|

市场调查报告书

商品编码

1892771

全氟聚醚市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Perfluoropolyether Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

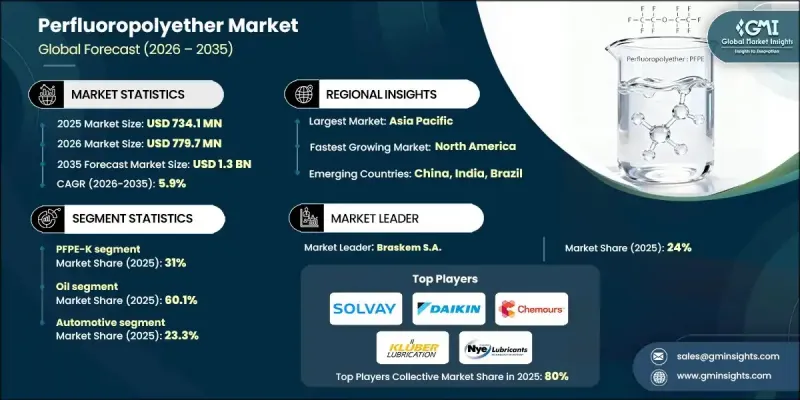

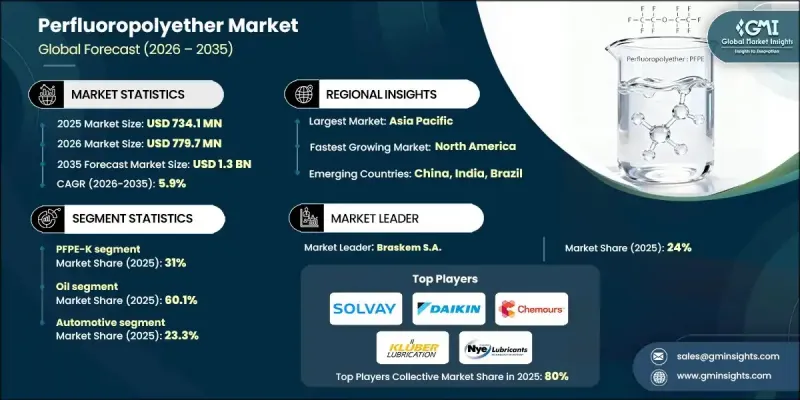

2025 年全球全氟聚醚市值为 7.341 亿美元,预计到 2035 年将以 5.9% 的复合年增长率增长至 13 亿美元。

全氟聚醚(PFPE)润滑剂的独特之处在于其能够在极端条件下保持优异性能,包括高温、腐蚀性化学品、真空环境和超洁净的生产空间。这使得它们在航太、半导体製造、医疗器材和高科技电子等行业中至关重要,因为这些行业对可靠性、低挥发性和长使用寿命的要求极高。 2021年至2024年间,PFPE的需求与先进製造业的发展趋势密切相关,尤其是在半导体、便携式电子产品和航太回收领域,这反映出这些产业对清洁、高性能润滑剂的需求日益增长。自动化程度的提高、资料中心的扩张以及对半导体晶圆厂的投资进一步推动了PFPE在晶圆加工工具、真空帮浦和精密微机械装置中的应用。此外,食品、医疗、製药和发电行业日益严格的安全、环境和性能法规也支撑了对高纯度PFPE配方的持续需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 7.341亿美元 |

| 预测值 | 13亿美元 |

| 复合年增长率 | 5.9% |

2025年,PFPE-K市占率达到31%,预计到2035年将以5.1%的复合年增长率成长。製造商正根据黏度、挥发性和热稳定性对这些等级的产品进行定制,以满足半导体、航太、电动车和食品级应用领域的特定需求。许多客户选择从同一供应商购买两种不同等级的PFPE产品,以简化审批流程并减少认证延误。

从产品形态来看,PFPE油品在2025年占据了60.1%的市场份额,预计2026年至2035年将以5.8%的复合年增长率成长。企业正日益提供整合式油脂系统,旨在优化整个设备系统的耐温性、承载能力和挥发性,而非仅提供单一的润滑剂。这些解决方案广泛应用于半导体机械、涡轮机、电动车传动系统和无尘室作业等领域。

2025年北美全氟聚醚(PFPE)市场规模为2.06亿美元,预计到2035年将达到3.676亿美元,成为成长最快的区域市场。航太、半导体和先进汽车产业的需求成长,以及日益严格的可靠性标准和不断增长的电动车产量,都推动了PFPE相对于传统润滑剂的日益普及。美国仍然是该地区PFPE的主要消费国,这得益于其集中的半导体製造厂、航太OEM厂商和先进医疗技术製造企业,从而支撑了对高纯度、长寿命PFPE解决方案的强劲需求。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 在半导体和先进电子领域的应用日益广泛

- 航太和高性能行动应用领域的恢復

- 更严格的安全、清洁和可靠性法规工程

- 产业陷阱与挑战

- 高成本且复杂的氟化学品生产

- 对有限、专业化的全球供应商群体的依赖

- 市场机会

- 电动车、电力电子和再生能源基础设施的扩张

- 亚太地区先进製造业投资不断成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依产品划分,2022-2035年

- PFPE-K

- PFPE-M

- PFPE-Z

- PFPE-Y

- PFPE-D

第六章:市场估算与预测:依类型划分,2022-2035年

- 油

- 润滑脂

第七章:市场估算与预测:依最终用途划分,2022-2035年

- 汽车

- 引擎和动力总成部件

- 电动车传动系统与电动机

- 轴承、密封件和接头

- 煞车系统和执行器

- 内部机械装置(开关、天窗、座椅滑轨)

- 航太

- 机身和控制系统

- 发动机和涡轮部件

- 起落架与作动系统

- 航空电子设备、连接器和感测器

- 太空船和卫星机制

- 电子

- 连接器和开关

- 微电子和半导体

- 硬碟驱动器和精密驱动器

- 冷却和散热系统

- 洁净室和真空应用

- 金属加工

- 热轧和冷轧设备

- 热处理炉

- 发电

- 燃气涡轮机和蒸汽涡轮机

- 风力涡轮机齿轮箱和轴承

- 水力发电设备

- 核电厂辅助设备

- 纺织品

- 纺纱和捻线设备

- 织布机和针织机

- 染色和整理生产线

- 纸浆和造纸

- 烘干机和日历堆迭

- 压机部件和辊筒

- 输送机和搬运系统

- 其他的

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- The Chemours Company

- Daikin Industries, Inc.

- Solvay

- M&I Materials Limited

- LUBRILOG SAS

- IKV Tribology

- Fluorotech USA

- Metalubgroup

- Setral Chemie GmbH

- Jet-Lube

- Kluber Lubrication

- Fomblin (Solvay brand)

- Nye Lubricants

- Dow (Specialty Fluids)

- Halocarbon Products Corporation

The Global Perfluoropolyether Market was valued at USD 734.1 million in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 1.3 billion by 2035.

PFPE lubricants are unique in their ability to perform under extreme conditions, including high temperatures, aggressive chemicals, vacuum environments, and ultra-clean manufacturing spaces. This makes them essential across industries such as aerospace, semiconductor fabrication, medical devices, and high-tech electronics, where reliability, low volatility, and long service life are critical. Between 2021 and 2024, PFPE demand closely aligns with advanced manufacturing trends, particularly in semiconductors, portable electronics, and aerospace recovery, reflecting the growing need for clean, high-performance lubricants in these sectors. Increasing automation, expansion of data centers, and investments in semiconductor fabs have further driven the adoption of PFPE in wafer processing tools, vacuum pumps, and precision micro-mechanisms. Additionally, stricter safety, environmental, and performance regulations in food, medical, pharmaceutical, and power-generation sectors are supporting sustained demand for high-purity PFPE formulations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $734.1 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 5.9% |

The PFPE-K segment held a 31% share in 2025 and is expected to grow at a CAGR of 5.1% through 2035. Manufacturers are customizing these grades based on viscosity, volatility, and thermal stability to meet the precise needs of semiconductors, aerospace, electric vehicles, and food-grade applications. Many clients opt to dual-source different PFPE grades from a single supplier to streamline approval processes and reduce qualification delays.

In terms of form, the PFPE oils segment held a 60.1% share in 2025 and is projected to grow at a CAGR of 5.8% from 2026 to 2035. Companies are increasingly offering integrated oil-grease systems designed to optimize temperature resistance, load-carrying capacity, and volatility across entire equipment systems, rather than providing standalone lubricants. These solutions are widely applied in semiconductor machinery, turbines, EV drivetrains, and cleanroom operations.

North America Perfluoropolyether Market accounted for USD 206 million in 2025 and is anticipated to reach USD 367.6 million by 2035, emerging as the fastest-growing regional market. Demand is driven by aerospace, semiconductor, and advanced automotive sectors, alongside stringent reliability standards and growing electric vehicle production, which increasingly favors PFPE over conventional lubricants. The U.S. remains the key PFPE consumer within the region due to its concentration of semiconductor fabs, aerospace OEMs, and advanced medical technology manufacturing, supporting robust demand for high-purity, long-life PFPE solutions.

Leading companies operating in the Global Perfluoropolyether Market include The Chemours Company, Daikin Industries, Inc., Solvay, M&I Materials Limited, LUBRILOG SAS, IKV Tribology, Fluorotech USA, Metalubgroup, Setral Chemie GmbH, Jet-Lube, Kluber Lubrication, Fomblin (Solvay brand), Nye Lubricants, Dow Specialty Fluids, and Halocarbon Products Corporation. Companies in the Global Perfluoropolyether Market are employing multiple strategies to strengthen their market presence and maintain a competitive edge. They are investing in R&D to develop customized PFPE grades that meet specific industrial requirements for viscosity, thermal stability, and low volatility. Strategic partnerships with semiconductor, aerospace, and medical equipment manufacturers help secure long-term supply agreements. Firms are expanding production facilities in high-demand regions to reduce lead times and improve supply chain efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing use in semiconductor and advanced electronics

- 3.2.1.2 Recovery in aerospace and high-performance mobility applications

- 3.2.1.3 Stricter safety, cleanliness and reliability regulations engineering

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complex fluorochemical production

- 3.2.2.2 Dependence on limited, specialized global supplier base

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV, power electronics and renewables infrastructure

- 3.2.3.2 Rising advanced manufacturing investments in Asia Pacific n

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 PFPE-K

- 5.3 PFPE-M

- 5.4 PFPE-Z

- 5.5 PFPE-Y

- 5.6 PFPE-D

Chapter 6 Market Estimates and Forecast, By Type, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Grease

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Engine and powertrain components

- 7.2.2 Electric vehicle drivetrains and e-motors

- 7.2.3 Bearings, seals, and joints

- 7.2.4 Brake systems and actuators

- 7.2.5 Interior mechanisms (switches, sunroof, seat tracks)

- 7.3 Aerospace

- 7.3.1 Airframe and control systems

- 7.3.2 Engine and turbine components

- 7.3.3 Landing gear and actuation systems

- 7.3.4 Avionics, connectors, and sensors

- 7.3.5 Spacecraft and satellite mechanisms

- 7.4 Electronics

- 7.4.1 Connectors and switches

- 7.4.2 Microelectronics and semiconductors

- 7.4.3 Hard disk drives and precision drives

- 7.4.4 Cooling and heat dissipation systems

- 7.4.5 Cleanroom and vacuum applications

- 7.5 Metal Processing

- 7.5.1 Hot and cold rolling equipment

- 7.5.2 Heat treatment furnaces

- 7.6 Power Generation

- 7.6.1 Gas and steam turbines

- 7.6.2 Wind turbine gearboxes and bearings

- 7.6.3 Hydropower equipment

- 7.6.4 Nuclear plant auxiliary equipment

- 7.7 Textile

- 7.7.1 Spinning and twisting equipment

- 7.7.2 Weaving and knitting machines

- 7.7.3 Dyeing and finishing lines

- 7.8 Pulp and Paper

- 7.8.1 Dryers and calendar stacks

- 7.8.2 Press sections and rollers

- 7.8.3 Conveyors and handling systems

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 The Chemours Company

- 9.2 Daikin Industries, Inc.

- 9.3 Solvay

- 9.4 M&I Materials Limited

- 9.5 LUBRILOG SAS

- 9.6 IKV Tribology

- 9.7 Fluorotech USA

- 9.8 Metalubgroup

- 9.9 Setral Chemie GmbH

- 9.10 Jet-Lube

- 9.11 Kluber Lubrication

- 9.12 Fomblin (Solvay brand)

- 9.13 Nye Lubricants

- 9.14 Dow (Specialty Fluids)

- 9.15 Halocarbon Products Corporation