|

市场调查报告书

商品编码

1892767

基于感测器的矿业分选机市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Sensor Based Sorting Machines for Mining Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

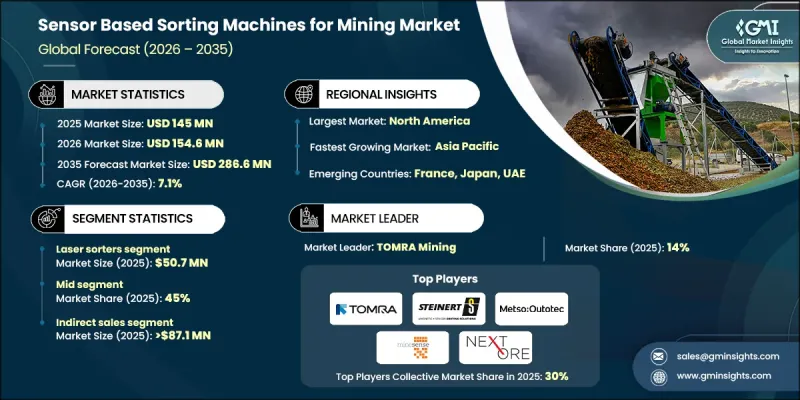

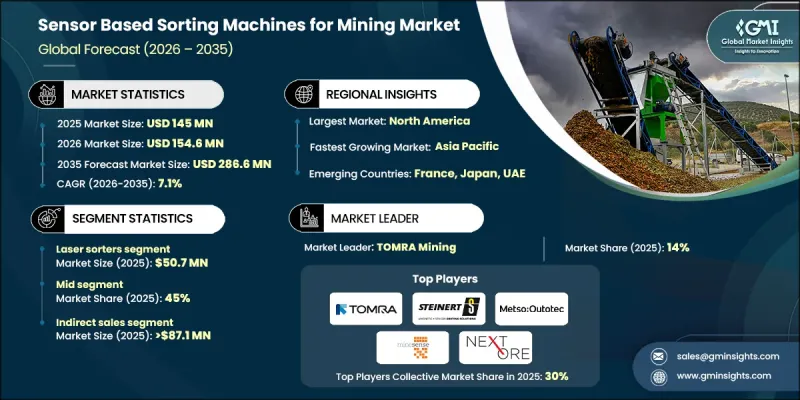

2025 年全球矿业用感测器分类机市场价值为 1.45 亿美元,预计到 2035 年将以 7.1% 的复合年增长率增长至 2.866 亿美元。

市场成长的驱动力来自全球对基本金属、贵金属和工业矿物日益增长的需求,而基础设施扩张、城市发展加速以及持续的能源转型则为其提供了支持。这些结构性转变增加了对铜、镍等材料的需求,进而推高了整体采矿量。随着生产规模的扩大,矿业公司面临提高效率和控制废料所产生的压力。基于感测器的分选技术能够实现早期矿石预浓缩,使营运商能够在下游加工之前分离出有价值的材料。这提高了回收率,并透过降低能源和水的消耗来减少对环境的影响。随着采矿活动越来越多地转向低品位矿床和地理位置偏远的地区,传统的选矿方法变得越来越复杂和昂贵。感测器驱动的分选技术能够实现选择性加工,最大限度地减少不必要的物料移动,并减轻选矿作业的负荷。这些系统在提高整体生产率的同时,也符合更严格的永续发展目标,使基于感测器的分选技术成为现代矿业营运的核心技术,专注于效率、成本控制和环境责任。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 1.45亿美元 |

| 预测值 | 2.866亿美元 |

| 复合年增长率 | 7.1% |

预计2025年,雷射分选设备市场规模将达5,070万美元。这些系统采用先进的雷射感测技术,利用矿石颗粒的表面和成分特征进行评估。透过分析矿物的纹理、反射率和元素组成,雷射分选比基于密度或颜色的分选方法具有更高的选择性。这种分析能力是透过雷射诱导击穿光谱法实现的,该方法利用高能量脉衝产生可测量的光谱,从而精确识别矿物特性。

到2025年,中等产能係统市占率将达到45%。这些设备的处理能力通常在每小时150至350吨之间,介于小型模组化装置和大型工业装置之间。它们通常用于初级或二级预浓缩,旨在保持稳定的处理量,同时不影响下游迴路。使用这些设备有助于在研磨前去除废料,减少试剂消耗,并稳定进料波动。

美国矿业感测器分选机市场占据75.6%的市场份额,预计2025年市场规模将达到1.096亿美元。强劲的采矿活动、先进的营运基础设施以及对生产力优化的重视,共同支撑了其市场领先地位。美国矿业营运商已广泛采用感测器技术,以提高资源利用率并最大限度地减少对环境的影响。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 采矿活动日益增多

- 营运成本节约

- 关键矿产的需求

- 产业陷阱与挑战

- 高昂的前期成本

- 整合复杂度

- 机会

- 自动化与人工智慧集成

- 客製化感测器解决方案

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 透过作业系统

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术划分,2022-2035年

- 雷射分类机

- X射线透射

- 基于颜色

- 近红外线

- LIBS技术

- 其他(X射线萤光光谱法、涡流光谱法)

第六章:市场估计与预测:依产能划分,2022-2035年

- 低(低于150吨/小时)

- 中型(150-350吨/小时)

- 高(超过350吨/小时)

第七章:市场估计与预测:依应用领域划分,2022-2035年

- 金属

- 非金属

第八章:市场估算与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第九章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Binder+Co

- Buhler Group

- Comex

- Eriez Manufacturing

- FLSmidth

- HPY Sorting Technology

- Metso

- MineSense Technologies

- NextOre

- Pellenc ST

- REDWAVE

- Scantech

- Sesotec

- STEINERT

- TOMRA Systems

The Global Sensor Based Sorting Machines for Mining Market was valued at USD 145 million in 2025 and is estimated to grow at a CAGR of 7.1% to reach USD 286.6 million by 2035.

Market growth is driven by rising global demand for base metals, precious metals, and industrial minerals, supported by infrastructure expansion, accelerating urban development, and the ongoing energy transition. These structural shifts are increasing the need for materials such as copper and nickel, which in turn is raising overall mining volumes. As production scales up, mining operators are under pressure to improve efficiency while controlling waste generation. Sensor-based sorting enables early-stage ore pre-concentration, allowing operators to separate valuable material before downstream processing. This improves recovery rates and reduces environmental impact by lowering energy and water consumption. As mining activity increasingly shifts toward lower-grade deposits and geographically remote locations, conventional beneficiation methods are becoming more complex and costly. Sensor-driven sorting technologies allow selective processing that minimizes unnecessary material movement and reduces the load on milling operations. These systems support higher overall productivity while aligning with stricter sustainability targets, positioning sensor-based sorting as a core technology in modern mining operations focused on efficiency, cost control, and environmental responsibility.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $145 Million |

| Forecast Value | $286.6 Million |

| CAGR | 7.1% |

The laser sorter segment generated USD 50.7 million in 2025. These systems rely on advanced laser-based sensing to evaluate ore particles using surface and compositional characteristics. By analyzing mineral texture, reflectivity, and elemental composition, laser sorting delivers higher selectivity than density- or color-based methods. This analytical capability is achieved through laser-induced breakdown spectroscopy, where high-energy pulses create measurable spectra used to identify mineral properties with precision.

The mid-capacity systems segment accounted for a 45% share in 2025. These machines typically process between 150 and 350 tons per hour, placing them between small modular units and full-scale industrial installations. They are commonly deployed for primary or secondary pre-concentration and are designed to maintain consistent throughput without disrupting downstream circuits. Their use supports waste removal before grinding, reduces reagent consumption, and stabilizes feed variability.

US Sensor Based Sorting Machines for Mining Market held 75.6% share and generated USD 109.6 million in 2025. Strong mining activity, advanced operational infrastructure, and a focus on productivity optimization support market leadership. Mining operators in the country have widely adopted sensor-based technologies to improve resource utilization while minimizing environmental impact.

Key companies active in the Global Sensor Based Sorting Machines for Mining Market include TOMRA Systems, Metso, STEINERT, REDWAVE, FLSmidth, Buhler Group, Sesotec, Binder+Co AG, Eriez Manufacturing, NextOre, MineSense Technologies, Scantech, HPY Sorting Technology, Comex, and Pellenc ST. Companies operating in the Sensor Based Sorting Machines for Mining Market are reinforcing their competitive position through continuous technology development, strategic collaborations, and expanded global presence. Manufacturers are investing in advanced sensing capabilities, artificial intelligence integration, and data analytics to improve sorting accuracy and throughput. Partnerships with mining operators enable customized solutions that align with specific ore characteristics and operational requirements. Many players focus on modular system designs that allow flexible deployment and scalability across mine sizes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing mining activities

- 3.2.1.2 Operational cost savings

- 3.2.1.3 Demand for critical minerals

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront costs

- 3.2.2.2 Integration complexity

- 3.2.3 Opportunities

- 3.2.3.1 Automation & AI integration

- 3.2.3.2 Customized sensor solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By operating system

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2022 - 2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Laser sorters

- 5.3 X-Ray transmission

- 5.4 Color based

- 5.5 Near infrared

- 5.6 LIBS technology

- 5.7 Others (XRF, eddy current)

Chapter 6 Market Estimates and Forecast, By Capacity, 2022 - 2035 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Low (less than 150 tons/hr.)

- 6.3 Mid (150-350 tons/hr.)

- 6.4 High (more than 350 tons/hr.)

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Metallic

- 7.3 Nonmetallic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Binder+Co

- 10.2 Buhler Group

- 10.3 Comex

- 10.4 Eriez Manufacturing

- 10.5 FLSmidth

- 10.6 HPY Sorting Technology

- 10.7 Metso

- 10.8 MineSense Technologies

- 10.9 NextOre

- 10.10 Pellenc ST

- 10.11 REDWAVE

- 10.12 Scantech

- 10.13 Sesotec

- 10.14 STEINERT

- 10.15 TOMRA Systems