|

市场调查报告书

商品编码

1892764

模切机市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Die-Cutting Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

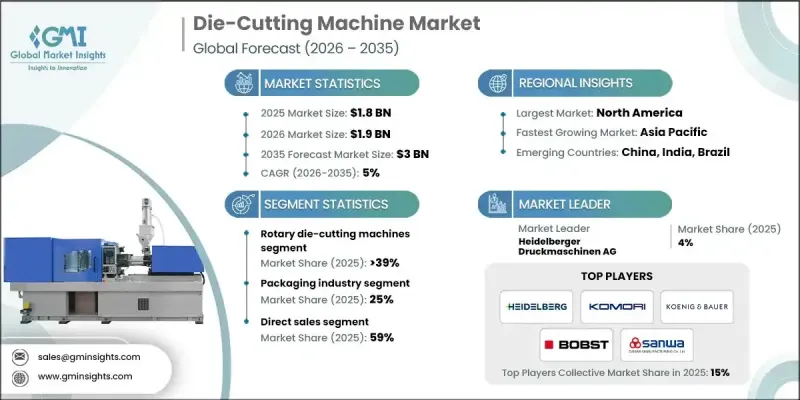

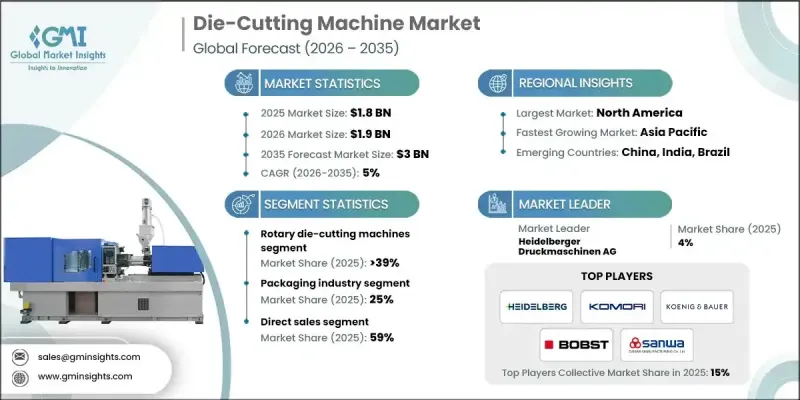

2025 年全球模切机市场价值为 18 亿美元,预计到 2035 年将以 5% 的复合年增长率增长至 30 亿美元。

随着模切机从传统机械工具向支援现代製造的先进智慧系统转型,市场也在不断发展。自动化是推动这一成长的主要动力,使製造商能够实现更高的精度、更快的生产速度并减少对劳动力的依赖。电子商务的兴起进一步加速了模切技术的应用,因为企业需要高效的方式来生产高品质、防护性强且外观精美的包装。永续性也影响市场,製造商在设计机器时力求符合全球环境标准,同时提高能源效率并减少浪费。物联网和数位控制的整合正在帮助企业优化生产、最大限度地减少错误并提高整体营运效率,使模切机成为现代工业工作流程中不可或缺的工具。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 18亿美元 |

| 预测值 | 30亿美元 |

| 复合年增长率 | 5% |

2024年,旋转模切机市占率达39%。其受欢迎的原因在于能够高速连续切割材料,这对于包装和标籤等大规模生产行业至关重要。与平板模切机不同,旋转模切机在材料运动过程中进行加工,提高了大规模生产的效率和产量。

到2025年,包装产业将占全球市场份额的25%,创造5亿美元的收入。该行业对纸盒、纸箱、标籤和软包装的精准切割需求,推动了对先进模切机的需求。电子商务和消费品产业的持续成长,也促使企业寻求创新的包装解决方案,以提升产品吸引力并促进销售。

2024年美国模切机市场规模达3.6亿美元,预计2035年将以5%的复合年增长率成长。包装、印刷和汽车行业的强劲需求,以及电子商务和消费品行业的快速成长,正在推动对自动化和高速机械的投资。美国製造商正越来越多地采用数位控制和物联网系统,以提高生产效率、减少浪费并保持竞争力。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 包装和印刷精度的需求日益增长

- 自动化和技术进步

- 电子商务和客製化趋势的扩展

- 产业陷阱与挑战

- 较高的初始投资和维护成本

- 技能差距与营运复杂性

- 机会

- 采用数位模切技术进行小批量生产

- 永续性和环保材料

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按机器类型

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依机器类型划分,2022-2035年

- 旋转模切机

- 平板模切机

- 数位模切机

- 雷射标籤模切机

第六章:市场估算与预测:依营运模式划分,2022-2035年

- 半自动

- 自动的

第七章:市场估算与预测:依应用领域划分,2022-2035年

- 盒子

- 纸箱

- 标籤和贴纸

- 装饰品

- 橡胶垫圈

- 其他(传单等)

第八章:市场估算与预测:依最终用途产业划分,2022-2035年

- 包装产业

- 汽车产业

- 製药

- 纺织品

- 印刷和出版

- 其他(电子产品等)

第九章:市场估算与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- Heidelberger Druckmaschinen AG

- Komori Corporation

- Duplo International

- Yawa Printing Machinery Co., Ltd.

- Masterwork Machinery Co., Ltd.

- Hunkeler AG

- BOBST

- SANWA Co., Ltd.

- ASAHI MACHINERY Limited

- Delta ModTech

- Winkler+Dunnebier GmbH

- Sysco Machinery Co., Ltd.

- Berhalter AG

- DIMO TECH

- Koenig & Bauer AG

The Global Die-Cutting Machine Market was valued at USD 1.8 billion in 2025 and is estimated to grow at a CAGR of 5% to reach USD 3 billion by 2035.

The market is evolving as die-cutting machines transition from traditional mechanical tools to advanced, intelligent systems that support modern manufacturing. Automation is driving this growth, enabling manufacturers to achieve higher precision, faster production speeds, and reduced dependence on labor. The rise of e-commerce has further accelerated the adoption of die-cutting technologies, as businesses need efficient ways to produce high-quality, protective, and visually appealing packaging. Sustainability is also influencing the market, with manufacturers designing machines to meet global environmental standards while improving energy efficiency and reducing waste. The integration of IoT and digital controls is helping companies optimize production, minimize errors, and increase overall operational efficiency, positioning die-cutting machines as essential tools in contemporary industrial workflows.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.8 Billion |

| Forecast Value | $3 Billion |

| CAGR | 5% |

The rotary die-cutting machines segment held a 39% share in 2024. Their popularity stems from their ability to cut materials continuously at high speeds, a critical requirement in mass production industries such as packaging and labeling. Unlike flatbed cutters, rotary machines process materials in motion, improving efficiency and throughput for large-scale operations.

The packaging industry accounted for a 25% share in 2025, generating USD 500 million. The sector's reliance on precise cutting for boxes, cartons, labels, and flexible packaging drives the demand for advanced die-cutting machines. Growth in e-commerce and consumer goods continues to push companies toward innovative packaging solutions that enhance product appeal and boost sales.

U.S. Die-Cutting Machine Market generated USD 360 million in 2024 and is projected to grow at a CAGR of 5% through 2035. Strong demand from the packaging, printing, and automotive industries, coupled with rapid growth in e-commerce and consumer products, is driving investments in automated and high-speed machinery. U.S. manufacturers are increasingly adopting digital controls and IoT-enabled systems to enhance productivity, reduce waste, and stay competitive.

Key players in the Global Die-Cutting Machine Market include Komori Corporation, Hunkeler AG, Delta ModTech, Winkler+Dunnebier GmbH, Yawa Printing Machinery Co., Ltd., BOBST, Berhalter AG, Heidelberger Druckmaschinen AG, SANWA Co., Ltd., ASAHI MACHINERY Limited, DIMO TECH, Masterwork Machinery Co., Ltd., Duplo International, Sysco Machinery Co., Ltd., and Koenig & Bauer AG. Companies in the Die-Cutting Machine Market are leveraging several strategies to strengthen their market position and expand their footprint. They are heavily investing in research and development to deliver innovative, high-speed, and automated solutions tailored to evolving packaging needs. Strategic collaborations with industrial integrators and OEMs improve distribution channels and customer reach. Market players are also focusing on geographic expansion to tap into emerging markets while enhancing service networks and technical support. Adoption of smart technologies, including IoT and digital monitoring, helps manufacturers optimize machine performance, minimize downtime, and offer value-added solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Mode of operation

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for precision in packaging and printing

- 3.2.1.2 Automation and technological advancements

- 3.2.1.3 Expansion of e-commerce and customization trends

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Skill gap and operational complexity

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of digital die cutting for short runs

- 3.2.3.2 Sustainability and eco-friendly materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Machine Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Rotary die-cutting machines

- 5.3 Flatbed die-cutting machines

- 5.4 Digital die-cutting machines

- 5.5 Laser label die-cutting machine

Chapter 6 Market Estimates and Forecast, By Mode of Operation, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Boxes

- 7.3 Cartons

- 7.4 Labels and stickers

- 7.5 Decorative items

- 7.6 Rubber gaskets

- 7.7 Others (flyers, etc.)

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Packaging industry

- 8.3 Automotive industry

- 8.4 Pharmaceuticals

- 8.5 Textile

- 8.6 Printing and publishing

- 8.7 Others (electronics, etc.)

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Heidelberger Druckmaschinen AG

- 11.2 Komori Corporation

- 11.3 Duplo International

- 11.4 Yawa Printing Machinery Co., Ltd.

- 11.5 Masterwork Machinery Co., Ltd.

- 11.6 Hunkeler AG

- 11.7 BOBST

- 11.8 SANWA Co., Ltd.

- 11.9 ASAHI MACHINERY Limited

- 11.10 Delta ModTech

- 11.11 Winkler+Dunnebier GmbH

- 11.12 Sysco Machinery Co., Ltd.

- 11.13 Berhalter AG

- 11.14 DIMO TECH

- 11.15 Koenig & Bauer AG