|

市场调查报告书

商品编码

1892753

外分泌性胰臟功能不全治疗市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Exocrine Pancreatic Insufficiency Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

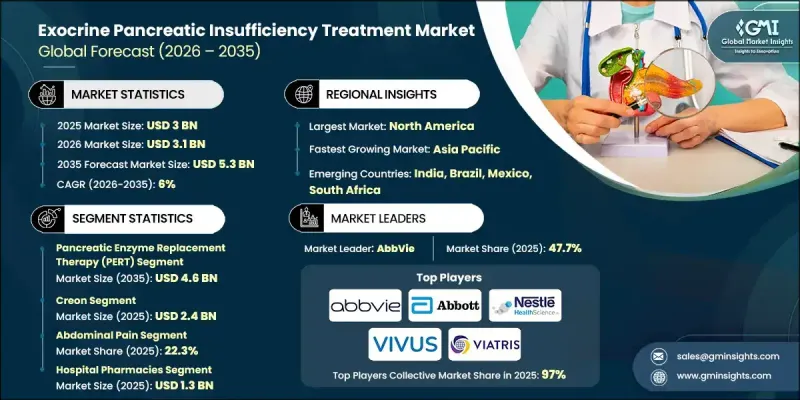

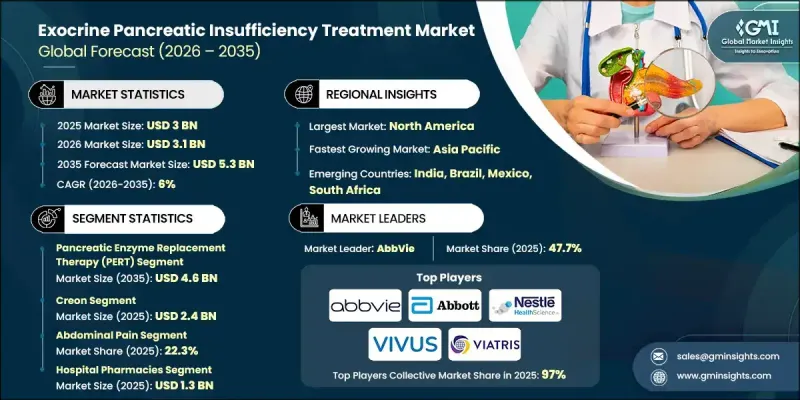

2025 年全球外分泌胰臟功能不全治疗市场价值为 30 亿美元,预计到 2035 年将以 6% 的复合年增长率增长至 53 亿美元。

慢性胰臟炎、囊性纤维化和人口老化的日益普遍,以及诊断技术的进步和药物创新,共同推动了市场成长。诊断方法的改进使得外分泌胰臟功能不全(EPI)的早期发现成为可能,从而改善治疗效果并提高患者的生活品质。研究日益关注寻找精准的生物标记物,以准确评估胰臟功能。粪便弹性蛋白酶-1水平低是胰臟功能不全的可靠指标,为侵入性检查提供了更简单、更适合门诊的替代方案。 EPI的治疗包括药物和饮食管理,以补充营养消化吸收所必需的胰酶。及时介入有助于减轻症状、改善营养吸收并显着提升患者的整体健康状况。人们对胰臟疾病的认识不断提高,以及对有效治疗方案的需求日益增长,进一步推动了全球对这些疗法的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 30亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 6% |

2025年,胰酶替代疗法(PERT)市场规模为26亿美元,预计2035年将达46亿美元。外分泌胰臟功能不全(EPI)是指胰臟无法产生或输送足够的消化酶,导致消化不良和吸收不良。常见的潜在原因包括慢性胰臟炎、胰臟癌、囊性纤维化和糖尿病。 PERT透过口服胰脂肪酶(一种脂肪酶、蛋白酶和淀粉酶的混合物)来帮助患者恢復正常的消化功能。

预计到2025年,腹痛类药物市占率将达到22.3%。腹痛是外分泌胰臟功能不全(EPI)的常见症状,由酵素分泌不足和消化不完全引起。胰酶替代疗法(PERT)透过改善消化和减少肠道内未消化食物的积聚来缓解这种不适。准确控制酵素製剂的剂量和服用时间(与餐点同服)对于有效控制症状至关重要。

2025年,美国外分泌性胰臟功能不全治疗市场规模预计将达16.2亿美元。胰臟疾病(包括胰臟癌和囊性纤维化)发生率的上升是该市场的主要成长驱动因素。随着这些疾病盛行率的持续成长,对先进且有效的外分泌性胰臟功能不全治疗方案的需求也不断扩大,进一步推动了北美市场的成长。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 慢性胰臟炎(CP)和囊性纤维化盛行率不断上升

- 人口老化日益加剧

- 诊断技术的进步

- 製药业的技术进步

- 产业陷阱与挑战

- 治疗费用高昂

- 认知和教育程度有限

- 市场机会

- 对个人化医疗的需求日益增长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 未来市场趋势

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依治疗方法划分,2022-2035年

- 营养管理

- 胰酵素替代疗法(PERT)

第六章:市场估算与预测:依药物类型划分,2022-2035年

- 克瑞翁

- Zenpep

- 胰臟

- 维奥卡斯

- 其他药物类型

第七章:市场估算与预测:依症状分类,2022-2035年

- 腹痛

- 便秘

- 腹泻

- 脂肪便

- 减肥

- 其他症状

第八章:市场估算与预测:依配销通路划分,2022-2035年

- 医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- AbbVie

- Digestive Care

- Essential Pharma

- Eisai

- Nestle

- Nordmark Pharma

- Sun Pharmaceutical Industries

- Viatris

- VIVUS

- Zentiva Pharma

The Global Exocrine Pancreatic Insufficiency Treatment Market was valued at USD 3 billion in 2025 and is estimated to grow at a CAGR of 6% to reach USD 5.3 billion by 2035.

Market growth is fueled by the rising prevalence of chronic pancreatitis, cystic fibrosis, and an aging population, combined with advancements in diagnostic technologies and pharmaceutical innovations. Enhanced diagnostic methods allow earlier detection of EPI, improving treatment outcomes and patient quality of life. Research increasingly focuses on identifying precise biomarkers to assess pancreatic function accurately. Low fecal elastase-1 levels serve as a reliable indicator of pancreatic insufficiency, offering a simpler, outpatient-friendly alternative to invasive procedures. EPI treatment involves medical and dietary management to replace deficient pancreatic enzymes essential for nutrient digestion and absorption. Timely intervention helps reduce symptoms, improve nutrient uptake, and significantly enhance overall patient well-being. The growing awareness of pancreatic disorders and the need for effective treatment solutions is further driving global demand for these therapies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6% |

The pancreatic enzyme replacement therapy (PERT) segment accounted for USD 2.6 billion in 2025 and is projected to reach USD 4.6 billion by 2035. EPI occurs when the pancreas fails to produce or deliver sufficient digestive enzymes, leading to maldigestion and malabsorption. Common underlying conditions include chronic pancreatitis, pancreatic cancer, cystic fibrosis, and diabetes. PERT provides patients with oral administration of pancrelipase, a combination of lipase, protease, and amylase, to restore normal digestive function.

The abdominal pain segment held a 22.3% share in 2025. Abdominal pain is a frequent symptom of EPI, arising from insufficient enzyme production and incomplete digestion. PERT alleviates this discomfort by improving digestion and reducing undigested food accumulation in the intestines. Accurate dosing and timing of enzyme intake with meals are essential for effective symptom control.

U.S. Exocrine Pancreatic Insufficiency Treatment Market was valued at USD 1.62 billion in 2025. Rising incidences of pancreatic disorders, including pancreatic cancer and cystic fibrosis, are primary growth drivers. As the prevalence of these conditions continues to increase, the demand for advanced and effective EPI therapies is expanding, supporting further market growth in North America.

Prominent companies active in the Global Exocrine Pancreatic Insufficiency Treatment Market include Sun Pharmaceutical Industries, Zentiva Pharma, Nordmark Pharma, Abbott Laboratories, Viatris, Digestive Care, Essential Pharma, Eisai, AbbVie, VIVUS, and Nestle. Companies in the EPI treatment sector are enhancing their market presence through targeted product innovation and portfolio expansion. Many are investing in next-generation enzyme formulations and combination therapies to improve efficacy and patient adherence. Research and development initiatives focus on identifying biomarkers and improving diagnostic tools, enabling earlier and more precise treatment. Strategic partnerships with healthcare providers and collaborations with research institutions strengthen credibility and market access. Manufacturers are also leveraging digital platforms and telemedicine solutions to educate patients and support treatment compliance. Expanding geographic presence in high-prevalence regions, optimizing supply chains, and aligning with regulatory standards ensures broader reach and trust.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment trends

- 2.2.3 Drug type trends

- 2.2.4 Symptom trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic pancreatitis (CP) and cystic fibrosis

- 3.2.1.2 Growing aging population

- 3.2.1.3 Advancements in diagnosis

- 3.2.1.4 Technological advancements in pharmaceutical industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Limited awareness and education

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for personalized medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Nutritional management

- 5.3 Pancreatic enzyme replacement therapy (PERT)

Chapter 6 Market Estimates and Forecast, By Drug Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Creon

- 6.3 Zenpep

- 6.4 Pancreaze

- 6.5 Viokace

- 6.6 Other drug types

Chapter 7 Market Estimates and Forecast, By Symptom, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Abdominal pain

- 7.3 Constipation

- 7.4 Diarrhea

- 7.5 Fatty stools

- 7.6 Weight loss

- 7.7 Other symptoms

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AbbVie

- 10.3 Digestive Care

- 10.4 Essential Pharma

- 10.5 Eisai

- 10.6 Nestle

- 10.7 Nordmark Pharma

- 10.8 Sun Pharmaceutical Industries

- 10.9 Viatris

- 10.10 VIVUS

- 10.11 Zentiva Pharma