|

市场调查报告书

商品编码

1892758

颅内动脉瘤市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Intracranial Aneurysm Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

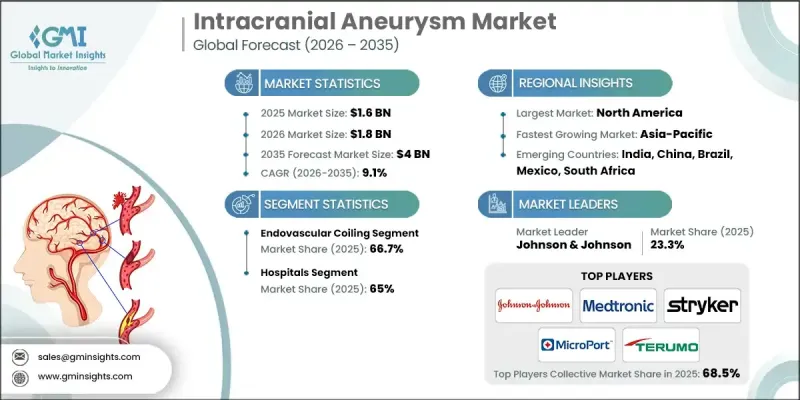

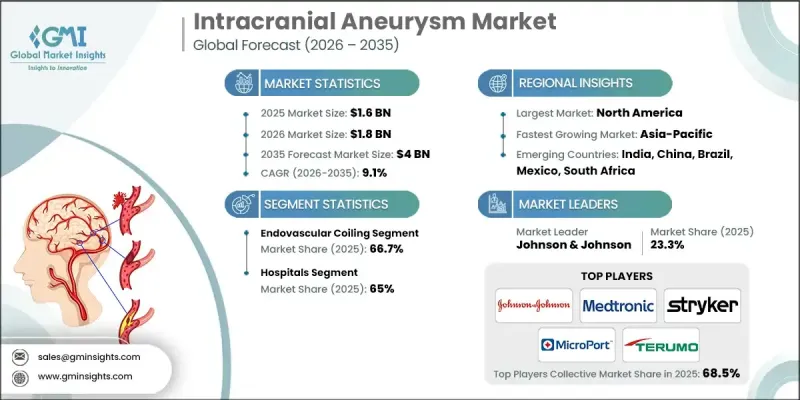

2025 年全球颅内动脉瘤市值为 16 亿美元,预计到 2035 年将以 9.1% 的复合年增长率增长至 40 亿美元。

微创神经血管技术的快速发展、临床上对血管内治疗而非开放性手术的日益青睐,以及全球颅内动脉瘤发生率的上升,共同推动了市场扩张。颅内动脉瘤是指因动脉壁退化而导致的脑血管局部壁薄弱和向外凸出。随着时间的推移,这种情况会恶化,并存在破裂的严重风险,可能导致危及生命的颅内出血。这些动脉瘤最常发生于脑内动脉交界处附近。器械工程和手术技术的进步显着提高了治疗的精确度,缩短了手术时间,并降低了併发症发生率。随着医疗系统越来越重视微创治疗方案,现代神经介入手术在全球的应用持续成长。领先製造商不断进行的研究计画和持续创新正在改善患者的治疗效果,并支持已开发和新兴医疗系统市场的持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 16亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 9.1% |

由于其微创性和良好的临床疗效,血管内栓塞术预计在2025年将占据66.7%的市场份额。此技术广泛应用于破裂和未破裂动脉瘤的治疗,尤其适用于老年患者和手术风险较高的人。较短的恢復时间和较低的手术负担使其继续成为首选治疗方案,随着医院推广微创治疗模式,手术量也不断增长。

预计到2025年,医院业务将占市场份额的65%,到2035年将创造25亿美元的收入。急性神经血管事件和动脉瘤併发症导致的患者入院率居高不下,推动了对住院治疗的需求。医院能够提供专科医生、先进影像设备和重症监护等综合服务,从而实现对复杂动脉瘤病例的快速协调管理。

预计到2025年,北美颅内动脉瘤市占率将达到41.7%。该地区人口老化和生活方式相关的风险因素导致疾病负担沉重。筛检率的提高和早期诊断的普及推动了治疗需求的成长。完善的神经血管基础设施和先进的手术能力进一步巩固了该地区的市场领先地位。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 高血压和生活型态相关疾病的发生率不断上升

- 神经介入手术和训练有素的专家团队不断壮大

- 血管内装置的技术进步

- 提高对颅内动脉瘤的认识

- 产业陷阱与挑战

- 设备和手术费用高昂

- 围手术期及术后併发症及发生率的风险

- 市场机会

- 向医疗基础设施日益完善的新兴市场扩张

- 对个人化植入物、3D列印设备和患者特定方案的需求激增

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 报销方案

- 消费者洞察

- 未来市场趋势

- 价值链分析

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依治疗类型划分,2022-2035年

- 血管内栓塞术

- 手术夹

- 分流器

- 其他治疗类型

第六章:市场估算与预测:依最终用途划分,2022-2035年

- 医院

- 门诊手术中心

- 其他最终用途

第七章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- B. BRAUN

- Balt Group

- INTEGRA

- Johnson & Johnson

- Medtronic

- MicroPort

- MIZUHO

- Penumbra

- Peter LAZIC

- phenox

- Shape Memory Medical

- Stryker

- TERUMO

- Wallaby Medical

- ZYLOX TONBRIDGE

The Global Intracranial Aneurysm Market was valued at USD 1.6 billion in 2025 and is estimated to grow at a CAGR of 9.1% to reach USD 4 billion by 2035.

Market expansion is driven by rapid progress in minimally invasive neurovascular technologies, a growing clinical preference for endovascular therapies over open surgical approaches, and the rising incidence of intracranial aneurysms worldwide. An intracranial aneurysm is defined as a localized weakening and outward bulging of a cerebral blood vessel caused by arterial wall degeneration. Over time, this condition can worsen and carries a serious risk of rupture, which may result in life-threatening intracranial bleeding. These aneurysms are most identified near arterial junctions within the brain. Advancements in device engineering and procedural techniques have significantly improved treatment precision, reduced intervention time, and lowered complication rates. As healthcare systems increasingly prioritize less invasive treatment pathways, adoption of modern neurointerventional procedures continues to rise globally. Ongoing research initiatives and sustained innovation by leading manufacturers are improving patient outcomes and supporting consistent market growth across developed and emerging healthcare systems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 Billion |

| Forecast Value | $4 Billion |

| CAGR | 9.1% |

The endovascular coiling segment held a 66.7% share in 2025 owing to its minimally invasive approach and strong clinical performance. This technique is widely favored for both ruptured and unruptured aneurysms, particularly among elderly patients and individuals with elevated surgical risk. Shorter recovery timelines and reduced procedural burden continue to support its role as a primary treatment option, with procedure volumes rising as hospitals expand minimally invasive care models.

The hospitals segment accounted for a 65% share in 2025 and is expected to generate USD 2.5 billion through 2035. High patient admissions related to acute neurovascular events and aneurysm complications are driving demand for hospital-based treatment. Hospitals provide integrated access to specialized clinicians, advanced imaging, and intensive care, enabling rapid and coordinated management of complex aneurysm cases.

North America Intracranial Aneurysm Market held a 41.7% share in 2025. The region experiences a high disease burden linked to aging populations and lifestyle-related risk factors. Increased screening rates and early diagnosis are supporting treatment demand. Well-established neurovascular infrastructure and advanced procedural capabilities further strengthen regional market leadership.

Key companies operating in the Global Intracranial Aneurysm Market include Medtronic, Stryker, TERUMO, Johnson & Johnson, Penumbra, B. BRAUN, Balt Group, MicroPort, INTEGRA, Shape Memory Medical, phenox, Wallaby Medical, ZYLOX TONBRIDGE, MIZUHO, and Peter LAZIC. Companies in the Global Intracranial Aneurysm Market are reinforcing their market position through sustained investment in research, technology refinement, and clinical validation. Manufacturers are focused on developing safer, more effective minimally invasive solutions that improve long-term patient outcomes. Strategic partnerships with hospitals and research institutions help accelerate product adoption and clinical acceptance. Geographic expansion into underserved regions supports volume growth, while regulatory approvals strengthen global reach. Many players are also investing in physician training programs and procedural education to increase familiarity with advanced treatment options.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of hypertension and lifestyle-related diseases

- 3.2.1.2 Growth in neurointerventional procedures and trained specialists

- 3.2.1.3 Technological advances in endovascular devices

- 3.2.1.4 Increasing awareness about intracranial aneurysms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices and procedures

- 3.2.2.2 Risk of peri- and post-procedural complications and morbidity

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets with growing healthcare infrastructure

- 3.2.3.2 Surging need for personalized implants, 3D-printed devices, and patient-specific planning

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Consumer insights

- 3.8 Future market trends

- 3.9 Value chain analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Endovascular coiling

- 5.3 Surgical clipping

- 5.4 Flow diverters

- 5.5 Other treatment types

Chapter 6 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 B. BRAUN

- 8.2 Balt Group

- 8.3 INTEGRA

- 8.4 Johnson & Johnson

- 8.5 Medtronic

- 8.6 MicroPort

- 8.7 MIZUHO

- 8.8 Penumbra

- 8.9 Peter LAZIC

- 8.10 phenox

- 8.11 Shape Memory Medical

- 8.12 Stryker

- 8.13 TERUMO

- 8.14 Wallaby Medical

- 8.15 ZYLOX TONBRIDGE