衰减机制及监测意义

- 热管理与无线监控集成

- 生产製造与品质管制注意事项

- 电池製造中的无线BMS集成

- 线上测试与调试

- 製造良率和缺陷检测

- 可扩展性和自动化

- 总拥有成本(TCO)模型

- 前期成本构成

- 製造成本节约

- 营运成本节约

- 生命週期末期价值

- 总拥有成本损益平衡分析

- 互通性和标准化格局

- 通讯协定标准

- BMS 资料标准

- 功能安全标准

- 网路安全标准

- 产业合作计划

- 区域监理协调工作

- 资料管理与分析框架

- 数据采集与预处理

- 边缘运算架构与云端处理架构

- 电池状态估价演算法

- 异常检测与诊断

- 预测性维护与车队分析

- 数位孪生实施

- 测试与验证规程

- 无线链路效能测试

- 环境测试

- 电磁干扰/电磁相容性测试

- 功能安全测试

- 网路安全测试

- 加速寿命试验

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 硬体

- 软体

- 服务

第六章:市场估算与预测:依通讯技术划分,2021-2034年

- 短距离无线(蓝牙)

- 远端/低功耗广域网

- 专有射频协定栈

- 混合架构

第七章:市场估计与预测:依电池化学类型划分,2021-2034年

- 锂离子电池

- 铅酸电池

- 镍氢电池

- 固态电池

- 其他的

第八章:市场估算与预测:依车辆类型划分,2021-2034年

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型

- 中型

- 重负

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 马来西亚

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Analog Devices (ADI)

- Texas Instruments (TI)

- NXP Semiconductors

- Infineon Technologies

- Renesas Electronics

- STMicroelectronics

- Dukosi

- Cavli Wireless

- u-blox

- Quectel Wireless Solutions

- Robert Bosch

- Continental

- Denso

- Hitachi Astemo

- Marelli

- LG Innotek

- Visteon

- ABB E-mobility

- BP Pulse

- Siemens eMobility

- 区域玩家

- Sunwoda EVB

- EVE Energy

- Ficosa

- Sensata Technologies

- Hyundai Mobis

- 新兴参与者

- Dragonfly Energy

- WeaveGrid

- Twaice

- VoltaIQ

- Ampeco

The Global Wireless EV Battery Monitoring Market was valued at USD 543.7 million in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 2.07 billion by 2034.

The automotive sector is increasingly redesigning electric vehicle platforms to reduce weight, improve energy density, and allow modular battery configurations. Wireless battery monitoring eliminates heavy wiring, speeds up assembly, and supports flexible, modular architecture, making it a preferred solution for next-generation EV platforms. Software-defined vehicles demand deeper data visibility, secure cloud connectivity, and over-the-air update capabilities. Wireless BMS systems offer rich telemetry and predictive analytics support, enabling advanced safety modeling and efficient energy management. OEMs transitioning to data-driven architectures find wireless monitoring aligned with their strategic goals. Additionally, monitoring second-life EV batteries for grid, home, and industrial storage applications is gaining importance. Wireless solutions reduce integration complexity, minimize costs, and meet the growing demand for adaptable energy storage monitoring, smart charging solutions, and optimized energy delivery for fleets and individual consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $543.7 Million |

| Forecast Value | $2.07 Billion |

| CAGR | 14.6% |

The hardware segment held 57% share in 2024. Rising battery electrification and the growing complexity of high-capacity packs are driving demand for robust sensor nodes, gateway modules, antennas, and processing units capable of withstanding harsh automotive environments.

The short-range wireless segment is expected to grow at a CAGR of 11.9% through 2034. Bluetooth, BLE, and other low-power short-range protocols remain vital for internal battery-pack communications, offering stable data transfer, low energy consumption, and compatibility with modular designs. These technologies address challenges such as electromagnetic interference, increasing cell counts, and stringent safety standards.

U.S. Wireless EV Battery Monitoring Market held a 75.8% share, generating USD 142.6 million in 2024. Strong federal and state initiatives are accelerating EV adoption, with programs providing incentives for EV purchases and charging infrastructure deployment. Policy targets lower battery costs and faster charging further drive demand for advanced monitoring technologies.

Key players operating in the Global Wireless EV Battery Monitoring Market include Analog Devices, Texas Instruments, LG Innotek, Marelli, NXP Semiconductors, Renesas, Visteon, ABB E-mobility, BP Pulse, and Siemens eMobility. Companies in the Wireless EV Battery Monitoring Market are strengthening their position by investing in R&D to develop advanced sensor nodes, gateway modules, and antenna systems that can handle high-capacity EV batteries. Many firms focus on short-range wireless protocols and IoT-enabled solutions to improve modularity, data accuracy, and energy efficiency. Strategic collaborations with OEMs, fleet operators, and energy providers help expand deployment and secure long-term contracts. Cloud integration and predictive analytics capabilities are being enhanced to support software-defined vehicles and over-the-air updates.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Communication technology

- 2.2.4 Battery chemistry

- 2.2.5 Vehicle

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Accelerating Global EV Adoption

- 3.2.1.2 Regulatory Mandates for Battery Safety & Monitoring

- 3.2.1.3 Cost Reduction Imperatives

- 3.2.1.4 Weight & Volume Optimization

- 3.2.1.5 Thermal Runaway Safety Concerns

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Implementation Costs & R&D Investment

- 3.2.2.2 Lack of Standardization & Interoperability

- 3.2.3 Market opportunities

- 3.2.3.1 Multi-Modal Sensor Fusion for Superior Thermal Runaway Detection

- 3.2.3.2 Energy-Autonomous Wireless Nodes with Energy Harvesting

- 3.2.3.3 AI-Driven Predictive Maintenance & Prognostics

- 3.2.3.4 Blockchain for Secure Battery Passport & Traceability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.8.3 Market Pricing Strategy & Economics

- 3.8.3.1 Pricing models comparison (capex vs. opex, subscription vs. perpetual)

- 3.8.3.2 Cost-plus and value-based pricing strategies

- 3.8.3.3 Volume discounts and tiered pricing structures

- 3.8.3.4 Regional pricing variations and localization factors

- 3.8.3.5 Unit economics and margin analysis by customer segment

- 3.8.3.6 Return on Investment (ROI) and payback period calculations

- 3.8.3.7 Bundling and cross-selling opportunities

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.9.4 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability & environmental aspects

- 3.11.1 Carbon Footprint Assessment

- 3.11.2 Circular Economy Integration

- 3.11.3 E-Waste Management Requirements

- 3.11.4 Green Manufacturing Initiatives

- 3.12 System Architecture Analysis

- 3.13 Battery Monitoring Requirements

- 3.13.1 By chemistry

- 3.13.2 By application

- 3.14 Battery Form Factor & Monitoring Implications

- 3.15 Battery Degradation Mechanisms & Monitoring Implications

- 3.16 Thermal Management Integration with Wireless Monitoring

- 3.17 Manufacturing & Quality Control Considerations

- 3.17.1 Wireless BMS Integration in Battery Manufacturing

- 3.17.2 In-Line Testing & Commissioning

- 3.17.3 Manufacturing Yield & Defect Detection

- 3.17.4 Scalability & Automation

- 3.18 Total Cost of Ownership (TCO) Models

- 3.18.1 Upfront Cost Components

- 3.18.2 Manufacturing Cost Savings

- 3.18.3 Operational Cost Savings

- 3.18.4 End-of-Life Value

- 3.18.5 TCO Breakeven Analysis

- 3.19 Interoperability & Standardization Landscape

- 3.19.1 Communication Protocol Standards

- 3.19.2 BMS Data Standards

- 3.19.3 Functional Safety Standards

- 3.19.4 Cybersecurity Standards

- 3.19.5 Industry Collaboration Initiatives

- 3.19.6 Regional Regulatory Harmonization Efforts

- 3.20 Data Management & Analytics Frameworks

- 3.20.1 Data Acquisition & Preprocessing

- 3.20.2 Edge vs Cloud Processing Architecture

- 3.20.3 Battery State Estimation Algorithms

- 3.20.4 Anomaly Detection & Diagnostics

- 3.20.5 Predictive Maintenance & Fleet Analytics

- 3.20.6 Digital Twin Implementation

- 3.21 Testing & Validation Protocols

- 3.21.1 Wireless Link Performance Testing

- 3.21.2 Environmental Testing

- 3.21.3 EMI/EMC Testing

- 3.21.4 Functional Safety Testing

- 3.21.5 Cybersecurity Testing

- 3.21.6 Accelerated Life Testing

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Communication technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Short-range wireless (Bluetooth)

- 6.3 Long-range / LPWAN

- 6.4 Proprietary RF stacks

- 6.5 Hybrid architecture

Chapter 7 Market Estimates & Forecast, By Battery Chemistry, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Lithium-ion battery

- 7.3 Lead-acid battery

- 7.4 Nickel-metal hydride battery

- 7.5 Solid-state battery

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial Vehicles

- 8.3.1 Light duty

- 8.3.2 Medium duty

- 8.3.3 Heavy-duty

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Analog Devices (ADI)

- 10.1.2 Texas Instruments (TI)

- 10.1.3 NXP Semiconductors

- 10.1.4 Infineon Technologies

- 10.1.5 Renesas Electronics

- 10.1.6 STMicroelectronics

- 10.1.7 Dukosi

- 10.1.8 Cavli Wireless

- 10.1.9 u-blox

- 10.1.10 Quectel Wireless Solutions

- 10.1.11 Robert Bosch

- 10.1.12 Continental

- 10.1.13 Denso

- 10.1.14 Hitachi Astemo

- 10.1.15 Marelli

- 10.1.16 LG Innotek

- 10.1.17 Visteon

- 10.1.18 ABB E-mobility

- 10.1.19 BP Pulse

- 10.1.20 Siemens eMobility

- 10.2 Regional Players

- 10.2.1 Sunwoda EVB

- 10.2.2 EVE Energy

- 10.2.3 Ficosa

- 10.2.4 Sensata Technologies

- 10.2.5 Hyundai Mobis

- 10.3 Emerging Players

- 10.3.1 Dragonfly Energy

- 10.3.2 WeaveGrid

- 10.3.3 Twaice

- 10.3.4 VoltaIQ

- 10.3.5 Ampeco