|

市场调查报告书

商品编码

1892785

金属粉末增材製造市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Additive Manufacturing With Metal Powders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

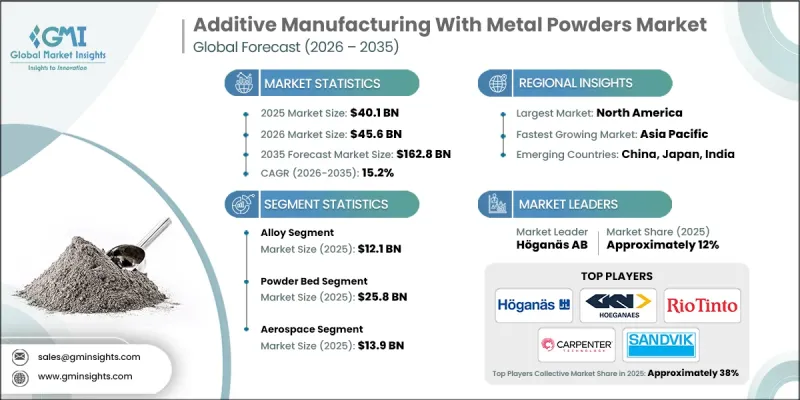

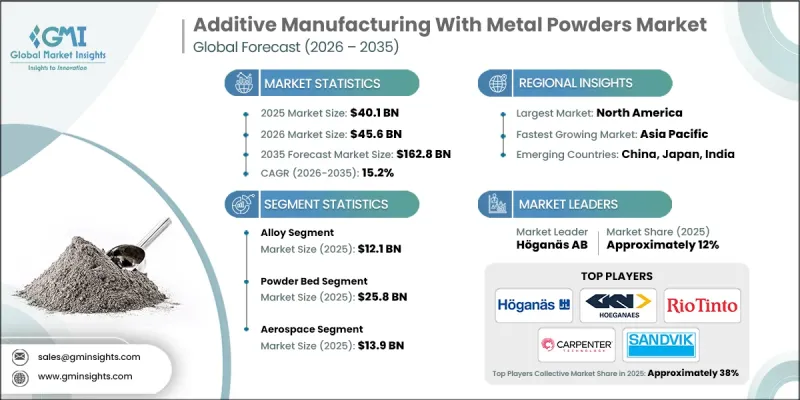

2025 年全球金属粉末增材製造市场价值为 401 亿美元,预计到 2035 年将以 15.2% 的复合年增长率成长至 1,628 亿美元。

随着各行业对轻量化、高强度零件的需求日益增长,以提升性能和燃油效率,金属积层製造市场正在迅速扩张。航太、汽车和国防领域正转向金属增材製造,以实现复杂几何形状和轻量化,同时又不影响耐用性。包括雷射系统、电子束方法和多雷射装置在内的3D列印技术的进步,正在加快建造速度并提高精度。粉末床熔融製程的广泛应用提高了製程可靠性,缩短了生产週期,并改善了表面光洁度,从而推动了金属增材製造解决方案的商业化。此外,医疗和牙科领域也透过采用金属积层製造技术来生产客製化植入物、假体和手术器械,推动了市场成长,并带来了对患者特定和高精度应用的大量需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 401亿美元 |

| 预测值 | 1628亿美元 |

| 复合年增长率 | 15.2% |

2025年合金市场规模达121亿美元,预计2035年将以15.5%的复合年增长率成长。包括不銹钢在内的合金因其耐腐蚀性、机械强度和适用于复杂几何形状等优点而被广泛应用。它们在航太、汽车、医疗和工业设备等领域的广泛采用,正在创造可持续的需求。其他类型的钢材为结构件和模具应用提供了经济高效的解决方案,使製造商能够有效地扩大原型製作和功能性生产的规模。

2025年,航太领域市场规模达139亿美元,占全球市场份额的34.7%,预计2026年至2035年间将以14.9%的复合年增长率成长。航太、汽车和医疗产业正在推动对高性能、轻量化和高精度零件的需求。航太公司需要先进的结构件和引擎零件,而汽车製造商则利用金属增材製造技术进行模具製造、原型製作以及小批量高性能零件的生产。随着客製化植入物和手术器械的普及,医疗应用正在迅速扩展。这些产业的融合正在强化高精度金属增材製造的发展趋势。

预计2025年,北美金属粉末增材製造市场规模将达138亿美元。金属粉末增材製造技术在航太、国防和医疗等领域的应用日益广泛,尤其适用于製造轻量化、高精度零件。先进的数位化製造技术、完善的基础设施以及持续的研发投入为该技术的商业化提供了有力支撑。金属粉末增材製造在原型製作、模具製造和特殊零件製造领域的应用日益广泛,加上混合和自动化製程的进步,正在推动区域市场的扩张。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 副产品

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料划分,2022-2035年

- 合金

- 钛

- Ti6Al4V

- Ti6Al4V(ELI)

- 其他的

- 钴

- 钴铬

- CoCrWC

- 钴铬钼

- 铜

- C18150

- CuCr1Zr

- CuNi2SiCr

- 镍

- Inconel 625

- Inconel 718

- 哈氏合金X

- 铝

- ALSi12

- ALSi7Mg

- ALSi10Mg

- AL6061

- 其他的

- 钛

- 不銹钢

- 奥氏体钢

- 马氏体钢

- 双相钢

- 铁素体钢

- 其他钢铁

- 高速钢

- 工具钢

- 低合金钢

- 贵金属

- 铂

- 其他贵金属

- 钨

- 其他材料

- 碳化硅

- 氧化铝粉末

- 锆

- 二氧化锆

- 钼

- 镁

- 氮化铝

- 碳化钨

第六章:市场估算与预测:依製造技术划分,2022-2035年

- 粉末床

- 直接金属雷射烧结(DMLS)

- 选择性雷射熔化(SLM)

- 电子束熔化(EBM)

- 吹粉

- 直接金属沉积(DMD)

- 雷射工程净成形(LENS)

- 其他的

第七章:市场估计与预测:依应用领域划分,2022-2035年

- 航太

- 汽车

- 医疗的

- 石油和天然气

- 活力

- 核

- 再生能源

- 其他

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Hoganas AB

- GKN Powder Metallurgy (Hoeganaes)

- Rio Tinto

- Carpenter Technology Corporation

- Sandvik Additive Manufacturing

- LPW Technology

- AP&C (Advanced Powders & Coatings)

- Arcam AB

- EOS GmbH

- Bright Laser Technologies

- Huake 3D

- ReaLizer

The Global Additive Manufacturing With Metal Powders Market was valued at USD 40.1 billion in 2025 and is estimated to grow at a CAGR of 15.2% to reach USD 162.8 billion by 2035.

The market is expanding rapidly as industries increasingly demand lightweight, high-strength components to enhance performance and fuel efficiency. Aerospace, automotive, and defense sectors are transitioning to metal additive manufacturing to achieve complex geometries and weight reduction without compromising durability. Advances in 3D printing technologies, including laser systems, electron-beam methods, and multi-laser setups, are accelerating build speed and improving precision. Wider adoption of powder-bed fusion processes has enhanced process reliability, shortened production cycles, and improved surface finishes, driving the commercialization of metal AM solutions. Additionally, the medical and dental sectors are fueling growth by adopting metal additive manufacturing for customized implants, prosthetics, and surgical instruments, creating a surge in demand for patient-specific and high-precision applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $40.1 Billion |

| Forecast Value | $162.8 Billion |

| CAGR | 15.2% |

The alloy segment generated USD 12.1 billion in 2025 and is expected to grow at a CAGR of 15.5% through 2035. Alloys, including stainless steel, are widely used due to their corrosion resistance, mechanical strength, and suitability for complex geometries. Their broad adoption across aerospace, automotive, medical, and industrial equipment sectors is creating sustainable demand. Other types of steel provide cost-effective solutions for structural and tooling applications, allowing manufacturers to scale both prototyping and functional production efficiently.

The aerospace segment accounted for USD 13.9 billion in 2025, holding a 34.7% share, and is anticipated to grow at a CAGR of 14.9% during 2026-2035. Aerospace, automotive, and medical industries are driving demand for high-performance, lightweight, and precision components. Aerospace companies require advanced structural and engine parts, while automotive manufacturers use metal AM for tooling, prototyping, and limited-volume high-performance components. Medical applications are expanding rapidly as patient-specific implants and surgical tools gain traction. The convergence of these industries is reinforcing the trend toward high-precision metal additive manufacturing.

North America Additive Manufacturing With Metal Powders Market held USD 13.8 billion in 2025. Adoption of metal AM is rising across aerospace, defense, and medical sectors for lightweight, precise parts. Advanced digital manufacturing, well-established infrastructure, and ongoing R&D investments support commercialization. Growing use in prototyping, tooling, and specialty parts, along with hybrid and automated processes, is driving regional market expansion.

Key players in the Global Additive Manufacturing With Metal Powders Market include Hoganas AB, GKN Powder Metallurgy (Hoeganaes), Rio Tinto, Carpenter Technology Corporation, Sandvik Additive Manufacturing, and others. Companies in the Global Additive Manufacturing With Metal Powders Market are leveraging multiple strategies to strengthen their market presence. They are investing heavily in research and development to enhance printing speed, accuracy, and material compatibility. Strategic collaborations, joint ventures, and acquisitions are expanding product portfolios and geographic reach. Companies are introducing new alloy compositions and customizing solutions for aerospace, automotive, and medical applications. Adoption of digital and hybrid manufacturing systems, alongside automated post-processing and quality control solutions, helps streamline production and reduce costs. Additionally, firms are emphasizing customer training, technical support, and service networks to improve adoption rates, establish long-term partnerships, and maintain competitive advantage in a rapidly evolving industry.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Manufacturing Technique

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material, 2022- 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Alloy

- 5.2.1 Titanium

- 5.2.1.1 Ti6Al4V

- 5.2.1.2 Ti6Al4V (ELI)

- 5.2.1.3 Others

- 5.2.2 Cobalt

- 5.2.2.1 CoCr

- 5.2.2.2 CoCrWC

- 5.2.2.3 CoCrMo

- 5.2.3 Copper

- 5.2.3.1 C18150

- 5.2.3.2 CuCr1Zr

- 5.2.3.3 CuNi2SiCr

- 5.2.4 Nickel

- 5.2.4.1 Inconel 625

- 5.2.4.2 Inconel 718

- 5.2.4.3 Hastelloy X

- 5.2.5 Aluminium

- 5.2.5.1 ALSi12

- 5.2.5.2 ALSi7Mg

- 5.2.5.3 ALSi10Mg

- 5.2.5.4 AL6061

- 5.2.5.5 Others

- 5.2.1 Titanium

- 5.3 Stainless Steel

- 5.3.1 Austenitic Steel

- 5.3.2 Martensitic Steel

- 5.3.3 Duplex steel

- 5.3.4 Ferritic Steel

- 5.4 Other Steel

- 5.4.1 High Speed Steel

- 5.4.2 Tool Steel

- 5.4.3 Low Alloy Steel

- 5.5 Precious Metal

- 5.5.1 Platinum

- 5.5.2 Other precious metal

- 5.6 Tungsten

- 5.7 Other materials

- 5.7.1 Silicon carbide

- 5.7.2 Aluminium oxide powder

- 5.7.3 Zirconium

- 5.7.4 Zirconium dioxide

- 5.7.5 Molybdenum

- 5.7.6 Magnesium

- 5.7.7 Aluminium nitride

- 5.7.8 Tungsten carbide

Chapter 6 Market Estimates and Forecast, By Manufacturing Technique, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Powder Bed

- 6.2.1 Direct Metal Laser Sintering (DMLS)

- 6.2.2 Selective Laser Melting (SLM)

- 6.2.3 Electron Beam Melting (EBM)

- 6.3 Blown powder

- 6.3.1 Direct Metal Deposition (DMD)

- 6.3.2 Laser Engineering Net Shapes (LENS)

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Aerospace

- 7.3 Automotive

- 7.4 Medical

- 7.5 Oil & Gas

- 7.6 Energy

- 7.6.1 Nuclear

- 7.6.2 Renewable

- 7.7 Other

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Hoganas AB

- 9.2 GKN Powder Metallurgy (Hoeganaes)

- 9.3 Rio Tinto

- 9.4 Carpenter Technology Corporation

- 9.5 Sandvik Additive Manufacturing

- 9.6 LPW Technology

- 9.7 AP&C (Advanced Powders & Coatings)

- 9.8 Arcam AB

- 9.9 EOS GmbH

- 9.10 Bright Laser Technologies

- 9.11 Huake 3D

- 9.12 ReaLizer