|

市场调查报告书

商品编码

1892763

植物固醇市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Phytosterols Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

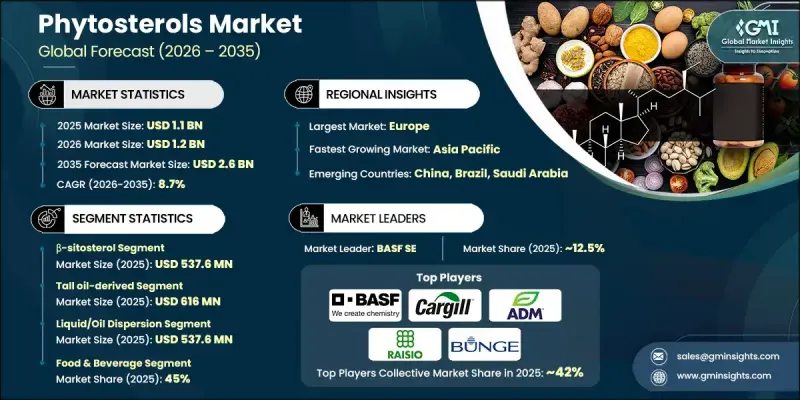

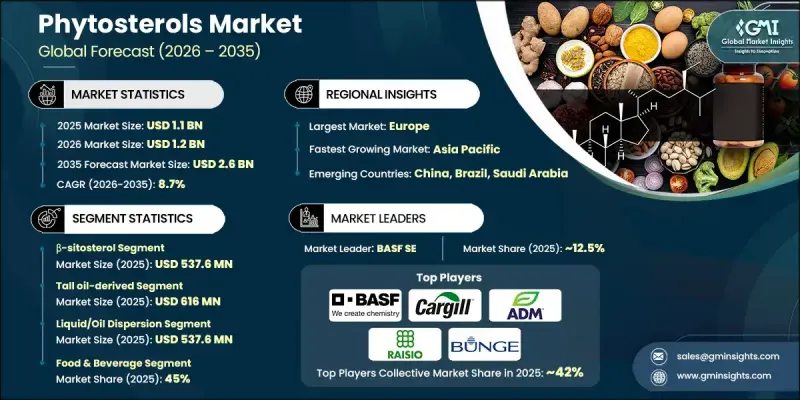

2025 年全球植物固醇市场价值为 11 亿美元,预计到 2035 年将以 8.7% 的复合年增长率增长至 26 亿美元。

市场成长得益于消费者对支持心血管健康和预防性营养的植物性生物活性成分需求的不断增长。植物固醇是天然存在的植物化合物,其结构与胆固醇相似,并因其能够限制消化系统对胆固醇的吸收而广为人知。消费者对心臟健康的日益关注,以及功能性食品、膳食补充剂和药品製剂的渗透率不断提高,并持续推动市场需求的成长。萃取、纯化和製剂技术的不断进步显着提高了产品的纯度、稳定性和吸收效率。先进的加工方法使得植物固醇更广泛地应用于各种食品和保健产品中,同时确保符合监管要求并维持稳定的品质。改良的製剂技术也有助于克服溶解性难题,从而促进其在食品、营养保健品和药品供应链中的更广泛应用。总而言之,这些发展使植物固醇成为符合长期健康发展趋势的高价值成分。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 11亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 8.7% |

2025年,β-谷甾醇市场规模预计将达5.376亿美元。其强大的市场地位得益于其广泛的植物来源、大规模生产的经济效益以及公认的降胆固醇功效。 β-谷甾醇在食品、医药和营养保健品领域的广泛应用也持续推动市场需求的稳定成长。

到 2025 年,妥尔油衍生的植物固醇市场规模将达到 6.16 亿美元。其领先地位的驱动因素是成本效益、可靠的原材料供应以及与成熟的工业加工基础设施的整合,从而支持高纯度甾醇成分的稳定生产。

2025年,美国植物固醇市场规模将达2.452亿美元。消费者对心血管健康的强烈关注、成熟的功能性食品产业以及先进的膳食补充剂生产能力,将继续支撑对符合严格监管标准的高品质植物固醇成分的持续需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按甾醇类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依固醇类型划分,2022-2035年

- β-谷甾醇

- 菜油甾醇

- 豆甾醇

- β-谷甾醇

- 菜油甾醇

- 芸薹甾醇

- 岩藻甾醇

- 其他的

第六章:市场估算与预测:依来源划分,2022-2035年

- 妥尔油衍生品

- 大豆衍生

- 向日葵衍生

- 油菜籽/芥花籽油衍生品

- 米糠衍生

- 其他植物来源

第七章:市场估算与预测:以实物形式划分,2022-2035年

- 液体/油分散体

- 粉末/晶体

- 微胶囊化

- 乳液

- 微米级/奈米级

第八章:市场估算与预测:依应用领域划分,2022-2035年

- 餐饮

- 涂抹酱和人造奶油

- 乳製品

- 饮料

- 烘焙产品

- 零食棒和糖果

- 其他的

- 製药

- 胆固醇管理

- 动脉粥状硬化预防

- 良性摄护腺增生治疗

- 抗发炎疗法

- 癌症预防及辅助治疗

- 代谢症候群管理

- 营养保健品和膳食补充剂

- 化妆品及个人护理

- 保湿霜和乳霜

- 抗衰老配方

- 保养

- 护髮产品

- 唇部护理

- 防晒护理

- 其他的

- 动物营养与兽医

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Chevron Corporation

- Petro-Canada/Suncor Energy

- Sonneborn LLC

- H&R Group (Hansen & Rosenthal KG)

- FUCHS Petrolub SE

- APAR Industries Limited

- Savita Oil Technologies Ltd.

- Panama Petrochem Ltd.

- Raj Petro Specialities Pvt. Ltd.

- Lodha Petro

- SEOJIN Chemical Co., Ltd.

- JX Nippon Oil & Energy Corporation

The Global Phytosterols Market was valued at USD 1.1 billion in 2025 and is estimated to grow at a CAGR of 8.7% to reach USD 2.6 billion by 2035.

Market growth is supported by rising demand for plant-based bioactive ingredients that support cardiovascular health and preventive nutrition. Phytosterols are naturally occurring plant compounds that share a structural resemblance with cholesterol and are widely recognized for their ability to limit cholesterol absorption in the digestive system. Increasing consumer focus on heart health, combined with the growing penetration of functional foods, dietary supplements, and pharmaceutical formulations, continues to strengthen market demand. Ongoing progress in extraction, purification, and formulation technologies has significantly improved product purity, stability, and absorption efficiency. Advanced processing methods have enabled broader incorporation of phytosterols into a wide range of food and wellness products while maintaining regulatory compliance and consistent quality. Improved formulation techniques have also helped overcome solubility challenges, supporting wider adoption across food, nutraceutical, and pharmaceutical supply chains. Together, these developments are positioning phytosterols as a high-value ingredient aligned with long-term health and wellness trends.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.1 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 8.7% |

The B-sitosterol segment generated USD 537.6 million in 2025. Its strong market position is supported by widespread availability from plant sources, favorable economics for large-scale production, and well-established cholesterol-lowering performance. Its broad acceptance across food, pharmaceutical, and nutraceutical applications continues to reinforce steady demand.

The tall oil-derived phytosterols segment reached USD 616 million in 2025. Their leadership is driven by cost efficiency, reliable raw material availability, and integration with established industrial processing infrastructure, supporting consistent production of high-purity sterol ingredients.

U.S. Phytosterols Market reached USD 245.2 million in 2025. Strong consumer awareness of cardiovascular health, a mature functional food sector, and advanced supplement manufacturing capabilities continue to support sustained demand for high-quality phytosterol ingredients that meet stringent regulatory standards.

Key companies operating in the Global Phytosterols Market include Cargill, Incorporated, BASF SE, Archer Daniels Midland, Wilmar International Ltd., Bunge Limited, Raisio Oyj, DuPont de Nemours / IFF, Kensing LLC, DRT (Les Derives Resiniques et Terpeniques), Vitae Naturals, Arboris LLC, Advanced Organic Materials (AOM) S.A., COFCO Biotechnology Co., Ltd., Ashland Global Holdings Inc., and Gustav Parmentier GmbH. Companies in the Global Phytosterols Market are strengthening their competitive position through investments in advanced extraction technologies, capacity expansion, and product purity enhancement. Strategic focus is placed on developing high-bioavailability formulations that align with functional food and nutraceutical trends. Partnerships with food manufacturers and supplement brands support long-term demand visibility and application-driven innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Sterol Grade

- 2.2.2 Source

- 2.2.3 Physical form

- 2.2.4 Application

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By sterol type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Sterol Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Β-sitosterol

- 5.3 Campesterol

- 5.4 Stigmasterol

- 5.5 Β-sitostanol

- 5.6 Campestanol

- 5.7 Brassicasterol

- 5.8 Fucosterol

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Source, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Tall oil-derived

- 6.3 Soybean-derived

- 6.4 Sunflower-derived

- 6.5 Rapeseed/canola-derived

- 6.6 Rice bran-derived

- 6.7 Other plant sources

Chapter 7 Market Estimates and Forecast, By Physical Form, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Liquid / oil dispersion

- 7.3 Powder / crystalline

- 7.4 Microencapsulated

- 7.5 Emulsion

- 7.6 Micronized / nano-sized

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Spreads & margarines

- 8.2.2 Dairy products

- 8.2.3 Beverages

- 8.2.4 Bakery products

- 8.2.5 Snack bars & confectionery

- 8.2.6 Others

- 8.3 Pharmaceuticals

- 8.3.1 Cholesterol management

- 8.3.2 Atherosclerosis prevention

- 8.3.3 BPH treatment

- 8.3.4 Anti-inflammatory therapies

- 8.3.5 Cancer prevention & adjunct therapy

- 8.3.6 Metabolic syndrome management

- 8.4 Nutraceuticals & dietary supplements

- 8.5 Cosmetics & personal care

- 8.5.1 Moisturizers & creams

- 8.5.2 Anti-aging formulations

- 8.5.3 Skin care

- 8.5.4 Hair care products

- 8.5.5 Lip care

- 8.5.6 Sun care

- 8.5.7 Others

- 8.6 Animal nutrition & veterinary

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 ExxonMobil Corporation

- 10.2 Royal Dutch Shell plc

- 10.3 Chevron Corporation

- 10.4 Petro-Canada/Suncor Energy

- 10.5 Sonneborn LLC

- 10.6 H&R Group (Hansen & Rosenthal KG)

- 10.7 FUCHS Petrolub SE

- 10.8 APAR Industries Limited

- 10.9 Savita Oil Technologies Ltd.

- 10.10 Panama Petrochem Ltd.

- 10.11 Raj Petro Specialities Pvt. Ltd.

- 10.12 Lodha Petro

- 10.13 SEOJIN Chemical Co., Ltd.

- 10.14 JX Nippon Oil & Energy Corporation