|

市场调查报告书

商品编码

1892752

血糖仪市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Glucometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

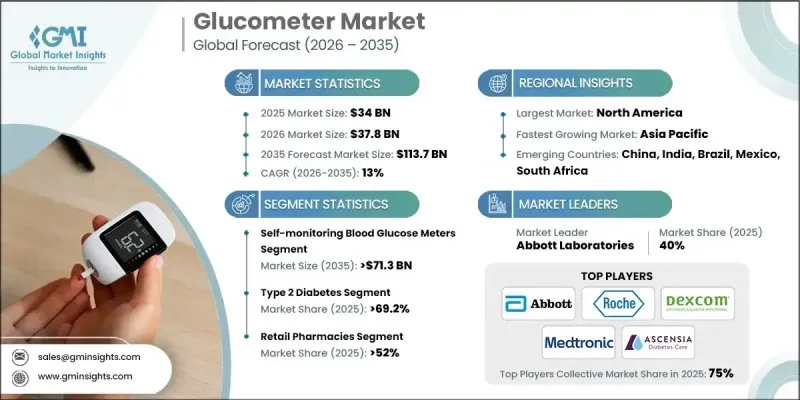

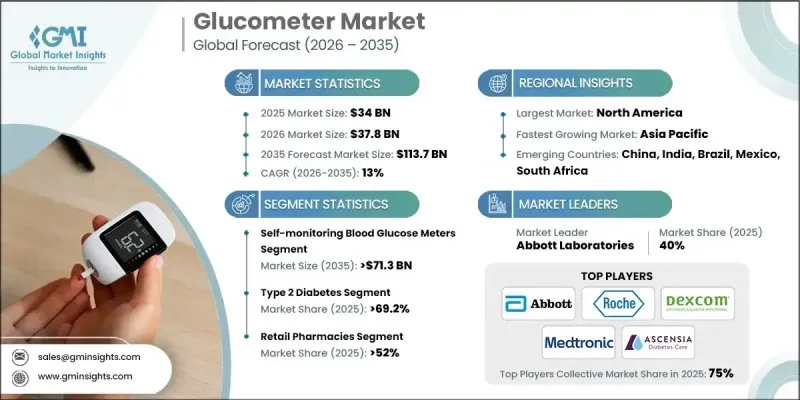

2025年全球血糖仪市值为340亿美元,预计2035年将以13%的复合年增长率成长至1137亿美元。

由于糖尿病盛行率不断上升,以及自我血糖监测(SMBG)在有效疾病管理中的重要性日益凸显,市场正在不断扩张。全球医疗保健系统正面临来自慢性病、人口老化以及提供经济高效医疗服务的巨大压力,这使得血糖仪成为增强患者自主权和改善临床疗效的关键工具。现代血糖仪的功能已不再局限于简单的血糖测量,而是融合了蓝牙连接、行动应用程式整合和云端资料共享等功能。这些进步实现了即时监测、远距会诊和数据驱动的决策,使患者能够积极管理自身病情,临床医生也能更有效率地制定个人化治疗方案,从而革新了糖尿病照护模式。与远距医疗和数位健康生态系统的整合进一步增强了全球范围内的患者参与度和慢性病管理能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 340亿美元 |

| 预测值 | 1137亿美元 |

| 复合年增长率 | 13% |

到 2025 年,自我监测血糖仪市占率将达到 63.5%。 SMBG 设备仍被患者广泛用于家庭监测,减少了对频繁就诊的依赖,并允许及时干预以更好地控制病情。

2025年,第2型糖尿病市场占比将达到69.2%,预计未来将持续成长。全球第2型糖尿病负担持续加重,支撑了该领域对血糖仪的持续需求。

预计到2025年,美国血糖仪市场规模将达到130亿美元,显示该市场已趋于成熟且技术先进。强大的医疗基础设施、广泛的保险覆盖、高糖尿病盛行率以及包括远距医疗和远距患者监测在内的数位化医疗解决方案的快速普及,都推动了市场成长。这些因素加速了血糖仪在常规临床实践和居家护理中的应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 全球糖尿病盛行率不断上升

- 血糖仪的技术进步

- 全球对自我监测设备的需求不断增长

- 政府为提高民众意识所采取的倡议

- 产业陷阱与挑战

- 先进设备和配件价格昂贵

- 缺乏报销机制和严格的监管

- 市场机会

- 将血糖仪与数位健康生态系统整合

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品类型划分,2022-2035年

- 自我监测血糖仪

- 连续血糖监测仪

第六章:市场估算与预测:依应用领域划分,2022-2035年

- 1型糖尿病

- 2型糖尿病

- 妊娠糖尿病

第七章:市场估算与预测:依配销通路划分,2022-2035年

- 医院药房

- 零售药局

- 线上销售

- 糖尿病诊所和中心

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- AgaMatrix

- All Medicus

- Arkray,

- Ascensia Diabetes Care Holdings

- B. Braun Melsungen

- Bionime Corporation

- DarioHealth Corporation

- Dexcom

- Essenlife Bioscience

- F. Hoffmann-La Roche

- LifeScan

- Medtronic

- Nova Biomedical

- Sinocare

The Global Glucometer Market was valued at USD 34 billion in 2025 and is estimated to grow at a CAGR of 13% to reach USD 113.7 billion by 2035.

The market is expanding due to the rising prevalence of diabetes and the increasing importance of self-monitoring of blood glucose (SMBG) for effective disease management. Healthcare systems worldwide are facing growing pressure from chronic illnesses, aging populations, and the need to deliver cost-efficient care, making glucometers a vital tool for patient empowerment and improved clinical outcomes. Modern glucometers are moving beyond simple glucose measurement, incorporating features such as Bluetooth connectivity, mobile app integration, and cloud-based data sharing. These advancements enable real-time monitoring, remote consultations, and data-driven decision-making, transforming diabetes care by allowing patients to actively manage their condition and clinicians to tailor personalized treatment strategies efficiently. Integration with telehealth and digital health ecosystems further strengthens patient engagement and chronic disease management capabilities globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $34 Billion |

| Forecast Value | $113.7 Billion |

| CAGR | 13% |

The self-monitoring blood glucose meters segment held a 63.5% share in 2025. SMBG devices remain widely used by patients for home-based monitoring, reducing dependency on frequent clinical visits and allowing timely interventions for better disease control.

The type 2 diabetes segment accounted for a 69.2% share in 2025 and is expected to grow further. The global burden of type 2 diabetes continues to increase, supporting sustained demand for glucometers in this segment.

U.S. Glucometer Market was valued at USD 13 billion in 2025, representing a mature and technologically advanced market. Growth is fueled by strong healthcare infrastructure, widespread insurance coverage, high diabetes prevalence, and rapid adoption of digital health solutions, including telehealth and remote patient monitoring. These factors accelerate the integration of glucometers into routine clinical practice and home-based care.

Key players in the Global Glucometer Market include Arkray, Bionime Corporation, Dexcom, DarioHealth Corporation, Nova Biomedical, Abbott Laboratories, All Medicus, Ascensia Diabetes Care Holdings, F. Hoffmann-La Roche, LifeScan, Medtronic, AgaMatrix, Essenlife Bioscience, B. Braun Melsungen, and Sinocare. Companies in the Global Glucometer Market are strengthening their presence through continuous innovation in device technology, such as integrating mobile connectivity, AI-driven analytics, and cloud platforms to enhance patient engagement and data accessibility. Strategic partnerships with healthcare providers and telehealth platforms help expand market reach and enable recurring usage. Firms are also investing in global distribution networks and after-sales support to improve accessibility and customer satisfaction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes worldwide

- 3.2.1.2 Technological advancements in glucometer

- 3.2.1.3 Rising demand for self-monitoring devices globally

- 3.2.1.4 Government initiatives for increasing awareness among people

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and accessories

- 3.2.2.2 Lack of reimbursement and stringent regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of glucometers with digital health ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Self-monitoring blood glucose meters

- 5.3 Continuous glucose monitors

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online sales

- 7.5 Diabetes clinics and centers

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AgaMatrix

- 9.3 All Medicus

- 9.4 Arkray,

- 9.5 Ascensia Diabetes Care Holdings

- 9.6 B. Braun Melsungen

- 9.7 Bionime Corporation

- 9.8 DarioHealth Corporation

- 9.9 Dexcom

- 9.10 Essenlife Bioscience

- 9.11 F. Hoffmann-La Roche

- 9.12 LifeScan

- 9.13 Medtronic

- 9.14 Nova Biomedical

- 9.15 Sinocare