|

市场调查报告书

商品编码

1892750

体外膜氧合市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Extracorporeal Membrane Oxygenation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

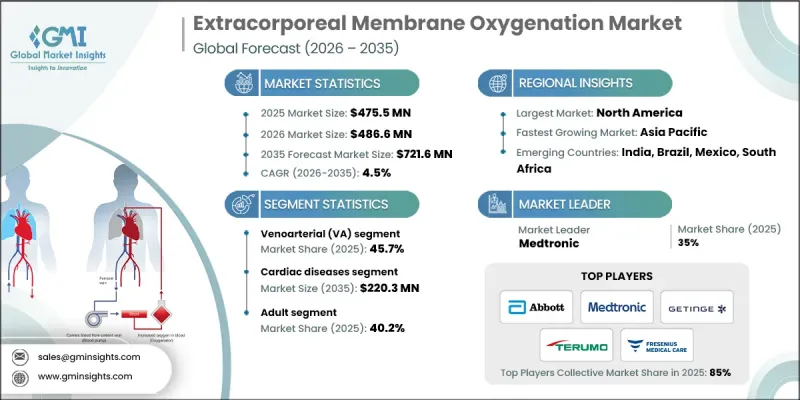

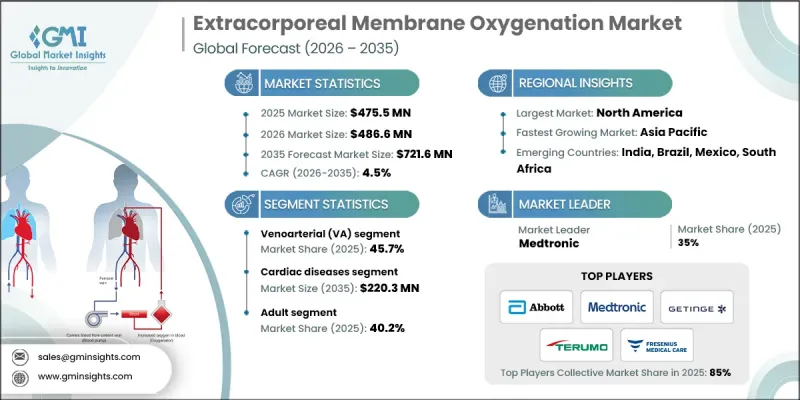

2025 年全球体外膜氧合市场价值为 4.755 亿美元,预计到 2035 年将以 4.5% 的复合年增长率增长至 7.216 亿美元。

市场成长的驱动因素包括心肺疾病和呼吸衰竭的日益普遍、体外膜氧合(ECMO)系统技术的快速发展,以及患者对这些维生设备益处的认识不断提高。 ECMO系统透过人工膜将血液循环至体外,暂时取代心臟和肺部的功能,补充氧气并清除二氧化碳。当机械通气等传统疗法不足以维持生命时,这些设备在重症监护中至关重要,可为患者康復或等待器官移植提供支持。全球医疗素养的提高和政府措施正在推动ECMO的普及应用,而先进治疗方案的可及性不断提高,也确保了ECMO被公认为治疗严重心肺衰竭的重要手段。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 4.755亿美元 |

| 预测值 | 7.216亿美元 |

| 复合年增长率 | 4.5% |

2025年,静脉-动脉(VA)体外膜氧合(ECMO)市占率占比达45.7%。 VA ECMO为重度心臟衰竭患者(常伴随呼吸功能障碍)提供心肺支持,广泛用于治疗心因性休克、心臟停止等疾病,或作为心臟移植的过渡治疗。其日益普及得益于其在危重心臟疾病(包括术后併发症和严重心肌功能障碍)治疗中展现出的显着疗效。

预计到2025年,成人市场将占据40.2%的份额,这反映出由于生活方式相关的风险因素,成人中严重心臟和呼吸系统疾病的盛行率更高。体外膜氧合(ECMO)作为一种首选的高级重症监护解决方案,在三级医院的应用日益广泛,它可在高风险手术期间提供挽救生命的支持,或作为器官移植的过渡手段。

2025年,北美体外膜氧合市场将占据58.2%的市占率。该地区的成长得益于先进的医疗保健基础设施、不断上升的心肺疾病发病率以及持续的技术创新,而心血管疾病负担的加重将进一步加速该技术的普及应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 心肺疾病和呼吸衰竭病例增加

- ECMO设备的技术进步

- 患者对体外膜氧合(ECMO)装置益处的认识不断提高

- 全球政府措施和计划日益增多

- 产业陷阱与挑战

- 设备成本高

- 缺乏熟练专业人员

- ECMO设备相关风险

- 市场机会

- 居家式和长期体外膜氧合(ECMO)解决方案

- 与人工智慧和数位监控的集成

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 技术进步

- 当前技术趋势

- 新兴技术

- 供应链分析

- 报销方案

- 2025年定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依模式划分,2022-2035年

- 静脉-动脉(VA)

- 静脉-静脉(VV)

- 动静脉(AV)

第六章:市场估算与预测:依应用领域划分,2022-2035年

- 心臟疾病

- 呼吸系统疾病

- 体外心肺復苏术(ECPR)

第七章:市场估计与预测:依病患群体划分,2022-2035年

- 婴儿

- 儿科

- 成人

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Abiomed

- Eurosets

- Braile Biomedica

- Edwards Lifesciences Corporation

- Fresenius Medical Care AG & Co. KGaA

- Getinge AB

- Hemovent GmbH

- LivaNova PLC

- Medtronic

- MicroPort Scientific Corporation

- Nipro

- SB-Kawasumi Laboratories, Inc.

- Senko Medical Instrument Mfg. Co., Ltd.

- Spectrum Medical, Terumo Corporation

- Weigao Group Co., Ltd.

The Global Extracorporeal Membrane Oxygenation Market was valued at USD 475.5 million in 2025 and is estimated to grow at a CAGR of 4.5% to reach USD 721.6 million by 2035.

Market growth is driven by the rising prevalence of cardiopulmonary diseases and respiratory failures, rapid technological advancements in ECMO systems, and increasing awareness among patients regarding the benefits of these life-support devices. ECMO systems temporarily take over the function of the heart and lungs by circulating blood outside the body through an artificial membrane, adding oxygen and removing carbon dioxide. These devices are crucial in critical care when conventional therapies, such as mechanical ventilation, are insufficient, offering support during recovery or while awaiting organ transplantation. Enhanced healthcare literacy and government initiatives worldwide are encouraging adoption, while improved access to advanced treatment options ensures that ECMO is recognized as a vital intervention for severe cardiac and respiratory failures.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $475.5 Million |

| Forecast Value | $721.6 Million |

| CAGR | 4.5% |

The venoarterial (VA) ECMO segment accounted for a 45.7% share in 2025. VA ECMO delivers cardiopulmonary support for patients with severe cardiac failure, often combined with respiratory compromise, and is widely used for conditions such as cardiogenic shock, cardiac arrest, or as a bridge to heart transplantation. Its growing adoption is driven by proven effectiveness in critical cardiac conditions, including post-surgical complications and severe myocardial dysfunction.

The adult segment captured a 40.2% share in 2025, reflecting the higher prevalence of severe cardiac and respiratory conditions among adults due to lifestyle-related risk factors. ECMO adoption is increasing in tertiary hospitals as a preferred advanced critical care solution, providing life-saving support during high-risk surgeries or as a bridge to transplantation.

North America Extracorporeal Membrane Oxygenation Market held a 58.2% share in 2025. Growth in the region is fueled by advanced healthcare infrastructure, rising cardiopulmonary disease incidence, and continuous technological innovation, with cardiovascular disease burden further accelerating adoption.

Key players in the Global Extracorporeal Membrane Oxygenation Market include Abbott Laboratories, Getinge AB, Fresenius Medical Care AG & Co. KGaA, Medtronic, Eurosets, LivaNova PLC, Abiomed, Braile Biomedica, Hemovent GmbH, MicroPort Scientific Corporation, Nipro, Edwards Lifesciences Corporation, SB-Kawasumi Laboratories, Inc., and Senko Medical Instrument Mfg. Co., Ltd., Spectrum Medical, Terumo Corporation, and Weigao Group Co., Ltd. Companies in the Extracorporeal Membrane Oxygenation Market strengthen their presence by investing heavily in R&D to develop innovative, energy-efficient, and compact ECMO systems with improved safety features. Expanding global distribution networks ensures timely delivery and service support for hospitals and critical care centers. Strategic partnerships with healthcare providers and government agencies enable long-term adoption contracts and market penetration. Manufacturers focus on enhancing product usability, reducing complications, and providing training programs for medical staff to improve device acceptance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Modality trends

- 2.2.3 Application trends

- 2.2.4 Patient population trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in cases of cardiopulmonary diseases and respiratory failures

- 3.2.1.2 Technological advancements in ECMO devices

- 3.2.1.3 Rising patient awareness about benefits delivered by extracorporeal membrane oxygenation devices

- 3.2.1.4 Rising government initiatives and programs worldwide

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment

- 3.2.2.2 Dearth of skilled professionals

- 3.2.2.3 Risks related to ECMO device

- 3.2.3 Market opportunities

- 3.2.3.1 Home-based and long-term ECMO solutions

- 3.2.3.2 Integration with artificial intelligence and digital monitoring

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2025

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Modality, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Venoarterial (VA)

- 5.3 Veno-venous (VV)

- 5.4 Arteriovenous (AV)

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiac diseases

- 6.3 Respiratory diseases

- 6.4 Extracorporeal cardiopulmonary resuscitation (ECPR)

Chapter 7 Market Estimates and Forecast, By Patient Population, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Infant

- 7.3 Pediatric

- 7.4 Adult

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Abiomed

- 9.3 Eurosets

- 9.4 Braile Biomedica

- 9.5 Edwards Lifesciences Corporation

- 9.6 Fresenius Medical Care AG & Co. KGaA

- 9.7 Getinge AB

- 9.8 Hemovent GmbH

- 9.9 LivaNova PLC

- 9.10 Medtronic

- 9.11 MicroPort Scientific Corporation

- 9.12 Nipro

- 9.13 SB-Kawasumi Laboratories, Inc.

- 9.14 Senko Medical Instrument Mfg. Co., Ltd.

- 9.15 Spectrum Medical, Terumo Corporation

- 9.16 Weigao Group Co., Ltd.