|

市场调查报告书

商品编码

1892762

边缘运算市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Edge Computing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

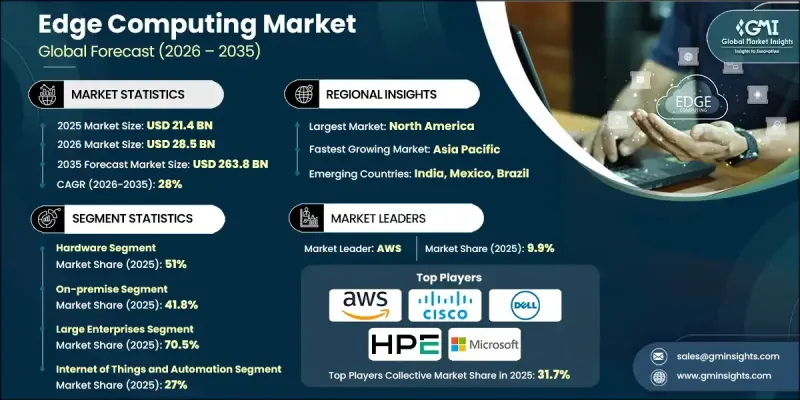

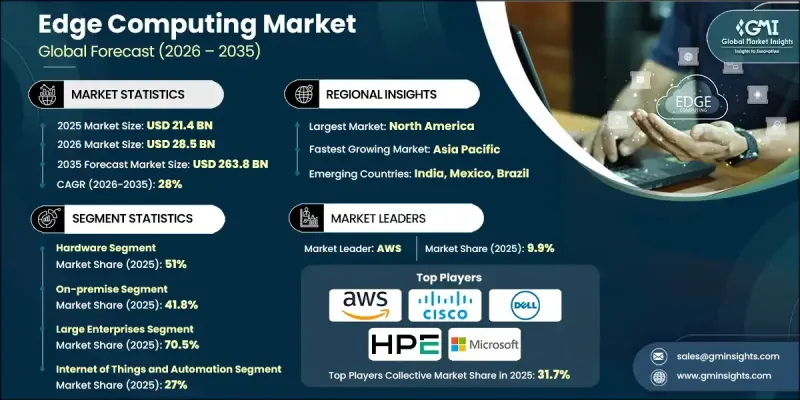

2025 年全球边缘运算市场价值为 214 亿美元,预计到 2035 年将以 28% 的复合年增长率成长至 2,638 亿美元。

企业正日益从集中式IT基础设施转向分散式处理模式,这使得边缘运算对于设备级即时资料处理至关重要。产业分析师预测,到2025年,全球将产生近180 ZB的新资料,这将推动对本地化运算的需求,而非仅依赖远端云端或资料中心资源。边缘运算正帮助製造业和工业自动化等行业实现更高的营运视觉性、预测性维护和更少的停机时间。电信业者正在快速扩展多接入边缘运算(MEC)基础设施,以满足日益增长的高速资料和视讯流量需求,而工业企业则持续投资于物联网设施,以优化分散式网路中的生产和营运效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 214亿美元 |

| 预测值 | 2638亿美元 |

| 复合年增长率 | 28% |

到2025年,硬体领域将占据51%的市场份额,预计到2035年将以26.5%的复合年增长率成长。预计到2030年,全球连网设备数量将达到290亿,这将推动终端用户对处理器、储存模组和网路硬体的需求。此外,由于边缘网路对即时分析、编排系统和网路安全工具的需求不断增长,软体平台也将快速扩张。

到 2025 年,本地部署部分占 41.8% 的份额,并且从 2026 年到 2035 年将以 24.3% 的复合年增长率增长,因为各行业越来越多地采用本地化基础设施,利用工业物联网、生产线优化和即时资产监控。

美国边缘运算市场占据87%的份额,预计到2025年将创造70亿美元的市场规模。美国5G服务的扩展正在推动交通运输、製造业、医疗保健和公共安全等各行业采用边缘运算技术。企业正越来越多地部署预测性维护、自动化和资产监控技术,以提高营运效率并减少停机时间。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 即时资料处理技术的日益普及

- 工业物联网的扩展

- 多接入边缘部署的成长

- 基于分析的工作负载增加

- 产业陷阱与挑战

- 高昂的基础设施和整合成本

- 各供应商之间的标准化程度有限

- 市场机会

- 智慧城市专案成长

- 私人企业网路的扩展

- 边缘人工智慧的进步

- 成长潜力分析

- 监管环境

- 北美洲

- 美国联邦通讯委员会(FCC)指南

- 美国国家标准与技术研究院 (NIST) 网路安全框架

- 资料隐私和保护法规

- 欧洲

- 欧盟资料保护法规

- 边缘系统的 GDPR 合规性

- 欧盟人工智慧法案

- 网路安全法

- 欧盟数位服务法规

- 亚太地区

- 中国网路安全法

- 个人资讯保护法(PIPL)

- 资料安全法

- 印度资讯科技法和数位规则

- 日本个人资讯保护法(APPI)

- 拉丁美洲

- 巴西通用资料保护法(LGPD)

- 阿根廷个人资料保护法

- 墨西哥联邦个人资料保护法

- 中东和非洲

- 阿联酋资料保护法

- 沙乌地阿拉伯国家网路安全局规章

- 南非个人资讯保护法(POPIA)

- 北美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 定价分析

- 按地区

- 副产品

- 成本細項分析

- 硬体和边缘设备成本

- 软体和平台授权费用

- 营运和维护成本

- 监理合规和安全成本

- 连接性和能源成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

- 投资和融资环境

- 边缘运算领域的创投与私募股权趋势

- 政府对边缘部署的拨款和激励措施

- 按地区和行业分類的投资热点

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2022-2035年

- 硬体

- 边缘伺服器

- 网路装置

- 储存装置

- 软体

- 边缘运算平台

- 应用软体

- 服务

- 专业服务

- 託管服务

第六章:市场估算与预测:依部署方式划分,2022-2035年

- 本地部署

- 基于云端的

- 杂交种

第七章:市场估算与预测:依组织规模划分,2022-2035年

- 大型企业

- 中小企业

第八章:市场估算与预测:依应用领域划分,2022-2035年

- 工业物联网与自动化

- 智慧城市

- 视讯监控与分析

- 内容散布

- 扩增实境(AR)和虚拟实境(VR)

- 自动驾驶和连网汽车

- 远端监控

- 智慧零售

- 远距医疗与医疗保健优势

- 其他的

第九章:市场估算与预测:依最终用途划分,2022-2035年

- 金融服务业

- 能源与公用事业

- 电信与资讯技术

- 卫生保健

- 零售与电子商务

- 媒体与娱乐

- 政府和公共部门

- 汽车

- 製造业

- 农业

- 其他的

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 荷兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 新加坡

- 泰国

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

第十一章:公司简介

- 全球参与者

- AWS

- Cisco

- Dell

- Google Cloud

- HPE

- IBM

- Intel

- Microsoft

- NVIDIA

- Oracle

- 区域玩家

- Atos

- Fujitsu

- Huawei

- NEC

- ZTE

- 新兴参与者/颠覆者

- Avassa

- ClearBlade

- Edge Impulse

- Hailo

- Vapor IO

- ZEDEDA

The Global Edge Computing Market was valued at USD 21.4 billion in 2025 and is estimated to grow at a CAGR of 28% to reach USD 263.8 billion by 2035.

Businesses are increasingly shifting from centralized IT infrastructures to distributed processing models, making edge computing essential for real-time data processing at the device level. Industry analysts project that nearly 180 ZB of new data will be generated worldwide by 2025, driving the need for localized computing rather than relying solely on distant cloud or data center resources. Edge computing is enabling industries such as manufacturing and industrial automation to achieve enhanced operational visibility, predictive maintenance, and reduced downtime. Telecommunications providers are rapidly expanding Multi-Access Edge Computing (MEC) infrastructure to support rising demands for high-speed data and video traffic, while industrial organizations continue to invest in IoT-enabled facilities to optimize production and operational efficiency across distributed networks.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.4 Billion |

| Forecast Value | $263.8 Billion |

| CAGR | 28% |

In 2025, the hardware segment held a 51% share and is expected to grow at a CAGR of 26.5% through 2035. The rising number of connected devices, projected to reach 29 billion globally by 2030, is driving demand for processing units, storage modules, and network hardware at the point of use. Software platforms are also set to expand rapidly due to the growing need for real-time analytics, orchestration systems, and cybersecurity tools across edge networks.

The on-premises segment accounted for a 41.8% share in 2025 and is growing at a CAGR of 24.3% from 2026 to 2035, as localized infrastructure adoption increases across industries, leveraging IIoT, production line optimization, and real-time asset monitoring.

United States Edge Computing Market held an 87% share, generating USD 7 billion in 2025. The expansion of 5G services in the US is driving edge compute adoption across sectors such as transportation, manufacturing, healthcare, and public safety. Companies are increasingly implementing predictive maintenance, automation, and asset monitoring technologies to improve operational efficiency and reduce downtime.

Key players operating in the Global Edge Computing Market include Intel, IBM, Dell, HPE, Microsoft, Cisco, AWS, Oracle, NVIDIA, and Google Cloud. Companies in the Global Edge Computing Market are strengthening their position by investing heavily in R&D to develop high-performance hardware, secure software platforms, and integrated edge-to-cloud solutions. Strategic partnerships and collaborations with telecom providers and industrial IoT vendors allow them to expand deployment networks and reach diverse verticals. Firms offer managed services, low-latency computing solutions, and scalable-edge infrastructure to attract enterprise clients. Additionally, innovation in AI-driven analytics, real-time monitoring, and orchestration platforms enables companies to differentiate themselves and create long-term customer loyalty while addressing increasing demand for localized computing solutions across multiple industries.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment

- 2.2.4 Organization Size

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising adoption of real time data processing

- 3.2.1.3 Expansion of industrial Internet of Things

- 3.2.1.4 Growth in multi-access edge deployments

- 3.2.1.5 Increase in analytics-based workloads

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure and integration costs

- 3.2.2.2 Limited standardization across vendors

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in smart city projects

- 3.2.3.2 Expansion of private enterprise networks

- 3.2.3.3 Advancement in artificial intelligence at the edge

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Federal communications commission (FCC) guidelines

- 3.4.1.2 National institute of standards and technology (NIST) cybersecurity framework

- 3.4.1.3 Data privacy and protection regulations

- 3.4.2 Europe

- 3.4.2.1 EU data protection regulations

- 3.4.2.2 GDPR compliance for edge systems

- 3.4.2.3 EU AI act

- 3.4.2.4 Cybersecurity act

- 3.4.2.5 EU digital services regulations

- 3.4.3 Asia Pacific

- 3.4.3.1 China cybersecurity law

- 3.4.3.2 Personal information protection law (PIPL)

- 3.4.3.3 Data security law

- 3.4.3.4 India IT act and digital rules

- 3.4.3.5 Japan act on the protection of personal information (APPI)

- 3.4.4 Latin America

- 3.4.4.1 Brazil general data protection law (LGPD)

- 3.4.4.2 Argentina personal data protection act

- 3.4.4.3 Mexico federal law on protection of personal data

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE data protection law

- 3.4.5.2 Saudi national cybersecurity authority regulations

- 3.4.5.3 South Africa protection of personal information act (POPIA)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.9.1 Hardware and edge device costs

- 3.9.2 Software and platform licensing costs

- 3.9.3 Operational and maintenance costs

- 3.9.4 Regulatory compliance and security costs

- 3.9.5 Connectivity and energy costs

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.13 Best case scenarios

- 3.14 Investment and funding landscape

- 3.14.1 Venture capital and private equity trends in edge computing

- 3.14.2 Government grants and incentives for edge deployments

- 3.14.3 Investment hotspots by region and sector

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 2035 (USD Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Edge Servers

- 5.2.2 Networking Equipment

- 5.2.3 Storage Devices

- 5.3 Software

- 5.3.1 Edge Computing Platform

- 5.3.2 Application Software

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment, 2022 - 2035 (USD Mn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Organization Size, 2022 - 2035 (USD Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 Small & Medium Enterprises (SMEs)

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Mn)

- 8.1 Key trends

- 8.2 Industrial IoT & Automation

- 8.3 Smart Cities

- 8.4 Video Surveillance & Analytics

- 8.5 Content Delivery

- 8.6 Augmented Reality (AR) & Virtual Reality (VR)

- 8.7 Autonomous & Connected Vehicles

- 8.8 Remote Monitoring

- 8.9 Smart Retail

- 8.10 Telemedicine & Healthcare Edge

- 8.11 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 (USD Mn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Energy & Utilities

- 9.4 Telecommunication & IT

- 9.5 Healthcare

- 9.6 Retail & E-commerce

- 9.7 Media & Entertainment

- 9.8 Government & Public Sector

- 9.9 Automotive

- 9.10 Manufacturing

- 9.11 Agriculture

- 9.12 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Netherlands

- 10.3.9 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 AWS

- 11.1.2 Cisco

- 11.1.3 Dell

- 11.1.4 Google Cloud

- 11.1.5 HPE

- 11.1.6 IBM

- 11.1.7 Intel

- 11.1.8 Microsoft

- 11.1.9 NVIDIA

- 11.1.10 Oracle

- 11.2 Regional Players

- 11.2.1 Atos

- 11.2.2 Fujitsu

- 11.2.3 Huawei

- 11.2.4 NEC

- 11.2.5 ZTE

- 11.3 Emerging Players / Disruptors

- 11.3.1 Avassa

- 11.3.2 ClearBlade

- 11.3.3 Edge Impulse

- 11.3.4 Hailo

- 11.3.5 Vapor IO

- 11.3.6 ZEDEDA