|

市场调查报告书

商品编码

1892751

客製化软体开发市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Custom Software Development Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

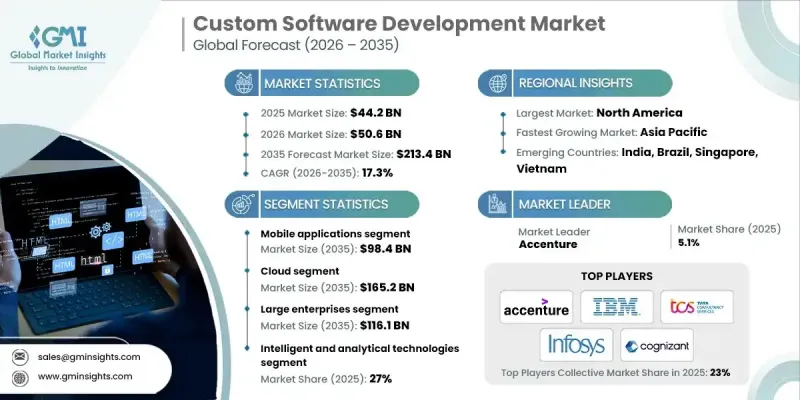

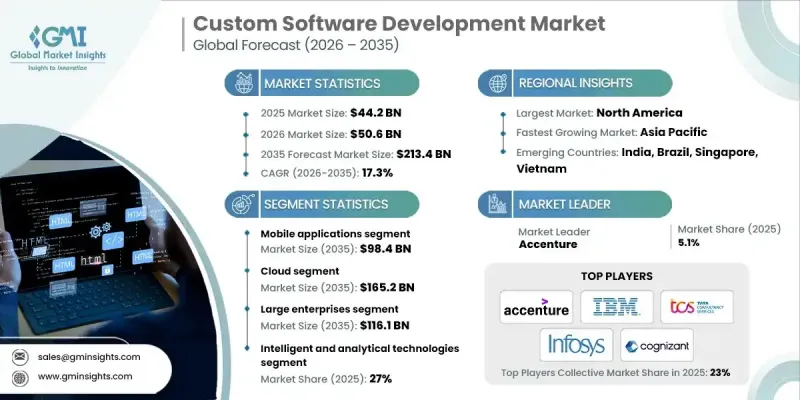

2025 年全球客製化软体开发市场价值 442 亿美元,预计到 2035 年将以 17.3% 的复合年增长率成长至 2,134 亿美元。

推动这一成长的因素是各组织加速推动数位转型,以简化内部流程、增强客户互动并强化数据驱动的决策。客製化软体解决方案使企业能够设计符合自身营运需求的应用程序,与现有系统无缝集成,并应对特定行业的挑战。随着企业在竞争激烈的市场中追求可扩展的自动化和差异化,市场需求持续成长。云端架构、人工智慧、自动化、连网技术和进阶分析的日益普及,进一步强化了对能够支援复杂数位生态系统的客製化软体平台的需求。中小企业也在投资客製化解决方案,以实现营运现代化、减少人工工作量并建立敏捷的技术驱动型环境。人工智慧和机器学习功能正越来越多地嵌入到客製化应用程式中,从而实现智慧工作流程、预测性洞察、个人化和自适应效能改进。此外,简化开发平台的日益普及使组织能够加快应用程式交付速度,同时减少对高度专业化技术资源的依赖。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 442亿美元 |

| 预测值 | 2134亿美元 |

| 复合年增长率 | 17.3% |

行动应用领域在2025年占据了38%的市场份额,预计到2035年将达到984亿美元。强劲的需求得益于企业和消费者在各种应用场景中对行动优先计算、无缝设备整合、离线功能和高级特性的日益增长的依赖。各组织机构持续优先考虑行动解决方案,以满足不断变化的使用者期望并提升服务的可近性。

2025年,云端部署细分市场占据67%的市场份额,预计到2035年将达到1,652亿美元。基于云端的开发能够实现灵活扩展、成本效益和全球访问,同时降低整体拥有成本。透过公有云、私有云和混合云部署模式,云端部署在新创企业、成熟企业和数位化原生组织的应用程式持续成长。

预计到2025年,美国客製化软体开发市场规模将达155亿美元。为了支援分散式办公、增强安全性以及大规模企业运营,企业正持续从传统的本地部署系统转向云端原生应用环境。持续的现代化改造工作主要集中在以模组化架构和现代开发框架取代传统平台。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 数位转型加速

- 需要量身订製的商业解决方案

- 云端运算、人工智慧和物联网应用扩展

- 中小企业和新创企业的成长

- 越来越重视客户体验

- 产业陷阱与挑战

- 高昂的开发和维护成本

- 熟练开发人员短缺

- 市场机会

- 对人工智慧驱动的自动化解决方案的需求不断增长

- 扩展云端原生和微服务解决方案

- 业界特定且合规驱动的解决方案

- 低程式码/无程式码采用支援的成长

- 成长潜力分析

- 监管环境

- 北美洲

- 美国 - 加州消费者隐私法案

- 加拿大 - 个人资讯保护和电子文件法

- 欧洲

- 英国 - 资料保护法

- 德国 - 联邦资料保护法

- 法国——数位共和国法案

- 义大利 - 个人资料保护法

- 西班牙—资料保护与数位权利组织法

- 亚太地区

- 中国 - 个人资讯保护法

- 日本—个人资讯保护法

- 印度 - 数位个人资料保护法

- 拉丁美洲

- 巴西 - 通用资料保护法

- 墨西哥 - 私人持有个人资料保护联邦法

- 阿根廷 - 个人资料保护法

- 中东和非洲

- 阿联酋 - 个人资料保护法

- 南非 - 个人资讯保护法

- 沙乌地阿拉伯 - 个人资料保护法

- 北美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 成本細項分析

- 开发成本结构

- 研发成本分析

- 行销和销售成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 案例研究

- 未来市场展望及机会

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依解法划分,2022-2035年

- 网路为基础的解决方案

- 行动应用

- 企业软体

第六章:市场估算与预测:依部署模式划分,2022-2035年

- 云

- 现场

第七章:市场估算与预测:依企业规模划分,2022-2035年

- 大型企业

- 中小企业

第八章:市场估算与预测:依技术划分,2022-2035年

- 情报与分析

- 连接与物联网

- 分散式帐本与安全

- 其他的

第九章:市场估算与预测:依最终用途划分,2022-2035年

- 金融服务业

- 资讯科技与电信

- 卫生保健

- 政府

- 製造业

- 零售

- 其他的

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 葡萄牙

- 克罗埃西亚

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

第十一章:公司简介

- 全球参与者

- Accenture

- IBM

- Tata Consultancy Services

- Cognizant

- Infosys

- Capgemini

- ATOS

- EPAM Systems

- HCL

- Wipro

- DXC Technology

- NTT Data

- Tech Mahindra

- 区域玩家

- Infopulse

- Brainvire Infotech

- MentorMate

- Iflexion

- Magora

- Trigent Software

- Persistent Systems

- Sopra Steria

- Globant

- SoftServe

- Emerging / Disruptor Players

- Andersen Lab

- Netguru

- STX Next

- Simform

- Altoros

- Daffodil Software

The Global Custom Software Development Market was valued at USD 44.2 billion in 2025 and is estimated to grow at a CAGR of 17.3% to reach USD 213.4 billion by 2035.

The expansion is driven by organizations accelerating digital transformation initiatives to streamline internal processes, enhance customer engagement, and strengthen data-driven decision-making. Custom software solutions allow enterprises to design applications aligned with their operational requirements, integrate seamlessly with existing systems, and address industry-specific challenges. Demand continues to grow as businesses pursue scalable automation and differentiation in competitive markets. The increasing adoption of cloud-based architectures, artificial intelligence, automation, connected technologies, and advanced analytics is further reinforcing the need for tailored software platforms capable of supporting complex digital ecosystems. Small and medium-sized enterprises are also investing in customized solutions to modernize operations, reduce manual workloads, and establish agile, technology-driven environments. Artificial intelligence and machine learning capabilities are increasingly embedded into customized applications to enable intelligent workflows, predictive insights, personalization, and adaptive performance improvements. Additionally, the growing use of simplified development platforms is allowing organizations to accelerate application delivery while reducing reliance on highly specialized technical resources.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $44.2 Billion |

| Forecast Value | $213.4 Billion |

| CAGR | 17.3% |

The mobile applications segment held a 38% share in 2025 and is projected to reach USD 98.4 billion by 2035. Strong demand is supported by the growing reliance on mobile-first computing, seamless device integration, offline functionality, and advanced feature availability across enterprise and consumer use cases. Organizations continue to prioritize mobile solutions to meet evolving user expectations and improve accessibility.

The cloud deployment segment held a 67% share in 2025 and is expected to reach USD 165.2 billion by 2035. Cloud-based development enables flexible scaling, cost efficiency, and global accessibility while lowering overall ownership costs. Adoption continues to increase across startups, established enterprises, and digital-native organizations through public, private, and hybrid deployment models.

U.S. Custom Software Development Market was valued at USD 15.5 billion in 2025. Companies continue to transition away from traditional on-premises systems toward cloud-native application environments to support distributed workforces, enhanced security, and large-scale enterprise operations. Ongoing modernization efforts focus on replacing legacy platforms with modular architectures and contemporary development frameworks.

Key companies operating in the Global Custom Software Development Market include Tata Consultancy Services, Accenture, Infosys, IBM, Cognizant, ATOS, MentorMate, Iflexion, and Infopulse. Companies in the Global Custom Software Development Market adopt several strategic approaches to strengthen their market position. Continuous investment in research and innovation enables providers to deliver advanced, future-ready solutions aligned with evolving enterprise needs. Firms focus on expanding cloud-native, AI-enabled, and automation-driven service portfolios to address complex digital transformation projects. Strategic partnerships and acquisitions help broaden technical expertise and geographic reach. Emphasis on agile delivery models improves project speed, flexibility, and client satisfaction. Companies also prioritize long-term client relationships through customized engagement models and ongoing support services.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Deployment model

- 2.2.4 Enterprise size

- 2.2.5 Technology

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Digital transformation acceleration

- 3.2.1.3 Need for tailored business solutions

- 3.2.1.4 Expansion of cloud, AI, and IoT adoption

- 3.2.1.5 Growth of SMEs and startups

- 3.2.1.6 Increasing focus on customer experience

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and maintenance costs

- 3.2.2.2 Shortage of skilled developers

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for AI-driven automation solutions

- 3.2.3.2 Expansion of cloud-native and microservices solutions

- 3.2.3.3 Industry-specific and compliance-driven solutions

- 3.2.3.4 Growth of low-code / no-code adoption support

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - California Consumer Privacy Act

- 3.4.1.2 Canada - Personal Information Protection and Electronic Documents Act

- 3.4.2 Europe

- 3.4.2.1 UK - Data Protection Act

- 3.4.2.2 Germany - Federal Data Protection Act

- 3.4.2.3 France - Digital Republic Act

- 3.4.2.4 Italy - Personal Data Protection Code

- 3.4.2.5 Spain - Organic Law on Data Protection and Digital Rights

- 3.4.3 Asia Pacific

- 3.4.3.1 China - Personal Information Protection Law

- 3.4.3.2 Japan - Act on the Protection of Personal Information

- 3.4.3.3 India - Digital Personal Data Protection Act

- 3.4.4 Latin America

- 3.4.4.1 Brazil - General Data Protection Law

- 3.4.4.2 Mexico - Federal Law on Protection of Personal Data Held by Private Parties

- 3.4.4.3 Argentina - Personal Data Protection Law

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - Personal Data Protection Law

- 3.4.5.2 South Africa - Protection of Personal Information Act

- 3.4.5.3 Saudi Arabia - Personal Data Protection Law

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Case study

- 3.12 Future market outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Solution, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Web-based solutions

- 5.3 Mobile applications

- 5.4 Enterprise software

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Intelligence & Analytics

- 8.3 Connectivity & IoT

- 8.4 Distributed Ledger & Security

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2022-2035 (USD Mn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT & Telecom

- 9.4 Healthcare

- 9.5 Government

- 9.6 Manufacturing

- 9.7 Retail

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.3.10 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Accenture

- 11.1.2 IBM

- 11.1.3 Tata Consultancy Services

- 11.1.4 Cognizant

- 11.1.5 Infosys

- 11.1.6 Capgemini

- 11.1.7 ATOS

- 11.1.8 EPAM Systems

- 11.1.9 HCL

- 11.1.10 Wipro

- 11.1.11 DXC Technology

- 11.1.12 NTT Data

- 11.1.13 Tech Mahindra

- 11.2 Regional Players

- 11.2.1 Infopulse

- 11.2.2 Brainvire Infotech

- 11.2.3 MentorMate

- 11.2.4 Iflexion

- 11.2.5 Magora

- 11.2.6 Trigent Software

- 11.2.7 Persistent Systems

- 11.2.8 Sopra Steria

- 11.2.9 Globant

- 11.2.10 SoftServe

- 11.3 Emerging / Disruptor Players

- 11.3.1 Andersen Lab

- 11.3.2 Netguru

- 11.3.3 STX Next

- 11.3.4 Simform

- 11.3.5 Altoros

- 11.3.6 Daffodil Software